Form 26AS is an annual consolidated tax credit statement that taxpayers can view access or download. To view Form 26AS or download Form 26AS from the Income Tax Website read our complete guide on How to View Tax Credit Statement Form 26AS. Form 26as is an annual consolidated tax statement recording all transactions where various […]

Codys Statement Of Financial Position

Their home was just appraised at 215000 on which they owe only 18000. Statement of Financial Position. Page 20 223A4 Take Charge Today August 2013 Statement of Financial Position Funded by a grant from Take Charge America Inc. Use the complete Statement of Financial Positions for Cody Chuck and Wendy and Ed and Mary to […]

Cash Flow Report

See what numbers go where what maths takes place and how to read the results. Forecast your future cash position and regain your control on your business finances. Borrow against company financial. Straightforward Business Accounting Forms. A cash flow statement tells you how much cash is entering and leaving your business in a given period. […]

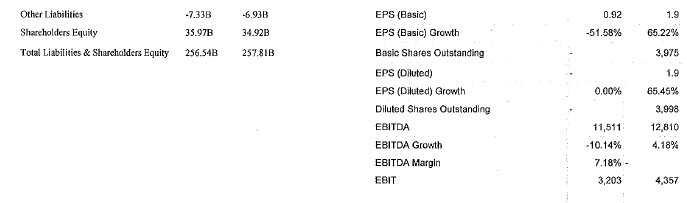

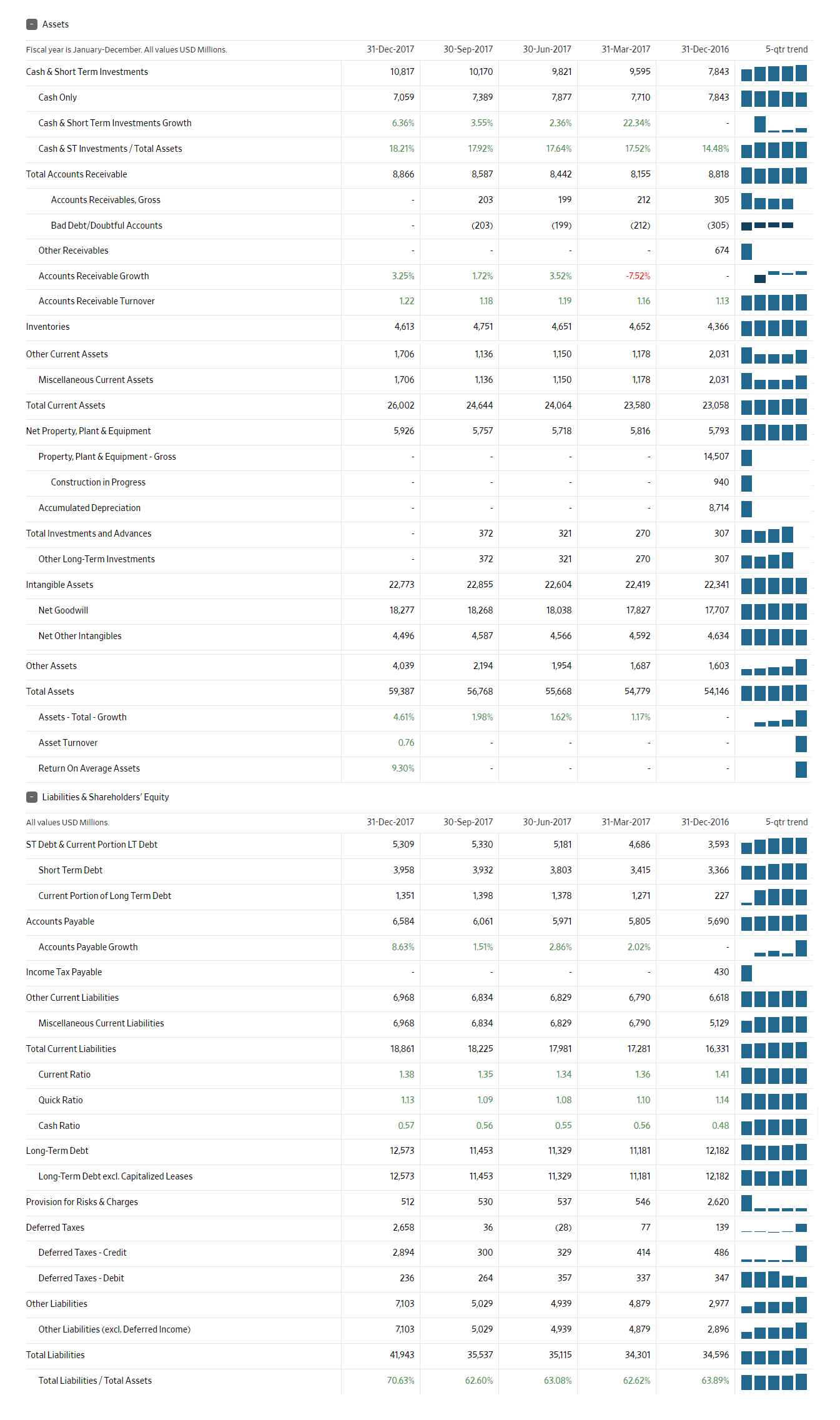

Jumia Balance Sheet

Ad 1 Create Free Balance Sheet In Minutes 2 Print Export Instantly – 100 Free. Dec 2021 5-quarter trend. However total payment volume reduced from 59 million to 56 million. Income statements balance sheets cash flow statements and key ratios. Jumias balance sheet is growing Among the turnarounds Jumia recorded in Q1 2020 the most […]

Statement Of Cash Receipts And Disbursements

This statement reflects the states General Fund cash position and compares actual receipts and disbursements for the 2021-22 fiscal year to cash flow estimates prepared by the Department of Finance DOF. If the omitted disclosures were included in the financial statement they might influence the users conclusions about Tracy V. Cash disbursements are monies paid […]

Negative Audit Report

Negative assurances also help establish a defense to claims that. Be performed earlier this Fiscal Year so that NSF management will have a final report ready by September 30th and available earlier in the annual financial statement audit. Dear experts when i run the Inventory Audit report i have found that the Cumulative values is […]

Ias Accounting Standards

Ias 37 provisions contingent liabilities and contingent assets outlines the accounting for provisions liabilities of uncertain timing or amount together with contingent assets possible assets and contingent liabilities possible obligations and present obligations that are not probable or not reliably measurable. Identifying the exact entity which is reporting discussing any going concern questions specifying. 12 […]

Bakery Financial Statements

Shop Bakery Budget Template. The total revenue for the first 12 months will hopefully be. Solid package of print-ready reports including PL and cash flow statements and a complete set of financial ratios. Has 230 total employees across all. Fri Oct 21 2011. Less Cost of goods sold 75330. Bakery financial statements. Sample Financial Statement […]

Explain The Purpose Of Trial Balance

Describe what aspects of the method or technique you used to read this short story you would modify. In order to identify and detect inaccuracies that are recorded in general ledgers, trial balance is created. A worksheet with two columns—one for debits and one for credits—known as a trial balance is used to check the […]

Consolidated Financial Statements Example In Excel

Stand-alone financial statements are different than consolidated financial statements. NPV Calculator – A simple spreadsheet to help calculate Net Present Value and Internal Rate of. The purpose of this model is to provide a simple way to see the financial statements for many companies in i file. This allows you to draw together the financial […]