Like most other income you earn the money you make. With Postmates Unlimited you get free delivery with no blitz pricing or small cart feesever.

Postmatess Income Statement based on Industry Averages Trademark Applications Trademark applications show the products and services that Postmates is developing and marketing. Verify Postmates Employees Truework allows you to complete employee employment and income verifications faster. Oct 2016 Jan 2017 Sep 2017 Apr 2018 Jul 2018 Sep 2018 Oct 2018 Y 2019. The process is simple and automated and most employees are verified within 24 hours.

Postmates income statement.

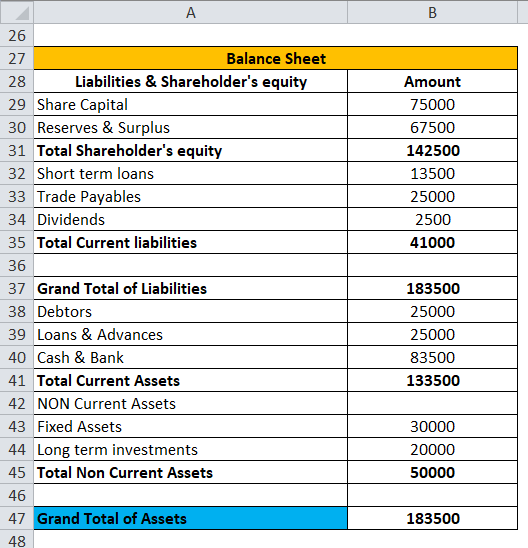

How Do Food Delivery Couriers Pay Taxes Get It Back Quickbooks Profit And Loss Report A Balance Sheet Is Used To

Postmates is an American company that offers local delivery of restaurant-prepared meals and other goods. Im sure they have a method of veryifying the income of the self employed ask them about that The end of the the year is close so for your taxes make sure you do a schedule C I think that any bank will take your schedule c as proof of your income. The 4 step model about how Postmates works. According to Postmates if you dont meet this requirement you wont receive a 1099-NEC.

Postmates generated 500 million revenue in 2019. There are many 1099 forms but were only interested in 1099-MISC because thats the one you need. Being an independent contractor means youll still get paid and have access to income statements but not pay stubs like you would in an employee position.

Step 1 Browse stores and products. Got it Order delivery or pickup from more than 600000. It will look something like this.

Package Or Food Delivery Amazon Flex Vs Postmates Doordash Ridesharing Driver Balance Sheet Simple Template Ey Accounting Firm

View as YoY growth or as of revenue. On Schedule C you will be able to show your income as well as your expenses. This is where you enter your earnings from Grubhub Doordash Uber Eats and others. Right now Postmates drivers are earning at minimum 20-27 an hour depending on when and where you deliverAdd in customer tips and you can get paid.

Learn more by visiting our Cookie Statement or opt out of third party ad cookies using the button below. People have a smartphone app as well as a desktop application which lets them request an article at their doorstep. TurboTax will also add Schedule SE which.

That includes referral payments bonuses and other income that comes from something other than deliveries. As gig workers all of our money is. Youre eligible for this form if the company doesnt employ you and instead you work independently.

Package Or Food Delivery Amazon Flex Vs Postmates Doordash Ridesharing Driver Indirect Method Cash Flow From Operating Activities A Financial Statement That Summarizes Company Revenue And Expenses Is

That goes in the income section of your profit and loss. Postmates net worth Apr 2022. Fortunately you can still file your taxes without it. Postmates says you can earn up to 27 an hour delivering food and more.

So if you have determined that you are a contractor you can always call and ask Postmates then you will have to file a Schedule C on your tax return in TurboTax this is the Self-employed version or Home Business. The form 1099-MISC for independent contractors serves as proof of how much they earned through an employer. Typically you should receive your 1099 form before January 31 2021.

Form 1099-NEC Youll generally receive a 1099-NEC if you made at least 600 in non-trip earnings from Postmates. But it is your BUSINESSS income. Postmates drivers are in high demand right now.

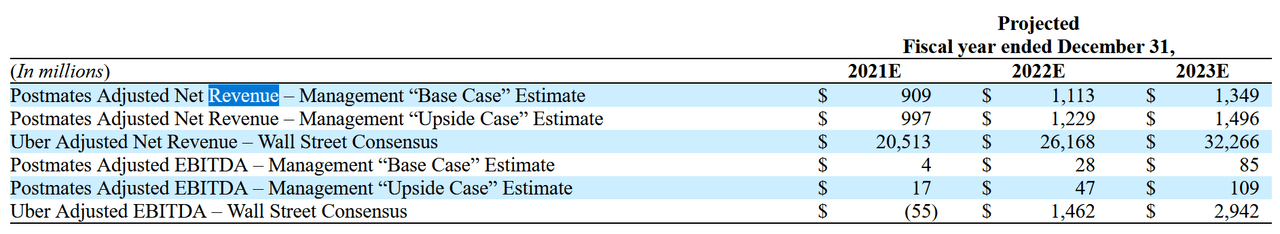

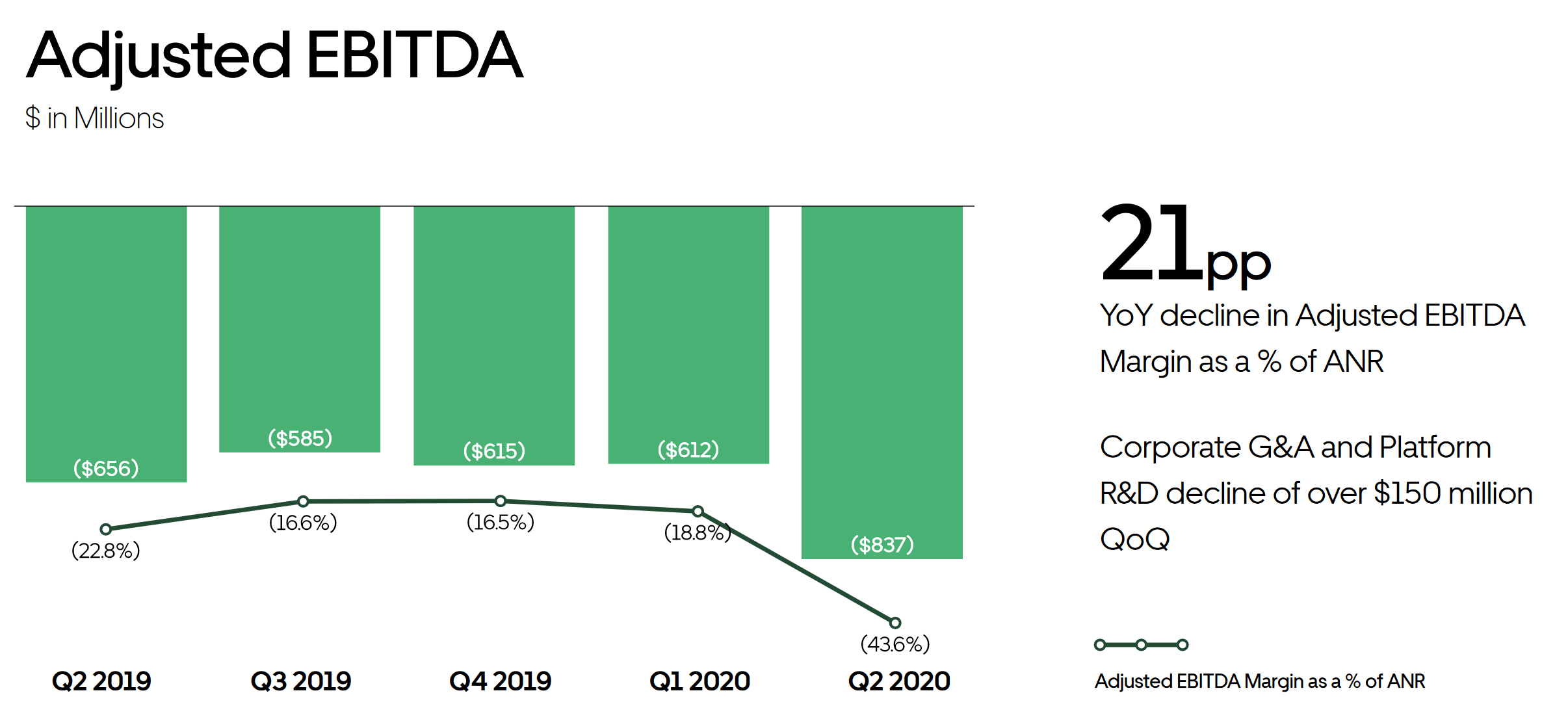

Uber Postmates Isn T Contributing Much For 2 65 Billion Nyse Seeking Alpha Pro Forma Costs Meaning Corning Financial Statements

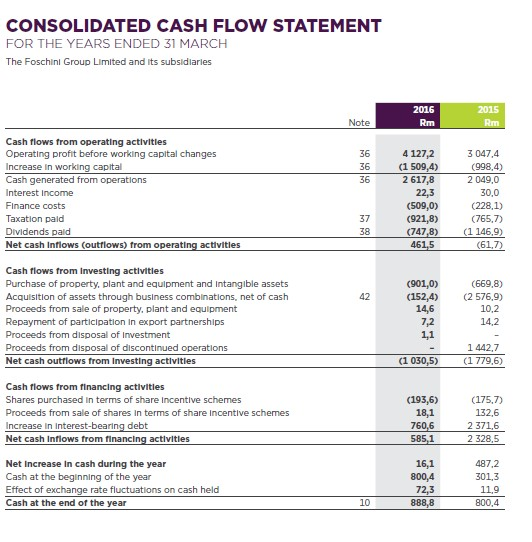

Get the detailed income statement for DoorDash Inc. Revenue of 32 billion grew 13 quarter-over-quarter down 16 year-over-year Mobility exceeded 1 billion trips in Q4 Delivery Gross Bookings grew 130 YoY with continued Adjusted EBITDA improvement Uber Technologies Inc. Postmates doesnt have any recent trademark applications indicating Postmates is focusing on its existing business rather than expanding into new products and. Annual Revenue Postmates revenue was 104 b in Y 2018 which is a 747 year over year increase from the previous period.

This average is clearly a far cry away from the potential 25 per hour the food delivery app occasionally advertises. Its one of the best gig jobs and one of the best food delivery services out there. As of February 2019 Postmates operates in 2940 US.

In this case Postmates. Verifiers love Truework because its never been easier and more streamlined to verify an employee learn more here. According to Glassdoor data the average Postmates courier makes about 11 per hour plus 100 of customer tips.

425 1 E20424 Uber Htm Filed Accounting And Finance Personal Statement Lse Autodesk Financial Statements

Here are the 1099 forms you may receive from Postmates. Very simply its a statement that shows how much money has come in and how much money went out. His insights are. The first step in the business model of Postmates is about creating a demand.

We estimate revenue increased to 880 million in 2020 although Postmates has not disclosed any official numbers Postmates has 10 million monthly active users who order five million items a month Over 600000 merchants are partners on Postmates Uber acquired Postmates in 2020 for 265 billion. If you delivered for multiple delivery platforms and received multiple 1099 forms you add all that money up and enter the total income on Line 1. Having completed hundreds of trips for companies including Uber Lyft and Postmates.

Postmates will send you a 1099-NEC form to report income you made working with the company. Up to 10 years of financial statements. I mentioned earlier that the money you get from Doordash Grubhub Uber Eats Postmates Lyft Instacart or any other gig app is NOT your income.

Leaked Postmates Financials Suggest Company Might Be Doing Better Than Everyone Thought Techcrunch Gojek Financial Statement Country Club Statements 2019

In fact its lower than the minimum wage in major metropolitan areas like Los Angeles and New York City. Regardless of whether or not you receive a 1099-NEC you must still file taxes with the IRS. Attractive pay with a side of flexibility makes on-demand food delivery an ideal way to put extra cash in your pocket. Like most other income you earn the money you make delivering food to hungry folks via mobile apps such as UberEATS Postmates and DoorDash is subject to taxes.

Postmates will only prepare a 1099-NEC for you if your earnings exceed 600 in a year. CitiesThe service relies on mobile phone applications and their Global Positioning System capabilities to match inventories and consumer demandLaunched in 2011 Postmates is one. UBER today announced financial results for the fourth quarter and full year ended December 31 2020.

Postmates revenue increased from 5942 million in 2017 to 1 billion in 2018 a 747 increase. The most important box on this form that youll need to use is Box 7 Non-employee Compensation. You dont actually work for Postmates you are an independent contractor.

Uber Postmates Isn T Contributing Much For 2 65 Billion Nyse Seeking Alpha Ge Financial Statements 2018 What Is Asset Or Liabilities

Try it free with a 7-day free trial cancel anytime. Here you will add up how much money you received for your delivery work.

Postmates Financials Comparably How To Prepare A Trial Balance Airline Industry Financial Ratios 2018

Uber Postmates Isn T Contributing Much For 2 65 Billion Nyse Seeking Alpha Modified Cash Basis Financial Statements Small Business Flow Projection Template