Examples of Prior Period AdjustmentsErrors Following are few examples of Prior Period Errorsadjustments along with their Adjustment entry to rectify it- MSA Company in the year 2017 incorrectly charged furniture and fixtures for advertisement expenses amounting to Rs. New standards or amendments for 2017 and forthcoming requirements 154 II.

Sometimes an error in a prior period does not merit a prior period adjustment. For example suppose the allowance for uncollectibles as of December 31 2018 was adequate based on the facts that existed when the financial statements were created. Statement of cash flows Direct method 158 IV Example disclosures for entities that early adopt. These changes added two examples no4 and 5 to IAS 8 that illustrate applying the.

Prior period errors disclosure note example.

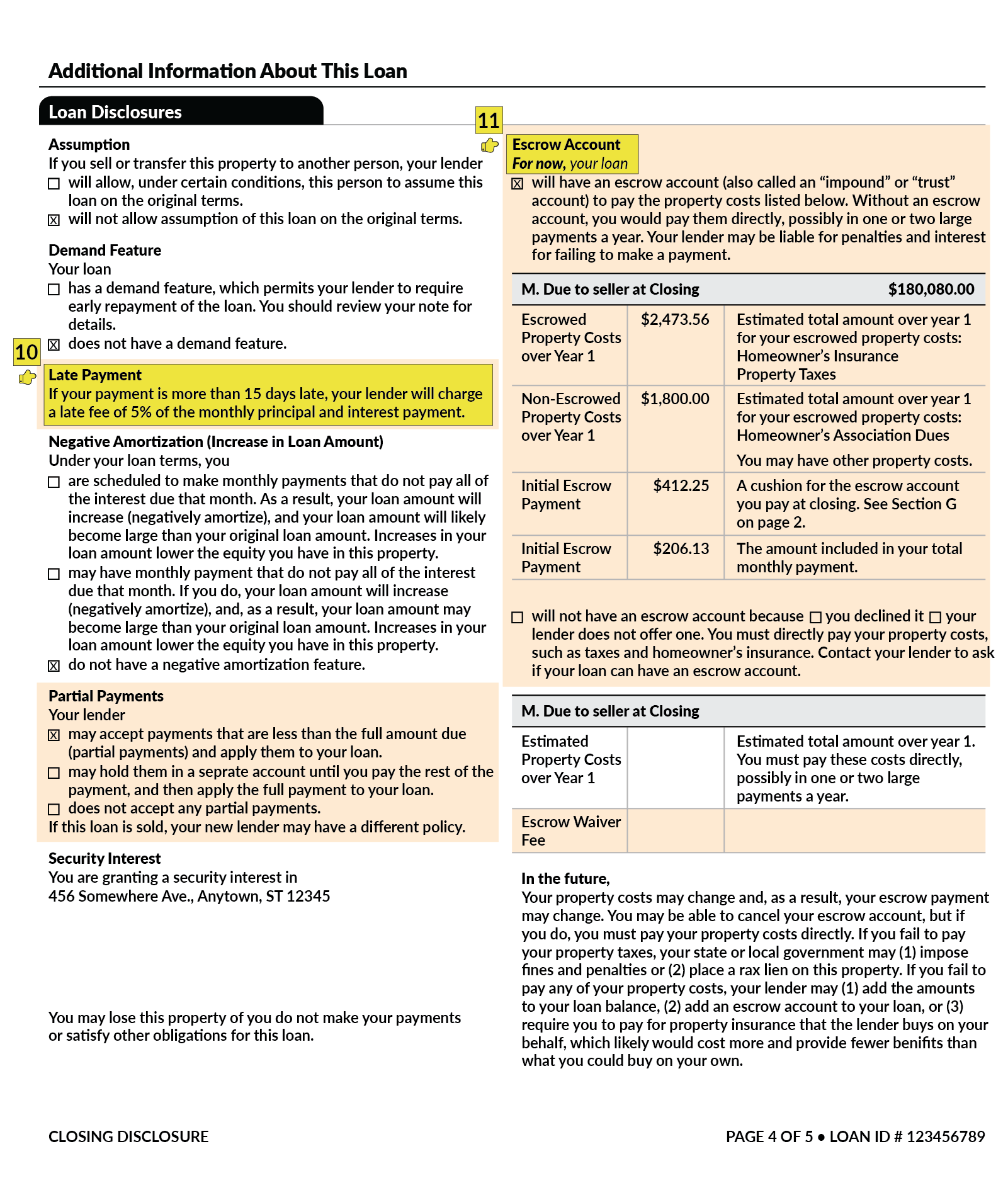

3 Day Rule For Closing Disclosure Graphics Mortgage Calendar Cash Flow Planning Template Big 20 Accounting Firms

Proceeds were used to provide funds for capital improvements to various State facilities. Prior Period Adjustment Example Company A has prepared a financial statement for the year 202X. Instructions to preparer. Common examples of such changes include changes in the useful lives of property and equipment and estimates of uncollectible receivables obsolete inventory and warranty obligations among others.

Application of a new accounting policy The department acquires a property in the current period which qualifies as an immovable asset. Finally when you record a prior period adjustment disclose the effect of the correction on each financial statement line item and any affected per-share amounts as well as the. FRS 102 para 1023 requires the entity to disclose the following about material prior period errors.

If you are making a prior period adjustment to an interim period of the current accounting year restate the interim period to reflect the impact of the adjustment. Adapted from IAS 8. Current period as an out-of-period adjustment when it is considered to be clearly immaterial to both the current and prior periods.

2 P & L Account Reserve Clean Opinion Audit Report

C to the extent practicable the amount of the correction at the beginning of the. Xerox provides extensive disclosure as to the effect of the errors on the income statement and the balance sheet for each year affected. SUBSEQUENT EVENT On August 14 2003 the State issued 1210 million of general obligation bonds. In January of year 1 a company dedicated to the sale of computers has an initial balance of 100 computers at 700 dollars in March the entity acquired 150 units at 750 dollars.

B for each prior period presented to the extent practicable the amount of the correction for each financial statement line item affected. It happens due to the wrong calculation of depreciation expense. The following is an example of a prior period error highlighting how this could be disclosed in a set of statutory accounts.

A the nature of the prior period error. FRS 102 para 1023 requires the entity to disclose the following about material prior period errors. Example of Correction of Prior Period Accounting Errors 2 minutes of reading Management of ABC LTD while preparing financial statements of the company for the period ended 31st December 20X2 noticed that they had failed to account for depreciation in last years accounts in respect of an office building acquired in the preceding year.

2 A Balance Sheet Is Bank Statement Financial

Statement of changes in equity SOCIE Year ended 30 April 20XX 20XX 20YY As restated Profit for the financial year 12000 14200 Unrealised surplus on revaluation of certain fixed assets 25000. The error adjustment intentional errors in this instance was made in 2000 by Xerox. The nature of the prior period errors. And b in government-wide and enterprise funds only other material adjustments which meet the criteria for prior period adjustments.

Please prepare journal entries for the year 202X 202X1 and 202X2. 3 Illustrative Examples on Prior Period Errors and disclosures thereon Table 1. In June of this year 170 computers were sold to 1500 per unit and at the end of this year 50 units were.

Prior Period Errors are omissions from and misstatements in prior period financial statements resulting from the failure to use or the misuse of reliable information that was available or could be reasonably expected to have been obtained at the time of preparation of those financial statements. Or a change in a measurement technique are changes in accounting estimates unless they result from the correction of prior period errors IAS 834A. Notes to the consolidated financial statements.

Special Reporting Situations Principlesofaccounting Com Ifrs 16 Cash Flow Statement Presentation Sba Form 413 Disaster Loan

Practical example 1 – changes in accounting policies. A corrections of material errors in the financial statements of a prior period. B for each prior period presented to the extent practicable the amount of the correction for each financial statement line item affected. Adjustments related to prior periods and thus excluded from the operating statements for the current period are limited to.

In order to disclose the correction of a prior period errors an agency must disclose the following. The department previously never had immovable assets. These serial bonds mature between July 1 2004 and July 1 2023 and bear average interest rates of 386.

KPMG International – KPMG Global. Statement of Financial Performance Statement of Financial Performance for the year ended 31 March 2015 20142015 20132014 Note R000 R000 REVENUE. A the nature of the prior period error.

Special Reporting Situations Principlesofaccounting Com How To Read A Cash Flow Statement For Dummies Ford Financial Statements 2019

PRIOR PERIOD ADJUSTMENT DELDOT Fund. Presentation of comprehensive income Twostatement approach 156 III. An example of the disclosure provided when an error adjustment is made through a prior-period adjustment is given below. Other capital assets owned by the department qualify as movable assets therefore the accounting policy for movable assets were used.

Such errors result from mathematical. Two years later in 202X2 they just realize that operating expenses were understated of 100000. Note that IAS 830 requires disclosure about IFRS that have been issued but are not yet effective.

For each prior period presented to the extent practicable the amount of the correction for each financial statement line item affected. Prior period errors are omissions from and misstatements in an entitys financial statements for one or more prior periods arising from a failure to use or misuse of reliable information that was available and could reasonably be expected to have been obtained and taken into account in preparing those statements. However in August 2019 after the issuance of the 2018 statements the company realizes it will not collect a material 2018.

2 Personal Financial Statement Pdf Subsidiary Meaning In Accounting

IFRS 9 Financial Instruments.

What Is A Closing Disclosure Lendingtree Net Profit And Loss Doubtful Debts Income Statement

Making Changes And Correcting Errors Boundless Accounting How To Understand Profit Loss Statement Cash Receipts From Customers In Flow

2 Amex Financial Statements Statement Of Profit And Loss Is Also Known As