Ii Provision for doubtful debts was to be increased to 15 on debtors. Identify in which category of the profit and loss account the following items may appear.

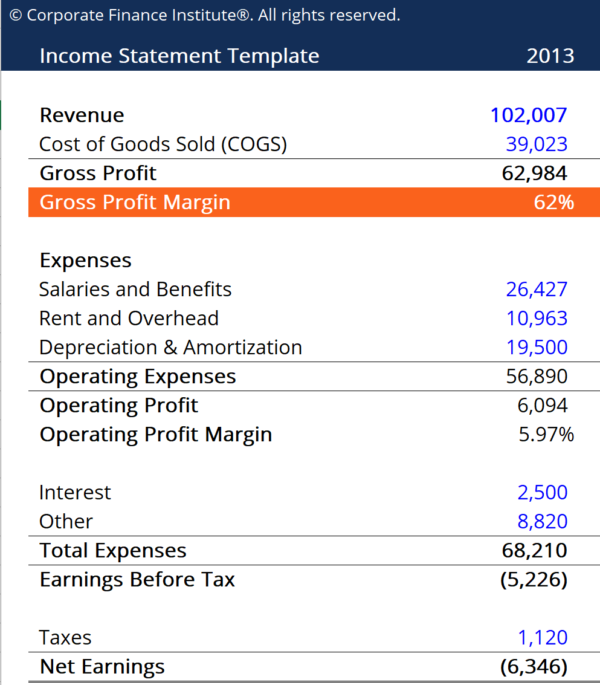

Following the net income in the profit and loss report is a very important. Revenue Cost of sales Gross profit Expenses overheads these are the costs that do not change as production increases or decreases. The main categories that can be found on the PL. The credit entry of 145000 is the gross profit for the period.

Profit and loss account items list.

Profit And Loss Vs Appropriation Account Accounting Capital Coca Cola P L Management

Definition of Profit and Loss Statement Format. Depending upon the company policy telephone expenses are charged to the Profit and loss account. Lets look at each of the Profit LossIncome Statement types one by one. Rated the 1 Accounting Solution.

As of March 31 2016 the business had stock capital debt and long-term loans. Profit and Loss Account is a type of financial statement which reflects the outcome of business activities during an accounting period ie. Under the double entry accounting.

Expenses and losses are shown on the debit side of Profit Loss Account. A lot of legal considerations have to be kept in kind before. The following items are debited in the profit and loss account.

Profit And Loss Statement Guide To Understanding A Company S P L Global Cash Flow Template Account From Trial Balance

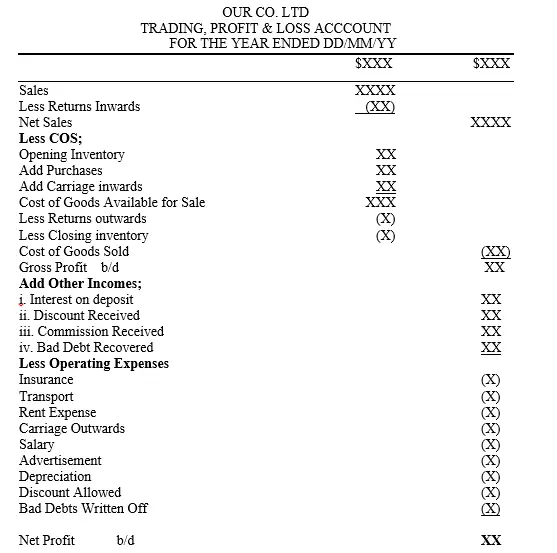

Profit and Loss Account for the year ended 31122005 if accounting period ends on 31122005 Sequence of Expenses in Profit and Loss Account. This includes interest paid on loans insurance. PL or PL or PNL. The profit and loss account starts with gross profit at the credit side and if there is a gross loss it is shown on the debit side.

The balance sheet on the other hand is a snapshot. Ad QuickBooks Financial Software. GST Checklist Before Finalisation of Books of Accounts WRT Profit and Loss Items PART-II INTRODUCTION.

Iii Furniture was to be decreased to Rs. This article provides an outline for the profit and loss statement format. Profit and Loss Account Format Items not shown in Profit and Loss.

Everything You Need To Know About The Income Statement Score Ifrs Accounting Standards List Of Directors Responsibilities Example

Profit and Loss Statement is the report that shows the results of the. Total operating expenses include cost of goods administrative expenses financial expenses and selling expenses. Ad QuickBooks Financial Software. It is also useful for analyzing performance YOY.

A companys statement of profit and loss is portrayed over a period of time typically a month quarter or fiscal year. Rated the 1 Accounting Solution. Helping business owners for over 15 years.

I Plant and Machinery was undervalued by 10. Office salaries Office Rent Office Lighting Printing. All expenses losses incomes and gains are the components of Profit and Loss Account.

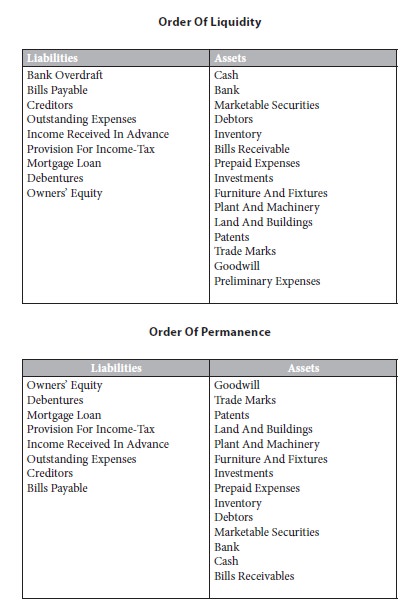

Listing Of Items On The Balance Sheet Study Material Lecturing Notes Assignment Reference Wiki Description Explanation Brief Detail Types Reserves In Form 26as

If we dont make this simple thing complicated then Profit and Loss Account will include the revenue items relating to the current financial year. The PL or income statement like the cash flow statement shows changes in accounts over a set period of time. Public deposits had been accounted for in a. 2 Travelling Expenses These are the expenses that are paid by the company for.

There is no hard and fast. Single Step Income Statement Multi-Step Income Statement Comparative Income Statement. Cost of goods sold are also known as direct operating Expenses and the rest.

The main components of a profit and loss account are Revenue Cost of goods sold Selling administrative and general expenses Marketing and advertising expenses. In this example all accounts are closed and transferred to the trading account. Interest received accountancy fees share premiums electricity standing charge interest paid rents.

Trading And Profit Loss Account Definition Types Example How Do I Read A Balance Sheet Difference Between Combined Consolidated

Accounting Nest Beginner Trading Account Profit And Loss P&l Process Excel Spreadsheet Templates

What Items Can I Show In Profit And Loss Account Quora Abbv Balance Sheet Topgolf Financial Statements

8 Types Of P L Profit Loss Income Statements What Are Prepaid Expenses On A Balance Sheet Notes Financial Company

What Is A Profit Loss Statement Uber Stock Balance Sheet Iasb Ifrs 16