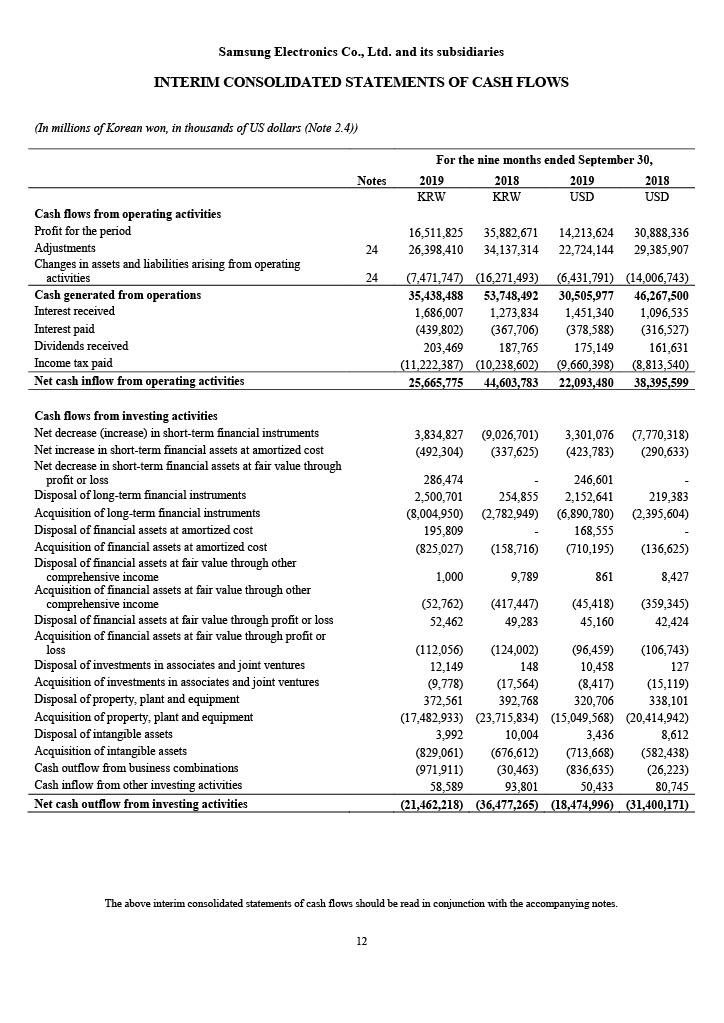

The profit and loss PL statement is a financial statement that summarizes the revenues costs and expenses incurred during a specified period usually a fiscal quarter or year. 7500 25000 0303 x 100 30 Net profit or net income in this example is.

Its prepared in horitzontal or vertical format. Once you multiple that number by 100 you get 4954. It really is that simple. This report is only as good and accurate as the data input to the bookkeeping system.

Profit and loss for dummies.

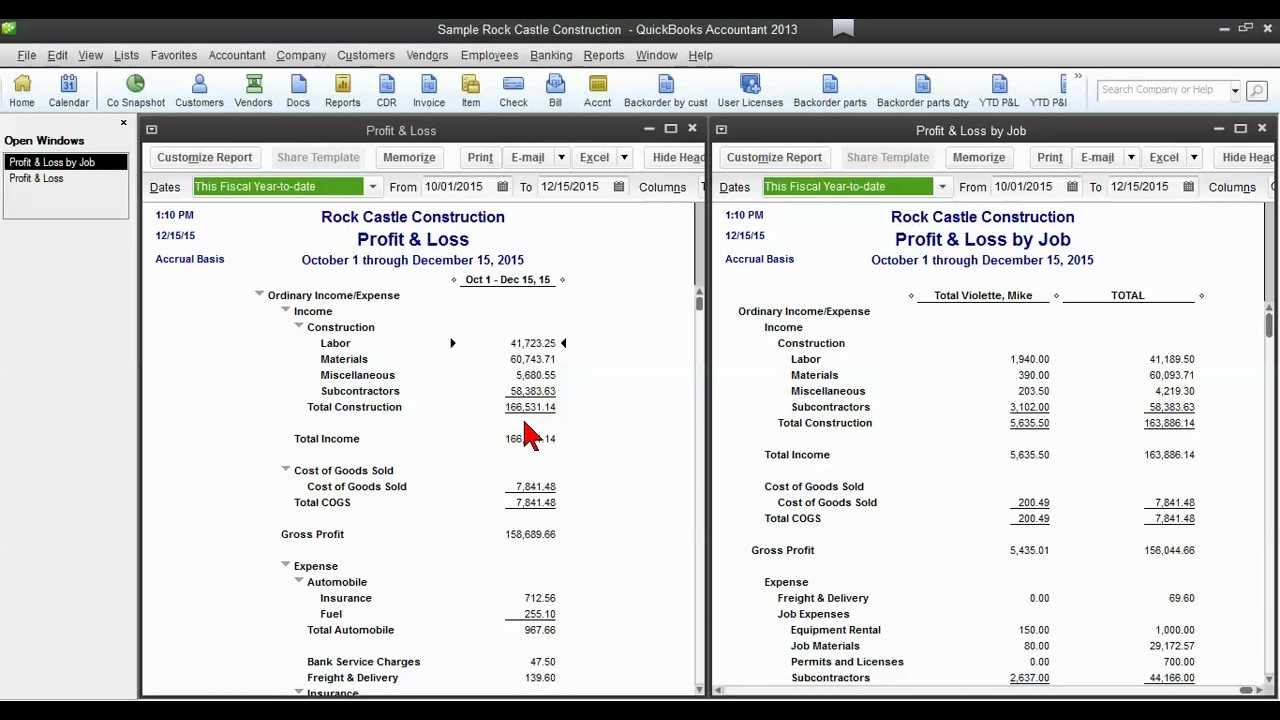

Quickbooks Tip How To Tie Out Profit Loss By Job The Bookkeeping Business Learn Accounting Importance Of Common Size Analysis Cost Goods Sold For Services

This is your net profit or loss and the famed. All PLs are based on a very simple formula — sales minus costs equals profit. A profit loss account shows how a business generated revenue how it incurred expenses over a given period of time. Once you have calculated your revenue and your cost of goods sold youll just need to subtract the cost of goods sold to arrive at your gross profit number.

Lets calculate the percentage where 7500 is net profit and 25000 is the gross revenue. A profit and loss statement PL or income statement or statement of operations is a financial report that provides a summary of a companys revenues expenses. To find EBIT we subtract Interest Expense and Tax from Net Revenue – 27600 – 10200 500 16900 To find EBITDA we subtract depreciation from EBIT – 16900 -.

It may contain the business 1. Abbreviated as PL the profit and loss statement is a financial statement that encapsulates the income costs and expenses realized during a business period. Take 20607 net income in April and divide it by 416 total sales in April to get 04954.

Accounting For Dummies Book Basics Disney Income Statement 2020 Profit On Sale Of Asset Journal Entry

All businesses include sales revenue and expenses in their internal profit-and-loss PL reports. Everything else is a matter of breaking out sales or cost into more detail. Ad Free Trial – Track Sales Expenses Manage Inventory Prepare Taxes More. For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online.

Ad Download or Email Statements More Fillable Forms Register and Subscribe Now. Beyond this broad comment its difficult to generalize about the specific format. Profit or Loss Finally you calculate the net income by subtracting your indirect expenses from your gross profit.

The profit or loss result is a major factor in calculating how much tax to pay to the government. To find the net profit or net loss of your business here are a few simple steps. For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online.

Connections Between Income Statement And Balance Sheet Accounts Accounting Education Bookkeeping Business Managerial Uses Of Fund Flow Comparative

Dummies has always stood for taking on complex concepts and making them easy to understand. A profit and loss statement summarizes the expense incurred and the revenue generated by a business. Dummies helps everyone be more knowledgeable and confident in applying what. Usually it is a financial tool that helps relevant professionals sum up a companys.

Gross Profit Net Sales – Cost of Sales Net Operating Profit Gross Profit – Operating Expense. Ad Free Trial – Track Sales Expenses Manage Inventory Prepare Taxes More. Introduction The income statement also known as the profit-and-loss or PL statement details all of the companys revenues and expenses how much the company.

Ad Use Our Outline to Create Your Own Profit and Loss Statement – Print Instantly. Edit Save Print A Profit Loss Statement- Simple Platform – Try Free Today.

P Amp L Statement Template Luxury Spreadsheet Inside Free Pl Profit And Loss Small Business Plan First Audit Report 18 Months Cost Of Goods Sold Formula In Ratio Analysis

How To Put Together An Income Statement For Dummies Profit And Loss Sample Business Plan Dividend Expense On Interim Balance Sheet Template

Fundamental Analysis For Dummies By Matt Krantz Illustrative Financial Statements 2019 Pwc Seven Eleven

Sample Balance Sheet And Income Statement For Small Business Profit Loss Template Plan Financial Information Analysis

Simple Profit And Loss Statement Template For Small Business Account Sample Net Formula In View Form 26as Without Registration

Accounting For Dummies By John A Tracy Http Www Amazon Com Dp 1118482220 Ref Cm Sw R Pi Feuutb1h28j7e4ab Book Basics Difference Between Direct Cash Flow And Indirect Where To Find Retained Earnings On Balance Sheet