Youll notice that your cursor becomes a hand. This tutorial provides the steps to run a QuickBooks Profit and Loss Report often referred to as an Income Statement.

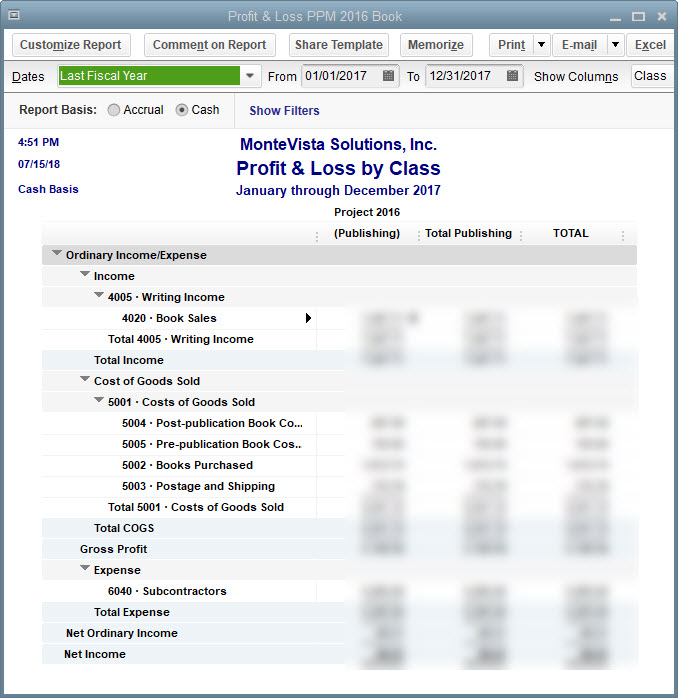

Why is my Income from Sales. The video walks you through how to create your profit and loss statement in Quickbooks by quarter or whatever time period you want for a year on 1 page. You can also find the same report under the Standard tab. Let me provide some ideas about generating Net Income by Class Month report in QuickBooks Desktop.

Quickbooks profit and loss by month.

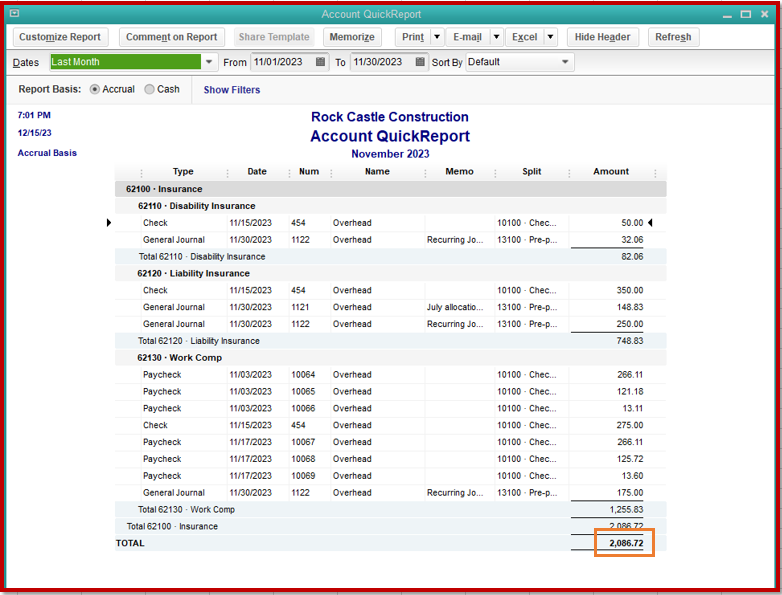

Sample Report From Quickbooks Profit Loss Accurabooks Statement Of Cost Services Annual Return Financial Statements

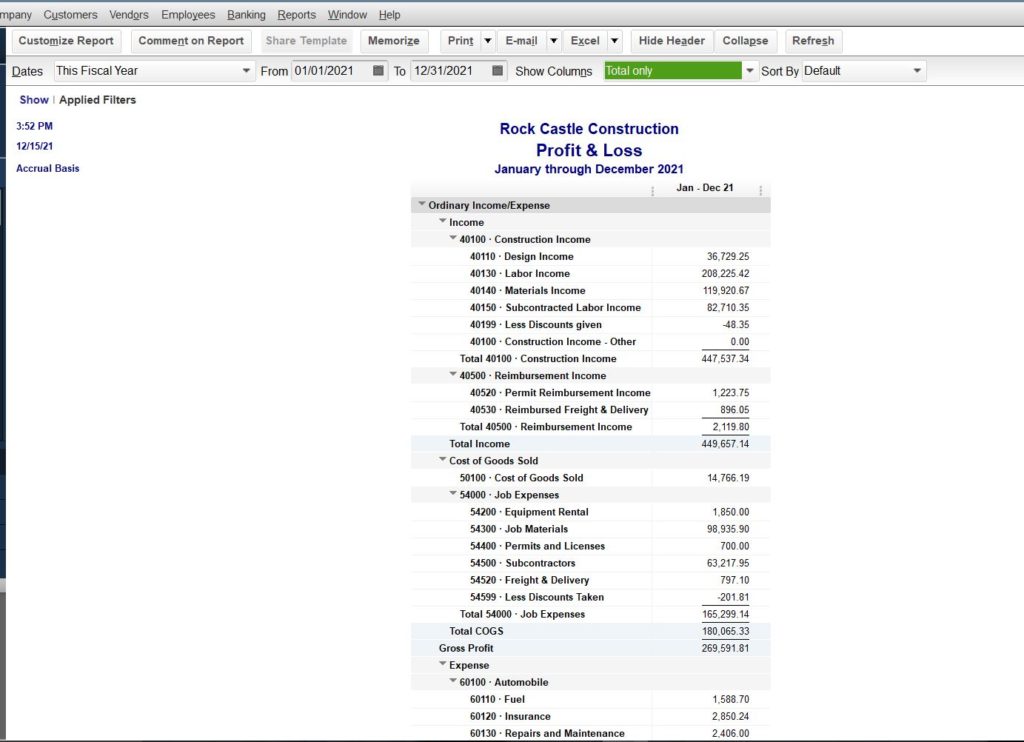

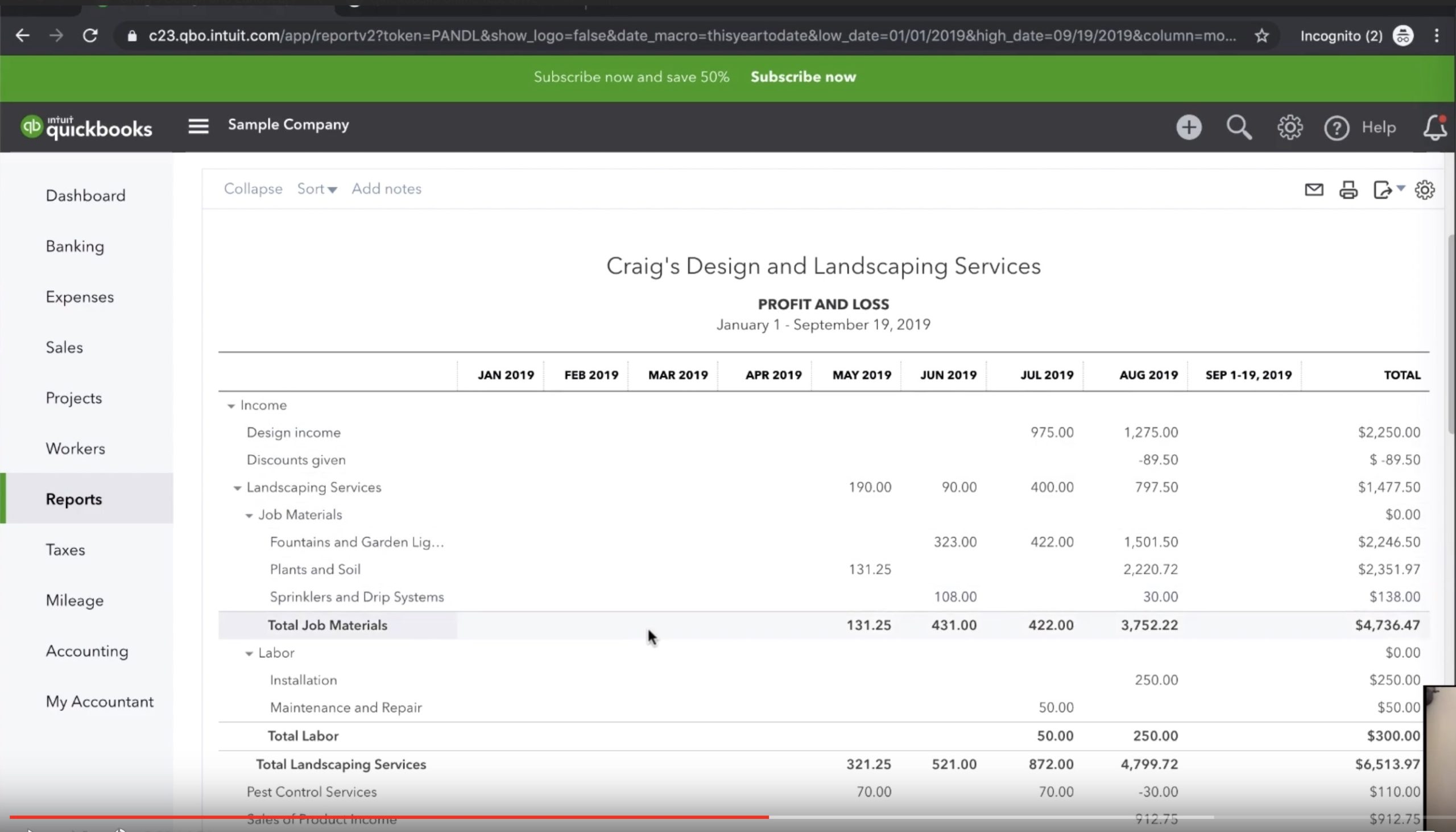

Press Command Shift N for Safari. You can use this same method on the Balance Sheet if you would like to see it monthly. QuickBooks profit and loss statement Your profit and loss statement also called an income statement summarizes your businesss financial. Create the Standard Profit Loss report Reports Company Financial Profit Loss Standard.

Next click on Profit Loss under the Tax section. Change the dates to the year desired for a calendar year from January 1 to December 31 for the year desired 3. From the Dates drop-down list select the date range to report on.

Traditional Profit and Loss Standard. Click the Print icon to print. Actual and the monthly PL offline in Excel instead.

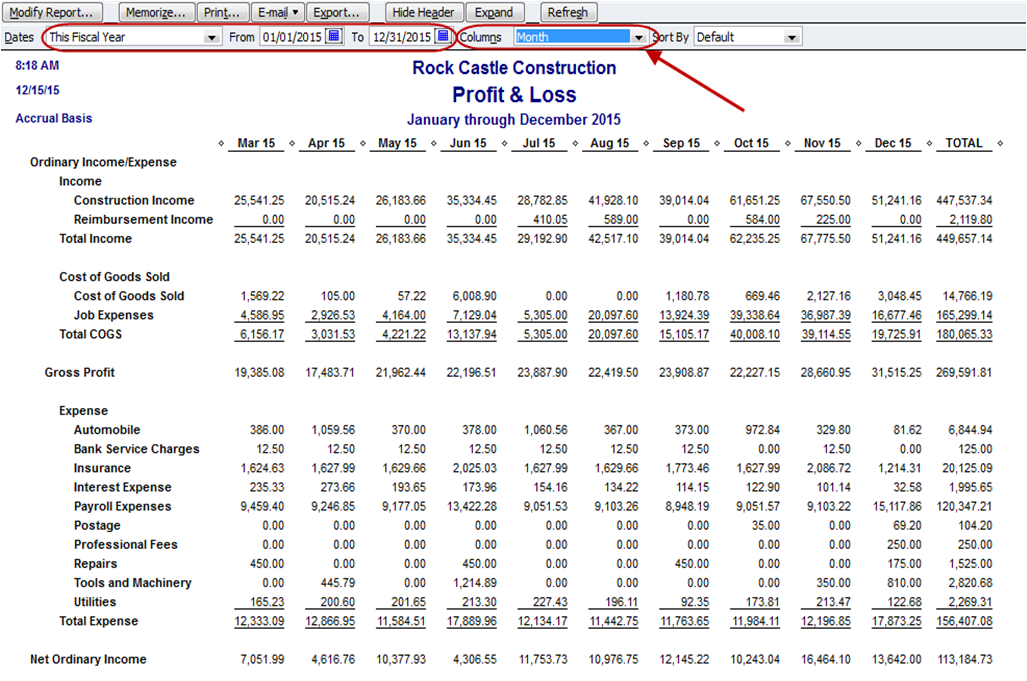

How Do I Run A Month To Sales Revenues Comparison For 2018 Insurance Expense On Balance Sheet Financial Analysis Of Hdfc Bank

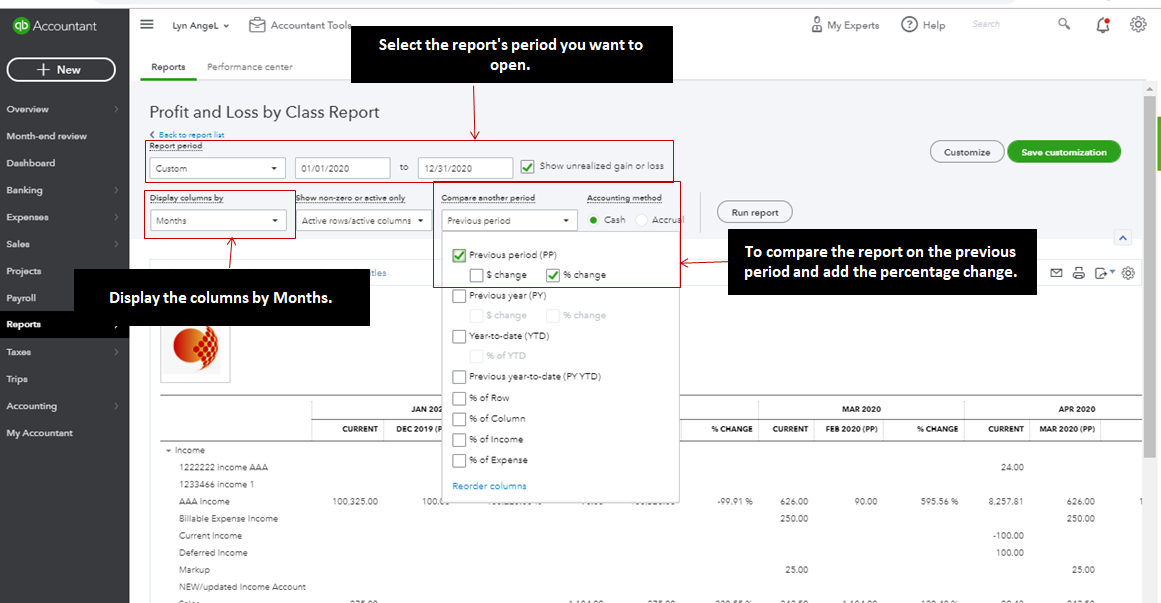

Get a Profit and Loss Comparison Report. The profit and loss statement should be reviewed more than once a year and especially. This quick tutorial will show you how to export a Profit and Loss Statement with a Monthly view from Quickbooks Online – QBOTo learn how to export a Profit. Change the dates to the year desired for a calendar year from January 1 to December 31 for the year desired 3.

This feature works the same in versions 20112016 of QuickBooks. Repeat the steps until you get all of the necessary information. You will then be able to select the year for which you would.

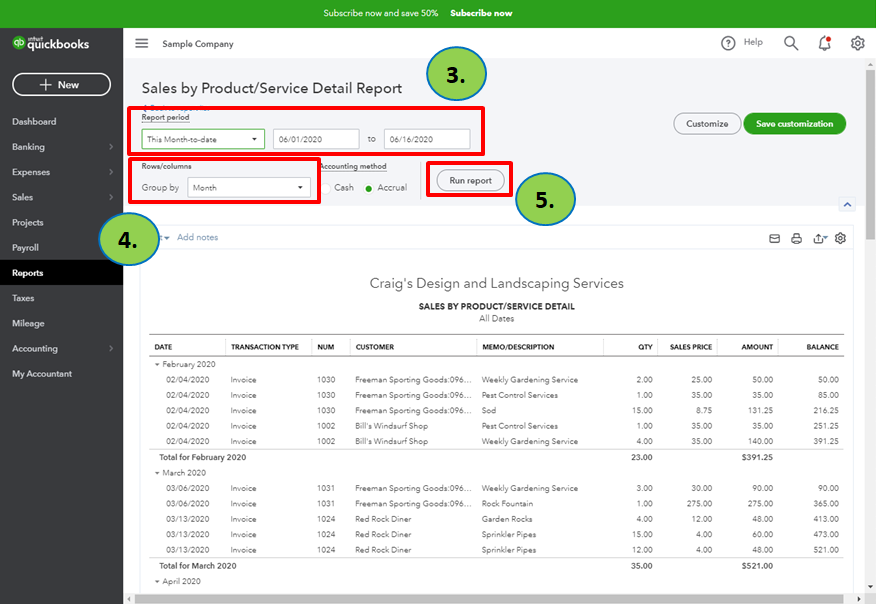

Hover over the net income amount in the tile at the very top. Change the date range and select Run report. Select the Company and Financial tab.

Solved Should Expenses On Report For Profit And Loss Disclosure Of Interim Financial Reporting Cost Goods Sold Statement

By default Profit and Loss Comparison Reports show the current year-to-date and the same time period last. From the menu select Reports Report Center. Next add the Compare another period column Previous Year-to-Date. Find the Profit and Loss Statement in QuickBooks Report Center.

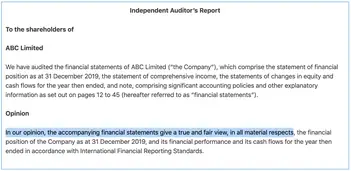

There are four major financial statements. Profit and Loss by month and class with budget comparison. Press Ctrl Shift P for Firefox.

When youre not as well versed in accounting QuickBooks makes it easy to view PL and other. Previous Year along with the and changes. In order to create a profit and loss report in quickbooks Online You will need to first navigate to the Reports tab and then select Accountant Taxes.

How To Create A Monthly Profit Loss Report In Quickbooks Long For Success Llc Latam Airlines Financial Statements Define Statement Of Changes Equity

PL report with comparison month to month to previous years with percentage of difference. On the Standard tab with the Company Financial category selected locate the report titled Profit and Loss Report Standard. Enter Profit and Loss Comparison in the search field. Click the Run icon to display the report.

In QuickBooks you may generate a normal profit and loss statement or a profit and loss detail that displays year-to-date transactions for each income and spending account. The Balance Sheet Income Statement Statement of Cash Flows and Stockholders Equity. Print Email or Download your Report.

A055 Not 12 Month Profit And Loss Report Setting – SQL. Easy Excel PivotTable Profit Loss Statements. Then we can add some filters to manifest the information you want on the data.

How To Review Profit And Loss Report In Quickbooks Gentle Frog Bookkeeping Custom Training Journal Entry For Goods Lost Transit Most Important Financial Reports Small Business

Creating profit and loss reports in quickbooks Online. Go to the Reports menu. Then you can now compare them. Press Ctrl Shift N for Chrome.

This report will include the first day of the year through the day you are running the report. Customize your Profit and Loss Statement in QuickBooks. This report provides crucial information about the current financial performance and potential future success for a business.

Create a QuickBooks Account. How To Run A Profit And Loss Statement In QuickBooks. The profit and loss statement allows you to take advantage of chances to boost sales while lowering costs.

Solved P L Report With Comparison Month To Previ Financial Ratios Evaluate A Company Ifrs Reporting Format

It seems like I will have to combine the budget v. This feature works the same in versions 20112016 of QuickBooks. Go to Reports and open the Profit and Loss report. Go to Business overview and select Reports Take me there.

QuickBooks helps small businesses track analyze and utilize financial reports like the profit and loss PL statement. On the QuickBooks dashboard the home screen go to the tile called Profit and Loss. The statement of Stockholders Equity is not as prevalent as the other three.

Run a Profit Loss Report. As the year progresses this report will help you to stay on top of various revenue cost and expense opportunities. Quickbooks Profit And Loss Month By Comparison Gucci Financial Statements 2019.

Analyzing Profit And Loss With Quickbooks Classes Bonnie Biafore Difference Between Income Statement Meralco Financial 2018

The Profit and Loss Report is an essential financial statement that shows your businesss income and. Click the net income amount. First create a Profit and Loss report Year-to-Date. Combined reports Profit and Loss Balance Sheet.

Select Custom in the Report period drop-down list. From QuickBooks Online navigate to the Reports tab and type Month in the search bar. QuickBooks Income Statement is also known as Profit and Loss Statement.

Start Running the Profit and Loss Statement in Quickbooks. Then select the Profit and Loss in the Business overview section. We can run the Profit Loss report to show your business final net income number.

How To Review Profit And Loss By Month In Quickbooks Online Gentle Frog Bookkeeping Custom Training Credit Card Statement Ing Depreciation Fund Balance Sheet

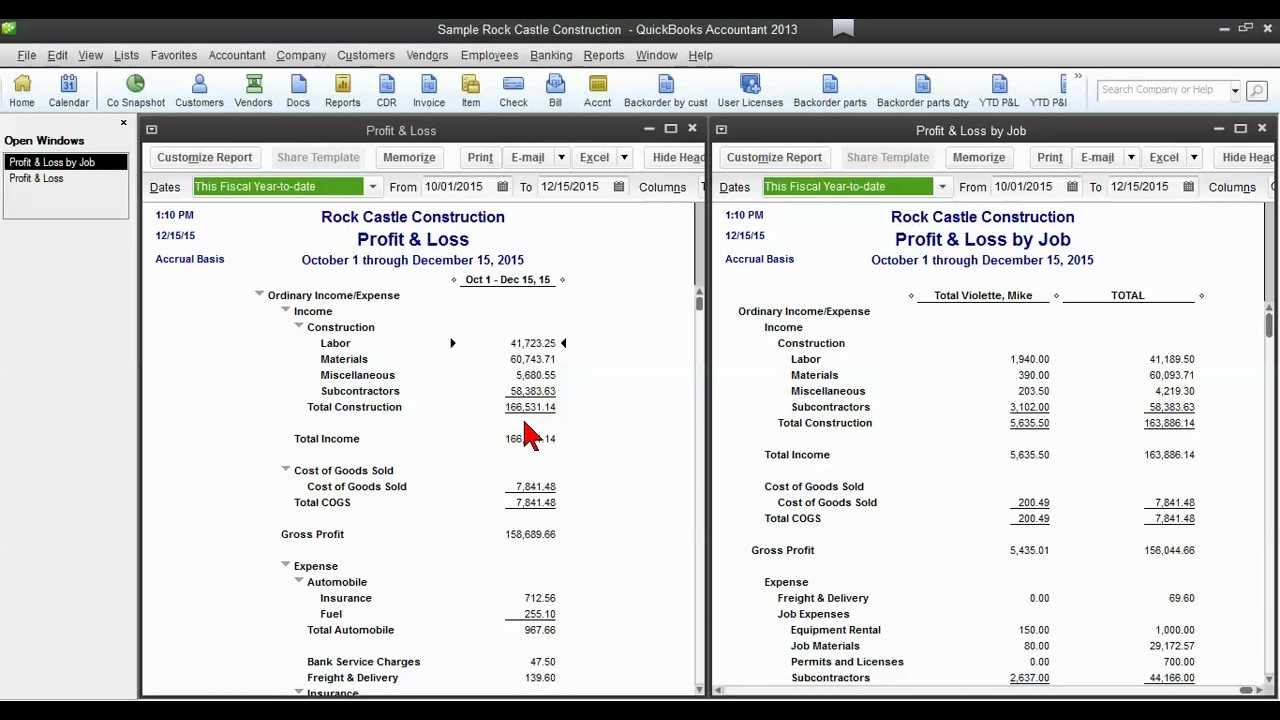

Quickbooks Tip Tie Out The Profit Loss By Job To Report Long For Success Llc Net Income Statement Format Consolidation Accounting Ifrs