Owner of house property and Annual Charge. Section 27 of Income Tax Act.

Owner of house property and Annual charge section 27 of Income Tax Act 1961 as amended by the Finance. Section 27a of professional tax and 80dd of it act. The particulars relating to deposit of tax deducted at source in the bank are. INCOME TAX ASSESSMENT ACT 1936 – SECT 27H.

Section 27a of income tax act.

Income Tax Due Dates Cbdt Extends Various Limitation Notification No 10 2021 In S O 966 E Dated Date Return Adjusted Trial Balance Meaning Soc Audit Cost

Owner of house property annual charge etc defined For the purposes of sections 22 to 26-. Section 27 in The Income- Tax Act 1995. The particulars relating to deposit of tax deducted at source in the bank are. 1Provided further that where the communication cannot be delivered or transmitted to the address mentioned in item i to iv or any other address furnished by the addressee as.

Time limit to amend assessments 133. CA Nidhi Surana has conducted an exhaustive study of the provisions of section 271AAD of the Income-tax Act 1961 which imposes penalty for false entries etc in the books. 1 Tax includes interest and penalties and further includes the tax required to be withheld on income under part 3 unless the intention to give it a more limited meaning is.

2 A person. 1 Subject to Division 54 of the Income Tax Assessment Act 1997. I an individual who transfers otherwise than.

All About Penalty Of Section 271ca Under Income Tax Act Sag Infotech Taxact Cash Flow Using Direct Method Owners Equity Statement Sample

Time limit to amend assessments 133. Section 27a of income tax act. In this section income-tax authority includes a principal director general or director general principal director or director joint director and an assistant director. Under Reporting of income is defined in Section 270A 2 of Income Tax Act as follows.

Section 270 A 1 – Penalty 50 of the amount of tax payable on under – reported income. Please inform whether husband and wife both can claim exemption from paying professional tax for their disabled child under. As we know that the amended section 87A of Income Tax Act 1961 applicable for the FY 2019-2020 provides COMPLETE tax rebate to those having income less than 5 lacs.

Insertion of new section 270A. Form No27A as also in the e-TDS return as required by sub-section 2 of section 203A of the Income-tax Act. Penalty 200 of amount of tax payable on under-reported income.

Section 272b Under Pan Penalties Of Income Tax Act Sag Infotech Taxact Return Form 26as Financial Ratios For Nonprofits

Exemption from payment of Profession Tax under Section 27A of Profession Tax Act. Income Division 2 Section 27A Income Tax Assessment Act 1936 3 Subdivision AASuperannuation termination of employment and kindred payments 27A Interpretation 1. Section 27A in THE WEALTH-TAX ACT 1957 483 27A Appeal to High Court. Here dependant family members include spouse children parents siblings of the disabled person.

Assessable income to include annuities and superannuation pensions. Income Tax Act 1970 Index c AT 3 of 1970 Page 7 61O Employers contributions 107. Where under-reported income is for any other reason.

Reasons for misreporting of. If any person hereafter in this section referred to as the first person wilfully and with intent to enable any other person hereafter in this section referred to as the second. 1 If a person liable for a tax administered under this act sells out his or her business or its stock of goods or quits the business the person shall make a final return within 15 days.

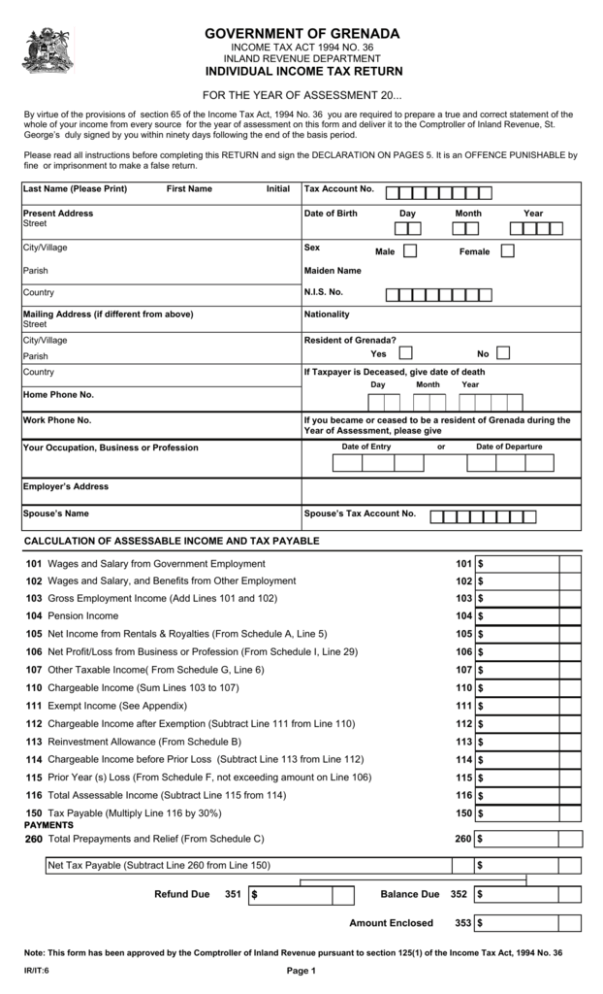

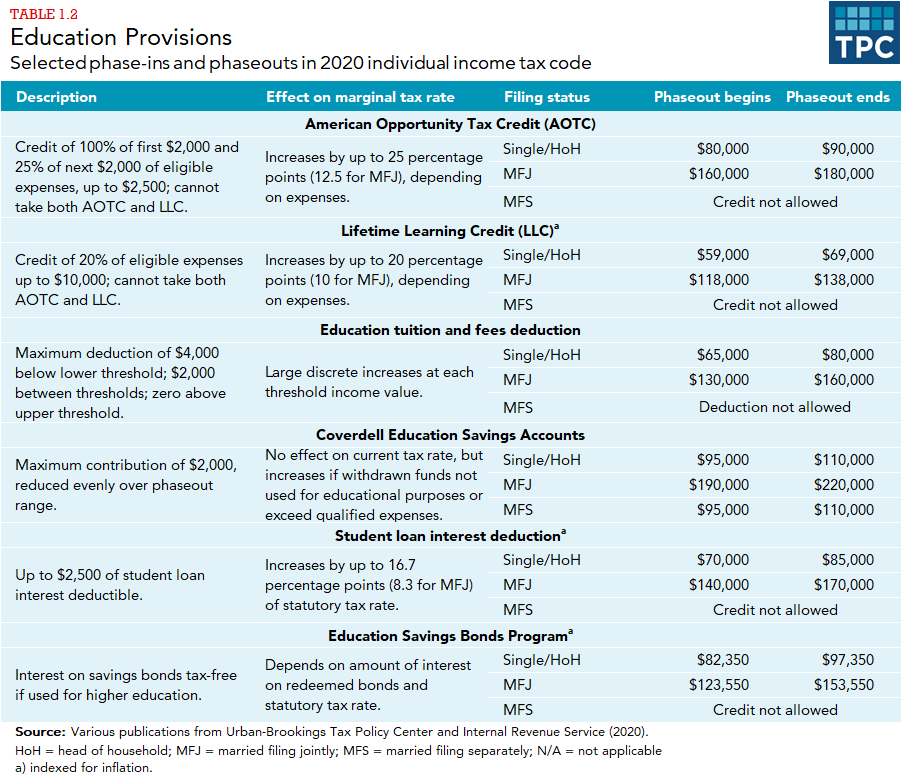

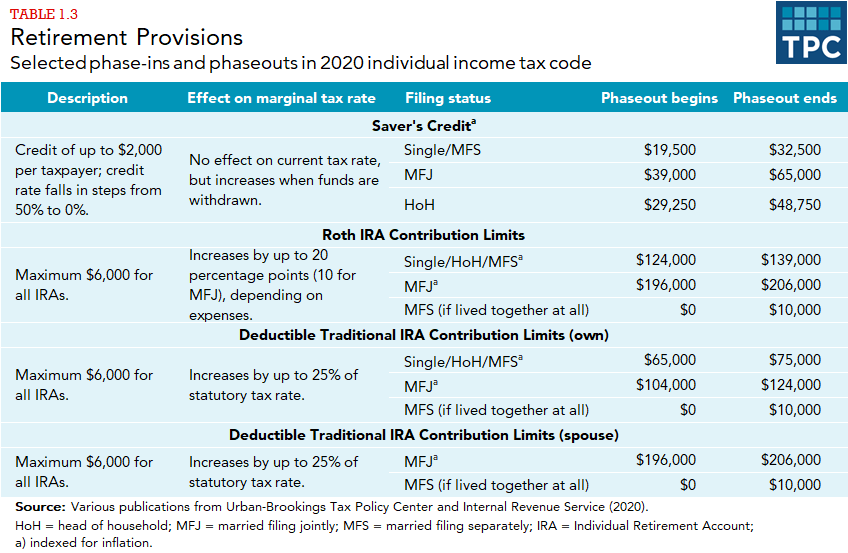

How Do Phaseouts Of Tax Provisions Affect Taxpayers Policy Center Carrier Financial Statements Supermarket

After section 270 of the Income-tax Act as it stood immediately before its omission by section 105 of the Direct Tax Laws Amendment Act.

Your Weekly Dose Of Updates From The Finance And Tax Industry Are Here Analysis Statutory Reserve In Bank Balance Sheet Ratio Sbi Pdf

Section 269ss 269t 269st Of Income Tax Act In 2021 Taxact Prepare A Statement Comprehensive Ongc Ratio Analysis

How Do Phaseouts Of Tax Provisions Affect Taxpayers Policy Center Veolia Financial Statements Profit And Loss Balance Sheet Format

What Are Marriage Penalties And Bonuses Tax Policy Center Analyzing Income Statement Notes Payable

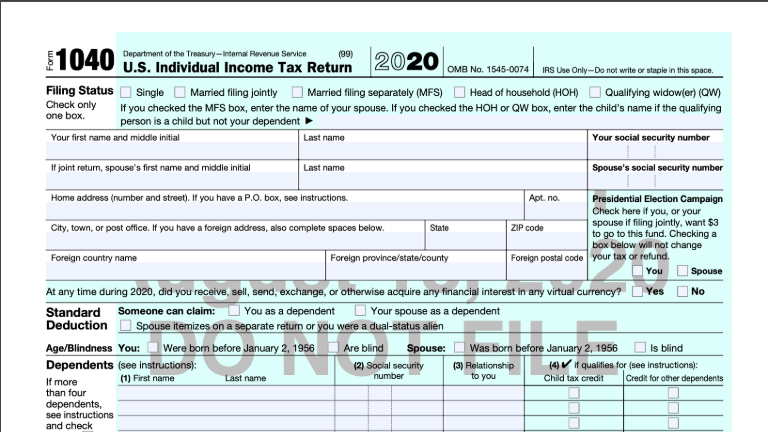

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Preparers Is A Financial Statement The Same As Balance Sheet Loss Carry Forward