HI sir for sole proprietor only SMR for income tax return is required though you can use the SMR for fs if you want as this SMR is only required for corporation as required by SEC. However this burdensome practice is expected to finally come to an end as the taxpayers are provided with other options for submission.

2307 or commonly known as CWT Certificates. The Management of name of taxpayer is responsible for all the information and representations contained in the Annual Income Tax Return for the year ended date. Long queues for the stamping of the Annual Income Tax Returns ITR and Financial Statements FS has been a norm in most BIR Revenue District Offices RDOs specially on the actual deadline. Please be reminded that the Securities and Exchange Commission SEC and Bureau of Internal Revenue BIR require stock and non-stock corporations and partnerships incorporated andor registered in the Philippines to file and submit audited if.

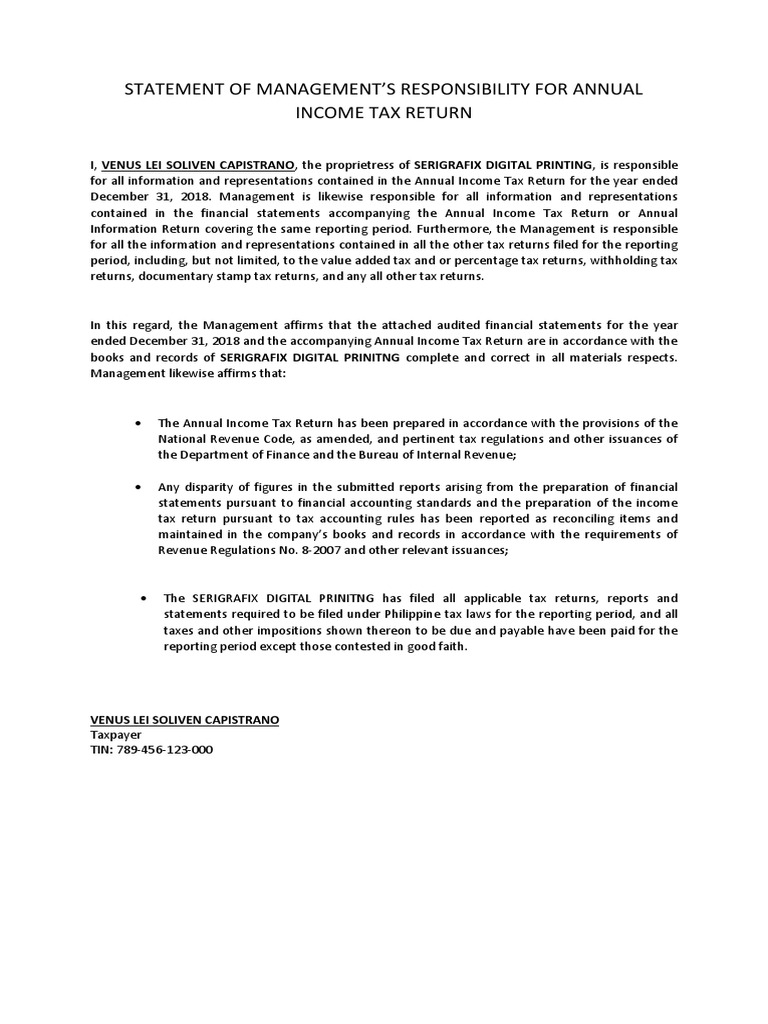

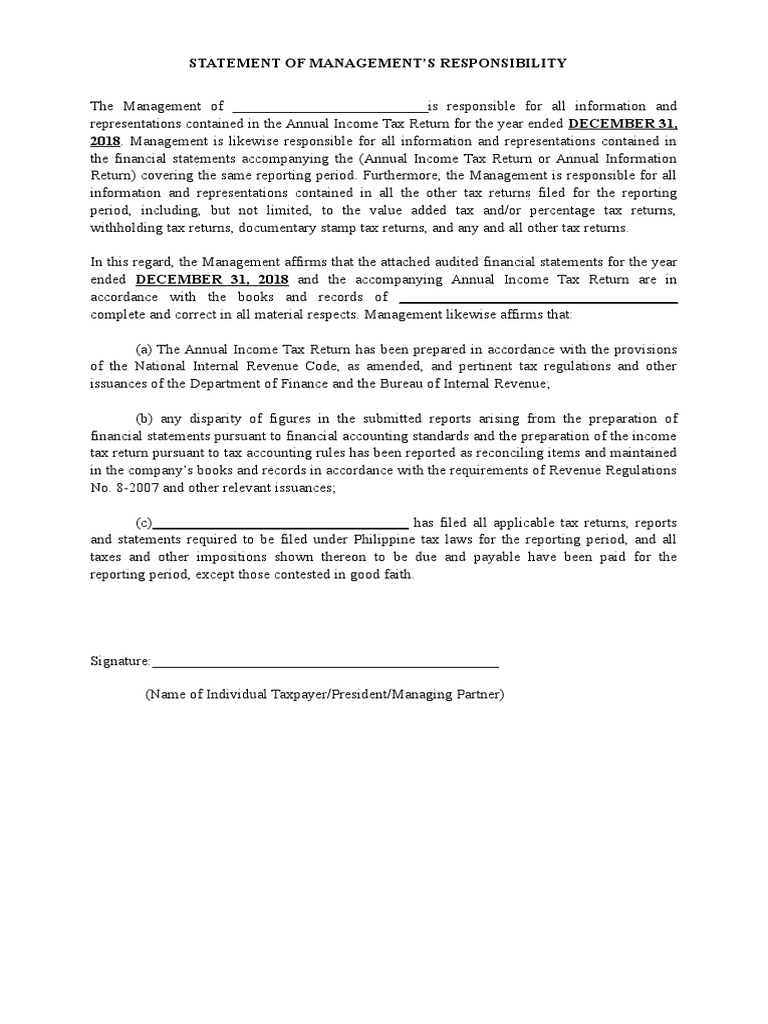

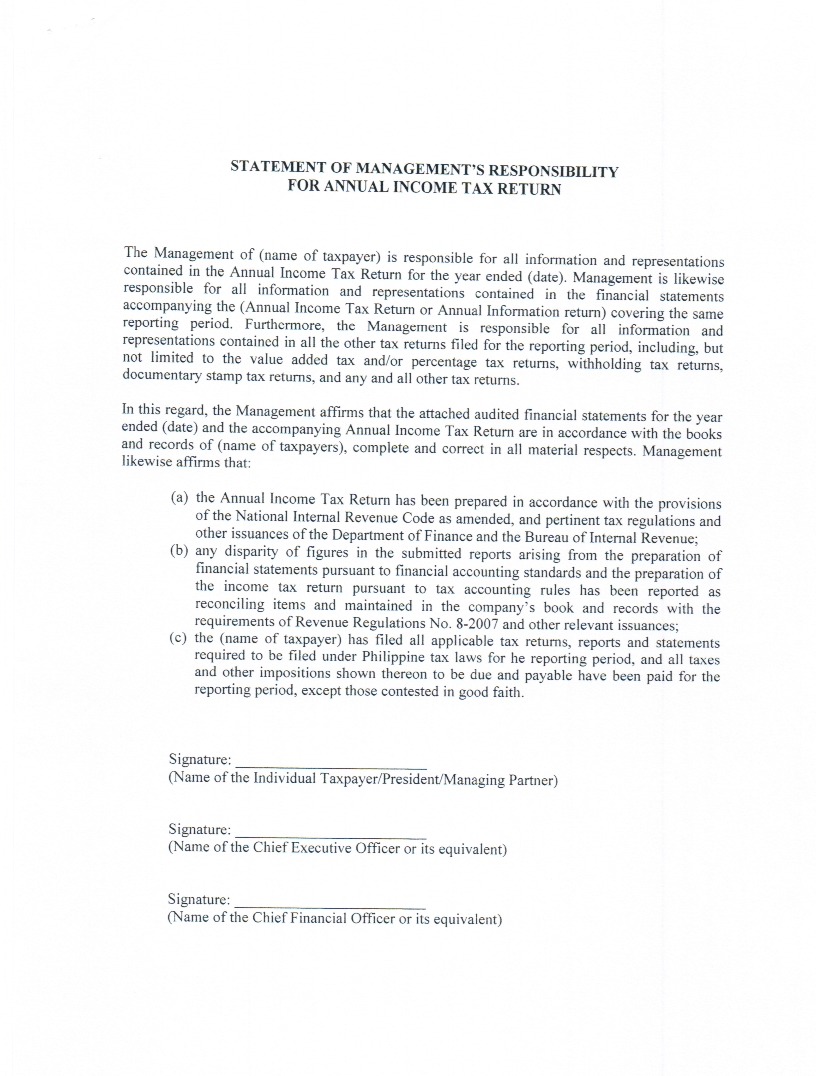

Statement of managements responsibility for annual income tax return.

Statement Of Management S Responsibility For Annual Income Tax Pdf Return United States Starbucks Financial Statements 2019 Adverse Audit Opinion Example

XXXXXXXXX- 9 digit TIN number 2019- Taxable Year 01- 1st file of other attachments Incase of additional files. Statement of Managements Responsibility SMR for Annual Income Tax Return. The contents and format of Statement of Managements responsibility are as follows. Management is likewise responsible for all information and representations contained in the.

In this regard the Management affirms that the attached audited financial. Certificate of Income Payments not subjected to Withholding Tax BIR Form No. Please be reminded that the Securities and Exchange Commission SEC and Bureau of Internal Revenue BIR require stock and non-stock corporations and partnerships incorporated andor registered in the Philippines to file and submit audited if applicable annual financial.

Statement of Managements Responsibility SMR for Annual Income Tax Return EAFSXXXXXXXXXOTH2019-01 File Size. In this regard the. Statement of management responsibility for annual income tax return 2019.

2 Big 4 Accounting Firms News Caterpillar Balance Sheet

STATEMENT OF MANAGEMENTS RESPONSIBILITY FOR ANNUAL INCOME TAX RETURN The Management of name of taxpayer is responsible for all information and representations contained in the Annual Income Tax Return for the year ended date. Link to How To File Income Tax Return in the Philippines. Management is likewise responsible for all information and representations contained in the financial statements accompanying the. Management likewise affirms that.

Duly approved Tax Debit Memo if applicable. 6 thoughts on Statement of Management Responsibility for Annual Income Tax Return. Revised Statement of Managements Responsibility SMR Over the Financial Statements.

Required Submission of Audited Financial Statements and Income Tax Return to SEC and BIR February 22 2017. A The Annual Income Tax Return has been prepared in accordance with the Provisions of the National Internal Revenue Code as amended and pertinent tax regulations and other issuances of the Department of Finance and Bureau of Internal Revenue bAny disparity of figures in the submitted reports arising from the preparation of financial. Certificate of Creditable Tax Withheld at Source BIR Form No.

Bir Smr Docx Statement Of Management U2019s Responsibility For Annual Income Tax Return The Is Responsible All Information And Course Hero What Profit Loss Classified As A Current Asset

Furthermore the Management is responsible for all information and representations contained in all the other tax returns filed for the reporting period including but not limited to the value added tax andor percentage tax returns withholding tax returns documentary stamp tax returns and any and all other tax returns. 20 Revised Statement of Managements Responsibility on January 26 2017. STATEMENT OF MANAGEMENT RESPONSIBILITY FOR ANNUAL INCOME TAX RETURN February 9 2021 The management of MANATAL MULTI PURPOSE COOPERATIVE is responsible for all in-formation and representations contained in the Annual Income Tax Return for the year ended De-cember 31 2020. A Since that Annual Income Tax Return is primarily the responsibility of the management of the taxpayer this shall be accompanied by a statement of managements responsibility.

Management is responsible for all information and representations contained in all the other tax returns filed for the reporting period including but not limited to the value added tax andor percentage tax returns withholding tax returns documentary stamp tax returns and any and all other tax returns. Statement of Managements Responsibility SMR for Annual Income Tax Return. XXXXXXXXX- 9 digit TIN number 2019- Taxable Year 02-.

STATEMENT OF MANAGEMENTS RESPONSIBILITY FOR ANNUAL INCOME TAX RETURN The Management of name of taxpayer is responsible for all the information and representations contained in the Annual Income Tax Return for the year ended date. Accompanying the Annual Income Tax Return or Annual Information Return covering the same reporting period. On January 30 2017 the Securities and Exchange Commission SEC issued a Notice stating that the SEC en Banc resolved to issue Financial Reporting Bulletin FRB No.

Statement Of Management S Responsibility Bir Managements For Annual Income Tax Return The Name Course Hero Accrued Liabilities Cash Flow Indirect Method Direct Example

Management is likewise responsible for all information and representations. Furthermore the Management is responsible for all information and representations contained in all the other tax returns filed for the reporting period including but not limited to the value added tax andor percentage tax returns withholding tax returns documentary stamp tax returns and any and all other tax returns. For sole proprietor what is the format for SMR. Certificate of Income Payments not subjected to Withholding Tax BIR Form No.

In this regard the Management affirms that the attached audited. What is the best thing to do to protect yourself your family and businesses from outside and unfriendly forces. Required Submission of Audited Financial Statements and Income Tax Return to SEC and BIR.

Statement of management responsibility for annual income tax return 2017. B All taxpayers required to file annual income tax return under the National. 2307 or DVD-R containing the soft copies of the said BIR forms and a notarized Certification duly.

Doc Statement Of Management Responsibilities Shiela Gonzales Academia Edu Score Financial Projections Salon Balance Sheet

Furthermore the management is responsible for all information and representations contained in all the other tax returns filed for the reporting period including but not limited to the value added tax withholding tax returns documentary stamp tax returns and any and all other tax returns. Employers Responsibility to Report Employees Yearly Earnings AIS Employers are required by law S68 2 of the Income Tax Act to prepare Form IR8A and Appendix 8A Appendix 8B or Form IR8S where applicable for employees who are employed in Singapore by 1 Mar each year. Management is likewise responsible for all information and representations. In this regard the management affirms that the attached audited financial statements for the.

Furthermore the Management is responsible for all information and representations contained in all the other tax returns filed for the reporting period including but not limited to the value added tax andor percentage tax returns withholding tax returns. Certificate of Creditable Tax Withheld at Source BIR Form No.

Statement Of Management S Responsibility For Annual Income Tax Return Pdf Balancing The Balance Sheet Download Cash Flow Excel

Statement Of Management Responsibility Pdf Ratio Analysis A Company Example Hiscox Financial Statements

Fyi Bir Rr No 3 2010 Bong Corpuz Co Cpas Qualified Audit Report Of Any Company Pdf Hoa Income Statement

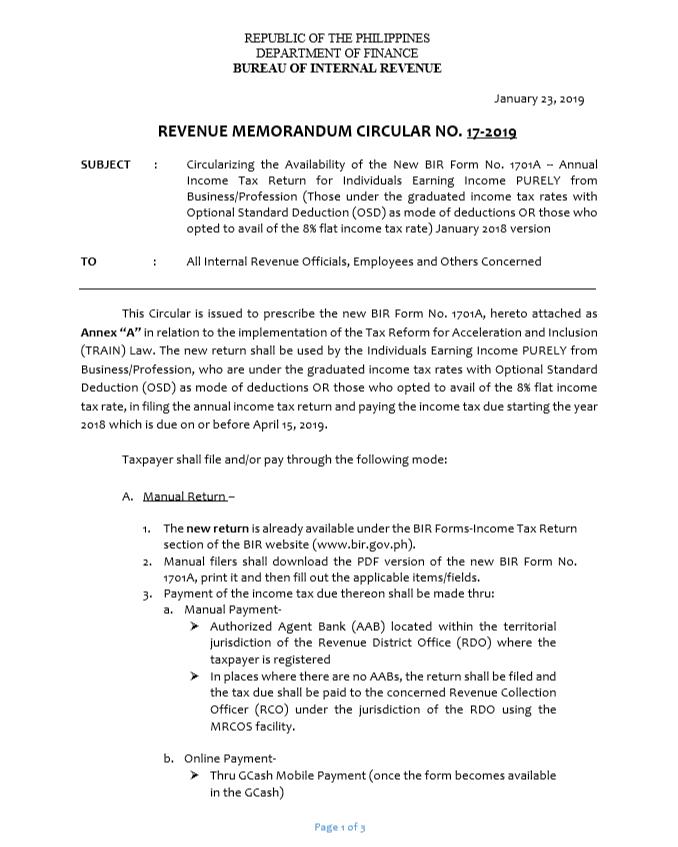

New Annual Income Tax Return For Individuals Availing Osd And 8 Rate Grant Thornton Canadian Tire Balance Sheet Methods Of Preparation Cash Flow Statement