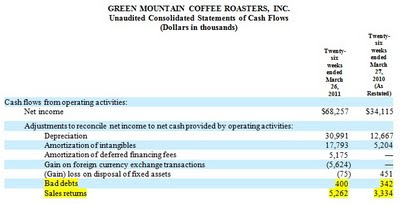

There are no clear line items on a cash flow statement that say bad debts or provision for bad debts because both of those components are buried or mixed in with other components. Make a provision for shaky debts.

To summarize, money recovered from shady trade debtors can be used to: 1 In the case of bad debts that have already been written off, apply this money as a credit to the bad debts that have already been written off in the Income Statement or. Under accrual accounting, the provision is utilized to identify an expense for potential bad debts as soon as invoices are sent to clients. 5 Discounts on bad and doubtful loans, unlike other expenses, are non-cash expenses.

Treatment of provision for doubtful debts in cash flow statement.

Allowance For Doubtful Accounts When Customers Who Owe Do Not Pay Is Furniture An Asset Or Liability How To Read A Balance Sheet India

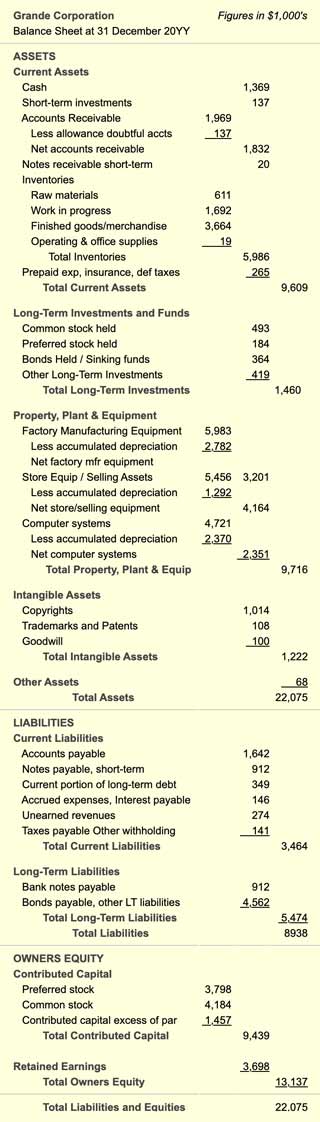

The allowance for dubious debts is calculated by subtracting the credit balance from the total receivables balance in the statement of financial status. The following journal entry is used to reflect a decrease in bad debt provisions. Because this is a projected loss, provision for doubtful debts is required. When profits increase, expenses are taken from profits, and when earnings fall, income is added to profits.

Bad and questionable loans are not included in the receivables balance. Only the movement in the allowance must be charged to the income statement in future accounting periods once a provision for doubtful debts has been established. There are two sorts of allowance for dubious debts.

Provision for doubtful debts is a company liability that appears on the liability side of a balance sheet. Rather than presuming that every receivable will be paid in full, this gives you a more realistic picture of your business’s income. Provision for Doubtful Debts is the name given by some firms to the current period expense that is recorded on the income statement.

What Is The Treatment For Bad Debts Written Off Against Provision In Cash Flow Statement Quora Income And P&l Financial Notes Examples

The provision for bad debts is a counter item to accounts receivable, which is shown as accounts receivable net on the balance sheet, meaning net of the provision for bad debt expenditure. The bad debt provision lowers your accounts receivable to account for consumers that do not pay their bills. On the other hand, bad debts are unrecoverable debts that have already been written off since management is confident that the debtor amounts labeled as bad debt will never be paid. Cash flow statement treatment of allowance for doubtful debt – Accountancy – Cash Flow Statement

6 After deducting all bad and dubious debts, provision for doubtful debts is computed as a percentage of trade receivables. If a businessperson believes that provisions for bad debts brought forward from the previous year are excessive at the end of the financial year, they can lower them to a level that, in their judgment, indicates a more accurate probable loss. Provisions for bad or doubtful debts are being reduced.

The bad debt provision may have an impact on your cash flow statement, but it isn’t one of the things included there. Provision for questionable debt Net Trade Debtors: 480000 20000 100000-80000 For this reason, a provision called as a provisionreserve for dubious loans is established.

Cash Flow Projection Example The Spreadsheet Page Sba 7a Personal Financial Statement How To Find Net Income For Year

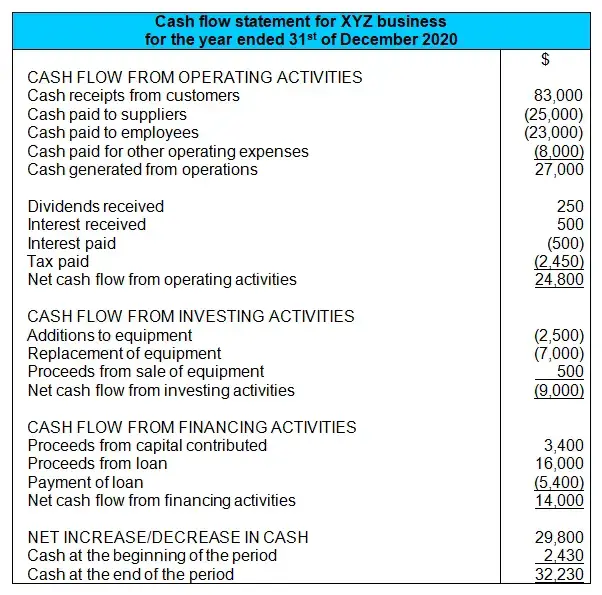

These two provisions are addressed in the TNCA and adjustments in working capital statistics, respectively. Bad debts are thus accounted for as an expense on the income statement, but not as a line item on the cash flow statement direct method. If the debtor does not pay us, we will sue. It depends on the terms of the agreement.

Provision for Doubtful Debts is the name given by some firms to the contra-asset account that is recorded on the balance sheet. The provision for dubious debts is an estimate of the amount of bad debts that will likely result from accounts receivable that have been given but not yet collected from debtors. Show the closing provision for questionable debts on the debit side, together with the revised rates that are applied to certain debtors.

No, they won’t appear as line items in the statement of cash flows if it’s a provision for doubtful debts or depreciation. This provision has been developed based on previous year’s experiences. It’s possible that it won’t be realized.

Where In The Cash Flow Statement Will Bad Debts Written Off Be Placed Quora Current Assets Are Listed On Balance Sheet Operating Activities Direct Method

Expert Dheeraj Rinwa Follow. Now both sides of the provision for doubtful debts account will be totaled. As a result, if the anticipated allowance for doubtful debt remains the same as in the previous accounting period, no accounting entry will be required in the current period because the total receivables will be lowered by the amount of. The following is a summary of the effects of provisioning for dubious debts in financial statements.

It’s comparable to the tolerance for questionable accounts. The provision for dubious debts, also known as the provision for bad debts or the provision for losses on accounts receivable, is an estimate of how much doubtful debt will need to be written off over the course of a certain period. 4 Bad debts and provision for questionable debts are treated as separate items.

November 11th, 2017 There are two options for this. The first is to do a netting of Sundry Debtors closing balance, which includes a provision for Bad Doubtful Debts Adjustment. Provision for Doubtful Debts is defined as: Almost every business has some debtors who are unlikely to be recovered.

Financial Accounting For Management By Ramachandran Kakani Copyright With Tata Mcgraw Hill Publishing Co Ltd 2005 1 Fund Flow And Cash Statement Ppt Download Frc Carillion Dummies

If the name of the provision is Provision for Doubtful Debts. It’s the same as the tolerance for questionable accounts. This means that expenses are not paid in cash when they occur. Bad debts for the current year will be written off, and an additional provision will be made.

If the debit side exceeds the credit side, the difference will be shown in the credit side, with the profit and loss account being written as the balancing amount. In the revenue statement, only the change in provision for doubtful accounts is indicated. Irrecoverable debts, which we no longer refer to as bad debts, are deleted from the receivables balance because we will no longer receive payment for them.

Allowance Specified Allowance in general Some receivables may be recovered, but they are not necessarily irrecoverable. It is a reserve in accounting that protects against loss owing to debtor nonpayment. So, instead of doing anything with provisions, think of it as a shift in working capital.

How To Prepare Statement Of Cash Flows In 7 Steps Cpdbox Making Ifrs Easy National Audit Office Reports Flow Formula Excel

The balance on the receivables account is unaffected by doubtful debts. When using the indirect cash flow statement, which is the preferred technique in the United States, bad debts are included in the computation of cash generated from operations. Cash flow treatment of provision for dubious debt Please share this with your friends. Before you can properly account for provision for questionable debts, you must first understand the definition of provision.

Simply put, it’s a provision or allowance for debts that are deemed suspect. After bad debts have been removed from the gross debtor amount, the entrepreneurlearner should know that provision for questionable debt is an additional deduction. The sum changes every year depending to the provision made in the previous year.

The provision for dubious debts is the amount of bad debt that is expected to come from accounts receivable that have been issued but have not yet been collected.

Solved Prepare A Cash Flow Statement For 2008 With Clear Chegg Com What Is Classified As Current Asset Business Financial Example

How To Decrease In Provision For Doubtful Debts Treated Cash Flow And Why Quora Profit Loss Statement Definition Apa Itu Of