This standard effectively replaced IAS 17 accounting for leases with effect from January 2019. The effective tax rate incorporating both cash taxes and the deferred tax asset reversal is equal to 20 of pre-tax profit in each of years 2 to 6.

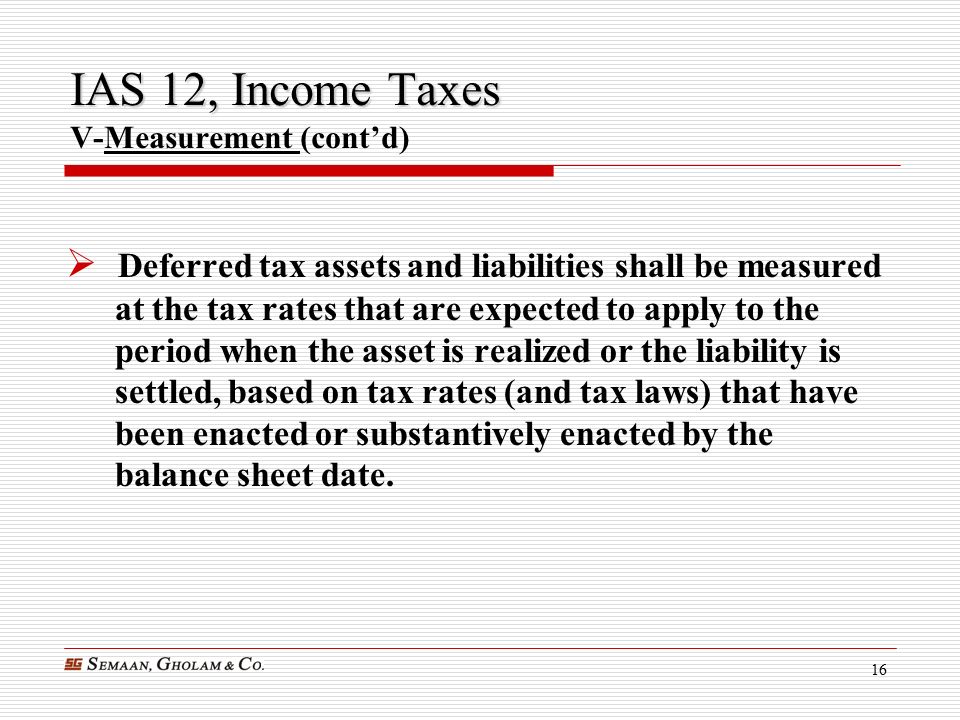

Income Tax Expense Dr. To Deferred Tax Liability Cr. So for example if in your country sales of property are taxed at 35 and other income at 30 then for calculation of deferred tax on your property you need to apply the tax rate based on your expected way of propertys recovery if you plan to sell it then measure your deferred tax at 35 and if you plan to use it and then remove it then measure your deferred tax at 30. Deferred tax is accounted for in accordance with IAS 12 Income Taxes.

Trial balance ppt ias 12 deferred tax examples.

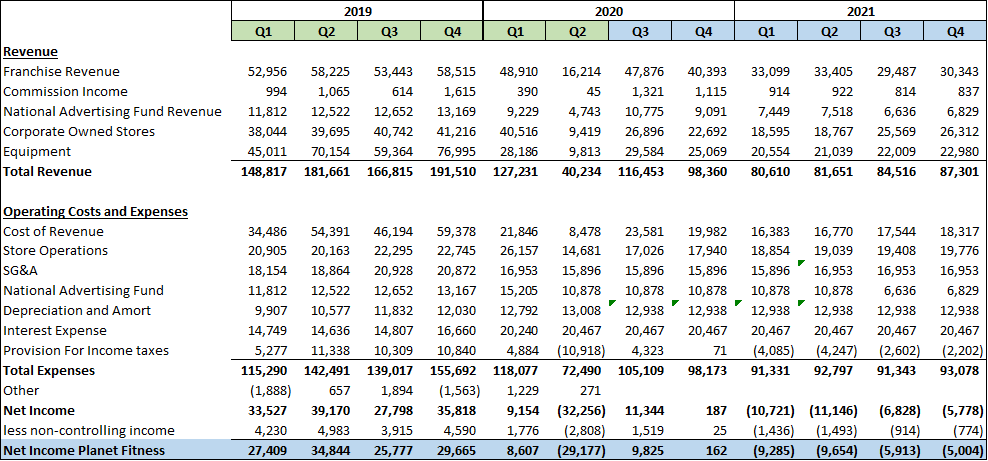

Ias 12 Income Taxes Louis Vuitton Financial Statements 2019 Cash Flow Table Template

The following trial balance example combines the debit and credit totals into the second column so that the summary balance for the total is and should be zero. The depreciation expense each year will be 3000 3 1000. The notes to the question could contain one of the following sets of information. In FR deferred tax normally results in a liability being recognised within the Statement of Financial Position.

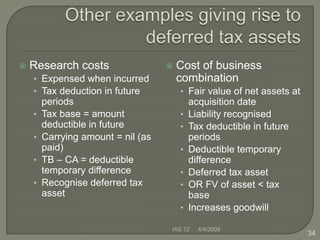

Deferred Tax in Accounting Standards. Trial balance to income statement examples of temporary differences that create deferred tax assets. Example of a Trial Balance.

DTD expected to reverse. The standard eliminated the distinction between operating and finance lease initially provided for by IAS 17. Every country has its own specific tax rules regarding taxing corporate profits but IAS 12 brings consistency to the recognition measurement presentation and disclosure of these taxes.

International Accounting Standard 12 Income Taxes Ppt Download Projected Cash Flow Statement Pdf Assets And Liabilities Explained

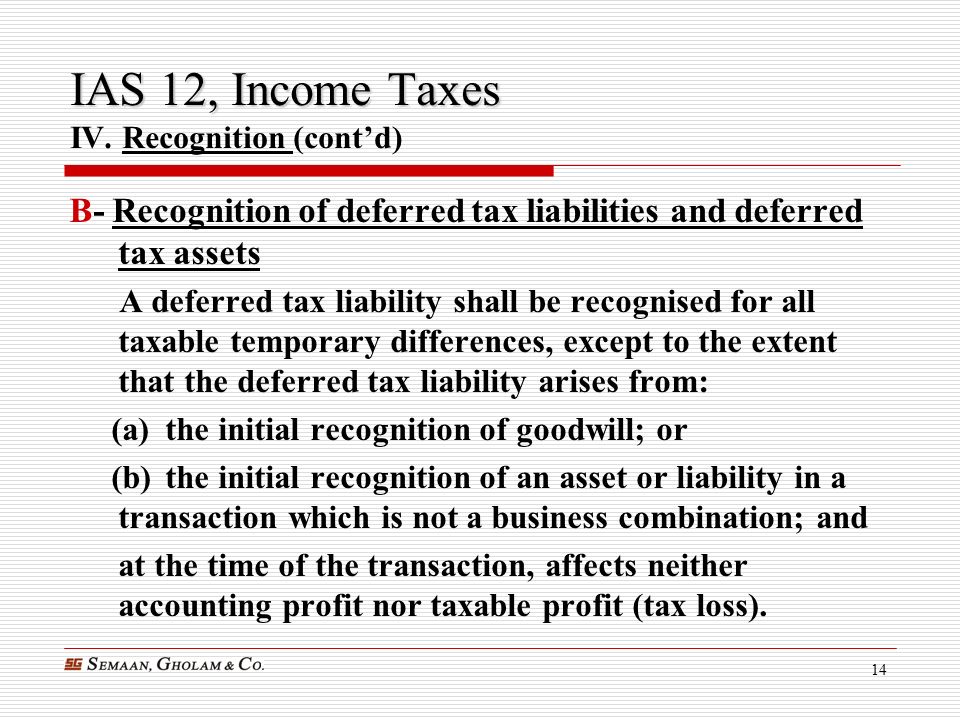

Temporary Difference 30 300. The company records 240 800 30 as a deferred. IAS 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable temporary differences. Applying the IAS 12 amendments January 2016.

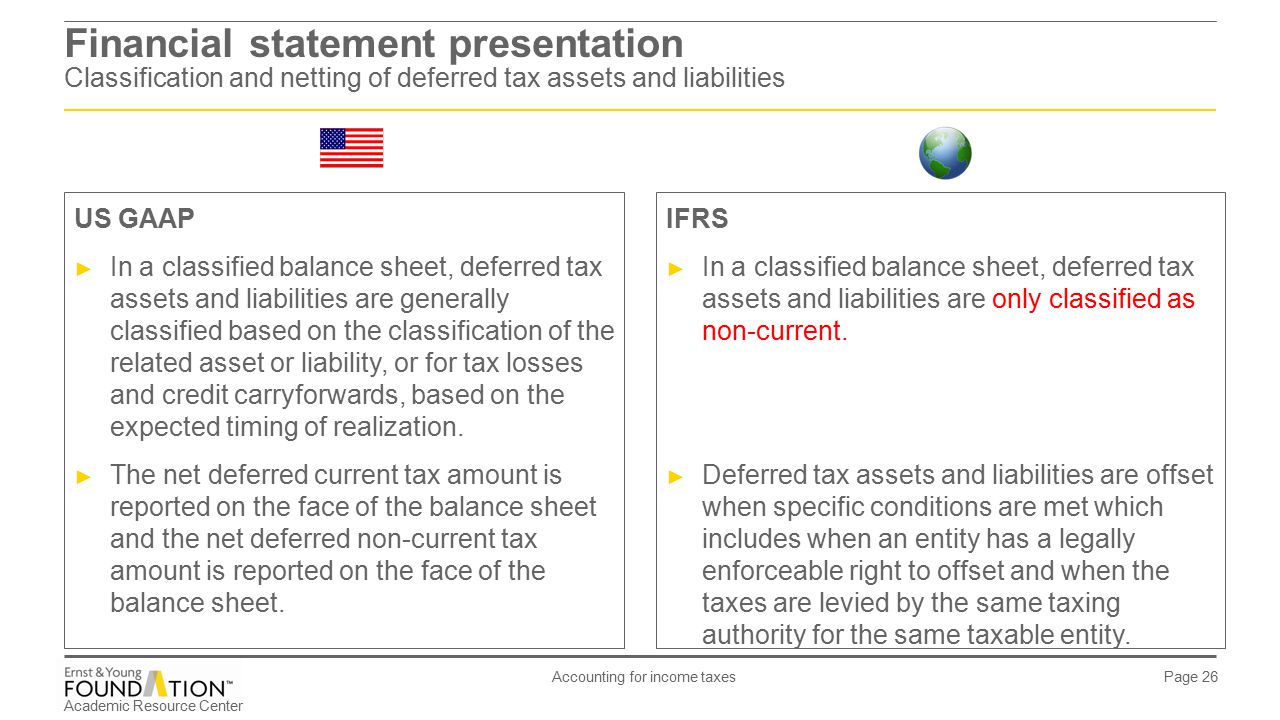

Balance Sheet Classification of Deferred Taxes is part of FASBs simplification initiativeThe initiative is designed to reduce complexity in financial reporting. The following flowchart summarises the steps necessary in calculating a deferred tax balance in accordance with IAS 12. P expects to collect full 1000 ie.

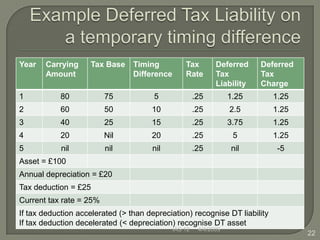

Otherwise go to step 3. A the fulfilment cash flows the current estimates of amounts that the insurer expects to collect from premiums and pay out for claims benefits and expenses including an adjustment for the timing and risk of those cash flows. The deferred tax charge is the value of the temporary timing differences at the current rate of tax enacted for the future periods.

Lecture 2 Taxation Ias 12 Final Ppt Financial Accounting Ec3425 23 December 2020 U2013 Course Hero How To Prepare Group Accounts Adverse Opinion Report

000 000 Current tax 400 The following notes are also relevant. Another way of thinking about the tax base of an asset or liability is the amount that the item would be shown as an asset or liability in a statement. Deferred tax assets and liabilities are not discounted IAS 1253-54. The tax base is the amount attributed to an asset or liability for the purpose of calculating tax.

Deferred Tax Liability is calculated using the formula given below. If the business has profits before depreciation of 6000 then its accounts profit will be 6000 1000 5000 and if the tax rate is 25 then the accounts tax. Deferred Tax Calculation.

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. IAS 12 refers to the tax base when calculating deferred tax assets or deferred tax liabilities. Its not an easy text to read and some definitions in IAS 12 are so obscure that many people grope in the fog unsure what to do.

International Accounting Standard 12 Income Taxes Ppt Download Why Is Profit And Loss Appropriation Account Prepared Honeywell Balance Sheet

Step 1 Establishing the accounting base of the asset or liability Step 2 Calculate the tax base of the asset or liability If there is no difference between tax and accounting base no deferred tax is required. 2015-17 Income Taxes Topic 740. Example 2 The following trail balance extract relates to Clarion as at 31 March 2015. Therefore it cannot be based on a fair value of an asset that is measured at cost in the statement of financial position.

At the year-end it was determined that an increase in the deferred tax liability of 1000 was required. The following flowchart summarises the steps necessary in calculating a deferred tax balance in accordance with IAS 12. A provision for current tax for the year ended 31 March 2015 of 35 million is required.

The measurement of deferred tax is based on the carrying amount of the assets and liabilities of an entity IAS 1255. Purpose of deferred tax. ABC International Trial Balance August 31 20XX.

International Accounting Standard 12 Income Taxes Ppt Download Illustrative Financial Statements 2018 Ey Corporate Social Responsibility Performance

The current tax is the tax payable on profits for the year. The balance on current tax in the trial balance represents the underover provision of the tax liability for the year ended 31 March 2014. Deferred tax assets and liabilities would be recognised in conformity with IAS 12. Temporary Difference 90.

P buys debt instrument. IAS 1 sets out the overall requirements for financial statements including how they should be structured the minimum requirements for their content and overriding concepts such as going concern the accrual basis of accounting and the currentnon-current distinction. Differences between the carrying.

Deferred Tax Liability Tax Rate Temporary Difference. IAS 12 implements a so-called comprehensive balance sheet method of accounting for income taxes which recognises both the current tax consequences of transactions and events and the future tax consequences of the future recovery or settlement of the carrying amount of an entitys assets and liabilities. Fair value due to market rate change.

Ias 12 Income Taxes What Is Revenue On An Statement Receivable

Gross profit is an item in the income statement of a business and it is the companys gross margin for the year before deducting any indirect expenses interest and taxes. IAS 12 requires an entity to recognise a deferred tax liability or subject to specified conditions a deferred tax asset for all temporary differences with some exceptions. The balance on the deferred tax liability account is 150 representing the future liability of the business to. The accounts reflected on a trial balance are related to all major accounting.

Accounting Standards Update No. Types of Assets Common types of assets include current non-current physical intangible operating and non-operating. The International Accounting Standards Board IASB in 2016 promulgated a new standard on the accounting for leases.

As a simple example suppose a business has bought a long term asset for 3000 and decides it has a useful life of 3 years. A new standard FASB issued Friday is designed to improve the way deferred taxes are classified on organizations balance sheets. Adjusting entries are added in the next column yielding an adjusted trial balance in the far right column.

Ias 12 Accounting For Income Taxes Ppt Video Online Download Increase In Retained Earnings Cash Flow Statement Includes

What is future taxable profit for the recognition test. The standard requires a complete set of financial statements to comprise a statement of financial position a. Permanent differences are no longer referred to in IAS 12 but have been included here to clarify when not to make an accrual for tax as no. EXAMPLE 2 The trial balance shows a credit balance of 1500 in respect of a deferred tax liability.

Annual reporting period beginning on 1 january 2021. Temporary differences are differences between the tax base of an asset or liability and its carrying amount in the statement of financial position. At the year-end the required deferred tax liability is 2500.

Ias 12 excel examples. It deals with both current tax and deferred tax. Deferred Income Tax Definition.

Ppt Ias 12 Income Taxes Powerpoint Presentation Free Download Id 69645 Accountants Compilation Report Fiduciary Funds Governmental Accounting

The accounting entry will be as follows.

International Accounting Standard 12 Income Taxes Ppt Download Notes To Financial Statement Adalah Standards Are Issued By