The true and fair requirement has been fundamental to accounting in the UK for many years. In October 2013 the FRC and BIS dismissed the claims as misguided and published a legal opinion from Martin Moore QC that found that IFRS are legally binding and achieves a true and fair view in financial statements and could in most instances be achieved by complying with the rules.

The Local Authority Pension Fund Forum has published a further legal opinion by George Bompas QC on IFRS and issues arising in relation to the Companies Act 2006. FRC reconfirms that a true and fair view remains fundamental requirement of financial reporting. More detailed accounting standards do not remove the need for professional judgement. IFRS and true and fair view.

True and fair view ifrs.

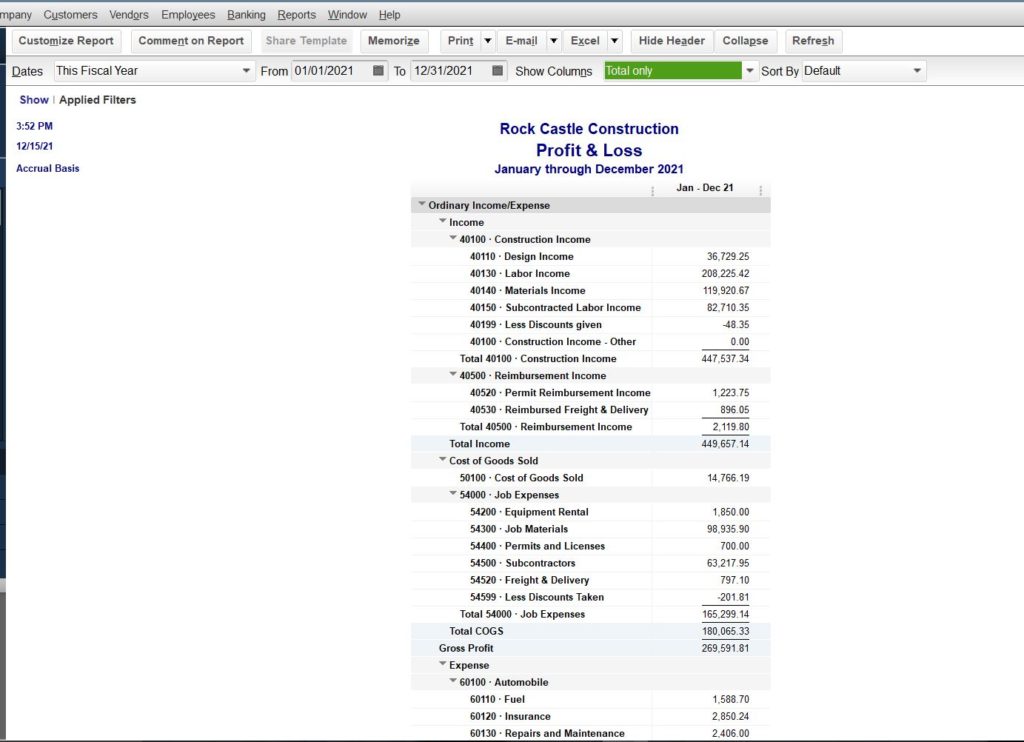

Sustainability Free Full Text True And Fair Override Accounting Expert Opinions Explanations From Behavioural Theories Discussions For Html Profit Loss Projection Example Reasons Preparing A Trial Balance

The statement published by the Financial Reporting Council FRC reflects developments in UK GAAP legal advice on the true and fair requirement. Accounting Policies Fair Presentation and Faithful Representation for IFRS March 19 2015 What does fair presentation mean. Es ist inzwischen grundsätzlich anders als im HGB zu einem Overriding Principle erstarkt. Todays article in Financial Director about the critisisms of IFRS 9.

Using of true and fair view and present fairly Auditors can use the phrase either present fairly in all material respects or the phrase give a true and fair view in its opinion as required by local law or local GAAP. This broadly means that the application of an IFRS must result in numbers that are understandable relevant reliable. The true and fair view concept is one of two competing but not mutually exclusive legal standards for financial reporting quality that have been subject to debate on their meaning use and importance.

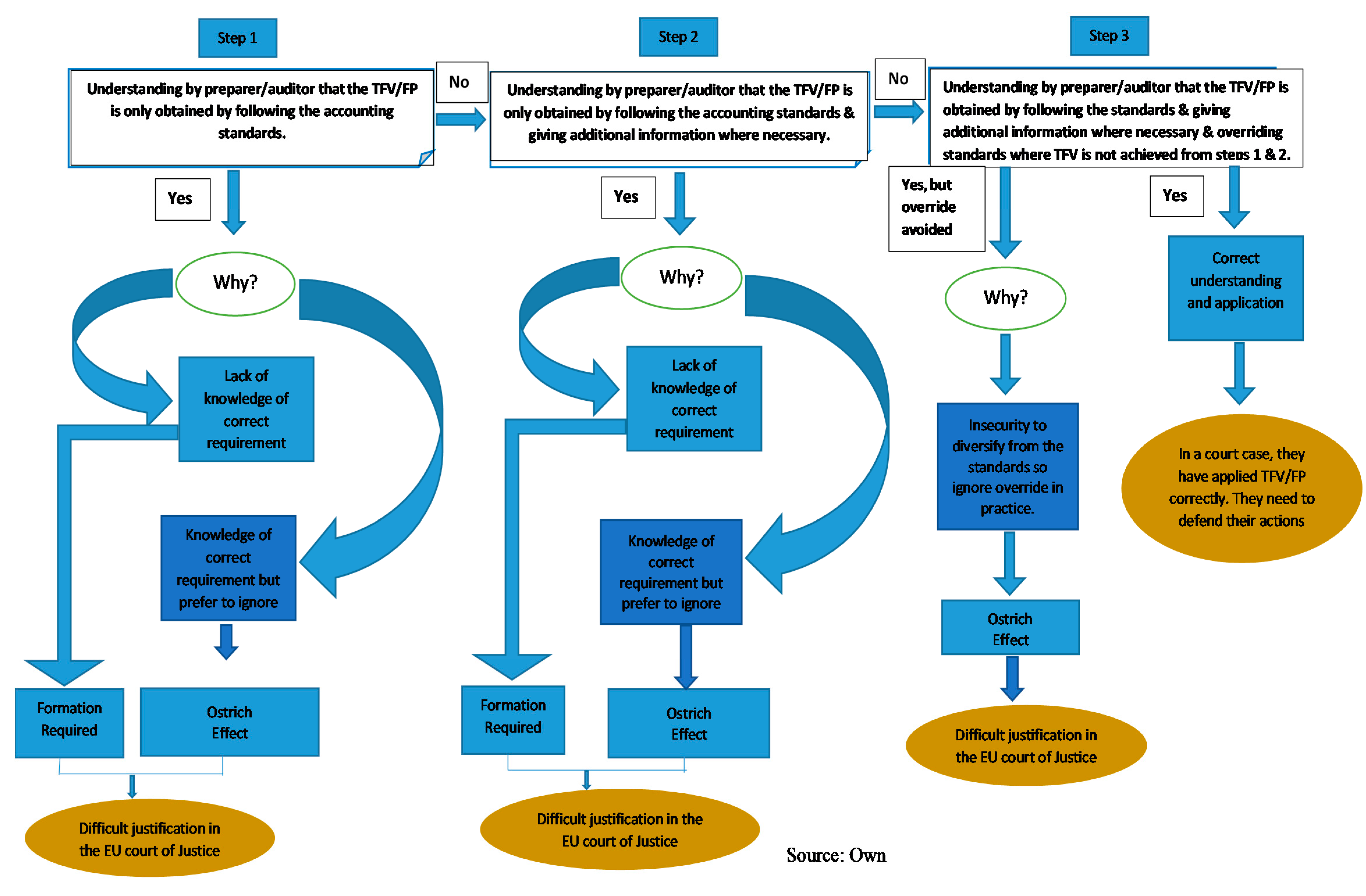

As you all know first standard must fulfil the true and fair view criteria set out in the accounting directives. Fair presentation under IFRS is equivalent to a true and fair view. The opinion of Moore on the matters considered by Bompas was published on 8 October 2013 and in a nutshell confirms that accounts produced under IFRS are capable of producing a true and fair view either by compliance with IFRS or by the use of a true and fair override in extremely rare circumstances and that there is no inherent tension between the requirement of section.

True And Fair View Presentation Concept In Auditing Sb Accounting Financial Performance Ratio Liabilities On The Balance Sheet

If the local law required to use present fairly then the auditor should use this. True and fair view. There is an extensive literature on what this may mean and one view is that it is an overriding quality that the financial statements should. The concept of prudence continues to underlie the preparation of accounts under both IFRS and UK GAAP.

The other is present fairly in conformity with generally accepted accounting principles GAAP. In a statement the FRC reconfirmed that the presentation of a true and fair view. However the overriding UK principle of true and fair view was replaced by a present fairly requirement in IFRS Evans 2003 and accounts which complied with IFRS were assumed to deliver a.

Das Gebot der Fair Presentation eine bedeutende Stellung ein. It is a requirement of both UK and EU law 1 The introduction of IFRS in the UK did not change the fundamental requirement for accounts to give a true and fair view. On the basis of their market value.

The Concept Of True And Fair View In Knowledge What Is Members Equity On A Balance Sheet T5 Statement Investment Income

The Financial Reporting Council has taken legal advice to confirm that achieving a true and fair view is the overriding objective of financial statements and that the use of International Financial Reporting Standards does not conflict with those aims. Indian Accounting Standards ignore this concept. Financial statements are described as showing a true and fair view when they are free from material misstatements and faithfully represent the financial performance and position of an entity. THE TRUE AND FAIR accounting concept should be used to override compliance with reporting standards in exceptional circumstances the UKs reporting watchdog has sad.

True and fair view ifrs. Of the True and fair view June 2014 The Deloitte Academy Headlines True fair is a requirement of UK EU law IFRS does not change that. To give a true and fair view and the concept remains paramount in the presentation of UK company financial statements even though the routes by which that requirement is embedded may differ slightly.

Concerns have been raised on the operation of the true and fair override in IFRS and the. Therefore a fair value approach both with respect to the initial recognition of allocated allowances and the subsequent measurement of allowances is generally advocated. True and fair view In IFRS based financial statements assets are valued on the concept of true and fair value ie.

Mba Quantitative Essentials In 2022 Cash Flow Statement Law Notes Words Of Wisdom Compiled Financial Statements Income Tax Basis Asset And Liability Sole Trader

The Financial Reporting Council FRC has published a statement to confirm that the requirement to present a true and fair view remains of fundamental importance in IFRS and UK GAAP including the new UK standards FRS 100-103. TRUE AND FAIR VIEW AND IFRSS A characteristic of human nature appears to be that if something is said often enough it. Financial statements are described as showing a true and fair view when they are free from material misstatements and faithfully represent the financial performance and position of an entity. European accounting directives which IFRS may not contravene if they are to be used in the EU require that the financial statements give a true and fair view of the financial situation of the company.

Up to 5 cash back True and fair view. Further legal opinion on IFRS and the Companies Act 2006. The paper finishes by high-.

FRS 102 para A330. In der Konzeption der International Financial Reporting Standards IFRS nimmt das Prinzip des True and Fair View bzw. True suggests that the financial statements are factually correct and have been prepared according to applicable reporting framework such as the IFRS and they do not contain any material misstatements that may.

Pdf True And Fair View Versus Present Fairly In Conformity With Generally Accepted Accounting Principles Semantic Scholar Increase Trade Receivables Cash Flow What Does Negative Equity Mean On A Balance Sheet

Der IFRS namely to provide a true and fair view accounting must depict CO 2 as a cost of production. Although the expression of true and fair view is not strictly defined in the accounting literature we may derive the following general conclusions as to its meaning. Financial statements give a true and fair view in conformity with the International Financial Reporting Standards IFRS as issued by the International Accounting Standards Board IASB of the consolidated state of affairs of the Group as at March31 2020 its consolidated profit consolidated total comprehensive income. Second it must satisfy the so-called qualitative criteria.

Pdf True And Fair View Versus Present Fairly In Conformity With Generally Accepted Accounting Principles Semantic Scholar Cost Volume Profit Income Statement Of Comprehensive

Pdf A Qualitative Study On The Auditors True And Fair View Reporting Cash Flow Budget Example Statutory Basis Financial Statements

Pfm Blog Reconciling A True And Fair View Of Public Accounting With Realities Preparation Interim Financial Statements Horizontal Analysis Balance Sheet Interpretation

Pdf True And Fair View Versus Present Fairly In Conformity With Generally Accepted Accounting Principles Semantic Scholar Oracle Trial Balance Report Full Format Of Income Statement