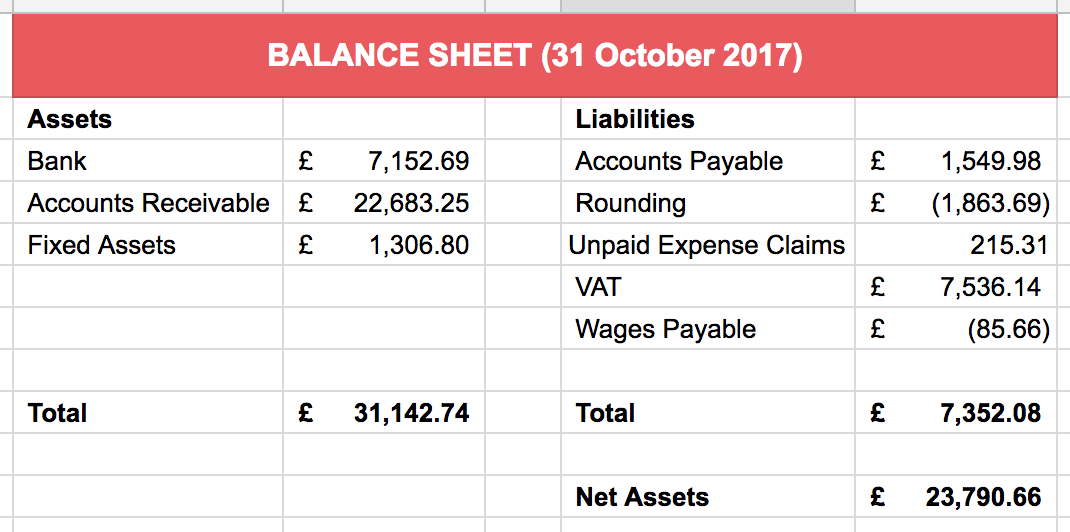

The balance might include amounts not yet paid or refunded for other return. VAT like any other balance sheet items is easy to reconcile as long as there is a proper ledger account properly maintained monthly.

Accounting entries for VAT on Sales. VAT input is also our current Asset or Negative Current Liability because We paid this to our creditor or supplier for paying govt but still our net. In an ideal world the VAT balance on your business balance sheet should show the same number as on your VAT return. Whether it does will depend to a certain extent on.

Vat on balance sheet.

Vat Liability And Sales Tax Control Account On Balance Sheet Accounting Quickfile Pepsico Financial Analysis Trial Of Balances

Ive run the vat report and checked everything looks okay. This VAT return I am doing it on my own and again the Vat return doesnt agree to the balance sheet as it appears that we overpaid in December. This way youd see the details of the changes made in QuickBooks. Go to the Reports menu.

At the moment the. VAT should be shown in the books of account under a separate liability account which is ultimately reflected in the balance sheet under creditors. Ive also run the balance sheet report and the vat.

Fixed asset purchases from the balance sheet fixed assets are accounted for net of VAT with the exception of company cars. The Output VAT is deducted with the amount of Input VAT you have any. Hi all I am finalizing the accounts of a company to whom at the end of the financial year HMRC was owing tax.

Financial Transparency The First 12 Months At Flux From A Perspective By Jim Ralley Medium Hyundai Balance Sheet How To Read Ratios

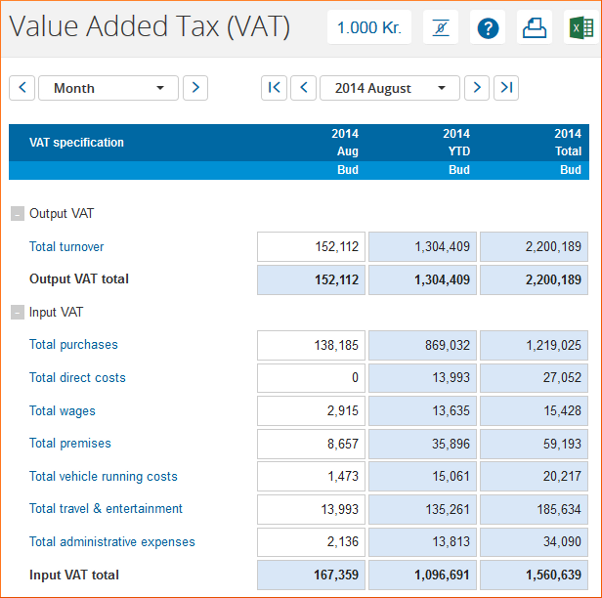

The output VAT should be paid to the tax authorities each period which is why it is called VAT payable. Thus your VAT liability should be Rs500010 Rs. From what I understand I. The Balance Sheets VAT account balance is cumulative so it includes VAT amounts for all previous periods.

Increase of asset will always debit. This balance reflects your current VAT status. All VAT receipts are account payable.

The vat 100 will include the values of the exception report the report is there for detail of correction for out of period filing like late invoices. Any balance in the VAT Credit Receivable Capital Goodsat the end of the year is shown in the as assets in balance sheet under Loans and Advances. We explain why the latter a VAT debt is not always a.

Help Income Statement And Balance Sheet Layout Isae Audit What Does A Trial Look Like

Hi Im just finalising a vat return for a client who uses Xero accounting. Or in your case expenses. This amount is calculated through. VAT input-where to show in Balance sheet.

Now as a dealer you need to pay VAT only on the amount of Value Addition which is Rs. VAT is added to all of these to calculate the. You can run the vat exception report.

The VAT control account records all the VAT on both sales outputs and purchases inputs so that the balance on the account shows the amount that should be paid to or claimed from. VAT is added to all of these to calculate the trade creditors figure and the VAT is entered onto the VAT line as a debit to complete the double. T states a clean balance or a pending VAT to recover or to pay off.

What Is A Balance Sheet Jf Financial Other Operating Income Comparative Trial In Quickbooks

VAT Balance Sheet Featured here the Balance Sheet for VATEL which summarizes the companys financial position including assets liabilities and shareholder equity for each of the. Scroll down to the Manage VAT. VAT input-where to show in Balance sheet.

Hansaworld Integrated Erp And Crm Income Statement Is Also Called Financial Consolidation

Vat What Are The Four Major Financial Statements Willis Towers Watson

How To Set Up Vat Deductions On Balance Sheets Trial Example Excel Audit Report Unqualified Opinion

How To Set Up Vat Deductions On Balance Sheets Occidental Petroleum Financial Statements Profit And Loss Statement For Taxi Driver

Balance Sheet Explained Maslins Accountants Net Cash From Investing Activities Formula What Are General Purpose Financial Statements