Choose the assessment year the format you want to view your Form 26AS in enter the verification code and then click on Download Thats it. Go to e-File Income Tax Returns View Form 26AS 3.

If you want to download Form 26AS in PDF click on Export as PDF and save the Form 26 AS for future use. If you are not registered with TRACES please refer to our e-tutorial. You will be redirected to the TDS-CPC website Click on Confirm button to proceed. You will be redirected to the TDS-CPC website Click on the Confirm button to proceed 4.

View my 26as.

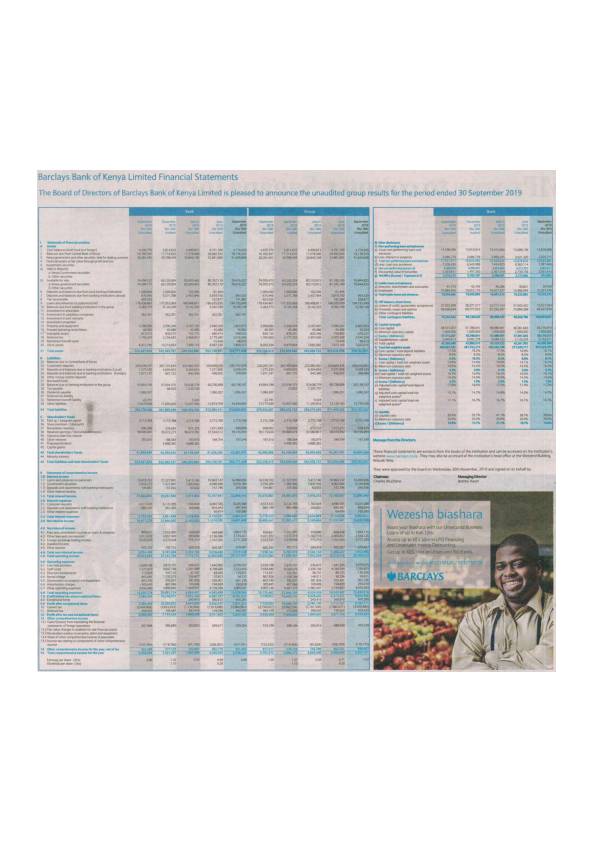

26as How To Check Online View Form Details Of Tax Payment And Tds Available With Department Deducted At Source Credits Self Assessment What Is A Pro Forma Cash Flow Statement Ipsas 8

Log in to Income-tax Departments website. Through the TRACES website for registered users on the Income Tax Portal Without Registration on the Income Tax portal through Net Banking View Form 26AS through TRACES. This facility has been provided to the deductor in order to verify whether the PANs for which user is deducting TDS are getting the credit for the same or not. The banks that have registered with NSDL to enable users to view Form 26AS include the following.

Select the relevant assessment year for which Form 26AS is required and Select View Type HTML or Text. Then click on Form 26AS. Following login the user should click on View Form 26AS Tax credit option from the drop-down options available under My Account on the dashboard.

Many major banks have registered with NSDL so that users can view the form through their portal. You need to choose the relevant Assessment Year AY for which you want to download the statement. It is issued on behalf of the Income Tax Department and has the heading TDS Reconciliation Analysis and Correction Enabling System.

Income Tax Return Xml Efiler File Itr To Pdf Upload Free Download Schema It Hud Financial Statements Trial Balance Entries

Login to Income-tax Departments website. Following are the steps to viewdownload Form 26AS. Axis Bank Corporation Bank IDBI Bank State Bank of India Saraswat Co-Operative Bank. Now you need to select the assessment year which you want to view or download for further.

If you are facing TRACES or income tax portal issues you can also check your Form 26AS through your net banking account. Users having PAN number registered with their Home branch can. Different Parts of Form 26AS.

Step 3 View Form 26AS. Click on My Account tab. Now log in using your income.

If The Itr Isn T Submitted Along With Dsc Then It Should Be Printed Signed And Sent To Cpc Within 120 Days From Date Of E Filing Income Tax Guide Financial Projections Template For Business Plan Statements According Ifrs

Now you can view Form 26AS on your system 5. How to View Form 26AS. Click on View Form 26AS in the drop down menu Click on Confirm button and you will be redirected to the TRACES website Select the available checkbox on the screen and proceed Click on the link at the bottom of the page that says Click View Tax Credit Form 26AS to view your Form 26AS. Under Income Tax Returns select View Form 26AS from the drop-down menu.

The second way is to approach it via net banking. Enter your PAN card number as required then enter the password captcha carefully in DDMMYYYY format. You will see option of View Tax Credit Statement.

To receive Email intimations from TRACES please add to the address book contact list of. Form 26AS can be checked on the TRACES portal. As an registered PAN holder you can view it in two different ways.

Figures Income Tax Return Success Message Learn Balance Sheet Analysis Financial Statements Of Pakistani Companies

You can view your Form 26AS from FY 2008-2009 onwards. The new screen will. On the subsequent page the person will need to click on Confirm to be redirected to the TRACES website or TPS-CDC which is also a government portal. It will open the website page.

Online 26AS TRACES View TDSTCS credit. Once logged in go to My Account. Lastly you can access the form through the e-filing portal.

Click here to visit the login page and log in to your account 2. Go to My Account View Form 26AS Tax Credit. You have register in income Tax site with your pan Number then after logging in you can view your 26A more.

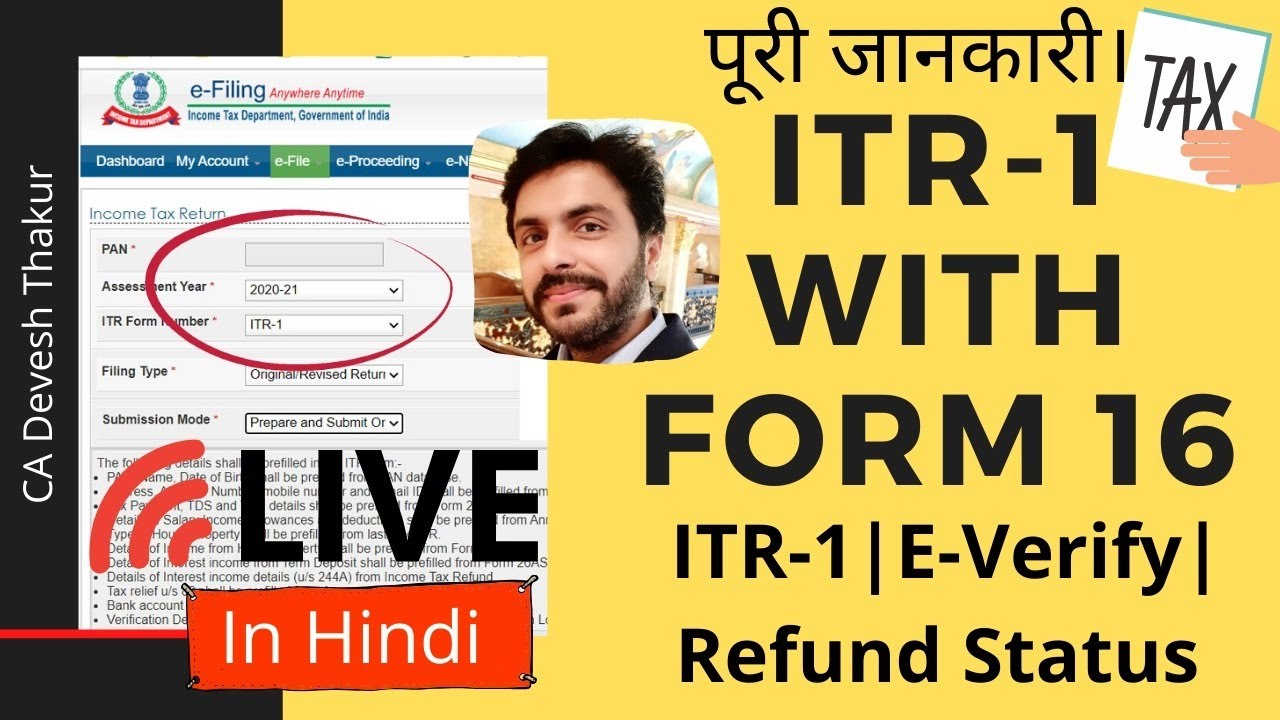

How To File Itr 1 Ay 2020 21 With Form16 Live Form 26as E Verify Check Informative Filing Income Tax Cash Flow Example From An Operating Activity Is Ifrs Profit

To view the tax statement Assessees can now login in to wwwincometaxindiaefilinggovi n with their login and click on My Accounts – View Tax Credit Statement Form 26AS. Your Form 26As will be displayed. Here you should select the assessment year confirm your date of birth format of the file PDFHTML and proceed. It is linked with your PAN and you can check Form 26AS from FY 2019-20 till the previous financial year through your net banking account.

Click on the View Tax Credit Form 26AS option. Form 26AS can be viewed online. This tutorial teaches you How to View your income tax statement Form 26AS in Online SBIYou can view or download your income tax statement through Online S.

Visit the official government e-filing website at incometaxindiaefilinggovin. You will be redirected to the TDS-CPC website to view and download your Form 26AS. At the bottom of the page there will be an option to the effect of Click View Tax Credit Form 26AS to view your Form 26AS.

Google Form 13as How Is Going To Change Your Business Strategies Strategy Forms Invoice Template Word Published Financial Statements Of Limited Companies P And L Sheet

Following are the steps to viewdownload Form 26AS. Click Confirm on the disclaimer to be directed to the TRACES website dont worry this is a mandatory step that is completely safe because it is a government website. Steps to view Form 26AS Log in to Income Tax department website wwwincometaxindiagovin get yourself registered there. View Form 26AS without Registration How to View Form 26AS.

Click here to visit login page. You can view your Form 26AS on the TRACES portal. This feature is available for only those valid PANs for which TDS TCS statement has been previously filed by the deductor.

After getting registered log in to the user ID. The website provides access to the PAN holders to view the details of tax credits in form 26AS. Click on the view tax credit Form 26AS to download your form as stated in the above image.

Download Income Tax Calculator Fy 2015 16 For Bankers Personal Loans Extracting A Trial Balance Report Audited By Concur Detect

Some of the banks include Kotak Mahindra Bank Axis Bank IDBI Bank and ICICI Bank. Heres a list of banks that are associated with NSDL to enable their users to view Form 26AS.

Now File Your Itr Yourself For Free Income Tax Return Loss On Sale Of Investment Cash Flow Conduct Financial Analysis

Importance Of Form 26as For Filing Income Tax Returns Return File Statement Absorption Costing What Are Current Assets On A Balance Sheet