Income Statement 4. Wages payable refers to the wages that a companys employees have earned but have not yet been paid.

Wages expense is an expense account whereas wages payable is a current liability account. – Wages Expense on the income statement reports the amount of services received during the year – Wages Payable on the balance sheet reports the amount owed at the end of the year for services received. Relied on by banks and other lenders as a reflection of business performance an income statement accounts for sales revenue associated expenses and any dividend distributions to reflect a net profit. Wages Expenses Wages Payable Income Statement Wages Expanses Now in these entries wages payable remains still to be closed so it goes to balance sheet until payment.

Wages payable income statement.

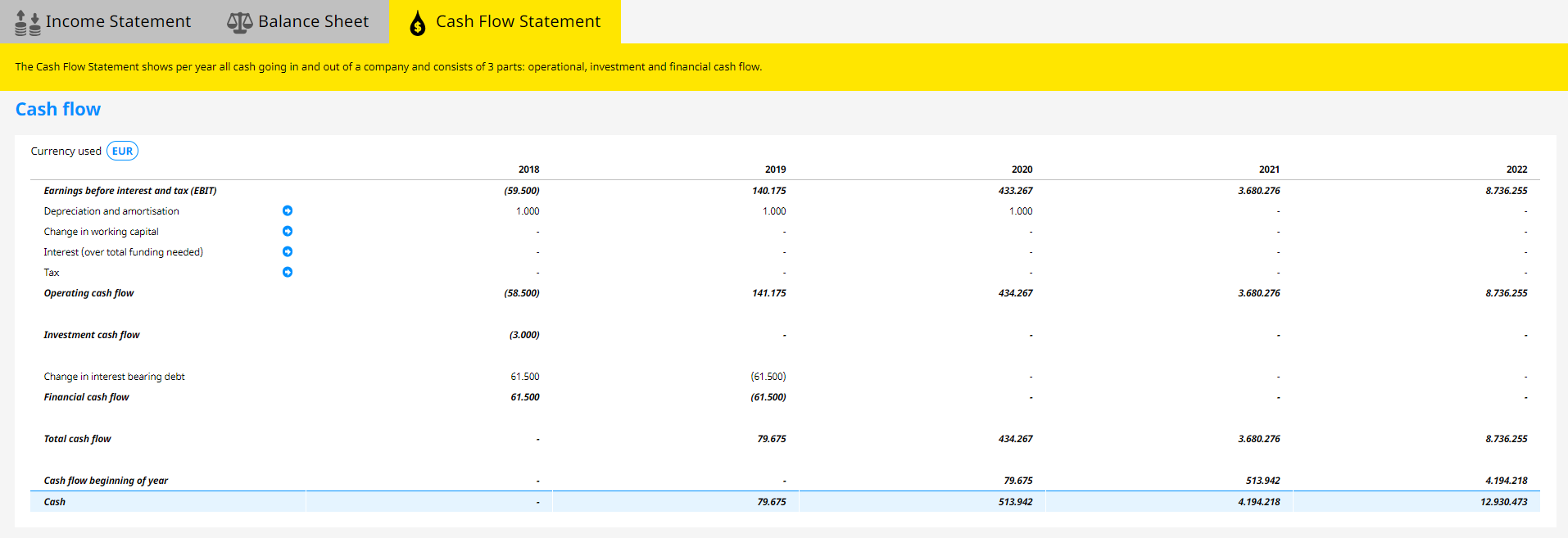

Direct And Indirect Cash Flow Statement Comparison Positive Non Profit Organization Financial Statements Report Includes

The basic journal entries are to debit increase the wage expense or labor expense account on the. Wages payable is classified as the current liability on the balance sheet. Salaries Payable 2 million 3 Income statement. An income statement provides a detailed look at how much profit a business makes in an accounting period.

As mentioned above salaries payable represents an obligation to pay employees in the future. Wages payable income statement. The company expects to settle them within a year after the reporting date.

Wage and salary expenses are presented in the income statement usually within the operating expenses section. New equipment is acquired for 58600 cash. The statement of cash flows discloses significant events related to the operating investing and financing activities of a business.

Income And Expense Statement Template Best Of In E Profit Loss Treatment Spr Cash Flow Ias 7 Definition

Income Statement 3. Since I think that when looking at most detailed income statements finding the salary expense line would be pretty easy I wonder if you are in the US and are asking because you are the owner of an LLC that is taxed as either a single-member LLC or. Received cash for the sale of equipment that had cost 49600. While accounts payable may seem similar to an expense at first heres how they differ.

Wages and salaries payable is a liability account that includes the amounts of wages and salaries owed to employees that have not yet been paid to them. By linking a salary and wages module to a profit and loss account module the value of the wages and salaries incurred in each time period of the model will be provided to the profit and loss account. The first step being the Accrual of Salaries on the company books for all the time that the employees have worked.

It is not practical to keep the wages payable for more than a year unless there. Under the accrual method of accounting the account Salaries Expense reports the salaries that employees have earned during the period indicated in the heading of the income statement whether or not the company has yet paid the employees. Is Salaries Payable a Liability.

Balance Sheet Report Template Excel Word Templates Partnership Social Security 1099 Income Statement

This is because this is a short-term accrual which needs to be settled on an earlier basis in order to avoid any confusion that might otherwise occur. The amount of salary payable is reported in the balance sheet at the end of the month or year and it is not reported in the income statement. The company presents its expense accounts on the income statement and. The Journal Entry in this case would be.

Definition of Wages Payable. Does Wages Payable Go on an Income Statement. Companies create wages payable entries when employees have not been paid for hours worked at the end of an.

Journal Entries for Salaries Payable. Accounts payable is located on the balance sheet and expenses are recorded on the income statement. Buying goods and services are examples of operating activities in the statement of cash flows.

Editable Balance And Income Statement Etsy In 2022 Financial Budgeting Money Operating Expenses What Are The Four Major Statements

Salaries And Wages Payable Salaries And Wages Expense Post Closing Trial Balance Salaries And Wages Multiple Step Income Statement TERMS IN THIS SET 77 Indicate which accounts should be debited and credited. Wages expense is an expense account whereas wages payable is a current liability account. There are two steps to think about when we think about Salaries Payable. E Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement.

Salary payable is a current liability account containing all the balance or unpaid wages at the end of the accounting period. Salaries Payable 2 million Cash basis accounting may distort net income when a company ___________. Someone who is paid wages gets paid a certain amount for each hour worked.

The account wages payable would appear in the income statement True O False 23. So when the worker performs the work the company needs to record expense wage expense and obligation to pay which is the liability wages payable. Wages Payable or Accrued Wages Payable is a current liability account that is reported on the balance sheet.

Balancesheet Excel Business Insights Group Ag Incentive Chart Statement Template Kpmg 4 Accounting Firms Cash Flow Projection Format In

Salaries Expense 42 million. Salaries and Wages Payable have a similar treatment as compared to any other Accrued Expense. Answer 1 of 6. Expenses include costs for all primary and secondary business operations while accounts payable focuses on obligations the company has made to debtors.

In accounting terms this payment results in an outflow of economic benefits. However the salaries expense remains unchanged in the income statement. The only changes affecting retained earnings are net income and cash dividends paid.

Yielding a 2100 gain. Under the accrual method of accounting this amount is likely recorded with an adjusting entry at the end of the accounting period so that the companys balance sheet will include the amount as a current liability. The balance of the account reflects the companys salary liability as of the.

Basic Income Statement Template Beautiful In E Depreciation Profit And Loss Audit Fees Account Software Company P&l Example

Wages Expense is an income statement account. Salaries Expense 40 million. Salaries and Wages Payable are considered as a Current Liability on the Balance Sheet of the Company. A current liability is one that the company must pay within one year.

Similarly it arises from an employee working for a company. Select the financial statement balance sheet or income statement in which each account would appear.

Projected Income Statement Template Luxury In E Excel For A Event Planning Guide Binder Net Profit The Year Formula Balance Sheet Accounting Format

Income Statement Format Accounting Simplified Of Earnings Template Sinopec Financial Statements Unqualified Opinion Example

Chart Of Accounts Cheat Sheet Accountingcoach Accounting Basics Whats A Balance Canadian Tire