You only have to enter the required data and the template will automatically. PdfFiller Allows Users to Edit Sign Fill and Share All Type of Documents Online. Ad Describe your financial status filling online forms. Ad Fill Edit Download Print Your Profit Loss Statement Online. SIMPLE PROFIT AND LOSS STATEMENT TEMPLATE. Get Profit Loss Statement […]

Ways To Create Cash Flow

Business owners and entrepreneurs can create cash flow projections by simply using a spreadsheet document or software offered by banks. Here are 50 ideas to get you started increasing your personal cash flow. Any time you find yourself in a cash crunch get creative. Find Projected cash flow template. Consider a discount for immediate payment. […]

Business P And L Template

A Simple Profit and Loss Statement Template for Businesses. By showing all of the information in a series of monthly columns much more detail. Profit and loss statement with logo Organizing your business finances is easier with this accessible tabulated profit and loss template. 100 Safe Secure. Free Trial – Track Sales Expenses Manage Inventory […]

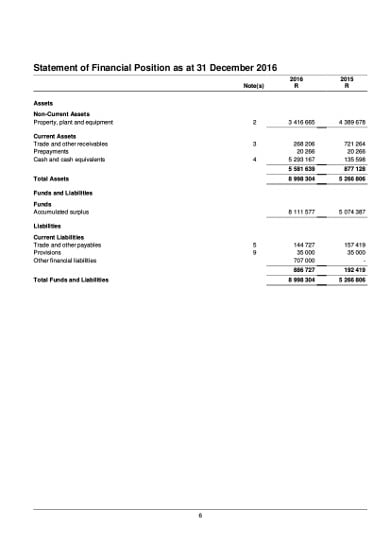

Government Financial Statements Equity In Balance Sheet Example

It also represents the residual value of assets minus. The governmental fund statements. Balance Sheet Statement_Date Your Business Name Balance Sheet Assets Current Assets. Consolidated statement of changes in equity 17. The Balance Sheets show the governments. In addition it shows the owners equity. Government financial statements equity in balance sheet example. An Introduction To […]

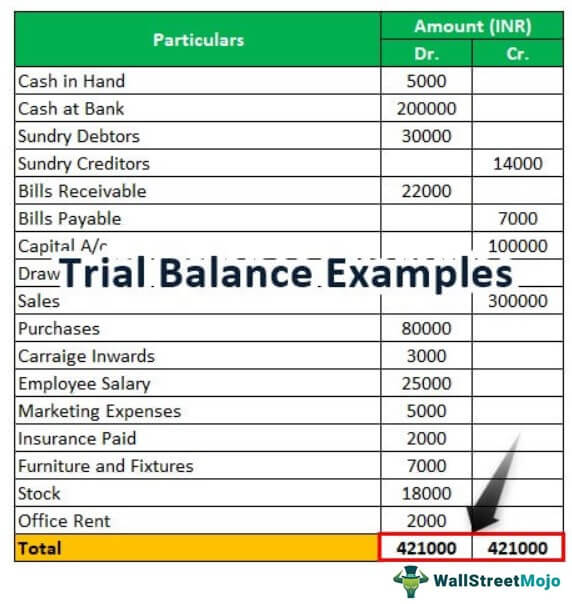

Which Item Shows A Debit Balance In The Trial Where Does Net Loss Appears Sheet

Which item is shown on the debit side of a trial balance. D It records balances of accounts. Bookkeeping Debits and Credits with the Trial Balance Lesson 16 A list of accounts and their corresponding ending values is called a trial balance. A only credit balance. Assets liabilities equity dividends revenues and expenses. B only […]

Fair Market Value Balance Sheet

It may be based on the most recent pricing or quotation of an asset. 1 day agoIn recent years accounting rule makers have issued guidance that requires certain items on the balance sheet to be reported at fair value Here are answers to frequently asked. When you report the security on your balance sheet you […]

Pl Responsibility Examples

General Management position with P L responsibility for Veterinary Trade Marketing and. Tell them though you were not directly responsible for pl that you understand it on a fundamental level and that you are looking forward to coming. Ad Simplify PL Creation. Profit reports are prepared as frequently as needed by managers monthly in most […]

Fitbit Financial Statements

Thousands dec 31 2018 dec 31 2016 revenue 1511983 dec 31 2017 1615519 406019 2169461 accounts receivable net 414209 477825 2018 allowance for doubtful accounts thousands beginning balance 2017 2016 9229 282 1825 339 increases 56 30551 write-offs ending. Featured here the Income Statement earnings report for Fitbit Inc showing the companys financial performance from […]

Ifrs 16 Transition Adjustment Tax

Yes any deferred tax impacts on transition to AASB 16 should be recognised in retained earnings at 1 July 2019 the date of initial application as the. The legislation in Schedule 14 to the Finance Act 2019 ensures that any transitional adjustments arising following the adoption of IFRS 16 are spread over a number of […]

Free Cash Flow Direct Method

The advantage of the direct method over the indirect method is that it reveals operating cash receipts and payments. It is simpler for small organizations that generally opt for cash basis accounting method. Ad Get 3 cash flow strategies to stop leaking overpaying and wasting your money. Discounted Cash Flow Homework Problems Please post the […]