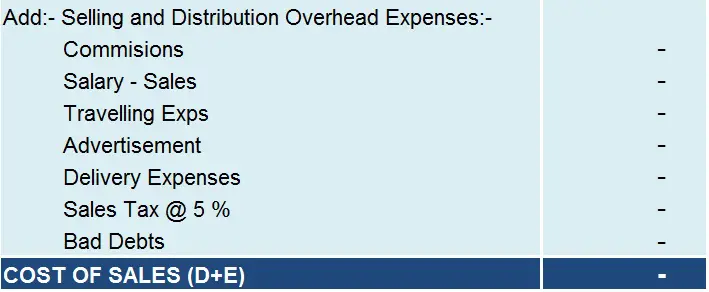

By the end of this lesson students should be able to. Why is Trading Account made. The financial account that is used to show the. Describe how a business can obtain a supernormal profit. Which appears both in Trading and Profit Loss Account. Definition and Explanation. Objective of profit and loss account. How To Prepare […]

Cash Flow Direct Method Format

The format of the indirect method appears in the following example. Also known as the income statement method the direct method cash flow statement tracks the flow of cash that comes in and goes out of a company in a specific period. For example purchase of machinery by paying cash is cash outflow while sale […]

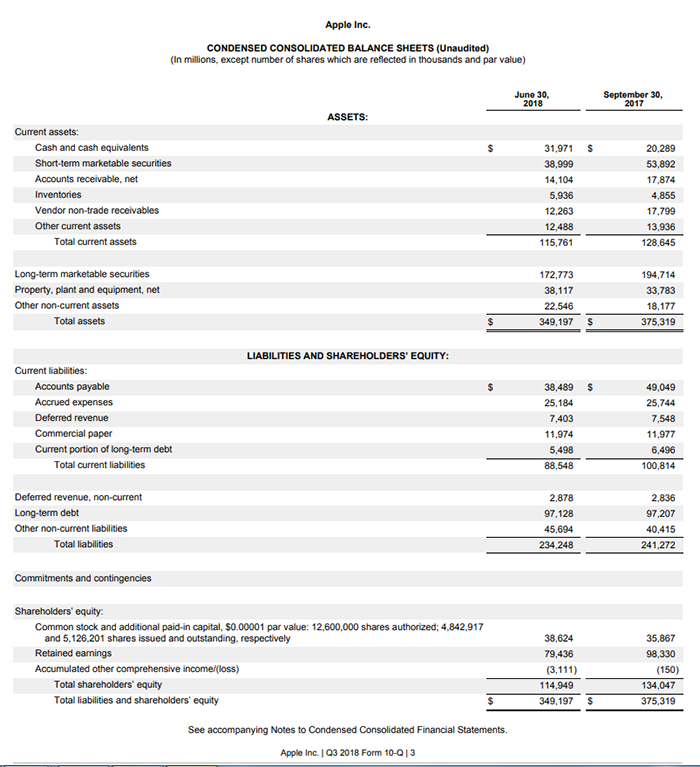

Statement Of Other Comprehensive Income

Other comprehensive income OCI is part of stockholders equity on the balance sheet and is not part of the income statement. The net income is the result obtained by preparing an income statement. Other comprehensive income OCI is an accounting item for firms that includes revenues expenses gains and losses that have yet to be […]

Cash Flow Example Problems

Negative cash flow might make it impossible for a company to pay. For small businesses Cash Flow from Investing Activities usually wont make up the majority of cash flow for your company. Ad Optimize cash shore up your capital position extend your runway for business resilience. Cash flow vectors — Up Inflow Benefit or — […]

Normalized Income Statement

– NET INCOME – – DIV0. Remember that normalizing adjustments are but one step in many in the valuation process. Normalizing net income is the process of cleaning reported net income from the impact of non-recurring items All continuing income including income from non-core activities is included in normalized net income. These are adjustments that […]

Operating Income Includes

The widgets cost 200000 to make and his. Operating expenses include all the cost or expenses which are directly related to the business activity. Do not forget to include vacancy rates in your Gross Operating Income GOI calculations as this will give a clearer picture of what a property can reasonably return in a year. […]

Saputo Financial Statements

All amounts in this news release are in Canadian dollars CDN unless otherwise indicated and are presented according to International Financial. Saputo produces markets and distributes a wide array of products of the utmost quality including cheese fluid milk yogurt dairy ingredients and snack-cakes. Notice of Annual General Meeting of Shareholders. 1 As compared to […]

Limited Liability Company Financial Statements

LEGO UKRAINE Limited Liability Company EDRPOU 36979658 name Statement of Financial Results Statement of Comprehensive Income for the year ended 31 December 2020 Form 2 DKUD Code І. Get Started On Any Device. Statement of Financial Position. According to definition a Limited Liability Company LLC is a corporate structure in which the shareholders of the […]

Stable Financial Position

In the profit and loss statement, profits are increasing. This information is used by your bank to measure the strength of your financial condition. According to the Auditor-Generals Report LKAN 2020 released on Monday March 21, the financial status of the Terengganu government as a whole for the year ended December 31, 2020 is stable. […]

Advance Income Tax Paid In Cost Sheet

Overview of the Income and Expenses. While the tax liability will appear as an expense in the profit and loss account the provision for income-tax will be shown in the Balance Sheet as a current liability and the Advance Tax of Rs. It is shown under. NoAdvance Tax is not an expense and an asset […]