Ratio of Debt to Equity Tata Motors Performance FY-2012 FY-2013 FY-2014 FY-2015 056 075 076 135 Tata Motors Ford GM Competitors Performance in FY-2015 The major ratios are shown, along with a comparison to industry peers and a five-year balance sheet.

All of these factors contributed to the Indian automotive industry’s strong and profitable growth in 2009-10. 32 rows Tata Motors Ltd. Financial Ratios Analysis In the case of both organizations, the current ratio and quick ratio are the same. From the balance sheet and profit ratio analysis.

Balance sheet of tata motors with ratio analysis.

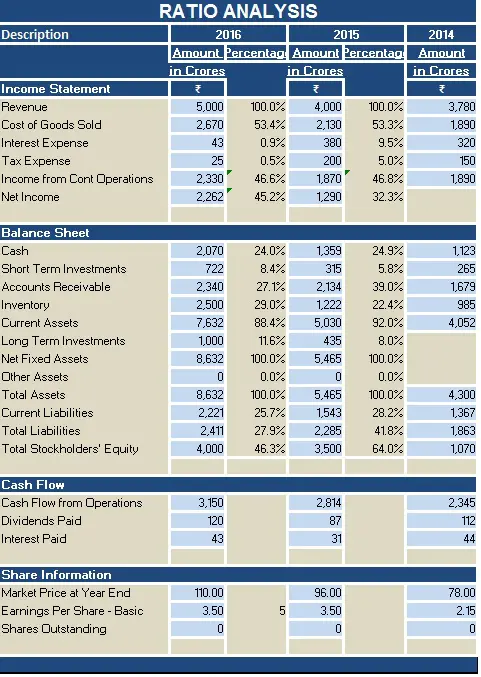

Ratio Analysis Formula Calculator Example With Excel Template Format Of Assets And Liabilities Statement In Management Reports Compared To Financial Are

For this study, both quantitative and qualitative methodologies were employed. A balance sheet’s three primary components are assets, liabilities, and equity. Get the most recent Balance Sheet Financial Statements and full profit and loss reports for Tata Motors. 419-405-1039 382 339 509 Pre-Tax Margin

Ratio Analysis of Tata Motors 1. Fixed Assets Investments on the Consolidated Balance Sheet 1 Use the Tofler search bar to find the company you’re looking for. 2 Select the financial reports you want to include.

It is Tata Motors’ first passenger car, as well as India’s first indigenously produced vehicle. Current Assets and Current Liabilities are the assets and liabilities that are currently in use. It is discovered in the loss statement that the liquidity ratio, i.e.

Tata Motors Ltd Fundamental Stock Analysis Profits And Losses Are Determined By Balance Sheet Forecast

TATA MOTORS PROJECT REPORT ON FINANCIAL RATIO ANALYSIS PROJECT REPORT. Tata Motors Ltd’s Balance Sheet Page shows revenue growth that is lower than the industry average. Today’s share price for Tata Motors.

TATA MOTORS LIMITED’s balance sheet may be downloaded in 5 simple steps. Ratio analysis is a technique for assessing many aspects of a business’s operations and finances. For the analysis of Tata Motors TTM, ten years of annual and quarterly financial ratios and margins were used.

The Tata Indica is a supermini car manufactured by Tata Motors in India since 1998. The goal of this project is to conduct a financial analysis and research on the company Tata Motors Limited. This ratio examines a company’s liquidity by comparing its current asset to its ability to pay.

Ratio Analysis On Specific Project Tata Motors Commerce 2019 20 Youtube Interest Expense Statement Of Cash Flows American Express Financial

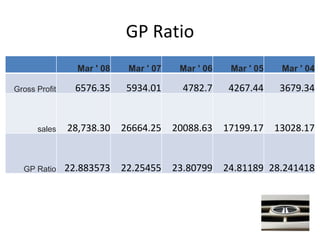

Analysis of the Tata Steel Ratio. Ratio Analysis of Tata Motors 2. TATA MOTORS FINANCIAL RATIO ANALYSIS The GP Ratio Sales 657635 593401 47827 426744 367934 Mar 08 Mar 07 Mar 06 Mar 05 Mar 04 Gross Profit 657635 593401 47827 426744 367934

1166 678 773 988 1049 1280 Core EBITDA Margin There is no description of the ratio formula. The Different Types of Balance Sheet Ratios

095-128-848 542 494 685 EBIT Margin In the last five years, Read the latest news from Tata Motors, including profit and loss accounts.

Tata Motors Ratio Analysis Big 6 Accounting Firms 2020 Negative Cash Flow Statement

Get the most recent Key Financial Ratios Financial Statements and full profit and loss statements for Tata Motors. – DEBT EQUITY RATIO -015 DEBT EQUITY RATIO -015 DEBT EQUITY RATIO -015 DEBT EQUITY RATIO -015 DEBT EQUITY TATA STEEL’S Important Financial Ratios

Higher-than-industry revenue growth indicates that the company has more room to develop its market share. Check out Tata Motors’ current BSENSE FO quote, as well as historical price charts. Now is the time to get the app.

BALANCE SHEET PL. ANEXURE They are further separated into sub-headings that are crucial to comprehend. 2Common Size Income Statement 1Common Size Balance Sheet

Accounts Project Ratio Analysis Of Financial Statements Class 12 Cbse Youtube Group In Reporting Amber Enterprises Balance Sheet

Summary Of Financial Ratio Analysis In Management Tutorial 20 April 2022 Learn 6337 Wisdom Jobs India Daily Expense And Income Excel Sheet Hotel Profit Loss Statement

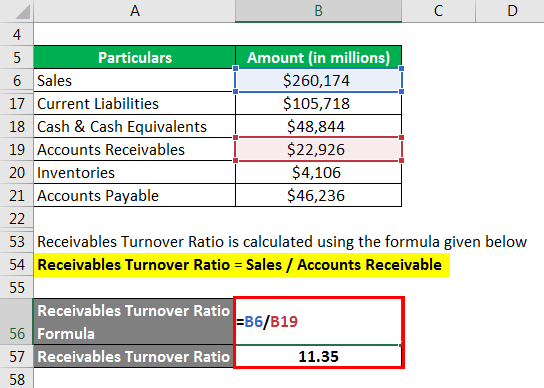

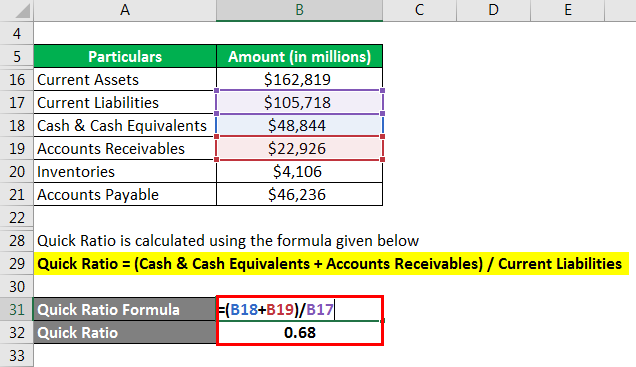

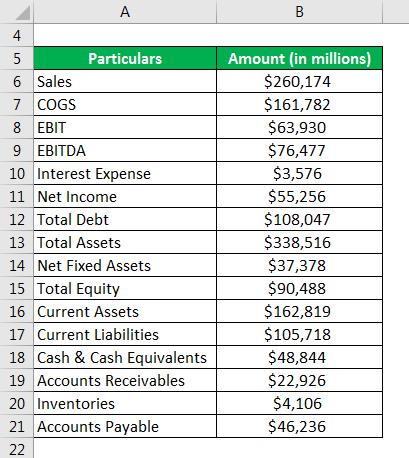

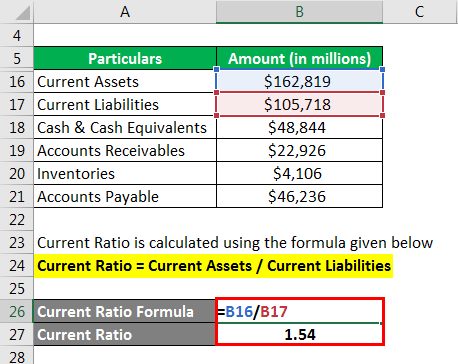

Ratio Analysis Formula Calculator Example With Excel Template Supplementary Notes Financial Statements Abb

Ratio Analysis Formula Calculator Example With Excel Template Abridged Financial Statements Investments In Subsidiaries Balance Sheet

Ratio Analysis Formula Calculator Example With Excel Template Interest Revenue Operating Activity What Is A Profit And Loss Statement