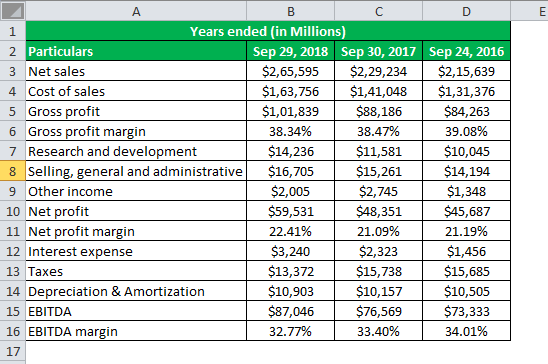

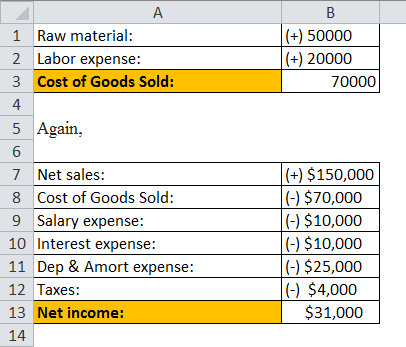

Observed by the cost of goods sold operating. Then divide gross profit by sales which would be.

Findings Gross profit and net profits are decreased during the period of study which indicates that firms. The project selected by me is. PROJECT REPORT TATA MOTORS TATA MOTORS. These ratios are as follows.

Profitability ratio analysis project report.

Download Ratio Analysis Excel Template Exceldatapro Other Operating Income Annual Report Project

Profitability ratio Analysis Ratios Operating profit Margin Net Profit margin Return on assets and return on equity Other recommended by the university How Profitability Ratio Helpful. Profitability Ratio Analysis Project In this project you have to. Net Sales Operating Income Total Assets 5. Gross profit ratio net profit ratio operating profit return on total assets net worth of the last five years of the company.

-The aim of research. Ratio analysis helps in making decision from the information provided in these financial Statements. We required details related to project which is helpful us for analysis and understanding the project which are as under.

The areas that these ratios focus on are sales performance costs management assets efficiency and sometimes cash flow management. Financial statements of latest 5 years 20 72 73 to 207778 have been taken as sample for the comparative analysis of Profitability ratio. Because it would leave a small margin to meet interest dividends and other corporate needs.

Pdf A Study On Ratio Analysis At Amararaja Batteries Limited Arbl Project Report Master Of Business Administration Under The Guidance Vivek Jain Academia Edu Bad Debts Treatment In Balance Sheet Prepare Cash Flow Statement From Following Sheets

The project report on profitability ratio analysis is presenting profitability ratio analysis of Askari Bank Bank Alfalah and Soneri Bank. For example if your company had gross sales of 1 million last year and net profits were 50000 thats a ratio of 500001000000 or 5. Profitability Ratio Analysis Project In this project you have to. MBA Finance Project Report on Ratio Analysis.

FINANCIAL RATIO ANALYSIS OF TATA MOTORS. This project report covers all the aspects relating to the Profitability ratios of Britannia industries Ltd interpreted according to standards. This is done by dividing each item into net sales and expressing the result as a percentage.

PROCESS We were briefed by our. Contact us for more detail. Roshan Kumar Assistant Manager Central Accounts Submitted by Srabani Dutta Roll No.

Profitability Ratio Definition Formula Guide To Analysis Significance Of Financial Example For Accrued Expenses

To study the profitability analysis of TATA motors ltd. – A PROJECT REPORT ON RATIO ANALYSIS Findings SUGGESTIONS CONCLUSION BIBLOGRAPHY. Net Profit Net Sales Operating Income 4. Helps in financial forecasting and planning-Ratio analysis is of much help in financial forecasting and planning.

Assets Turnover Ratio. Profitability Ratios Profitability ratios measure the earning ability of a firm. 40 100 40.

Calculate gross profit margin by first subtracting the cost of goods sold from sales. Unique Profitability Ratio Analysis Project Report Profitability ratios measure both returns on the investors money in the firm and company margins. The group has been created for those students whos are working on FIN619 Final Project Finance on Profitability Ratio Analysis.

Profitability Ratios Calculate Margin Profits Return On Equity Roe Balance Sheet Is Also Known As Cash Budget Template

Coefficient of variation for SAIL was higher than that of TISCO denoting variability in the ratio. In this project various ratios were studied to find out the financial position of bank. Under the guide of Faculty Guide Dr. Annual report of the company for last five years.

Shakti Prasad Tiwari Mob-9430434342 Industry Guide Md. Most companies refer to profitability ratios when analyzing business productivity by comparing income to sales assets and equity. Naturally higher the ratio the less favorable it is.

Select three listed companies existing in the same industry Get their financial statements for the most recent three years and. Operating Ratio Cost Goods Sold Operating Expenses. Profitability analysis in cost accounting is an assessment of the profitability of the production of an organization.

Profitability Ratios Calculate Margin Profits Return On Equity Roe Assets Items In Balance Sheet Accounting For Dividends Received From Subsidiary

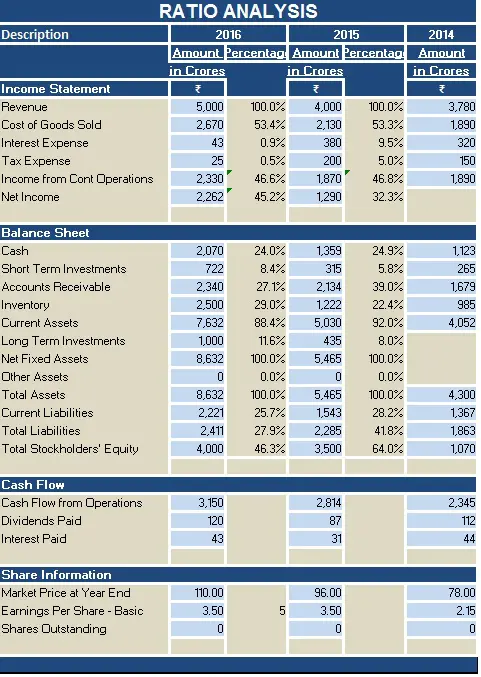

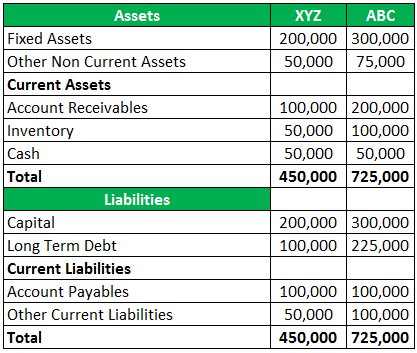

GENERAL PROFITABILITY RATIOS GROSS PROFIT RATIO NET PROFIT RATIO OPERATING RATIO. Chapter 3 Data Analysis PROFITABILITY ANALYSIS of three organizations under consideration will be conducted for the recent THREE financial years. An overall study of operating profit ratio shows that TISCO has performed better than SAIL from the view point of operating profit ratio because the average operating ratio for TISCO was 3451 percent while for SAIL it was 1442 percent. Six of the most frequently used profitability ratios are.

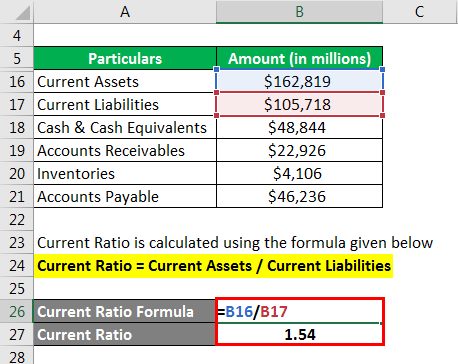

Capital Adequacy Ratio. Profitability ratio 32 Chapter 5 DATA ANALYSIS 33 LIQUIDITY RATIO 1. CHAPTER-1 EXECUTIVE SUMMARY- Financial statements provide summarized view of the financial position and Operation of the.

The three ways of expressing profit can each be used to construct what are known as profitability ratios. Organizational output can be categorized into products clients places routes andor operations. We are professional for writing FIN619 Final Project Finance of Virtual University of Pakistan.

Examples Of Financial Analysis Step By Guide Statement Owners Equity Template Excel Calculating Net Cash Flow From Operating Activities

Measuring the ability of the National Commercial Bank in achieve profitability by using the indicators of. Comparative data banks are presented in such a way to make the report informative to the reader. Tashfeen Chief Manager Cost Budget Mr. It measures the quantity of profit gained as a result of any business efficiency.

2 Operating Ratio- The ratio shows the percentage of net sales ie. Debit Equity Funds 3. Debt Equity Ratio.

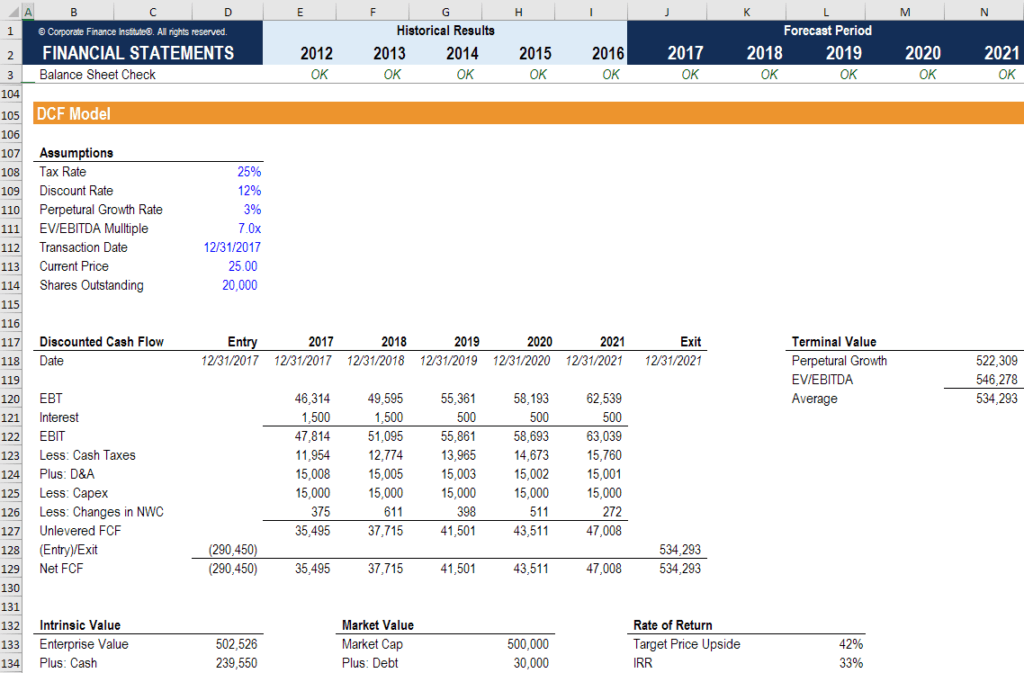

Net Turnover Margin Ratio. Planning is looking ahead and the ratios calculated for a number of years a work as a guide for the future. The group has been created for those students whos are working on FIN619 Final Project Finance on Profitability Ratio Analysis.

Profitability Ratio Definition Formula Guide To Analysis Directors Responsibility For Financial Statements Statement Of Position Balance Sheet Difference

A Brief Study on Ratio Analysis in Eastern Coalfield Limited. Select three listed companies existing in the same industry Get their financial statements for the most recent three years and Perform the PROFITABILITY RATIOS analysis The following ratios you are required to analyze. If sales are 100 and the cost of goods sold is 60 the gross profit is 40. We will refund your whole money back if your project dis-approve.

Profitability Ratios are the group of Financial Ratios that use for assessing and analyzing the entitys profitability through various ratios. This project was done with the help of secondary data as research in finance subjects is done on performance and not potential. Example Types Explanation Importance.

Population and Sample Among 28 commercial banks NABIL Bank Limited have been selected for the present study. The use of profitability ratios in the analysis of financial statements of commercial banks lead to the discovery of strengths and weaknesses in these banks. The high or increase.

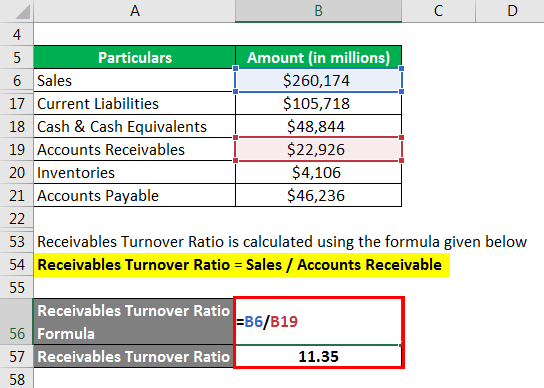

Ratio Analysis Formula Calculator Example With Excel Template Main Accounting Statements Trust Fund Financial

1 Gross Profit Margin Gross profit margin compares gross profit to sales revenue. CURRENT RATIO Amount in Rs Current Ratio Year Current Assets Current Liabilities Ratio 2003 58574151 7903952 741 2004 69765346 31884616 219 2005 72021081 16065621 448 2006 91328208 47117199 194 2007. The current ratio has shown in a fluctuating trend as 741 219 448 198 and 382 during 2003 of which indicates a continuous increase in both current assets and current liabilities. Page 1 A PROJECT REPORT Entitled.

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal Difference Between Trial Balance And Sheet Accounts Receivable Are Valued Reported On