In this example the owners value in the assets is 100 representing the companys. The state of equity provides some insight into how the finances of a business have progressed or failed and the anticipated growth rate and pattern.

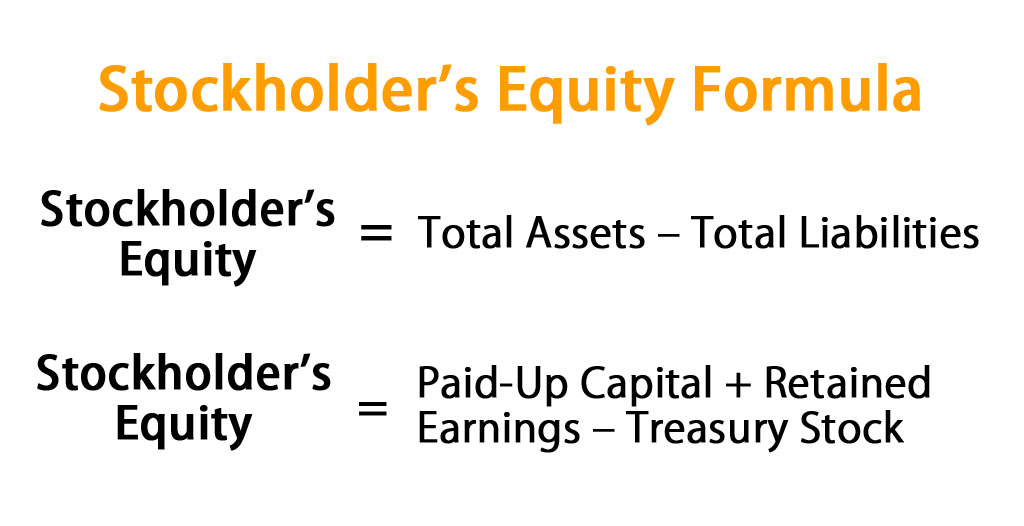

Liabilities Shareholders Equity All values USD. Since stockholders equity is equal to assets minus liabilities any reduction in stockholders equity must be mirrored by a reduction in total assets and vice versa. Liabilities include all the money a ongoing company owes. Stockholders equity is the amount of the business that is owned by investors.

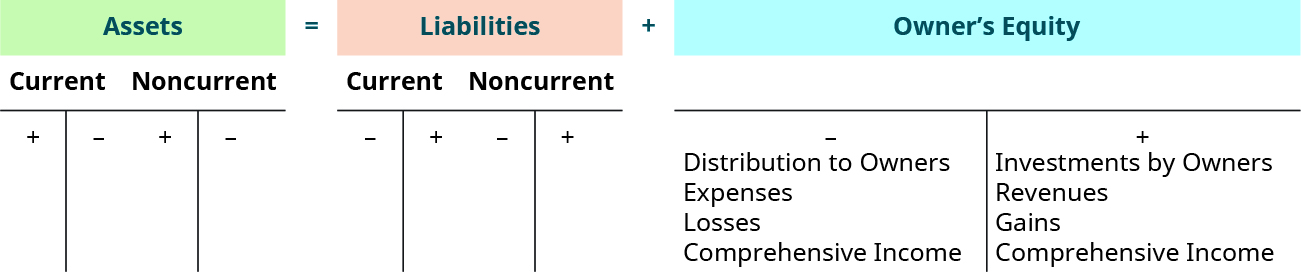

Assets liabilities and stockholders equity.

Balance Sheet Definition Examples Assets Liabilities Equity Private School Profit And Loss Statement Interim

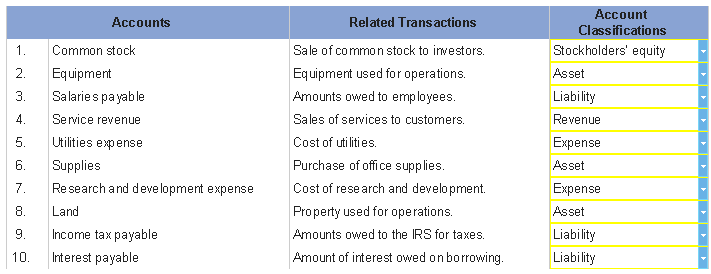

Stockholders equity is not the same as cash on hand. What type of audit opinion means that for the most part the companys financial statements are in compliance with GAAP but the auditors have reservations about something in the statements. Assets liabilities and stockholders equity are all found within which of the following financial statements. Revenues like fees earned and expenses like supplies expense and utilities expense are part of equity because these items.

5 rows Lets take the equation we used above to calculate a companys equity. Assets are usually classified as. Reports the assets liabilities and stockholders equity at a specific date.

The left side of the balance sheet outlines all of a companys assets. A balance sheet lists the value of all of a companys assets liabilities and shareholders or owners equity. Stockholders equity is the value of a firms assets after all liabilities are subtracted.

Assets Liabilities And Equity Double Entry Bookkeeping School Profit Loss Statement Nbfc Balance Sheet

If the company is a sole proprietorship it is referred to as Owners Equity The amount of Stockholders Equity is exactly the difference between the asset amounts and the liability amounts. An increase in equity can result from. The investing activities section of the Statement of Cash Flows. The Shareholders Equity Statement on the balance sheet details the change in the value of shareholders equity from the beginning to the.

When a business can pay out its liabilities the remainder of its assets is referred to as stockholders equity. T he assets and liabilities are separated into two categories. Enter one word per blank Expert Answer.

Lets consider a company whose total assets are valued at 1000. Total assets – Total liabilities Equity. With a debt of 900 liabilities.

Define Explain And Provide Examples Of Current Noncurrent Assets Liabilities Equity Revenues Expenses Principles Accounting Volume 1 Financial List Audit Firms Write A Note On Valuation Balance Sheet

To assets Similarly liabilities are split into current liabilities which include things such as rent tax utilities within a year debts that are payable and dividends payable. ST Debt Current. The format of the sheet is based upon the following accounting equation. Example of a Stock Dividend.

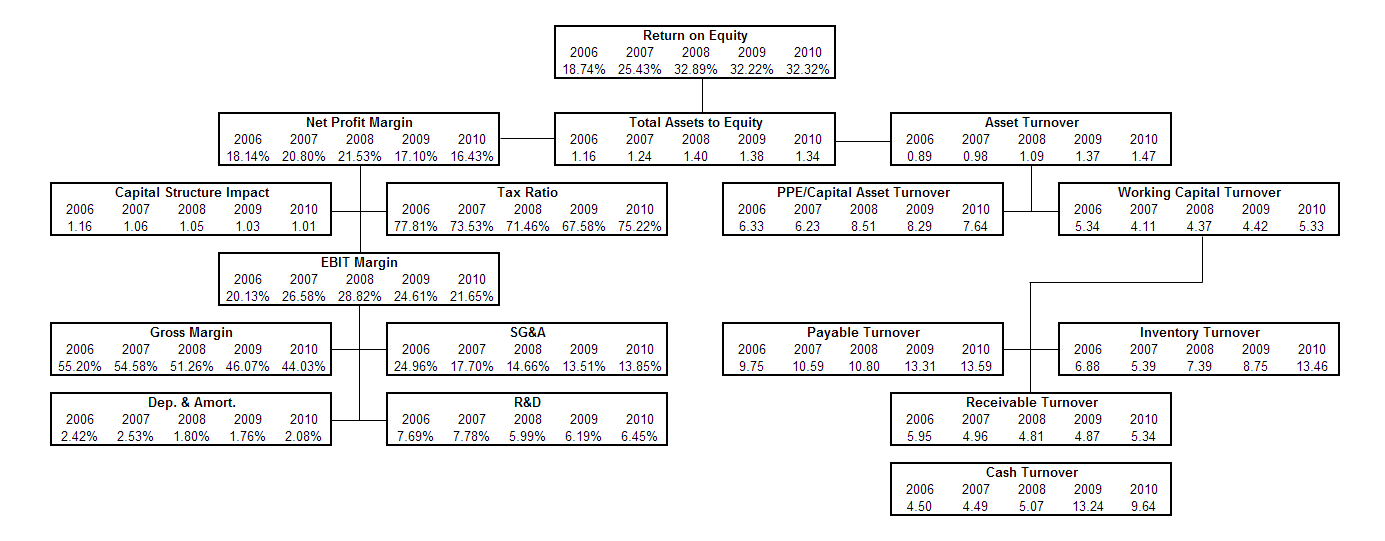

On a companys balance sheet the three main categories of information are its assets liabilities and stockholders equity. 1 Financial Statements And Business Decisions 2 Investing And Financing Decisions And The Accounting System 3 Operating Decisions And The Accounting System 4 Adjustments Financial Statements And The Quality Of Earnings 5 Communicating And Interpreting Accounting. It normally also provides information about the future earnings capacity of a company assets as well as an indication of cash flows that may come from receivables and inventories.

30000 Asset 25000 Liability 5000 Owner Equity. Statement of stockholders equity. The balance sheet has three sections each labeled for the account type it represents.

Free Homework S Help 24 7 Account Classifications Include Assets Liabilities Stockholders Equity Dividends Revenues And Expenses Required For Each Transaction Select Whether The Related Would Be Classified As An Asset Liability Or Financial Statement Income Tax Of

Experts are tested by Chegg as specialists in their subject area. We can see how this equation works with our example. Current assetliabilities and non-current long-term assetsliabilities. Assets are increased with _____ and liabilities and stockholders equity is increased with _____.

It normally also provides information about the future earnings capacity of a company assets as well as an indication of cash flows that may come from receivables and inventories. If the company is a corporation the third section of a corporations balance sheet is Stockholders Equity. The balance sheet provides creditors investors and analysts with information on company resources assets and its sources of capital its equity and liabilities.

Multiple Choice Balance sheet. The balance sheet provides creditors investors and analysts with information on company resources assets and its sources of capital its equity and liabilities. Stockholders equity represents the ownership claim of stockholders to the companys assets after deducting all liabilities.

Stockholder S Equity Formula Calculator Excel Template Explain Owners Discover Financial Statements

Assets Liabilities. We review their content and use your feedback to keep the quality high. The balance sheet equation assets equals liabilities plus owners equity a very important part of what goes on in accounting but whats an asset. Assets are arranged on the left-hand side and the liabilities and shareholders equity Equity Shareholders equity is the residual interest of the shareholders in the company and is calculated as the difference between Assets and Liabilities.

As a result accountants often refer to Stockholders Equity as the difference or. Who are the experts. Assets are the resources liabilities are claims on the resources held by outside parties creditors and stockholders equity are the claims on the resources not claimed by anybody else.

Property plant and equipment. Dividends are reported on the. Its also known as owners equity shareholders equity or a companys book value.

Equity Formula Definition How To Calculate Total Dolat Investment Balance Sheet Is The Income Statement Related

Assets include anything a company owns that has monetary value. You might think of it as how much a company would have left over in assets if business ceased immediately. View all FGMC assets cash debt liabilities shareholder equity and investments. Assets Liabilities Owners Equity.

On the right side the balance sheet outlines the companys liabilities and shareholders equity. Assets liabilities stockholders equity dividends revenues expenses. 100 1 rating Assets are increased with Deb.

In accounting the companys total equity value is the sum of owners equitythe value of the assets contributed by the ownersand the total income that the company earns and retains. Financing activity can included.

Balance Sheet Long Term Liabilities Accountingcoach Basic Accounting For Non Accountants Three Main Components Of A Cash Flow Statement

/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

Stockholders Equity Definition Common Base Year Financial Statements Personal Cash Flow Analysis

/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

Balance Sheet Definition Formula Examples How To Read In Hindi Profit And Loss Chart Of Accounts