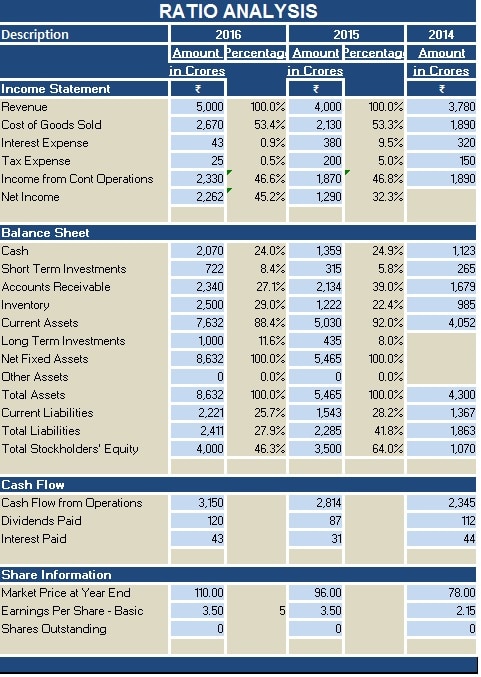

OVERVIEW Financial ratios are measures of the relative health or sometimes the relative sickness of a business. RATIO TREND ANALYSIS A.

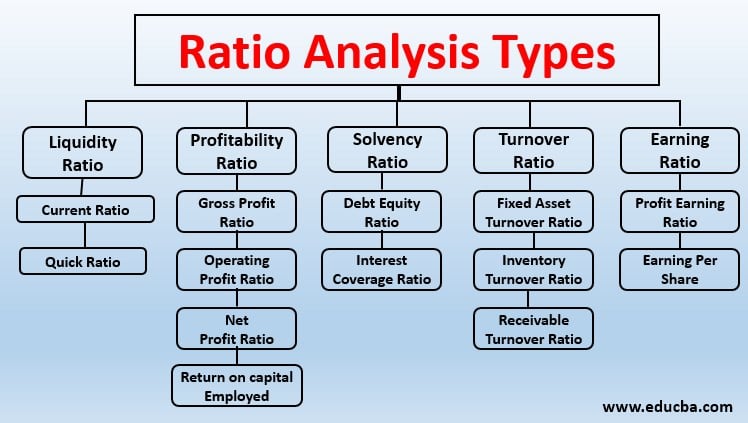

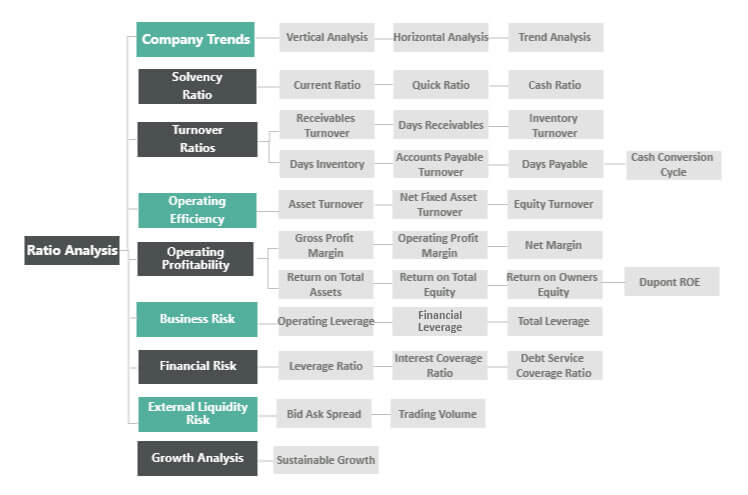

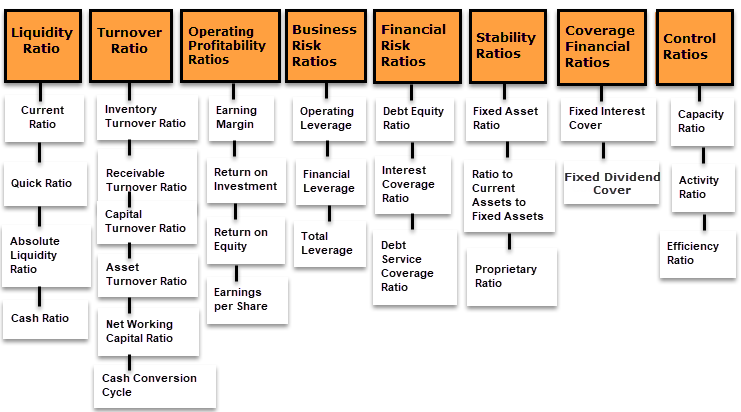

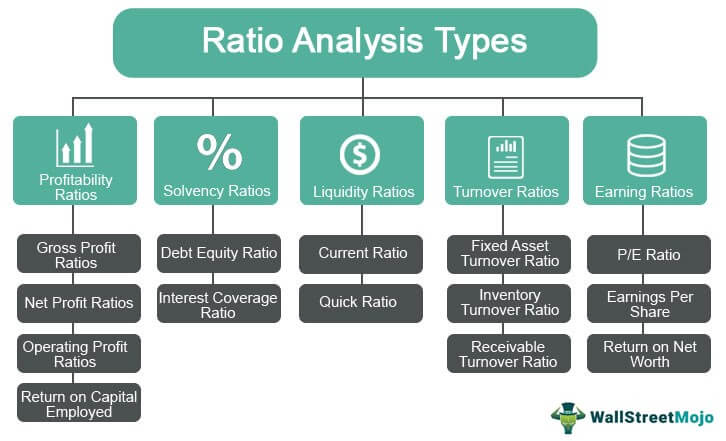

It is also a fundamental step in developing ratio trend and comparative analyses. Financial ratios can be somewhat loosely classified into different categories namely 1. Activity Operating Efficiency Profitability Valuation Financial Analysis Economic Analysis Environment Analysis Ratio Analysis. Current performance Past performances based on actual statements Expected performance based on pro forma or what if statements Through this analysis one is able to tell whether the companys financial standing and condition is in good health or otherwise.

Fundamental analysis ratios pdf.

Limitations Of Ratio Analysis Ratios Are Popular Learn About The Problems Ifrs Dividends Paid P&l Format

A class of financial metrics that is used to determine a companys ability to pay off its short-terms debts. Fundamental analysis unearthed secrets investors wanted to know Online tools to mak e analysis easier A checklist of things to consider in every annual report A dvice on how a good company in a bad industry can still make you money Why trends are important to. Components of ratio analysis Ratio analysis covers two basic groups. 42 FunDAMentAl AnAlysis Fundamental analysis is based on the premise that in the long run true or fair value of an equity share is equal to its intrinsic value.

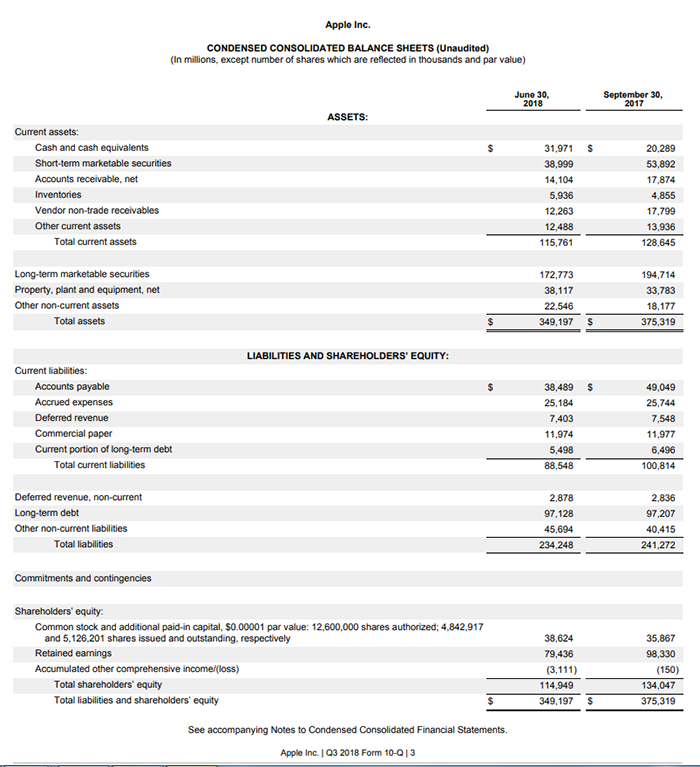

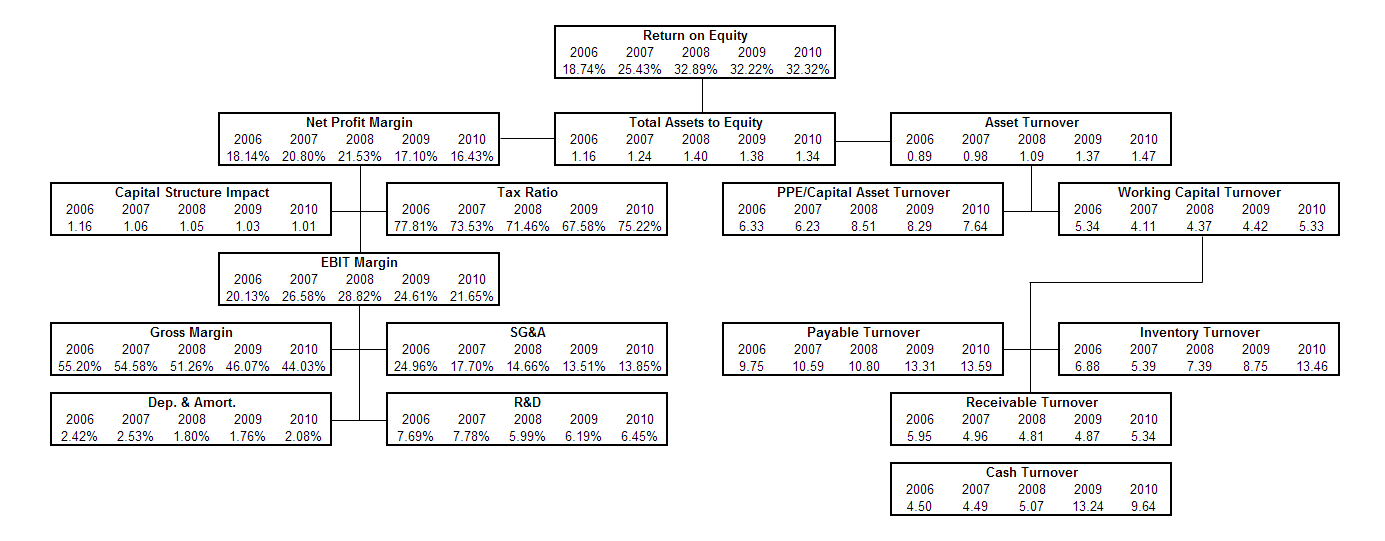

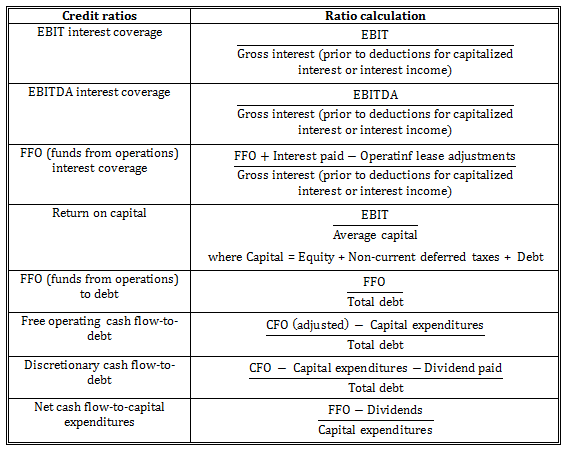

Financial statement analysis has traditionally been seen as part of the fundamental analysis required for equity valuation. Managers will use ratio analysis to pinpoint strengths and weaknesses from which strategies and initiatives can be formed. Operating Ratios The Profitability ratios help the analyst measure the profitability of the company.

Of Maximum Pass Certificate No. In case of an equity share it will be equal to the. Macro Economics Major Trends You dont want to be invested in a typewriter company in this age.

Download Ratio Analysis Excel Template Exceldatapro Fund Flow Statement In Accounting The Main Financial Statements

Fundamental Four provided by SP Capital IQ Combining these 4 metrics provides you with a broad overview of the companys financial results the markets demand for the companys shares and how much financial risk the investment carries Screenshot is for illustrative purposes only. Ratio analysis is a cornerstone of fundamental analysis. Key_metrics – lists the key metrics in total 57 metrics of a company over time annual and quarterly. The purpose of study HUL Godrej ITC Dabur was choosen to analysis was done using past five year computed date of Net Profit Margin Ratio Gross profit margin Price to Earnings Debt to.

The ratios convey how well the company is able to perform in terms of generating profits. Ratio analysis is a useful management tool that will improve your understanding of financial results and trends over time and provide key indicators of organizational performance. Profitability ratios are financial metrics used by analysts and investors to measure and evaluate the ability of a company to generate income profit relative to revenue balance sheet assets operating costs and shareholders equity during a specific period of time.

Ratios are calculated from current year numbers and are then compared to previous years. This work has the task to systematize knowledge about fundamental analysis so it can serve as a good base for future research. Political economic social technological legal.

Ratio Analysis Definition Formula Calculate Top 32 Ratios Kosmos Energy Balance Sheet Nrz

For the national economy fundamental analysis might focus on economic data to assess the present and future growth of the economy. Fundamental Analysis Management The companys management can make or mar a company even if other parts are great. Each category shows different aspect of the companys performance. That prevails when exact dollar amounts are used.

If fair value is not equal to the. Ratio Analysis fontCurrent Ratio Current ratio is the most common ratio for measuring liquidity. View Unit 3- Fundamental Analysispdf from ECN MICROECONO at Surana College.

As in the signal theory that management will always try to give a positive. Name of Module Fees Test No. Research Stocks Enter Company or Symbol 14.

Financial Analysis Tools Top 4 Used For Best Balance Sheet Stocks An Income Statement Sams Bookstore

The Price-to-Earnings PE Ratio The PE ratio is defined by dividing the current share price by earnings per share PE current share priceearnings per share. To forecast future stock prices fundamental analysis combines economic industry and company analysis to derive a stocks fair value called intrinsic value. Fundamental analysis is a method of evaluating a security in an attempt to measure its value by examining related economic financial and other qualitative and quantitative factors3The history of fundamental analysis can be traced back at least as far as the pioneering book on the topic by Graham and Dodd 1934. Fundamental analysis also examine various financial statements with the aim to asses a real value of companys stock.

Clicking on Athletic footwear shows that Under Armour only has 1397 revenue in footwear compared to Nikes 6616. Its primary advantage is its simplicity. But the analysis has typically been ad hoc.

For fundamental analysis Ratio Analysis is used. 13 How to learn the fundamental analysis of stocks course. This includes among other things Return on Equity ROE Working.

Financial Ratios Cheat Sheet By Reccur Download Free From Cheatography Com Sheets For Every Occasion Cdc Statements Toyota Motor Corporation 2019

Fundamental analysis financial indicators intrinsic value discount models stocks. Fundamental Analysis Module NATIONAL STOCK EXCHANGE OF INDIA LIMITED Surbhi Molasaria Full PDF Package This Paper A short summary of this paper 22 Full PDFs related to this paper Read Paper Fundamental Analysis Module NATIONAL STOCK EXCHANGE OF INDIA LIMITED fTest Details. Here are some of the key metrics used in the fundamental analysis of stocks. Fundamental Analysis Objectives of the chapter Importance of fundamental analysis Fundamental factors affecting.

5 How to Pick Stocks Using Fundamental Analysis 6 1 Price to Earnings Ratio 7 2 Returns on Equity Ratio 8 3 Price to Book Ratio 9 4 Debt to Equity Ratio 10 5 Profit Margins 11 Fundamental Analysis and Stock Market – FAQ 12 Which is the best fundamental analysis of stocks books. Drawing on recent research on accounting-based valuation this paper outlines a financial statement analysis for use in equity valuation. You can easily see that 74 of Under Armours total revenue comes from Sports Apparel while Nike has 28 of revenue from Sports Apparel.

The intrinsic value of an asset is the present value of all expected future cash inflows or earnings from that asset. Focuses on the fundamental analysis of the impact of financial ratios before and after being published on stock prices. When analysing the income statement we use performance ratios specifically those related to profitability.

Ratio Analysis Types Top 5 Of Ratios With Formulas Accumulated Profit And Loss Account Ifrs9 Cecl

Ratios are classified into four categories. Percentage analysis is taken for analysing primary data Tables and charts are also used for analysis. RATIO ANALYSIS Financial ratio analysis involves analyzing. Fully-fledged Fundamental Analysis package capable of collecting 20 years of Company Profiles Financial Statements Ratios and Stock Data of 20000 companies.

Cfa Level 1 Financial Ratios Sheet Analystprep Exams Calculation For Retained Earnings Unclaimed Dividend Treatment In Cash Flow Statement

20 Balance Sheet Ratios Every Investor Must Know Financial Ratio Statement Analysis Interest Expense On The Cash Flow For Project

Financial Ratio Analysis How To Interpret Ratios Analyse A Company Getmoneyrich Project Report On Cash Flow Statement Balance Sheet Of Joint Stock