Other comprehensive income OCI is part of stockholders equity on the balance sheet and is not part of the income statement. The net income is the result obtained by preparing an income statement.

Other comprehensive income OCI is an accounting item for firms that includes revenues expenses gains and losses that have yet to be realized. Övrigt totalresultat för året efter skatt. The statement of comprehensive income is a financial statement that summarizes both standard net income and other comprehensive income OCI. Offer helpful instructions and related details about Other Comprehensive Income Statement – make it easier for users to find business information than ever.

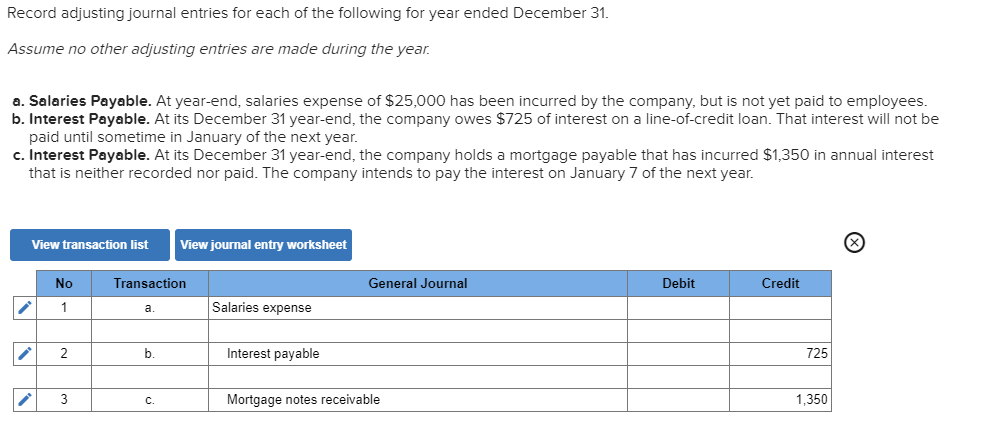

Statement of other comprehensive income.

Profit Loss Statement Example Inspirational 35 And Templates Form Template Business Budget Fletcher Building Financial Statements Ibm Audit Report

This means that they are instead listed after net income on the income statement. Importance of Other Comprehensive Income. Difference of the statement of comprehensive income of a service company and of a merchandising company on the other hand a merchandising company sells goods to customers and the main cost associated with the activity is the cost of the merchandise which is presented under the line item cost of goods sold. Comprehensive income is often listed on the financial statements to include all other revenues expenses gains and losses that affected stockholders equity account during a period.

2 ASC 220-10-45-5 requires presentation of comprehensive income attributable to NCI on the face of the financial statements. Total other comprehensive income. May 01 2021 Definition of Other Comprehensive Income Other comprehensive income contains all changes that are not permitted to be included in profit or loss.

In other words it adds additional detail to the balance sheets equity section to show what events changed the stockholders equity beyond the traditional net. Sample consolidated statement of comprehensive income that would follow the consolidated statement of income 1 Represents net income of 1000 less other comprehensive loss of 47. The statement of comprehensive income attempts to capture the effect of unrealized gains on investment securities on these changes to shareholders equity through the balance sheet by requiring companies to report other comprehensive income and accumulated AOCI comprehensive income.

Trading Translator What You Need To Know About Financial Statements Statement Budgeting Net Income Is Profit Bimbo

Net income for the year. Comprehensive income includes net income and OCI. Other comprehensive income OCI has long before the concept was implemented in the financial statements been widely discussed among as well standard setters as producers and users of financial information. Identification of items as OCI in the statement of profit and loss account gives a clear idea about the profits that are accrued to an organization subject to realization.

Statement of Comprehensive Income. In presenting these items on the statement of. Either gains or losses are recorded to OCI.

Top Credit Union In Illinois Top 10 Credit Unions Top Credit Unions In. 81 Deleted 81A The statement of profit or loss and other comprehensive income statement of comprehensive income shall present in addition to the profit or loss and other comprehensive income sections. Definition of Other Comprehensive Income Other comprehensive income or OCI consists of items that have an effect on the balance sheet amounts but the effect is not reported on the companys income statement.

Bank Statement Balance Sheet Five Benefits Of That May Change Y Personal Financial Free Uses And Limitations

Net income 4500 Other comprehensive income 3200 Comprehensive income 7700 Problem 5-5 IAA Bangladesh Company provided the following information for the current year. What is Other Comprehensive Income. OCI consists of revenues expenses gains and losses to be included in comprehensive income but excluded from net income. Instead these changes are reported on the statement of comprehensive income along with the amount of net income from the income statement.

Other comprehensive income is those revenues expenses gains and losses under both Generally Accepted Accounting Principles and International Financial Reporting Standards that are excluded from net income on the income statement. Comprehensive income that may be reclassified to profit or loss in the future are presented separately from items that would never be reclassified Title of statement of comprehensive income renamed to statement of profit or loss and other comprehensive income Presentation of Items of Other Comprehensive Income Amendments to IAS 1. A statement of comprehensive income is the overall income statement that consolidates standard income statement which gives details about the repetitive operations of the company and other comprehensive income Other Comprehensive Income Other comprehensive income refers to income expenses revenue or loss not being realized while preparing the companys.

In business accounting other comprehensive income OCI includes revenues expenses gains and losses that have yet to be realized and are excluded from net income on an income statement. It is particularly valuable for understanding ongoing changes in the fair value of a companys assets. Comprehensive income for the period being the total of profit or loss and other.

How Income Statement Structure Content Reveal Earning Performance Template Gross Net Profit Balancing Balance Sheet

Reporting entities should present each of the components of other comprehensive income separately based on their nature in the statement of comprehensive income. Other comprehensive income for the year net of tax. The statement of other comprehensive income represents a companys change in equity during a specific period from transactions and events that are typically non-cash gains and losses. The discussion has mainly evolved around the value relevance of OCI and how the concept should practically be used and interpreted.

OCI represents the current year activity that is used to calculated accumulated other comprehensive income AOCI at the end of the year. A firms pension obligations or a bond portfolio. Classification of items in OCI is important as it helps in the identification of overall profitability and earnings of the company.

When the gains and losses crystalize into cash they are usually reflected on the income statement and removed from other comprehensive income. Sales 50000 Cost of goods sold 30000 Distribution costs 5000 General and administrative expenses 400000 0 Interest expense 2000.

Income Statement Template 40 Templates To Track Your Company Revenues And Expenses Sumo Weekly Cash Flow Audited Profit Loss Sample

Profit And Loss Statement Templates 24 Free Docs Xlsx Pdf Formats Samples Example Template Business Budget Sba Form 413 Personal Financial Changes In Net Assets

Grant Financial Report Template New Monthly Statement Qualified Audit Opinion Opening Balances Example Net Cashflow From Operating Activities

The Balance Sheet Complete Guide To Corporate Finance Investopedia Good Essay Effective Resume Income Statement Contribution Margin Of Net Assets In Liquidation

Cash Flow Statement Templates 14 Free Word Excel Pdf Template Accounting Equation Income Gross Profit In Financial