Step 2 Transferring partners salary to Profit Loss Appropriation Ac. For a five-day workweek 900 5 days daily salaries are 180.

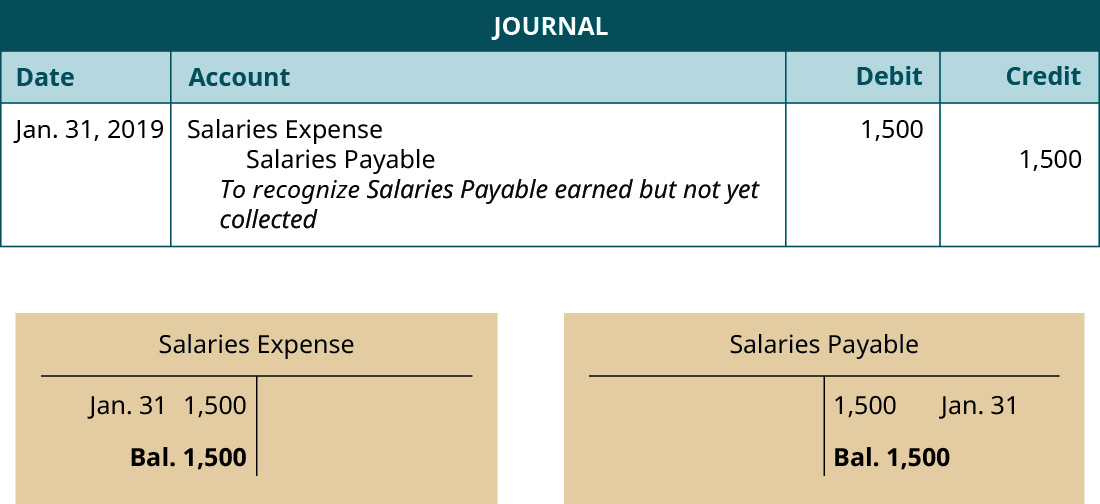

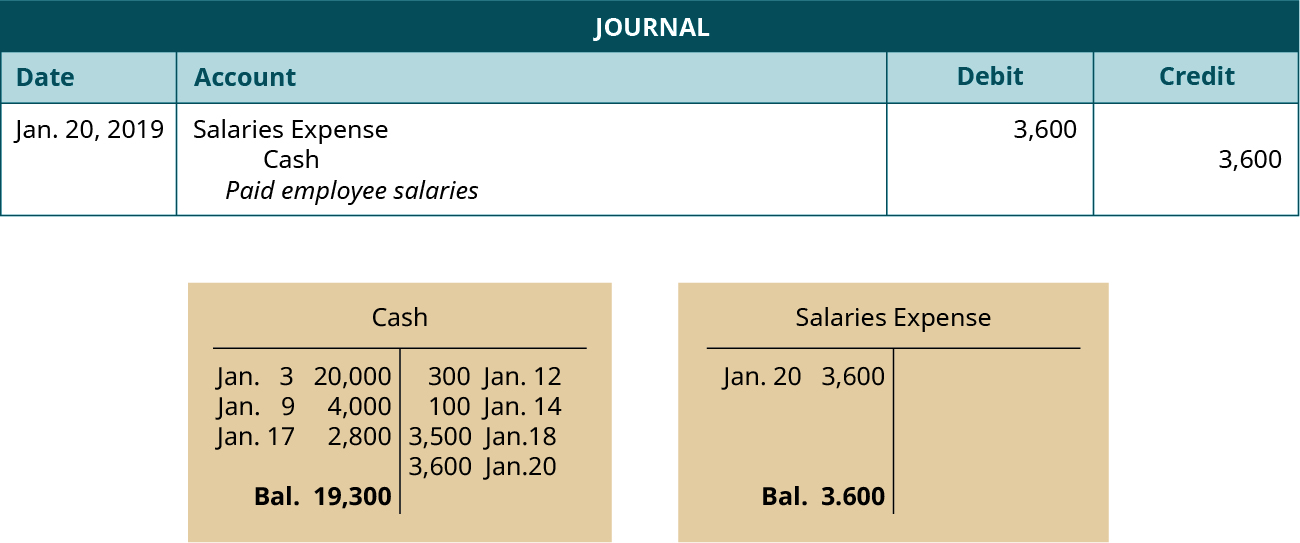

Creating an adjustment will allow us to comply with the matching principle by matching expenses with revenues earned for the period month. Salaries payable is a balance-sheet short-term liabilities account. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. The next two-week pay period ends on January 11 2022 and employees are paid 5320.

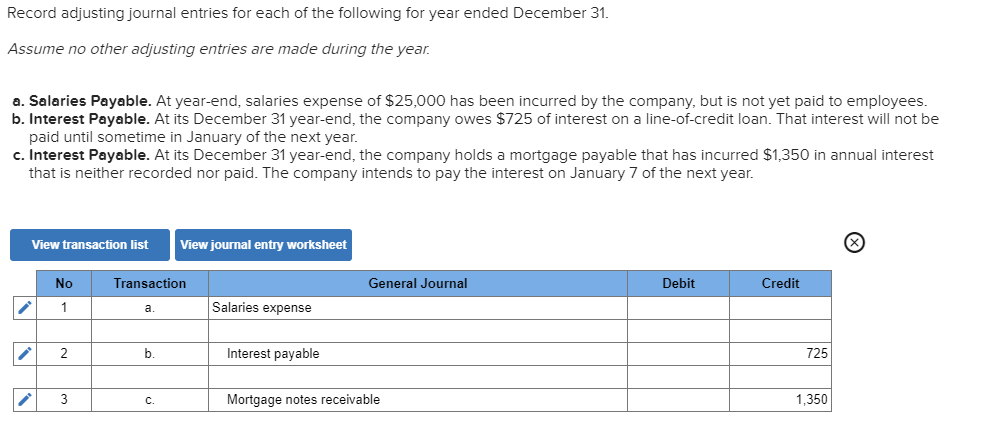

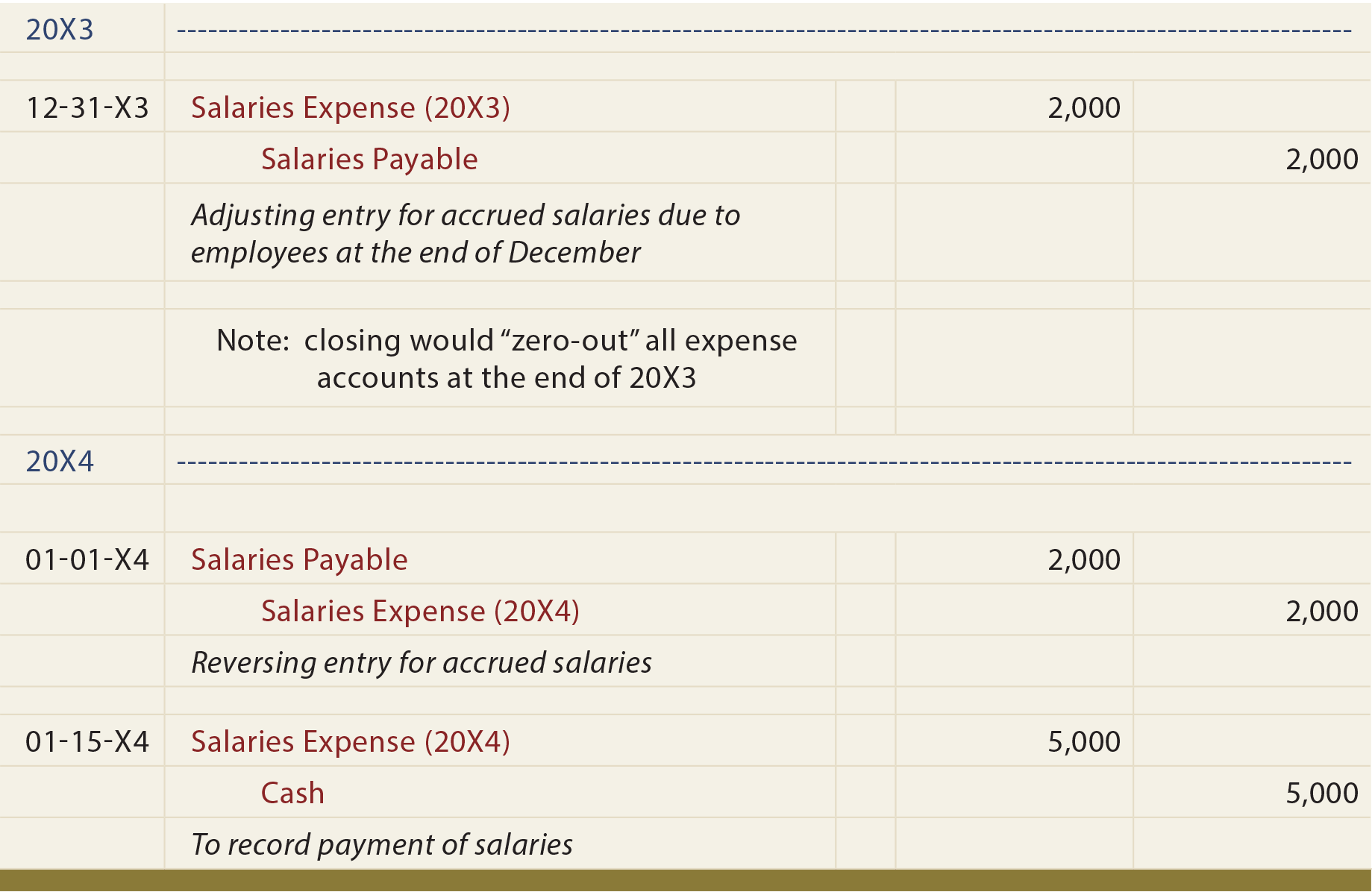

Adjusting entry for salaries payable.

Solved Record Adjusting Journal Entries For Each Of The Chegg Com Financial Statements Coca Cola 2019 Caseware Financials

Brief Exercise 3-11 Record the adjusting entry for salaries payable LO3-3 Fighting Irish Incorporated pays its employees 5320 every two weeks 380day. The total salary payable for the month of. Salaries expense is an income-statement account that reduces the net income for the period. Adjusting entries are made at the end of a period to update accounts.

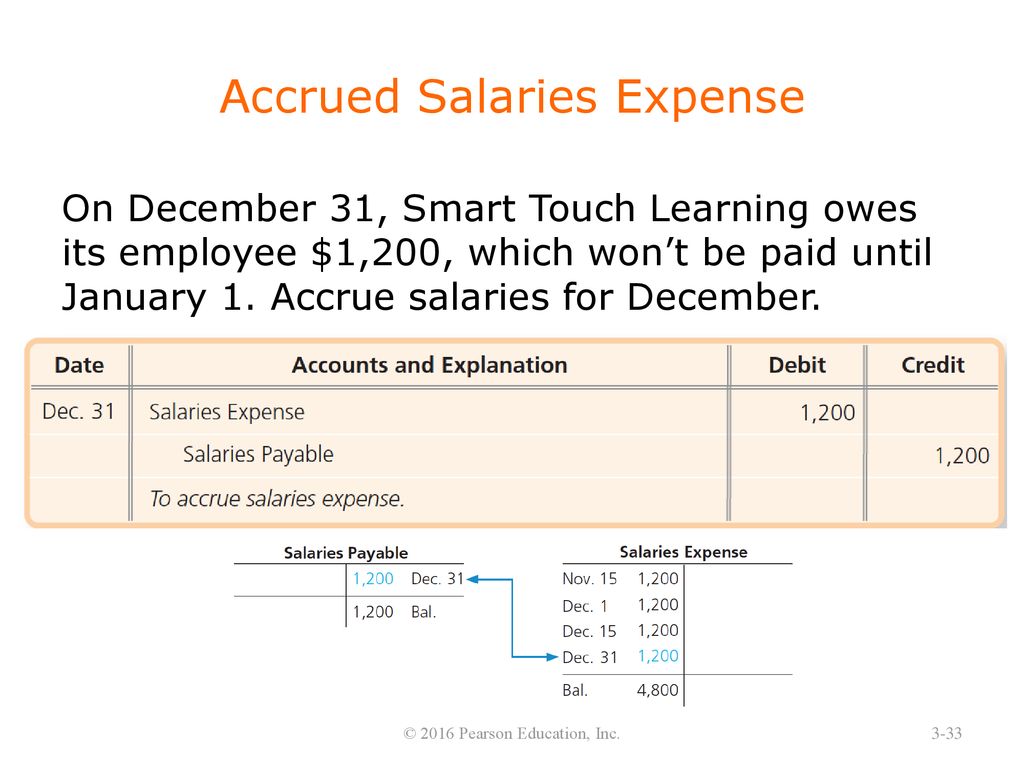

What is the adjusting entry for accrued salaries. The Moon company pays salary to its employees on fifth day of every month. For the above transaction we would have to record a Journal Entry on Dec 31st for the Salaries that have accrued from Dec 2620X7 to Dec 31st 20X7.

Credit Unearned revenues for 500. If the monthly accounting period ends on Tuesday and the employees worked on both Monday and Tuesday the month-end adjusting entry to record the salaries earned but unpaid isADebit Unpaid Salaries 600 and credit Salaries Payable 600. Debit to Salaries Payable for 500.

Lecture 05 Adjusting Entries Financial Statement Closing Generic Profit And Loss Kpmg Ifrs Illustrative Statements 2019

Debitsalaries expense and creditsalaries payable to record the accrued salaries. Partners Capital Ac to be credited if capitals are fluctuating. The clients will pay in January. December 28 and 29 are weekend days and employees do not work those days.

Step 1 Journal entry for salary due. Credit to Salaries Expense for 2000 b Credit to Salaries Payable for 500. During December the company performed services for clients and sent invoices of 6500.

Debit Salaries expense for 500. Determine the accounts requiring adjustment using the unadjusted trial balance4. 2 Accrued Expenses Wages paid to an employee is a common accrued expense.

What Is Wages Payable Definition Meaning Example P And L Finance Analysis Of Financial Data

The adjusting entry to record accrued salaries earned includes a debit to accrued salaries payable. Which of the following is the proper adjusting entry. Prepare an adjusted trial balance to check the equality of the debits and credits3. Credit to Salaries.

The company can make accrued salaries journal entry by debiting salaries expense account and crediting salaries payable account at the period-end adjusting entry. The basic rules of accounting denote the requirement of recording all revenues and expenses within the period when. FALSE Failure to adjust for an unrecorded expense such as wages expense will overstate net income and stockholders equity for the period.

Demonstrate the required adjusting journal entry by selecting from the choices below. To make an adjusting entry for wages paid to an employee at the end of an accounting period an adjusting journal entry will debit wages expense and credit wages payable. CDebit Salaries Expense 600 and credit.

Record And Post The Common Types Of Adjusting Entries Principles Accounting Volume 1 Financial Chapter 4 For Merchandising Operations Formulas Ratios

The following are the steps to record the journal entry for salary to partners. This first adjustment example will include salaries expense and a payable being accrued. Make the adjusting journal entries. An adjusting entry is made at the end of the year to record the expense and liabilities of the business in terms of the interest it owes and has accumulated during the year allow to ensure that the financial statements of the company are not understated in terms of expenses incurred and liabilities owed by the business.

The current two-week pay period ends on December 28 2021 and employees are paid 5320. Record the adjusting entries in the journal2. It is known as accruing the unpaid expenses.

The above journal entry of accrued salaries is to recognize the cost that has already incurred with the services that employees have performed for the company during the period. If salaries are 900 per week. B Service revenue would be credited for 300.

Chapter 3 The Adjusting Process Ppt Download Financial Stability Ratio Formula Apple Income Statement 2020

We need to do an adjusting entry to record the salary earned by employees from December 28 December 31 of this year. Credit Salaries expense for 500. The number of days the salary has accrued are 26 27 28 29 30 and 31 6 days Each Day 2000 of Salary accrues therefore 2000 x 6 days 12000. Check all that apply a Service revenue would be credited for 700.

An adjusting entry affects an income statement and balance sheet account. TRUE Failure to adjust for an unrecorded expense such as interest expense will understate liabilities. How to Adjust Entries for Accrued Salaries Now that youve worked out all of the dollar amounts involved youre finally ready to dive back into the books and make the needed adjustments.

We need to account for 2 days December 30 and 31. Such expenses are recorded by making an adjusting entry at the end of accounting period. Partners Current Ac to be credited if capitals are fixed in nature.

Use Journal Entries To Record Transactions And Post T Accounts Principles Of Accounting Volume 1 Financial Statement Changes In Equity Questions Answers Net Income Profit

Salaries payable balance is 350. First go back to the Wages Payable account on the credit side of your balance sheet or whatever that account is called in your books. BDebit Salaries Expense 400 and credit Salaries Payable 400. By the end of the accounting period employees have earned salaries of 500 but they will not be paid until the following pay period.

It is a result of accrual accounting Accrual Accounting In financial accounting accruals refer to the recording of revenues that a company has earned but has yet to receive payment for and the and follows the matching and. Consider the adjustment process at the end of the accounting period. Debit Salaries payable for 500.

You make the adjusting entry by debiting accounts receivable and crediting service revenue.

Payroll Journal Entries For Wages Accountingcoach 3 Statement Model Case Study Gain On Sale Income

Reversing Entries Principlesofaccounting Com Ulta Balance Sheet Cash Inflow And Outflow Statement

Adjusting Entries For Liability Accounts Accountingcoach Bs Balance Sheet Items In Order