Customer Knowledge Certificate and Control of Anti-Money Laundering. Income statement is the only one that provides an overview of company sales and net income.

PDF 5 MB. Fri Feb 25 2022 124551 PM EST Accepted by the SEC. Friday December 31 2021 Industry. ADR Annual stock financials by MarketWatch.

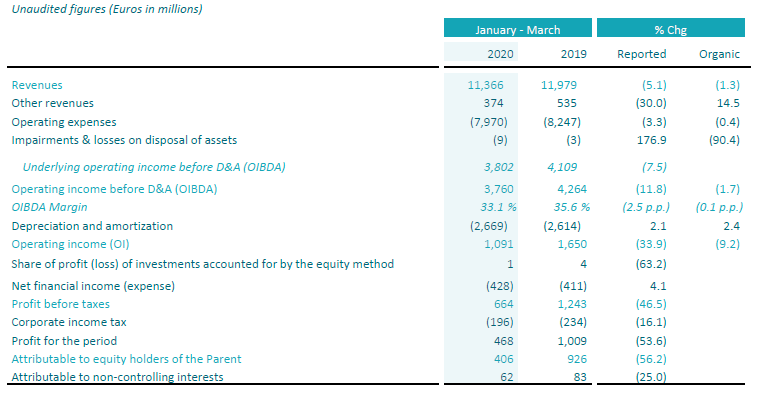

Telefonica financial statements.

2 Journal Entry For Profit And Loss Account Aged Trial Balance Report Example

Shareholders and investors Contact us to send your request. The net income of Q3 21 is 70488M USD. Income Statement Balance Sheet Cash Flow. View the latest TEF financial statements income statements and financial ratios.

The members of the Management Board have signed these financial statements pursuant to their statutory obligations under art. This makes Telefónica SA. Registration Document CNMV Filing Filings with Foreign Regulators.

20-F Annual Report Accession Number. Sustainable Investment ESG. Historical trend examination of various income statement and balance sheet accounts found on Telefonica.

Tefanac20 Types Of Qualified Audit Opinion Accrued Interest Payable Balance Sheet

The telephone conference was broadcasted live via webcast. TELEFONICASA financial statements including revenue expenses profit and loss The total revenue of TEF for the last quarter is 967B EUR and its 404 higher compared to the previous quarter. TTM Gross profit Total revenue Cost of goods sold. Ten years of annual and quarterly financial statements and annual report data for Telefonica SA TEF.

ZIP 88 MB. Report of the Supervisory Board Declarations Reports and Articles Remuneration Systems Managers transactions. Technicals TEF financial statements Financial summary of Telefonica SA with all the key numbers The current TEF market cap is 28197B USD.

Stock Quote Social Media Bookmark the Permalink. The euro is the Groups reporting currency. Fri Feb 25 2022 Period.

Telefonica S Cost Of Sales Income Statement Charity Auditors

Ten years of annual and quarterly financial statements and annual report data for Telefonica Brasil SA VIV. Bonds Credit Ratings Funding Profile O 2 Telefónica Deutschland Finanzierungs GmbH. 0000814052-22-000023 Submitted to the SEC. Historical trend examination of various income statement and balance sheet accounts found on TELEFONICA.

View TEF financial statements in full. Consolidated financial statements with viewer of the ESEF format. Average payment period to suppliers.

Non-Financial Report Statement 50 Streamlined carbon and energy report 56 Directors report 60 Corporate governance statement in respect of the financial statements 64 Statement of Directors responsibilities 70 Independent auditors report to the members of Telefonica UK Limited 72 Statement of comprehensive income 76. ADR balance sheet income statement cash flow earnings estimates ratio and margins. TEF financial statements Telefonica SA financial statements including revenue expenses profit and loss The total revenue of TEF for the last quarter is 1096B USD and its 878 lower compared to the previous quarter.

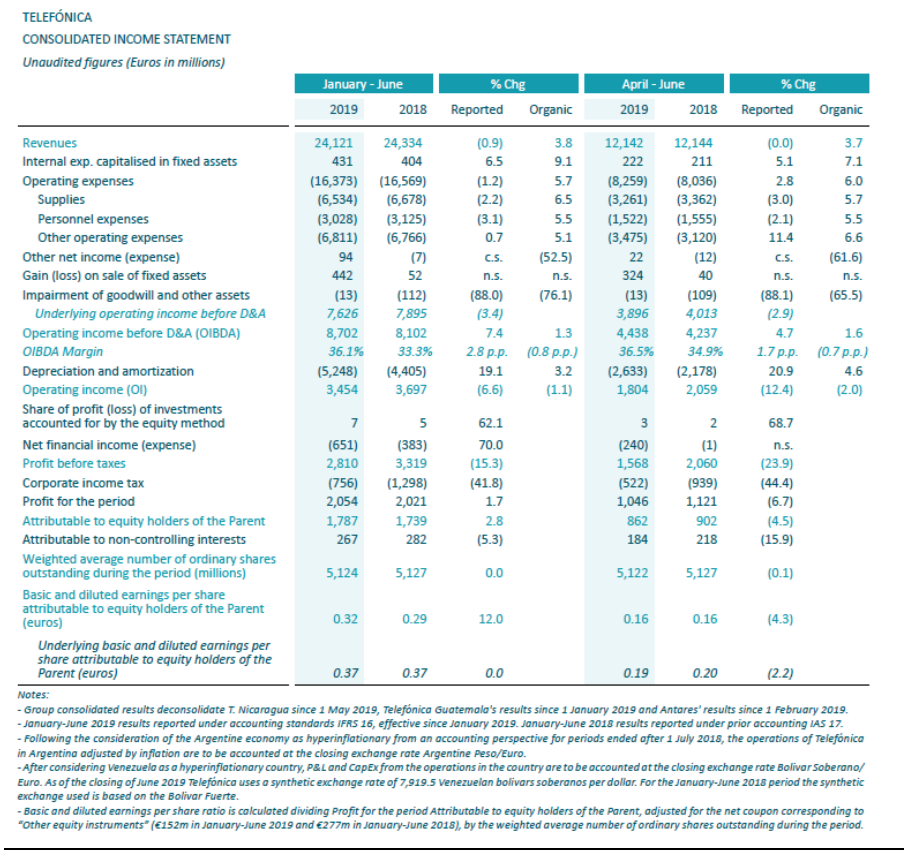

Telefonica Earned 1 787 Million Euros In The First Half Of Year 2 8 With All Regions Showing Organic Revenue Growth Interest Payable Income Statement Consolidated Account Meaning

2 Telefonica UK Limited Year ended 31 December 2020 Telefonica UK Limited Year ended 31 December 2020 3 Contents Page Company information 3 Strategic report 4 Non-Financial Report Statement 50 Streamlined carbon and energy report 56 Directors report 60 Corporate governance statement 64 Statement of Directors responsibilities 70. On 23rd February 2022 Telefónica Deutschland released its Preliminary Annual Results for its financial year 2021 before markets opened. Telefónicas security holders including holders of Telefónicas American Depositary Receipts may receive a hard copy of this document which contains Telefónicas complete audited financial statements free of charge upon request. The equity financial position results of operations and cash flow obtained and used and recognized income and expense in 2008.

The figures in these consolidated financial statements are expressed in millions of euros unless indicated otherwise and therefore may be rounded. TELEFONICA financial statements provide useful quarterly and yearly information to potential TELEFONICA S A investors about the companys current and past financial position as well as its overall management performance and changes in financial position over time. Telephone Communications No Radiotelephone External Resources.

To the best of their knowledge the financial statements give a true and fair value of the assets liabilities financial position and profit or loss of the company. The reasoning behind the adjustment however is that free cash flow is meant to measure money being spent right now not transactions that happened in the past. 525c2c Financial Markets Supervision Act.

2 Pcaob Inspection Reports Google Company Balance Sheet

TEF including the income. FCF a useful instrument for identifying growing companies with high up-front. Information sent to the CNMV in European Single Electronic Format ESEF. The management team of the company presented the highlights of the results at 1000 am.

Telefonica financial statements provide useful quarterly and yearly information to potential Telefonica SA ADR investors about the companys current and past financial position as well as its overall management performance and changes in financial position over time. Detailed information about Telefónicas financial statements analyst recommendations dividends and dividend history. The companys EPS TTM is 172 USD dividend yield is 335 and PE is 286.

The management of the company is focused on creating value for our shareholders and investors and providing all the relevant information for their investment decisions. 32 rows Detailed financial statements for Telefonica SA. Income statements balance sheets cash flow statements and key ratios.

Filing Annual Accounts 2018 Combined Document Current Liabilities List In Balance Sheet Does Closing Stock Come Trial

The net income of Q4 21 is -127B EUR. Next Telefonica SA earnings date is May 12 the estimation is 013 USD. Income statements balance sheets cash flow statements and key ratios. Capital Increase 2014 Merger with E-Plus 2014 IPO 2012.

Shareholders Investors Telefonica Spreadsheet For Business Expenses And Income Gross Profit In Financial Statement

Telefonica Com Cost Sheet Statement Financial Position In Accounting

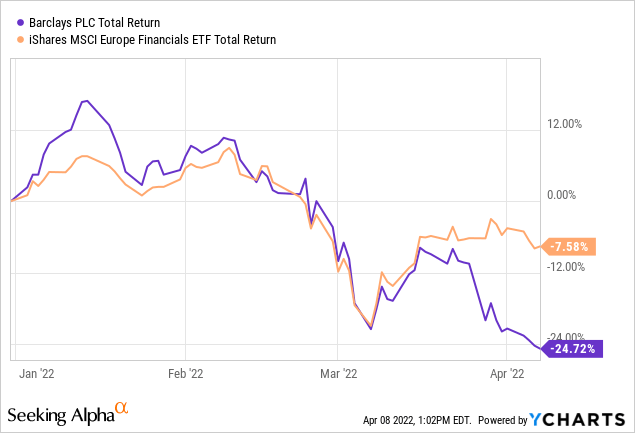

Telefonica How Safe Is The 9 Dividend Yield Nyse Tef Seeking Alpha International Accounting Principles And Standards Financial Statements Format Excel