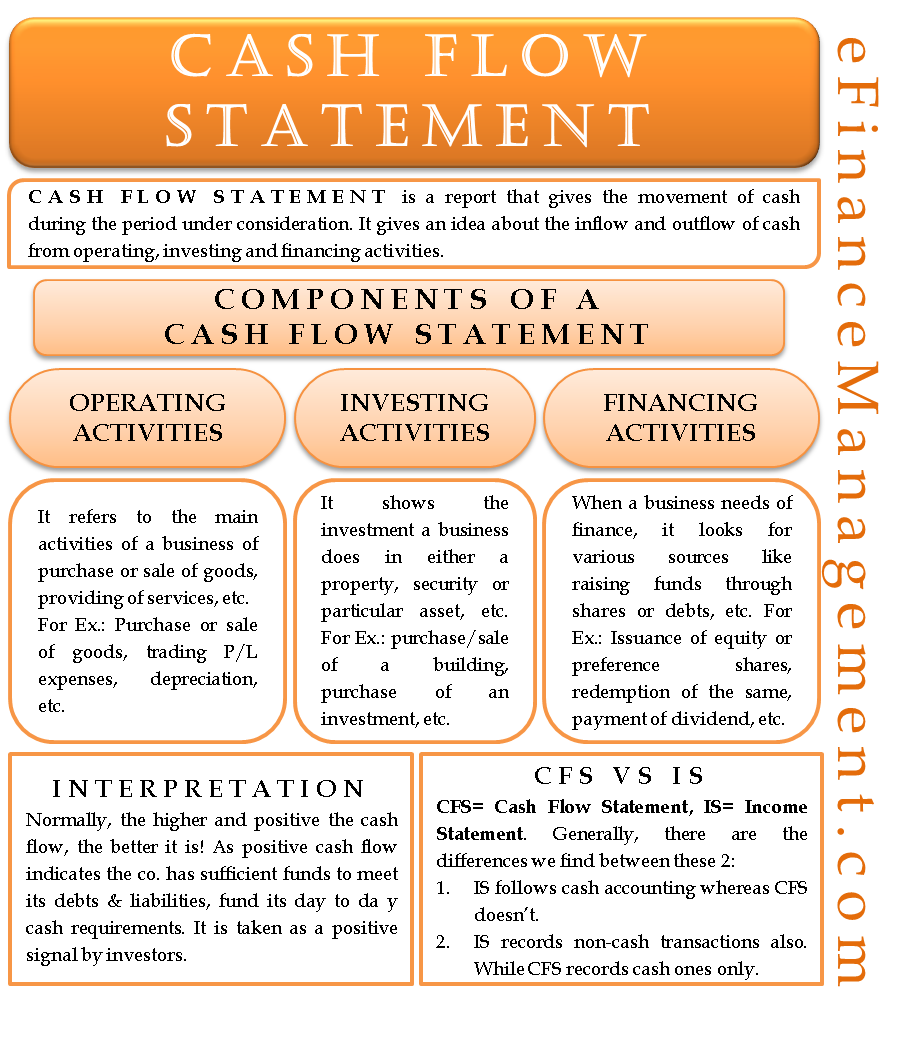

Types of Cash Flows. Statement of Shareholders Equity.

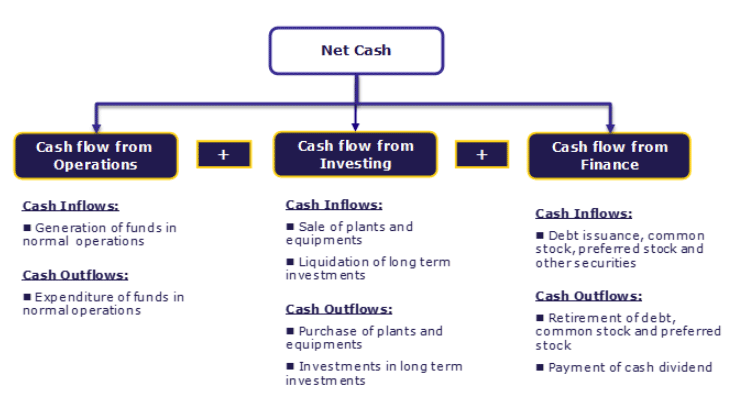

The cash flow generated from operating activities is termed as operating cash flow. Cash flow from investing activities. The direct method and the indirect method. Indirect cash flow statements are much more common.

Two types of cash flow statements.

The Statement Of Cash Flows Boundless Accounting Pfs Excel Template Financial Analysis And Reporting Pdf

The cash flow report is important because it informs the reader of the business cash position. A percentage value is calculated by computing a fraction of FCF and net operating cash-flow and multiplying it by 100. It is money generated by a companys primary business operation. There are two methods of calculating cash flow.

Essentially the direct method subtracts the money you spend from the money you receive. Therefore money is not equal to net income whereas on the income. The following points highlight the top two methods of presentation of cash flow statement.

Is the firm generating enough cash to purchase the additional assets required for growth. There are two different types of cash flow statements that a business may produce. An indirect cash flow statement and a direct cash flow statement.

Cash Flow Statement Classification Format Advantages Disadvantages More Cvp Income Example Simple And Expense Sheet

Direct and indirect are the two different methods used for the preparation of the cash flow statement of the companies with the main difference relates to the cash flows from the operating activities where in case of direct cash flow method changes in the cash receipts and the cash payments are reported in cash flows from the operating activities. A cash flow statement is simply a statement of cash generation and its use categorized under different activities. The direct method shows each major class of gross cash receipts and gross cash payments. The investing and financing sections are identical in form and flows to what would be seen in the direct cash flow.

Identify and briefly explain the three categories of activities in the statement of cash. The truth is that there is kind of a fourth category. The three types of cash flows are operating cash flows cash flows from investments and cash flows from financing.

Operating cash flows are generated from the normal operations of a business. The main difference between the two is how they calculate cash from operating activities. The direct method and the indirect method.

Cash Flow Statement Meaning 3 Components Examples Ratio Analysis Excel Sheet Jmmb Financial Statements

Operating activities include a companys. Is the firm generating any extra cash it can use to repay debt or to invest in new products. There are two ways to prepare a cash flow statement. The direct cash flow statement is basically a cash T – account split into the three components.

Operating activities are the principal revenue-producing activities of the entity. The indirect cash flow statement also has three parts. Not applying the fourth category of cash-flows.

The operating cash flows section of the cash flow statement under the. A projected cash flow statement predicts future cash inflows and outflows based on current information. Cash flow statement format.

Types Of Cash Flow Operating Investing Financing Free Prepare An Adjusted Trial Balance Whats On Income Statement In Accounting

The direct method and the indirect method. A positive percentage is better in this case as well. Read this article to learn about the following two methods for preparation of cash flow statement ie 1 Direct Method and 2 Indirect Method. Only the organisations cash balance is shown under the cash flow statement which can be obtained by two methods ie.

Wait I thought you said there were only three categories. Purpose of Cash Flow Statements The following are the purposes of Cash Flow statements. Direct method and Indirect method and which is prepared using the cash method of accounting.

For a business to be successful it must have sufficient cash at all times. The operating cash flows section of the cash flow statement under the direct method would appear as. Operating Activities Investing Activities and Financing Activities.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples Ifrs Simplified 3 Activities In

This category is often missed and improperly included in the statement of cash flows as if cash changed hands. Cash Flow from Operations typically. They start the operating activities section with your companys net income or the money you have after deducting expenses. Comprehensive Free Cash Flow Coverage.

While becoming familiar with the statement of cash flow and statement of owners equity is also valuable the balance sheet and income. Cash flow from operating activities. Both types of cash flow statements can be used for planning and decisionmaking.

There are two different types of cash flow statements. It needs cash to pay its expenses to pay bank loans to pay taxes and to purchase new assets. Elements of the Cash Flow Statement.

Types Of Cash Flows Flow Statement Investing What Is A Common Size Income Liquidation Expenses In

Indirect cash flow statement The indirect method starts with Net Income from the Profit and Loss statement and then makes additions and subtractions from that number to arrive at cash flow. A historical cash flow statement is a record of cash inflows and outflows that occurred in the past. Two Types of Financial Statements. Operating Cash Flow Net Income Non-Cash Expenses Changes in Working Capital Keep in mind that working capital is the money it takes to operate the business and can be calculated by subtracting current liabilities from current assets on your companys balance sheet.

A good example is dealer-provided financing. A higher OCF signifies a good liquidity position of the company. SELF-TEST – Cash Flow Statements What types of questions does the statement of cash flows answer.

For investors considering whether to purchase stock in a company two essential types of financial statements to analyze are the balance sheet and the income statement. Statement of Cash Flows. There are two types of cash flow statements – the direct cash flow statement and the indirect cash flow statement.

Statement Of Cash Flows Definition Format Examples Balance Sheet Quickbooks Self Employed Working Capital

Cash flow from financing activities. Direct method Operating cash flows are presented as a list of ingoing and outgoing cash flows. Direct Cash Flow Method The direct method adds up all of the cash payments and receipts including cash. It is a statement showing the capital investment by stockholders and the retained earnings of the company.

While generally accepted accounting principles US GAAP approve both the indirect method is typically preferred by small businesses. Statements of cash flow using the direct and indirect methods In order to figure out your companys cash flow you can take one of two routes. Operating Cash Flow OCF.

A cash flow report determines whether a business has enough cash to do exactly this. The direct method shows each major class of gross cash receipts and gross cash payments. The cash flow statement is different from the balance sheet and income statement because it does not include the future transaction of cash listed on credit.

Cash Flow Statement How A Of Flows Works Preparation Pdf Sample Balance Sheet And Income

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples Trial Balance Format Ppt Sheet Xlsx