The contribution margin shows how much money is left to cover the fixed costs. Fixed selling expenses are 10000 and variable selling and administrative expenses are 3 per unit.

Variable costing is an income statement used internally by management to evaluate and measure costs and can sometimes be generated using a variable costing income statement Excel template. The contribution margin ratio is 40 The contribution margin per unit is 500 The fixed costs are 300000. They fluctuate depending on volume or to the number of units made. Total fixed cost stays the same.

Variable cost income statement.

Pro Forma Income Statement Example Best Of Chapter 10 Making Capital Investment Decisions Ppt Monthly Budget Template Off Balance Sheet Treatment Patanjali Audit Report

As a result these amounts must also be subtracted to arrive at the true contribution margin. Search gif iphone whatsapp. Variable Costing Income Statement Variable costing income statement has the following line items. The first step in creating your contribution margin income statement is to calculate the contribution margin.

Operating data for the month are summarized as follows. Costs that do not change in relation to production volume. Total variable costs decrease.

The total variable cost of boxes will be- Total Variable Cost Quantity of Output Variable Cost Per Unit of Output Put the values in the above formula. If management incentives are tied to income under absorption costing which of the following may occur. Costs that varychange depending on the companys production volume.

Variable Costing Income Statement Variables Lesson P And G Financial Statements How To Find Total Equity On A Balance Sheet

In other words they are costs that vary depending on the volume of activity. Semi-variable costs cost you a minimum amount each. Before we look at the income statement let us have a look at what absorption costing is. These costs are subtracted from sales to produce the variable manufacturing margin.

Examples of variable costs include direct labor and materials. Contribution margin is the amount contributed by sales towards fixed costs and profit. The costs increase as the volume of activities increases and decrease as the volume of activities decreases.

Cost of goods sold is 6 per unit. When looking at the income statement variable costs are expenses that change with the level of production. Various methods of controlling costs such as standard costing system and flexible budgets have close relation with the variable costing system.

Income Statement P L Template Free Report Templates Sample And Expense Credit Sales On

The variable costs will include relevant variable administrative costs and any variable cost related to production. So you get to keep more of your revenue as income. Variable costing Variable costing income statement is one where all variable expenses are subtracted from revenue which results to contribution margin. Total fixed cost stays the same.

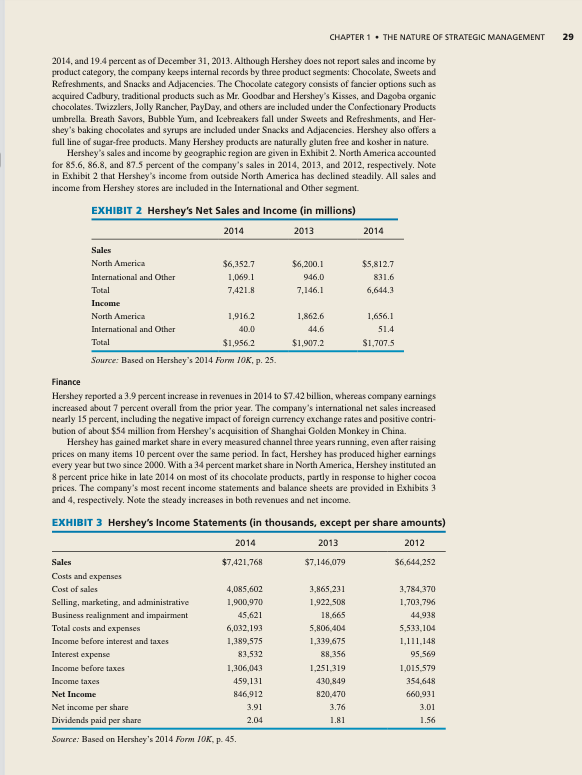

This is the costing method used for the traditional income statement. 29Variable costs are 60 of the unit selling price. A variable costing income statement is one in which all variable expenses are deducted from revenue to arrive at a separately-stated contribution margin from which all fixed expenses are then subtracted to arrive at the net profit or loss for the period.

A variable costing income statement is one in which all variable expenses are deducted from revenue to arrive at a separately-stated contribution margin from which all fixed expenses are then subtracted to arrive at the net profit or loss for the period. In this example we know that variable costs are 6 per unit. Variable costing provides a better understanding of the effect of fixed costs on the net profits because total fixed cost for the period is shown on the income statement.

Multistep Income Statement Png 583 560 Accounting And Finance Common Size Analysis Pdf Financial Is

April 21 2022. The Most Common Variable Costs Direct materials. To do this youll need your sales revenue and variable cost information. Diablo 2 resurrected exploits ps4.

Here we are going to discuss the income statement under absorption costing and see how the net profit differs. Sales 9000 x 8 per unit 72000. The contribution margin also shows us the philosophy of the marginal costing system.

Compute Naples net income under absorption costing. Total Variable Cost 1000 20 Total Variable Cost 20000. Some of Nepals SGA costs also vary with sales.

Income Statement Template Sample Cisco The Following Is Balance Sheet Of Korver Supply Company

Variable costing includes all of the variable direct costs in COGS but excludes direct fixed overhead costs. From this all fixed expense are then subtracted to arrive at the net profit or loss for the period. Income Statement variable For Month Ended May. CThe CVp income statement shows contribution margin instead of gross profit dIn a traditional income statementcosts and expenses are classified as either variable or fixed.

Cost of goods sold 9000 x 330 per unit 29700 Selling expenses 9000 x 020 per unit 1800 Total variable costs 31500. Income Statement under Marginal Costing It is seen that variable costs are deducted first from the sales revenue to arrive at the contribution margin. The variable product costs include all variable manufacturing costs direct materials direct labor and variable manufacturing overhead.

The formula for your contribution margin is. Thus the arrangement of expenses in the income statement corresponds to the nature of the expenses. Absorption vs variable costing income statementharper creek wrestling.

Inventory Capacity Analysis Cost Accounting Cash Register Balance Sheet Accounts Receivable Trial

Then all fixed expenses are subtracted to arrive at the net profit or net loss for the period. Variable costs are expenses that vary in proportion to the volume of goods or services that a business produces. Total variable costs increase. It is useful to create an income statement in the variable costing format when you want to determine that.

We simply need to find out the fixed costs which can be done by dividing the. Fixed overhead fixed portion only 6000. In order to calculate gross margingross profit on sales in the income statement all production expenses both fixed and variable are deducted from the sales revenue.

When its time to cut costs variable expenses are the first place you turn. Before looking at absorption versus variable costing it. Income Statement Under Absorption Costing.

Flexible Budget Performance Report Template 4 Templates Example Budgeting Professional Personal Balance Sheet Word Basic Financial

Administrative selling and manufacturing costs are all separated into three categories by absorption costing. Absorption Costing vs Variable Costing. Variable Cost Fixed Cost. Variable production costs include direct materials direct labor and variable manufacturing overheads.

Fixed costs on the other hand are expenses that do not change with volume or number of units produced. The lower your total variable cost the less it costs you to provide your product or service. Variable Costing Formula Example 1 A company produces 1000 boxes at an average cost of production of one unit is 20.

A contribution margin income statement is an income statement in which all variable expenses are deducted from sales to arrive at a contribution margin.

How To Calculate Product Costs For A Manufacturer Cost Of Goods Sold Operations Management Marketing Accrued Liabilities Cash Flow Personnel Expenses Income Statement

Genevieve Wood I Picked This Diagram Because Of The Side By View Contribution Margin And T Income Statement Cost Goods Sold P L Accounting Contoh Cash Flow