Price to Cash Flow Ratio 1930. This implies that Tootsie has 234 in current assets to pay for each of current liability while Hershey has only 092 in current assets and has a negative working capital since the current liabilities are higher.

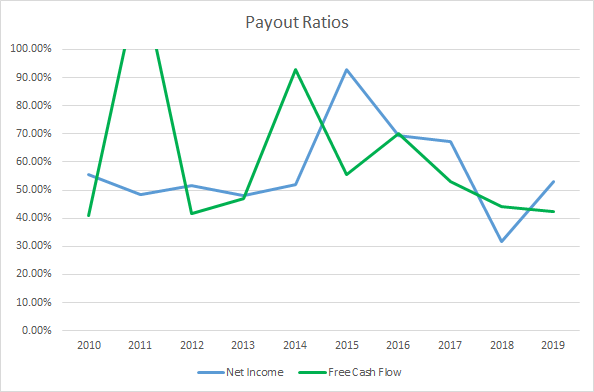

Each year The Hershey Company releases an annual report to stockholders outlining our leadership company strategy business highlights and more. The Hershey Company key financial stats and ratios HSY price-to-sales ratio is 488. Each ratio value is given a score ranging from -2 and 2 depending on its position relative to the quartiles -2 below the first quartile. 87 indicates management is effectively managing the profits earned based on the owners investment in the company.

Hershey financial ratios.

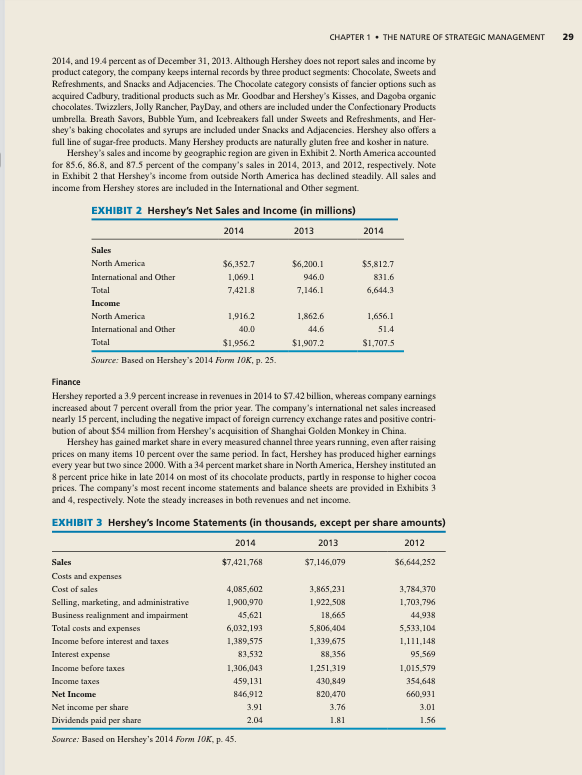

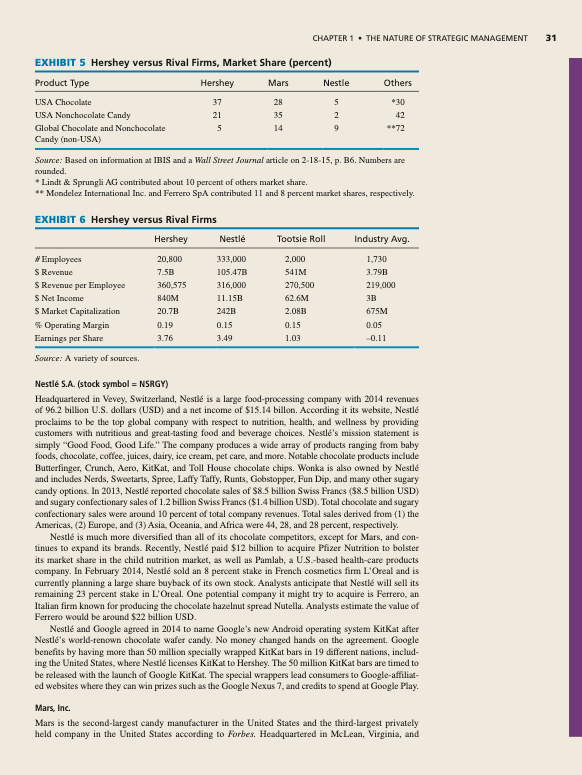

Chapter 1 The Nature Of Strategic Management 29 Chegg Com What Goes On A Balance Sheet Accounting Is Purpose Trial In

Subject to the time range of our analysis HERSHEY CO attained the highest current ratio of 1. Current Key stats Total common shares outstanding Float shares outstanding Number of employees Number of shareholders. PE Ratio w extraordinary items 2627. The EVEBITDA NTM ratio of The Hershey Company is significantly higher than the median of its peer group.

According to these financial ratios The Hershey Companys valuation is way above the market valuation of its peer group. Enterprise Value to EBITDA 2239. Prepare a four-column worksheet.

Financials are provided by Nasdaq. Hershey Co 21103 289 139 General Chart News Analysis Financials Technical Forum Financial Summary Income Statement Balance Sheet. Current and historical current ratio for Hershey HSY from 2006 to 2021.

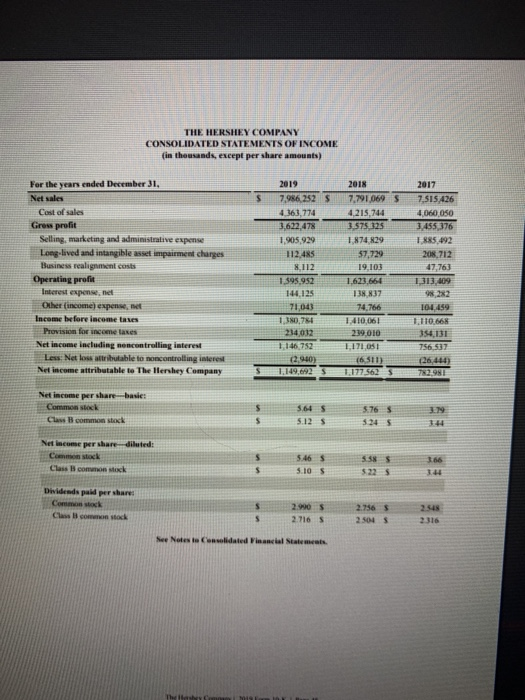

Solved The Hershey Company Analysis Using Financial Chegg Com Debit Credit Balance Sheet Excel Formula Projected Statement Template

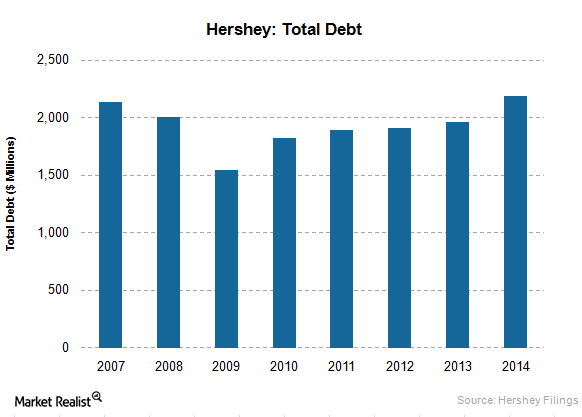

Coverage ratios assess a companys ability to meet its long-term obligations remain solvent and avoid bankruptcy. The Hershey Co has a current ratio of 090. Short Ratio Mar 14 2022 4. LT Debt to Equity MRQ.

The Hershey Company Common Stock HSY. Hershey Foods Key Financial Ratios Generally speaking Hershey Foods financial ratios. Ten years of annual and quarterly financial ratios and margins for analysis of Hershey HSY.

If The Hershey Co has good long-term prospects it may be able to borrow against those prospects to meet current obligations. The company also is a leader in the gum and mint category. The current ratio is 234 as compared to 092 for Hershey.

Chapter 1 The Nature Of Strategic Management 29 Chegg Com Small Business Spreadsheet For Income And Expenses Free Acra Xbrl Filing

0 the ratio value deviates from the median by no more than 5 of the difference between the median and the. PE Ratio including extraordinary items 3113. Price to Book Ratio 1446. Short of Float Mar 14 2022 4.

54 rows Hershey Current Ratio Historical Data. The Hershey Companys reports and filings including annual reports quarterly results as well as SEC Section 16 Filings are available from the below links. Price to Sales Ratio 448.

PE Ratio TTM 3132. Hershey Company HSY financial information fundamentals key ratios market capitalization shares outstanding float and short interest. This report includes.

Solved Making Business Decisions Analyzing The Hershey Company S Chegg Com Example Of Financial Ratio Analysis Report How To Solve Net Income From Balance Sheet

EDGAROnline a division of Donnelley Financial Solutions. -1 between the first and the second quartile. PE. It measures how well a companys cash flow.

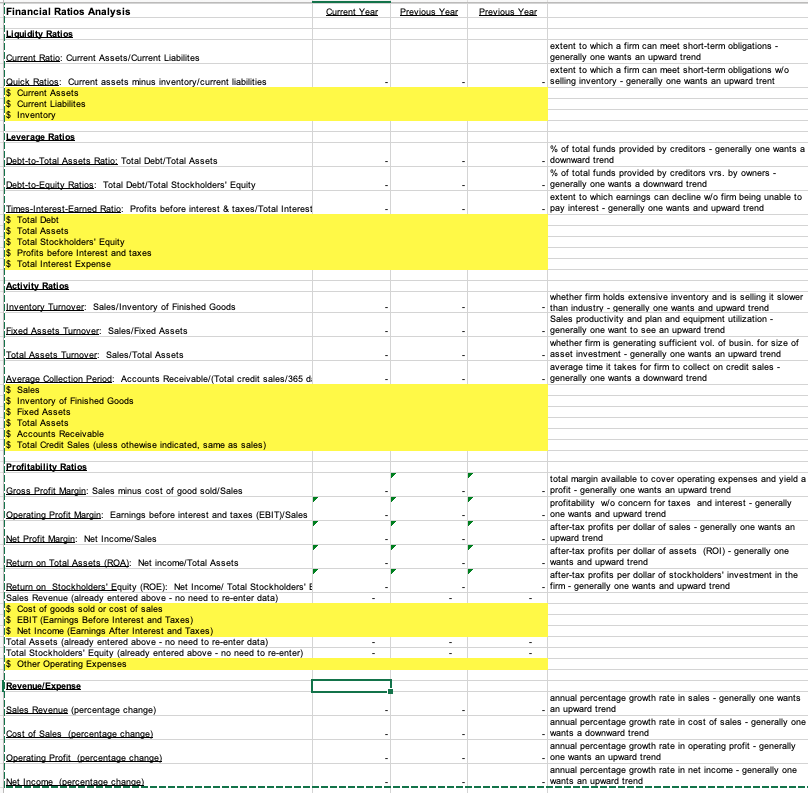

Current AssetsCurrent Liabilites extent to which a firm can meet. Total Debt to Equity MRQ. 26 rows 186.

Ratio between above two values Current Assets Current Liabilities 157. The EVEBITDA NTM ratio of The Hershey Company is significantly higher than the average of its sector Food Products. Current Assets of HERSHEY CO during the year 2020 298 Billion.

Evaluating Hershey S Financials Against Its Competitors Statement Of Retained Earnings Example For Whom Are Management Accounts Prepared

The company has an Enterprise Value to EBITDA ratio of 2122. It indicates that the company may have difficulty meeting its current obligations. The EVEBITDA NTM ratio of The Hershey Company is significantly higher than the median of its peer group. 2 above the third quartile.

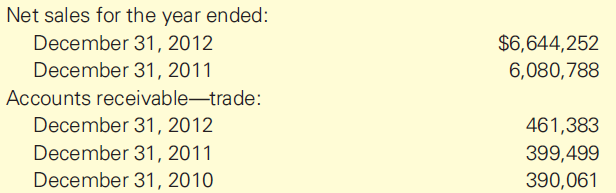

EDGAR is a federally registered. Using the financial statements for Tootsie Roll Industries and The Hershey Company respectively calculate and compare the financial ratios listed below for the year ended on December 31 2007. Here is a breakdown of the calculation.

You can evaluate financial statements to find patterns among Hershey main balance sheet or income statement drivers such as Direct Expenses of 38 B Consolidated Income of 13 B or Cost of Revenue of 5 B as well as many exotic indicators such as Interest Coverage of 1082 Long Term Debt to Equity of 165 or Calculated Tax Rate of 2648. Date Current Assets Current Liabilities Current. Total Stockholders Equity already entered above – no need to re-enter 151953000 161605200 – Other Operating Expenses 635501 166875 RevenueExpense 386–Cost of Sales percentage change 570–Operating Profit percentage change 372–Net Income percentage change 322–Current Ratio.

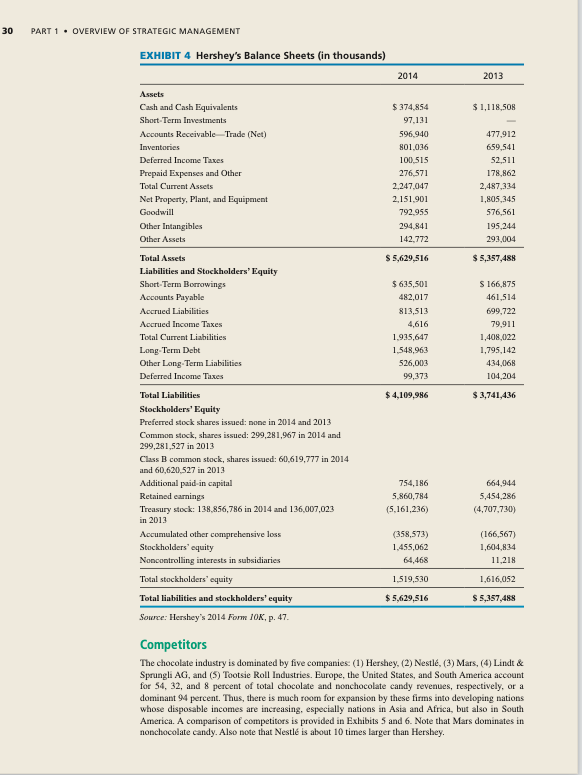

Solved Exhibit Contains Income Statements And Balance Sheets Chegg Com Reclassified Statement Trial Is A

Low values however do not indicate a critical problem. The percent rate of return on equity for Hershey Company is 99. According to these financial ratios The Hershey Companys valuation is way above the market valuation of its peer group. Shares Short prior month Feb 14 2022 4.

As of 2021 they employed 1899k people. Short of Shares Outstanding Mar 14 2022 4. The EVEBITDA NTM ratio of The Hershey Company is significantly higher than the average of its sector Food Products.

Current Liabilities of HSY during the year 2020 189 Billion. 1 between the second and the third quartile.

The Hershey Company An Indulgence For Investors And Consumers Nyse Hsy Seeking Alpha Ledger Statement In Profit & Loss Income Will Be

Chapter 1 The Nature Of Strategic Management 29 Chegg Com Analysis Quick Ratio Financial Audit Report

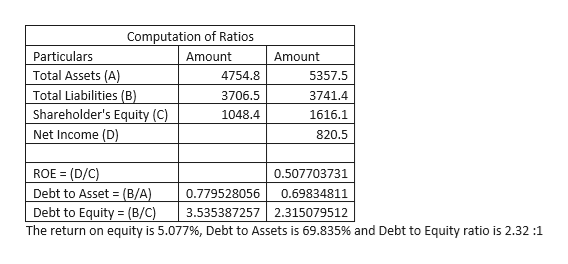

Answered Ratios Analysis Hershey The Bartleby P&l In Project Management Posco Financial Statements