Data for its single product for its first year of operations follow Direct materiale Direct labor Overhead costs 20 per unit 28 per unit 6 per unit 160000 per year Variable overhead Pixed overhead per year. Manufactured 26800 hats of which 25500 were sold.

Absorption Costing Absorption Costing Less cost of goods sold. Absorption costing statement assumes that fixed costs attach to products so all the production costs whether fixed or variable should become part of product cost. Variable cost income statement helps to measure the per unit variable cost which changes with the change in revenue. Fixed 100000 190000 Net operating income 230000 These are the 25000 units produced in the current period.

Absorption and variable costing income statements.

Pin On Acc 350 Income And Expenditure Account Of Charitable Trust In Excel Major Ratios Financial Analysis

Assuming the number of units sold and produced are the same which of the following statements is true when comparing net operating income using absorption and variable costing. Absorption costing includes all costs including fixed costs related to production while variable costing only includes the variable costs directly incurred in production. Up to 256 cash back Absorption and Variable Costing Income Statements for Two Months and Analysis During the first month of operations ended July 31 Head Gear Inc. Less cost of.

In absorption costing fixed manufacturing costs are assigned to units while in variable costing also called marginal costing fixed manufacturing costs are not assigned to units but are subtracted from sales in the period in which they are incurred. When production is more than sales as in this exercise the fixed manufacturing overhead is deferred in inventory that causes a higher net operating income under absorption costing than under variable costing. 13 Variable Costing Variable manufacturing costs only.

Calculated using absorption costing. In absorption costing technique no difference is made between fixed and variable cost in calculating profits. When production is not equal to sales income under absorption costing differs from income under variable costing due to the difference in treatment product cost and period cost of the fixed overhead cost under the two.

Variable Versus Absorption Costing Statement Of Changes In Fund Balance Prepaid Assets On Sheet

Income Statement Under Absorption Costing Administrative selling and manufacturing costs are all separated into three categories by absorption costing. Absorption and variable costing income statements P20-1B. Income Statement under Absorption Costing USD. Absorption uses standard GAAP income statement of Sales Cost of Goods Sold Gross Profit Operating Expenses Net Operating Income Variable uses a contribution margin income statement of Sales Variable Costs Contribution Margin.

Higher the variable cost lesser will be the contribution. Solution for Income Statements Variable and Absorption Costing The following information. Asked Aug 5 2017 in Business by Luana.

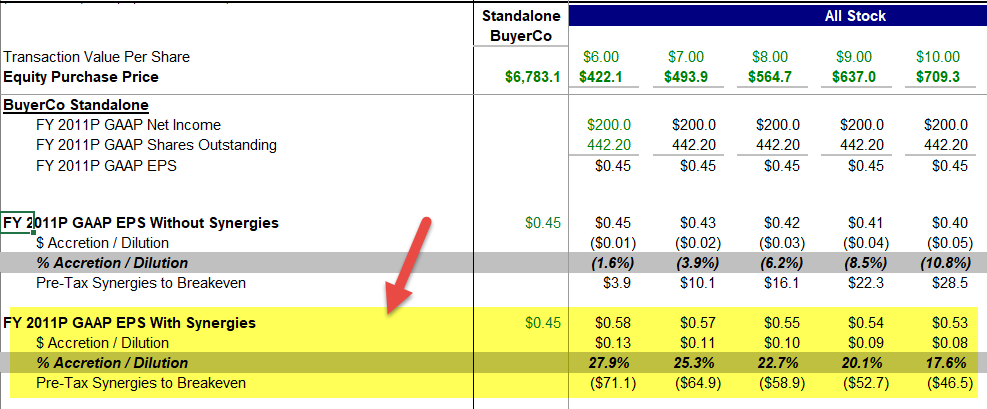

In the long-run total income reported under absorption costing will often be close to that reported under variable costing. The income from operations reported under absorption costing exceeds the income from operations reported under variable costing by the difference between the two due to fixed manufacturing costs that are deferred to a future month under absorption costing. A Absorption costing will yield a higher net operating income.

Standard Costing Fixed Overhead Variances Cost Accounting Budgeting Bank Loan In Trial Balance Year To Date P&l

Absorption costing income statement sales cost of goods sold gross profit SA expenses net income variable costing -preferred by managers for decision making – consistent with CVP analysis because all costs on the income statement are either variable or fixed – uses a contribution margin income statement format. Manufactured 24200 designer hats and sold 25500 hats. In variable costing income statement sales revenue is typically higher than in absorption costing income statement. Exercise 19-5 Absorption costing and variable costing income statements LO P2 Rey Companys single product sells ot a price of 216 per unit.

Depending on a companys level of transparency an income statement using absorption costing may break out variable direct costs and fixed direct costs into two line items or combine them together. In variable costing income statement all the variable cost is to be deducted from revenue to arrive at the contribution where the contribution is the amount contributed in the organisations income. Absorption costing income statement Net income under absorption costing is calculated as follows.

In order to calculate gross margingross profit on sales in the income statement all production expenses both fixed and variable are deducted from the sales revenue. Difference between absorption and variable costing. Hope this helps you.

Managerial Accounting Absorption Costing Prepare Income Statement Comparing Financial Statements Of Two Companies Why Do We Profit And Loss Appropriation Account

The net operating income under absorption costing is 20000 more than the net operating income under variable costing. Absorption and variable costing income statements Learning Objective 6 Murphys Foods produces frozen meals which it sells for 7 each. We have five solved problems about variable and absorption costing topic. Companies that use variable costing keep fixed-cost operating expenses separate from production costs.

Goods available for sale 480 000480000 Less ending inventory – 480000 Gross margin 420000 Less selling admin. Yearly income reported under absorption costing will differ from income reported under variable costing if production and sales volumes differ. Or click on a link below.

The factors the CFO should consider include. Also when production is less than sales for the period absorption. The company uses the FIFO inventory costing method and it computes a new monthly fixed manufacturing overhead rate based on the actual number of meals produced that month.

Inventory Capacity Analysis Cost Accounting Items Included In Profit And Loss Account The Unfavourable Balance Of Should Be

Variable costing operating income Absorption costing operating income 2937320 2694920 242400 Fixed manufacturing costs in beginning inventory under absorption costing Fixed manufacturing costs in ending inventory under absorption costing 4. Problem-1 Variable costing income statement and reconciliation Problem-2 Variable and absorption costing unit product costs and income statements Problem-3 Impact of change in production on variable and absorption costing. Marginal cost statement offers an alternative layout to the traditional income statement prepared under. Operating data for the month are summarized as follows.

During August Head Gear Inc.

Image Result For Cvp Analysis Financial Management Tally P&l Format Cash Flow Under Indirect Method

Theaccountingdr Com In This Video The Difference Between Absorption Managerial Accounting Cost Lectures Notes Assertions For Accounts Payable Forming An Opinion And Reporting On Financial Statements

I Found This Formulae Very Helpful It Shoes Four Different Ways Of Calculating Degree Operating Leverag Contribution Margin Financial Management Fixed Cost Variable Costing Method Income Statement Cash Flow Formula

Variable Costing Income Statement Variables Lesson Petsmart Financial Statements 2019 Template For Expenses And