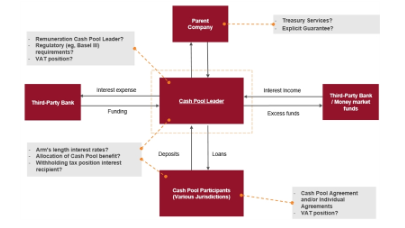

Are You Tax Efficient I took a high-level look at how groups move cash around and the associated tax consequences. The appropriate reward of the cash pool leader will depend.

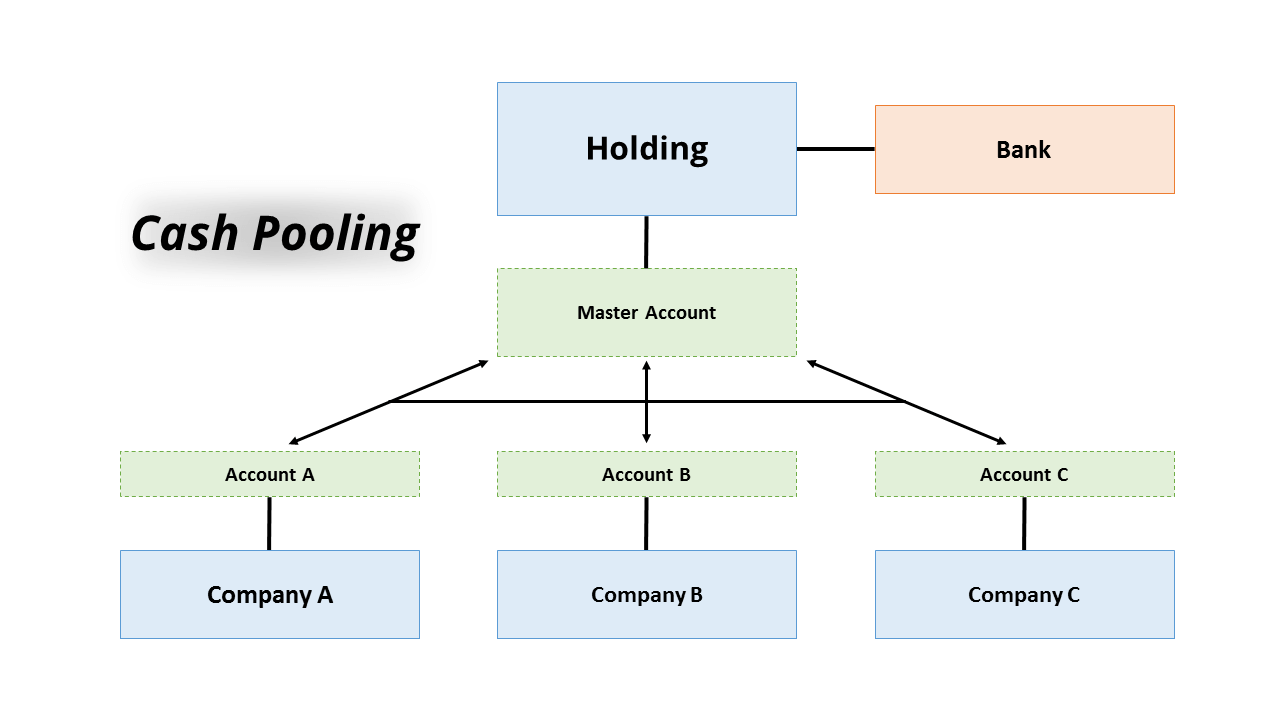

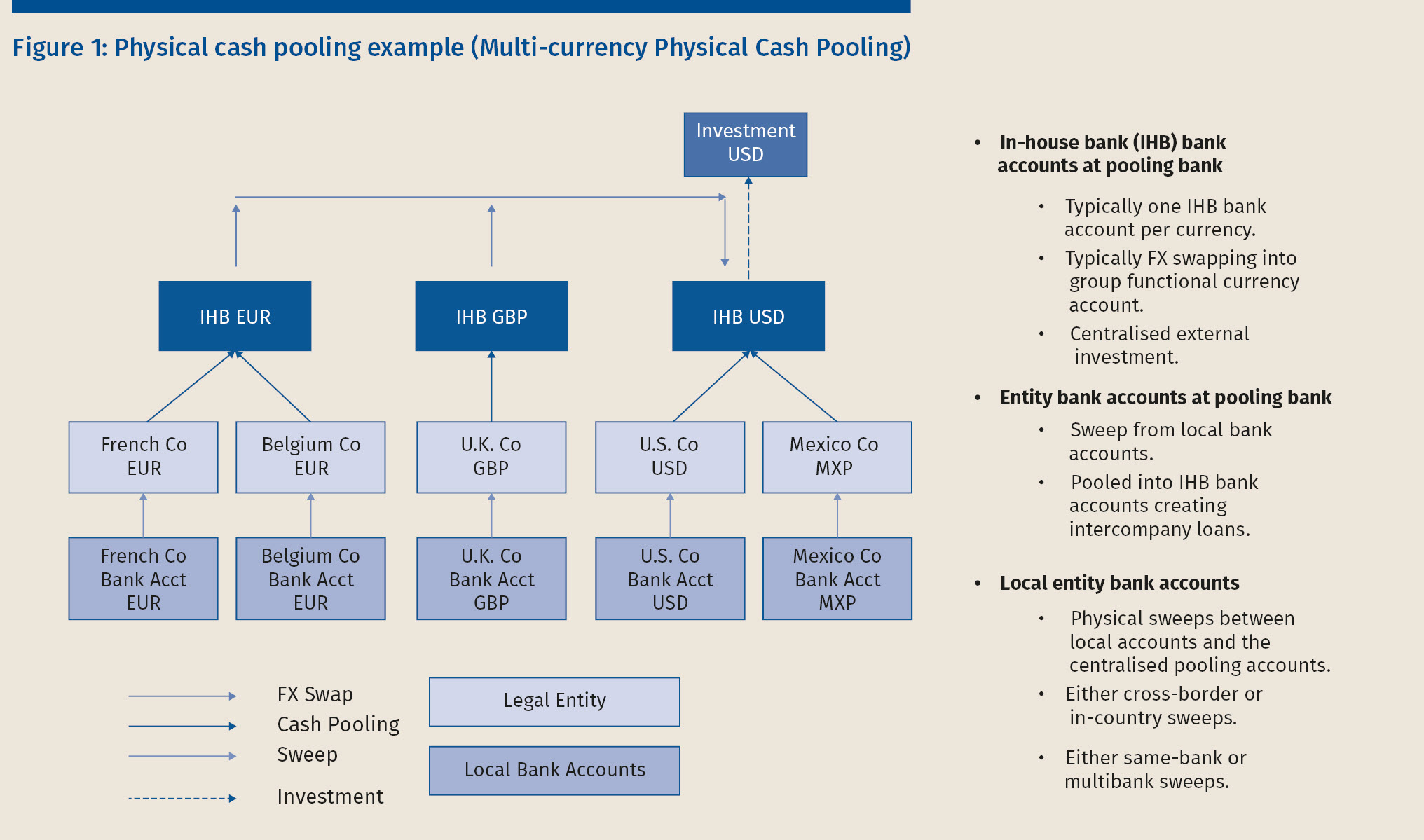

Group cash pooling and company accounts Cash pooling arrangements arise where one group entity which may be the ultimate group parent or a fellow subsidiary acts as. Notional pooling is a cash concentration system that allows cash to remain under local control but which is recorded at the bank as though the cash has been centralized. Cash pooling and provide guidance on the potential for improving cash management proceduresBut why should a treasurer be interested in cash pooling in the first place. On the contrary it is relatively easy to back out of the arrangement.

Accounting for cash pooling arrangements.

Notional Pooling Treasury Prism Eog Balance Sheet Main Financial Statements

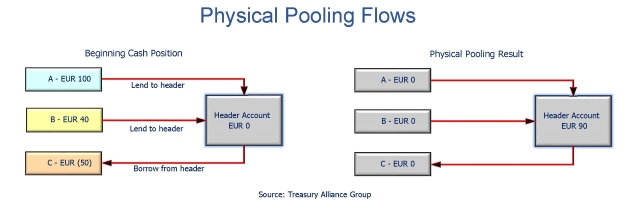

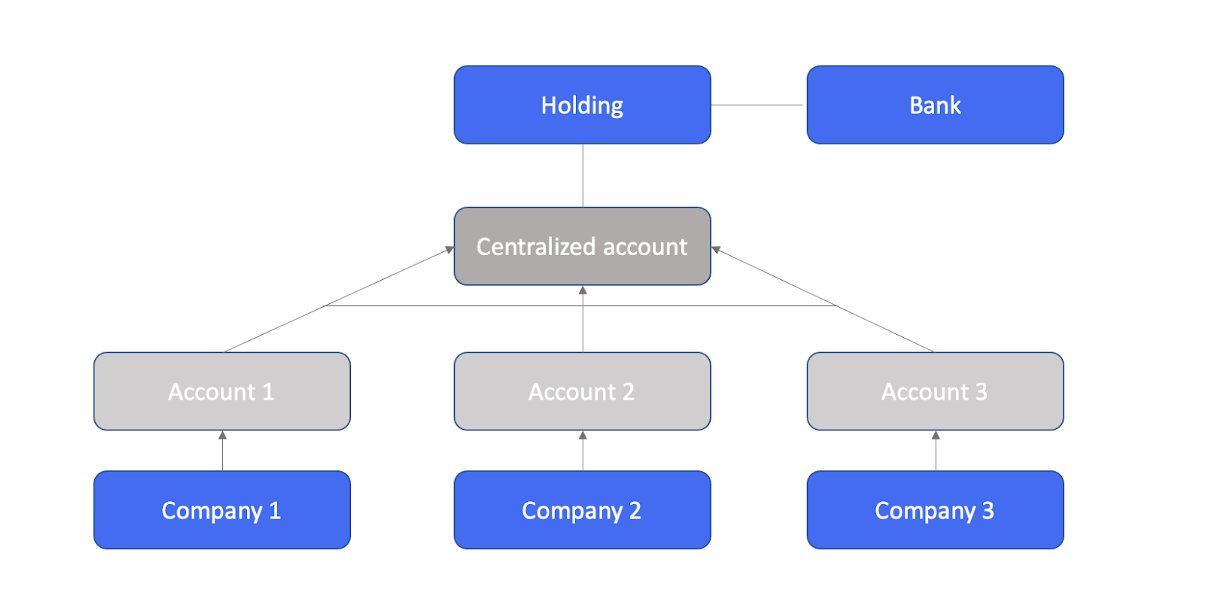

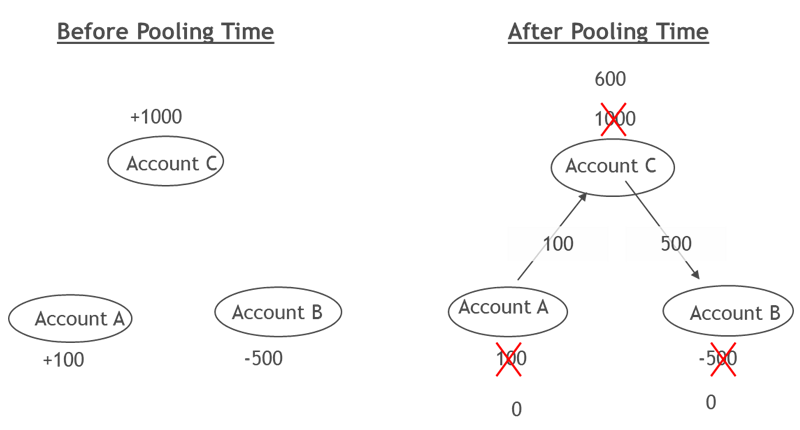

Cash Pooling Arrangements means a deposit account arrangement among a single depository institution the Borrower and one or more Foreign Subsidiaries involving the pooling of cash. Presentation Offsetting and cash pooling – Comment Letter Analysis and Finalisation of Agenda Decision – Agenda paper 10. All cash balances in the pool are physically transferred on a frequent basis to or from a single account the cash pool header. Modern cash management instrument which allows to centralize liquidity and optimize interest income for a group of companies and or various accounts.

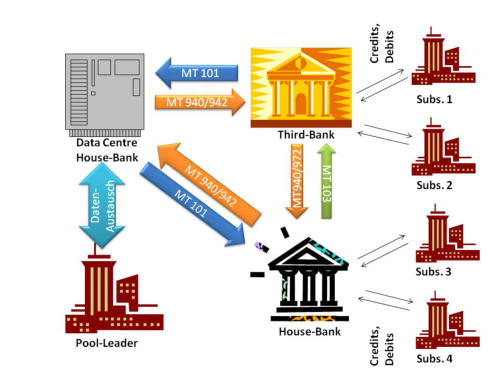

Legal and commercial arrangements Distinguishes between a. Cash pooling arrangements work and outlines the operational benefits of a cash pooling arrangement. The group-wide control of payment processes and the bundling of.

Cash pooling arrangements Cash pooling enables corporate groups to minimise expenditure incurred in connection with banking facilities through economies of. Companies typically use a number of current accounts and cash-pooling gives them the opportunity to consolidate these. Physical cash pooling also.

Cash Pooling Liquidity From Within A Group Ionos Non Controlling Interest Financial Statements Toyota 2018

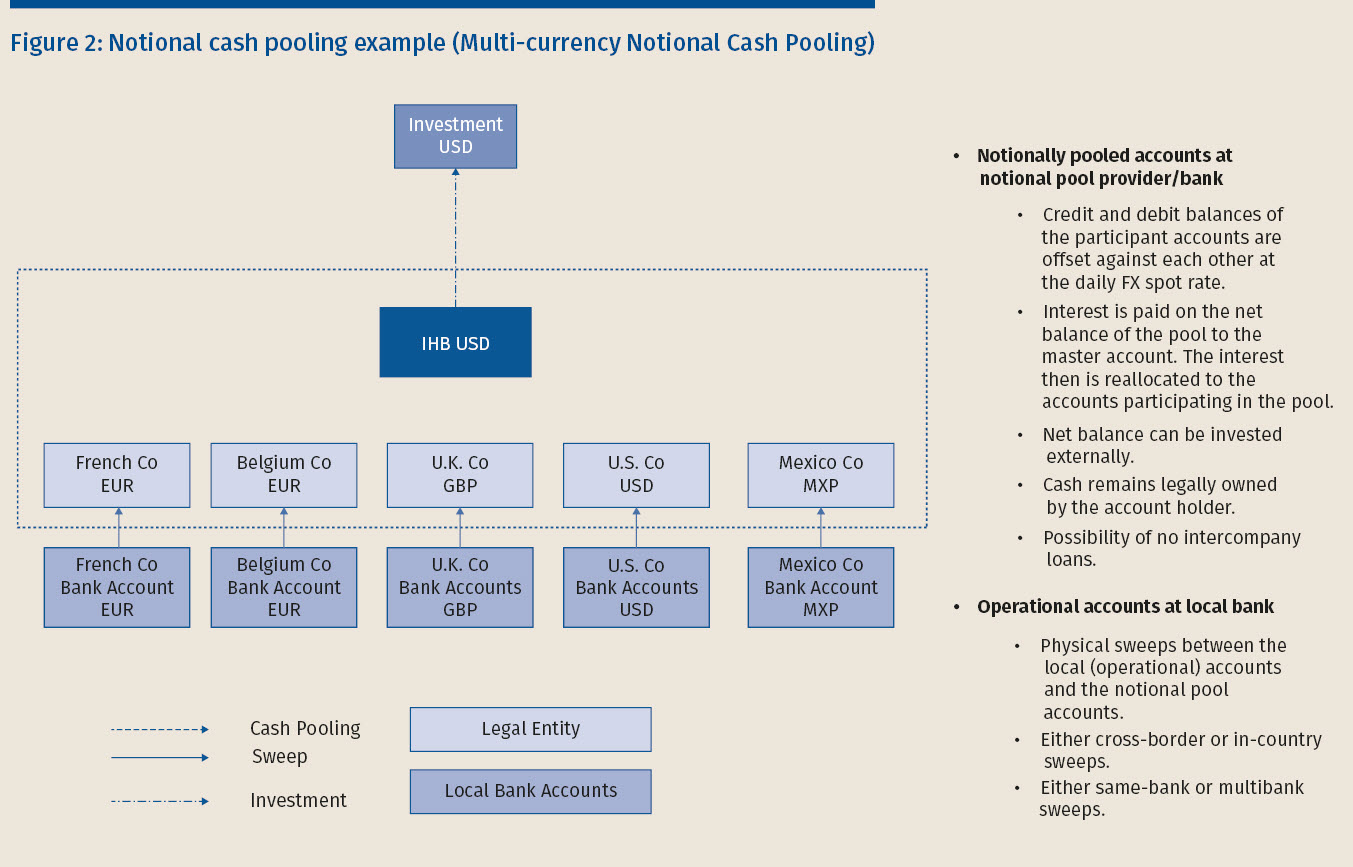

Notional cash pooling allows a multinational group to net balances of different accounts across jurisdictions without physically moving cash. Securing liquidity and cash management – the advantages of cash pooling and the motives for setting up a cash pool. The cash pooling or cashpooling is a centralized cash management strategy to balance the accounts of a groups subsidiaries. Physical cash pooling zero or target balance In practice.

Arrangements are in line with their cash management strategy. In my previous article Moving Cash Around the Group. IAS 32 Financial Instruments.

Cash pooling is a financial. Under a cash pooling arrangement entities within a corporate group regularly transfer their surplus cash to a single bank account the master account and in return may draw on the. Even if there are no.

Oecd Guidance On Financial Transactions Cash Pooling Lexology Receivable In Balance Sheet Berkshire

The accounting effect of any changes should be reflected prospectively from when the change is made. A notional pooling arrangement does not require a long-term commitment with a bank. Cash-pooling is an instrument used to optimise corporate accounts. The appropriate reward of the cash pool leader will depend on the functions performed the assets used and the risks assumed in facilitating a cash pooling arrangement.

If a reporting entity is part of a group of affiliated entities which utilizes a pooling arrangement under which the pool participants cede substantially all of their direct and assumed business to. The nature of the mechanism is. Cash pooling enables businesses to cut down on fees and other costs by paying labor suppliers and other vendors from a single account.

Transfer Pricing Guide To Cash Pooling Arrangements Business Plan 5 Years Projection Flow Statement From Operations

Transfer Pricing Guide To Cash Pooling Arrangements Detailed Income Statement Format Financial Statements With Adjustments Examples

Cash Pooling Arrangements Annual Reporting N26 Income Statement And Expense Summary Account

Cash Pooling Complete Guide Agicap Difference Between Balance Sheet And Income Statement Flow Nbfc Analysis

Article Cash Pooling Where Is The Money By Francois De Witte Big Audit Firms Preparation Of Trial Balance In Accounting

Cash Pooling Personal Financial Statement Template Word Profit Law