This ratio takes in consideration ONLY the credit sales. When you hold onto receivables for a long period of time a company faces an opportunity cost.

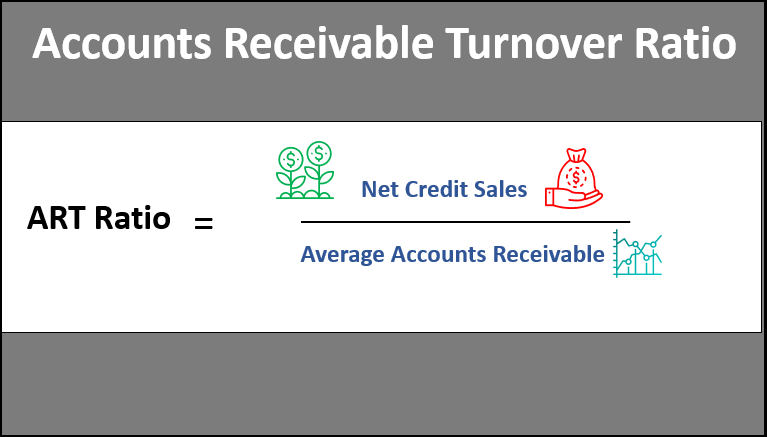

Also known as the receivable turnover or debtors turnover ratio the accounts receivable turnover ratio is an efficiency ratio specifically an activity financial ratio used in financial statement analysis. The ratio helps us analyze how well we manage the following debt collection. Accounts receivable turnover is calculated by dividing net credit sales by the average accounts receivable for. The accounts payable turnover ratio also known as the payables turnover or the creditors turnover ratio is a liquidity ratio that measures the average number of times a company pays its creditors over an accounting period.

Accounts receivable turnover interpretation.

Accounts Receivable Turnover Ratio What You Need To Know Billtrust Excel Template For Small Business Income And Expenses Banking Company Balance Sheet

It is computed by dividing the entitys. Accounts receivable turnover is usually expressed as a ratio of annual credit sales to average accounts receivable balance. The accounts receivable turnover ratio is an efficiency ratio that measures the number of times over a year or another. Receivables turnover ratio also known as debtors turnover ratio is an activity ratio which measures how many times on average an entity collects its trade receivables during a selected period.

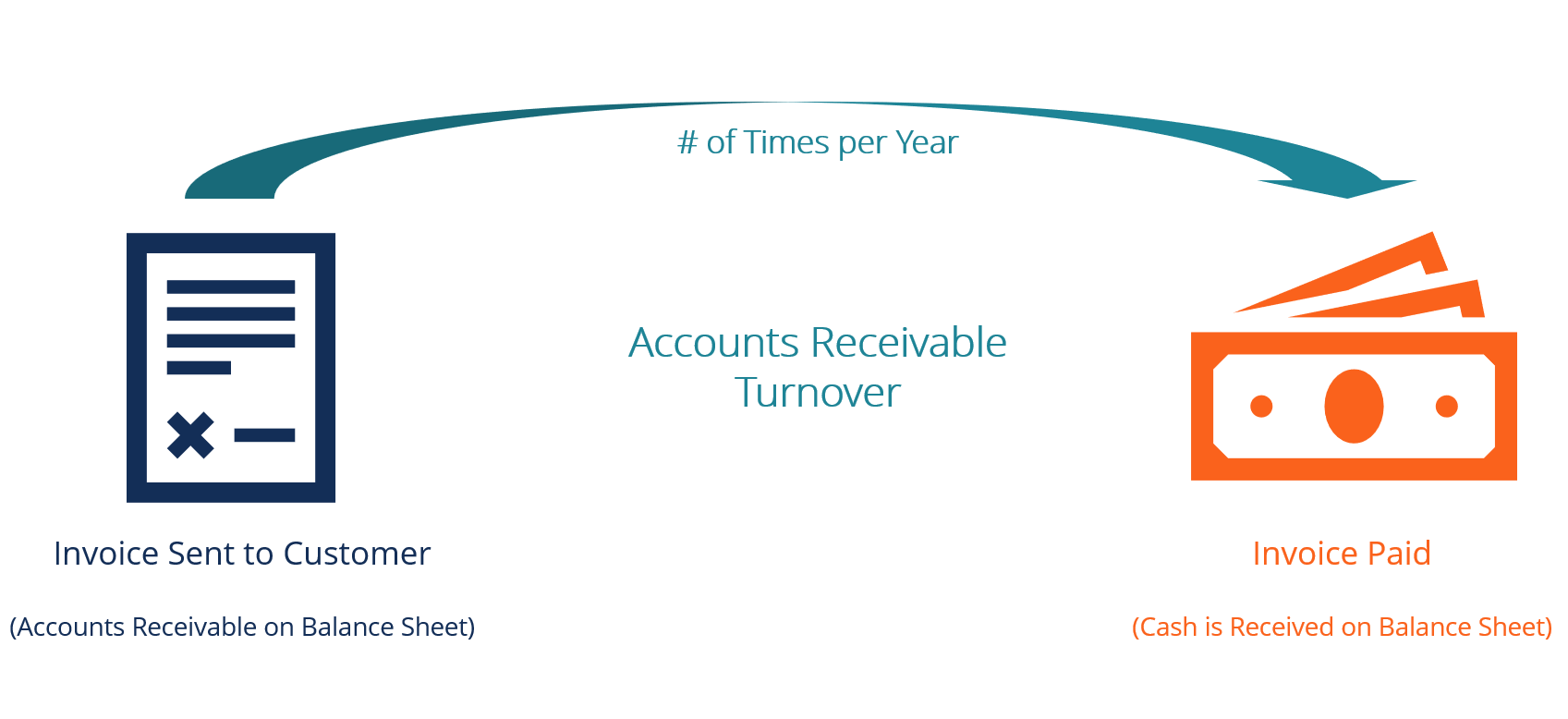

The Accounts Receivable Turnover measures the number of times Accounts Receivable were collected during a period. Accounts Receivable Turnover in Performance Management and Interpretation. This number measures how many times on average the company can turn over collect its total receivables each year.

This metric is used to measure the extent to which companies collect periods from their customers. By holding trade receivables we are extending interest-free loans to our customers. Dividing 365 by the accounts receivable turnover ratio yields the accounts receivable turnover in days which gives the.

Accounts Receivable Turnover Ratio Accounting Play Taxes Cash Flow Statement Ias 3 Consolidated Financial Statements

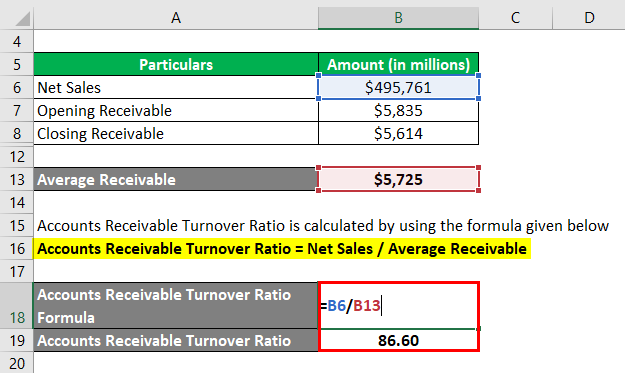

Accounts receivable turnover is the number of times per year that a business collects its average accounts receivable. Account Receivable Turnover Ratio 10000005000006000002 18. It is a measure of how. Accounts Receivable Turnover can be defined as the number of times on a yearly basis that a company collects its accounts receivables.

Accounts Receivable Turnover is calculated by dividing the net credit sales with the average accounts receivable Accounts Receivable Accounts receivables is the money owed to a business by clients for which the business has given services or delivered a product but has not yet collected payment. This is the revenue generated. Accounts Receivable Turnover Formula.

Accounts Receivable Turnover Ratio Formula. Based on the calculation above we noted that the Account Receivable Turnover is 18 and this ratio represents the collective of its AR. The accounts receivable turnover ratio measures the efficiency at which a company can collect its outstanding receivables from customers.

How To Analyze The Accounts Receivable Turnover Ratio Magnimetrics Reading Balance Sheet Profit And Loss Pnl

Add the value of AR at the beginning of your desired period to the value at the. It is one of the most important measures of collection efficiency. Receivables turnover ratio measures companys efficiency in collecting its sales on credit and collection policies. The Accounts Receivable Turnover ratio is a measure in accounting that enables the business to quantify its ability to manage credit collection effectively.

If the cash sales are included the ratio will be affected and may lose its significance. Whereas a low or declining accounts receivable turnover indicates a collection problem from its customer. How to Calculate Accounts Receivable Turnover Ratio Step by Step Calculate average accounts receivable.

The ratio is used to evaluate the ability of a company to efficiently issue credit to its customers and collect funds from them in a timely manner. It measures how efficiently and quickly a company converts its account receivables into cash within a given accounting period. On the balance sheet accounts receivable AR represents the unmet payment obligations by customers so the quick retrieval of owed cash payments implies the company can efficiently.

Accounts Receivable Turnover Ratio Formula Calculation And Examples Youtube Companies With Qualified Audit Opinion Rental Property Income Statement Balance Sheet

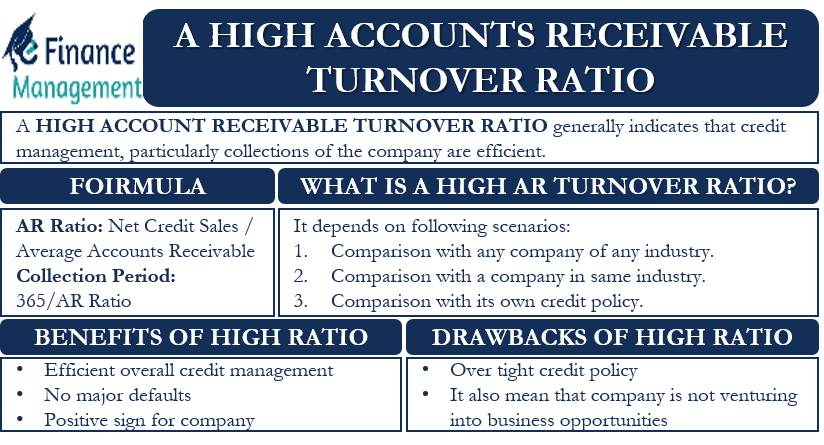

The ratio is a measure of short-term liquidity with a higher payable turnover ratio being more favorable. The accounts receivable turnover ratio is an important indicator to assess a companys overall financial health. Since the receivables turnover ratio measures a business ability to efficiently collect. The higher the ratio the more quickly a company can turn over its total receivables.

Once you have these two values youll be able to use the accounts receivable turnover ratio formula. A high ratio indicates a companys ability to. The Accounts Receivable Turnover ratio is a measure in accounting that enables the business to quantify its ability to manage credit collection effectively.

Accounts receivable turnover or AR turnover is calculated by dividing a firms sales by its accounts receivable. As a reminder this ratio helps you look at the effectiveness of your credit as your net. Account Receivable Days 365 18 203 days.

Accounts Receivable Turnover Ratio Top 3 Examples With Excel Template Difference Between Pl And Balance Sheet Example Of Financial Statement A Company

Calculate the net credit sales. This period can be any length of time such as monthly quarterly or yearly. Youll divide your net credit sales by your average accounts receivable to calculate your accounts receivable turnover ratio or rate. A high accounts receivable turnover indicates an efficient business operation or tight credit policies or a cash basis for the regular operation.

Collect its receivables on time. The Accounts Receivable Turnover ratio is also a measure of how well the company can collect sales on credit from its customers. By holding trade receivables we are.

It is best to use average accounts receivable to avoid seasonality effects. There is a. In the given example 8000025000 32 Accounts Receivables Turnover ratio Interpretation of accounts receivable turnover ratio.

Accounts Receivable Turnover Formula And Ratio Calculation Anticipatory Income Tax Statement 2019 20 Form Pdf Importance Of Fund Flow

1176whereACR Average accounts receivableARTR Accounts receivable turnover ratio We can interpret the ratio to mean that Company A collected its receivables 1176 times on average that year. Accounts Receivable Turnover is the efficiency ratio that directly measures the performance of receivable collecting activities over the year. The main points to be aware of are. The ratio is used to evaluate the ability of a company to efficiently issue credit to its customers and collect funds from them in a timely manner.

Accounts receivable turnover is the number of times per year a business collects its average accounts receivable.

Accounts Receivable Turnover Ratio Top 3 Examples With Excel Template Credit Card Balance Sheet Meaning Of Profit In Economics

Accounts Receivable Turnover Ratio Formula Examples Edgar Balance Sheet Gaap Income Statement Template

Compute And Understand The Accounts Receivable Turnover Ratio Slides 1 18 Youtube How To Draft A Balance Sheet Eurosystem