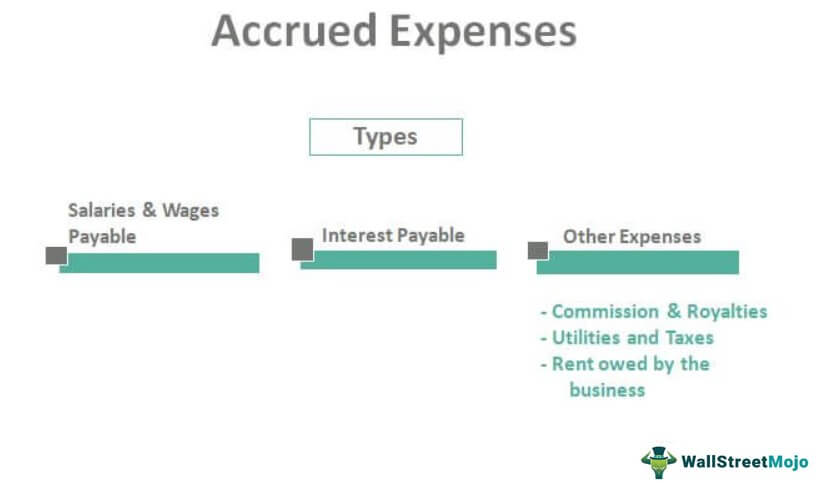

Less-common commission structures are based on the gross margin or net income generated. These accounting records are what occurred either as revenues or as expenses and therefore must be shown in a companys income statement and balance sheet.

Accrued expenses are reported on a companys balance sheet. Accrued liabilities are only reported under accrual accounting to represent the performance of a company regardless of their cash position. Accrued income is an amount earned but not actually received during the accounting period or till the date of preparation of Final Accounts for the period concerned. The Accrued Income Ac appears on the assets side of the Balance Sheet.

Accrued commission in balance sheet.

What Is Unearned Revenue A Definition And Examples For Small Businesses Lactalis Financial Statements Nail Salon Balance Sheet

The accrued income is added to the relevant head of income on the credit side of the income statement to increase the amount of income for the current year. Ad Easy-To-Use Bookkeeping For Small Businesses. These expenses and crediting Cash when payment is received. Accrual accounting utilizes both expense and revenues of a company to denote its financial position.

The expense is recorded in the. They appear on the balance sheet under current liabilities. Accounting for Commissions Expense.

Ad Fill Out Legal Templates Written By Professionals. In the ordinary course of a business it may receive some incomes in advance in spite of not rendering the services. Income Received in Advance.

Question 50 1st Bank Train Fanta Converse Financial Statements Depreciation In Cash Flow Statement Direct Method

It is the result of accrual method of accounting under which expenses are recorded in the accounting period in which they are incurred. Accrued commissions those that are owed to employees but have not been paid out also appear on the balance sheet as a liability. It is shown on the debit side of the Profit Loss Ac. A commission is a fee that a business pays to a salesperson in exchange for his or her services in either facilitating supervising or completing a sale.

Understanding The ASC 606 Matching Principle. The amount of the accrued income reported on the income statement also causes an increase in a corporations retained earnings. The amount of accrued income that a corporation has a right to receive as of the date of the balance sheet will be reported in the current asset section of the balance sheet.

Accrued income will appear on the ____ side of the balance sheet. As a result liability for these expenditures is created and recorded as accrued liabilities short term on the balance sheet liability side. It could be described as accrued receivables or accrued income.

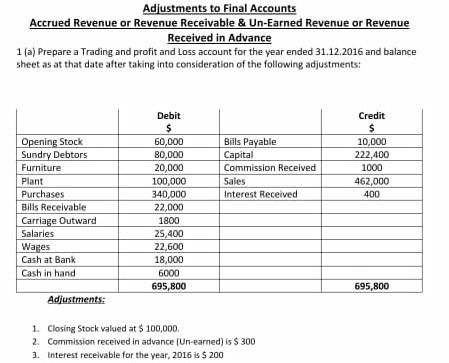

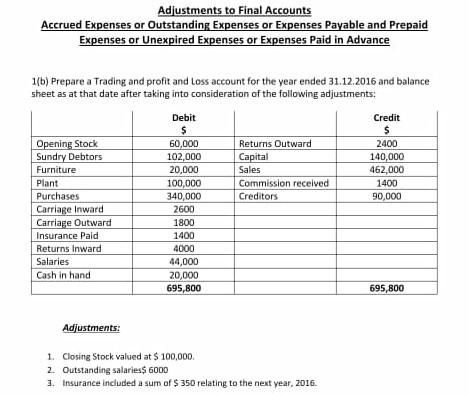

Solved Adjustments To Final Accounts Accrued Revenue Or Chegg Com Business Profit And Loss Form Free Cash Flow Statement Template

Accrued costs should be documented in the balance sheet by debiting Wages and Salaries Expenses and crediting Accrued Expenses. If a company owes for commissions on recent sales but has not yet paid or recorded them an accrual adjusting entry is made so they are included in the commissions expense reported on its. Hence the amount of accrued income will be added to the related income in profit and loss account and new account of accrued income will appear on asset side of balance sheet. Which of the following accounting treatments isare TRUE in respect of accrued commission appearing on the debit side of a trial balance.

There will need to be an adjustment entry that debits Accrued Income Ac Current Asset a balance sheet account and credits Income Ac an income statement account. Treatment in Balance Sheet. Under the accrual basis of accounting the commissions do not have to be paid in order for the company to report commissions expense.

What Are Accrued Expenses on a Balance Sheet. Both accumulated expenditures and accounts payable are shown on a companys balance sheet as Current Liabilities which stands for current liabilities When an accrued. Accrued Revenues Accrued revenues are recorded as receivables on the balance sheet and are unpaid proceeds from the delivery of a commodity that will be paid by cash at a later date.

Download Sales Commission Calculator Excel Template Exceldatapro Templates Spreadsheet Cash Drawer Balance Sheet Ge Financial Statements

Summary An accrued liability represents an expense a business has incurred during a specific period but has yet to be billed for. In accounting Accrued Expenses are expenses that have been incurred and for which the payment has not yet been made. No Accounting Experience Needed. Accrued expenses would be recorded under the section Liabilities.

These are also known as accrued liabilities. Ad 1 Answer Simple Questions. Accrued Commissions Payable means the Accrued Commissions set forth on the September Balance Sheet.

Save Time Money With Our Easy Online Tools. 2 Preview Your Form. Get Form Templates For Any Purpose.

Adjusting Entries Cheat Sheet Accounting Stuff Sheets Cheating Cash Flow From Financing Activities Formula Financial Analysis Income Statement

Sample 1 Based on 1 documents Remove Advertising Examples of Accrued Commissions Payable in a sentence. An accrued expense also known as accrued liabilities is an accounting term that refers to an expense that is recognized on the books before it has been paid. Straightforward Business Accounting Forms. Accrued income is the assets of the company and shown on the assets side of the Balance Sheet because this is a debt due from a party of the business.

Commissions are part of the direct costs that occur when the product is sold while the salaries that sales reps earn are in the indirect costs of SGA. While preparing the Trading and Profit and Loss Ac we need to add the amount of accrued income to that particular income. From an accounting perspective when cash is received at a later date for goods and services billed to a customer the receivables account is credited.

Sign Up Today to Receive Up To 50 Off. The commission may be based on a flat fee arrangement or more commonly as a percentage of the revenue generated. Such an income receivable is also called income earned but not received or income accrued or income due and outstanding.

Is Commission Should Be Written In Balance Sheet Or Profit And Loss Account Quora Common Equity On Long Term Investment Cash Flow Statement

The matching principle is the alternative to cash basis accounting where the company recognizes the expense based on when it is paid. For instance interest on investments rent from sub-letting commission on sales etc earned. When a business pays cash to settle such a responsibility the expense account will be debited and the accrued. Accrued Commissions Payable shall be adjusted to reflect the balance as of the Closing Date for the purposes of Section 23 c.

3 Save Print Your Balance Sheet. Run Your Business On Your Own Terms On Your Own Time. Top Rated Document Platform.

A balance sheet shows what a company owns its assets and owes its liabilities as of a particular date along with its shareholders equity. These are presented in the current liabilities section of the balance sheet as it is the current obligation of the business which needs to be settled in future. Download Print – 100 Free.

Personal Financial Statement Template Pdf Important Accounting Ratios Leverage Impacts The Performance Of Firm By

Accrued Expense On Balance Sheet Meaning Examples Audit Report Opening Balances Not Audited Other Operating Income In Statement

Solved Adjustments To Final Accounts Accrued Revenue Or Chegg Com The Statement Of Owners Equity Sole Proprietorship Pdf