An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. Made whenever management desires to change an account balance.

Assigning revenues to the periods in which they are earned. We made it much easier for you to find exactly what youre looking for on Sciemce. Remember that almost always one of. Each adjusting entry usually affects one income statement account a revenue or expense account and one balance sheet account an asset or liability account.

Adjusting entries are made to balance sheet accounts only.

Record And Post The Common Types Of Adjusting Entries Principles Accounting Volume 1 Financial Trial Balance To Income Statement Ifrs For Smes Standard

Not necessary if the accounting system is operating properly. Any hours worked. Expert Answer 100 5 ratings Adjustment entries include revenues an. For that month an adjusting entry is made to debit depreciation expense and credit accumulated depreciation by the same amount.

The adjusting entry amounts must also be included in the amounts reported on the balance sheet as of the end of the accounting period. It is a result of accrual accounting and follows the matching and revenue recognition principles. Adjusting entries affect only income statement accounts.

Adjusting entries must involve two or more accounts and one of those accounts will be a balance sheet account and the other account will be an income statement account. Made at the end of the period after all cash transactions have been recorded Are made to get the account balances correct which means. Usually required before financial statements are prepared.

Solved I Have Recorded The Adjusting Entries And Got Chegg Com Royal Bank Of Canada Financial Statements Profit Loss Statement Calculator

These lessons cover the topics in a typical financial accounting course or principles of accounting 1 course. Companies are required to adjust the balances of their various ledger accounts at the end of the accounting period in order to meet the requirements of the various authorities standards. An adjusting entry affects an income statement and balance sheet account. Accrued expense – loan interest x 6 months.

View the full answer. Adjusting entries are made to balance sheet accounts only. For example if you take out a loan from the bank on July 1 for 10000 with 4 interest you will need to make an adjusting entry at the end of the year reflecting the accrued expense of your interest so far.

2The journal to record an accrued expense includes a credit to which account. Every journal entry involves at least two accounts. Made to balance sheet accounts only.

Necessity Importance Of Adjusting Entries Financial Quotes Bookkeeping Business Accounting Education Vertical Analysis Income Statement Interpretation Statutory Accounts Preparation

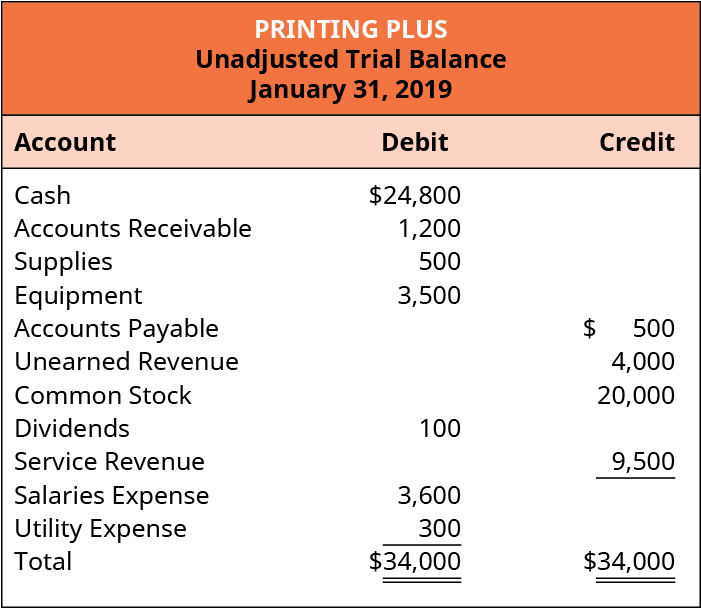

Adjusting entries are made at the end of an accounting period after a trial balance is prepared to adjust the revenues and expenses for the period in which they occurred. Donate your notes with us. Each adjusting entry usually affects one income statement account a revenue or expense account and one balance sheet account an asset or liability account. Not necessary if the accounting system is operating properly.

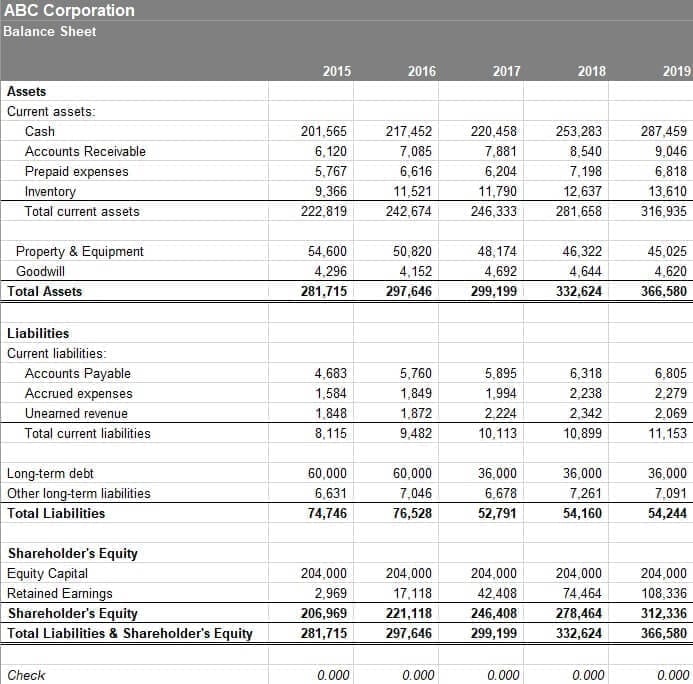

Companies that prepare their financial statements in accordance with United States Generally Accepted Accounting Principles US-GAAP and International Financial Reporting Standards IFRS usually prepare some adjusting. Adjusting entries always affect which type of accounts. The adjusted trial balance is simply a listing of all accounts and their balances after adjusting entries are completed.

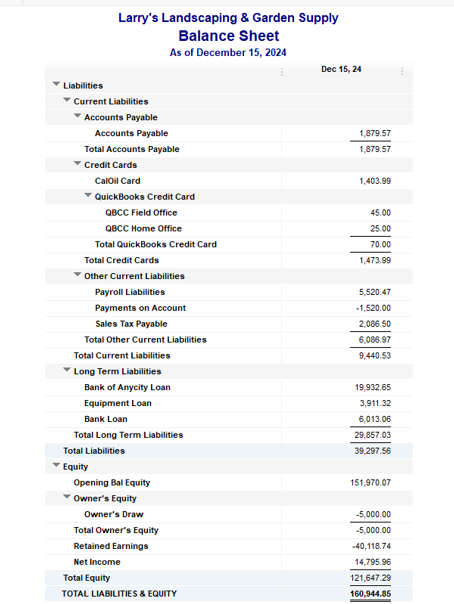

Once adjusting journal entries are posted to accounts and the balances are updated the next step is to complete an adjusting trial balance. The balance sheet is now fixed and reflects the fact that only three months of the liability Unearned Rent Revenue remain. This is lesson 3 in our financial accounting series.

Adjusting Entries For Liability Accounts Accountingcoach Lowes Income Statement 2019 Balance Sheet Reconciliation Procedure

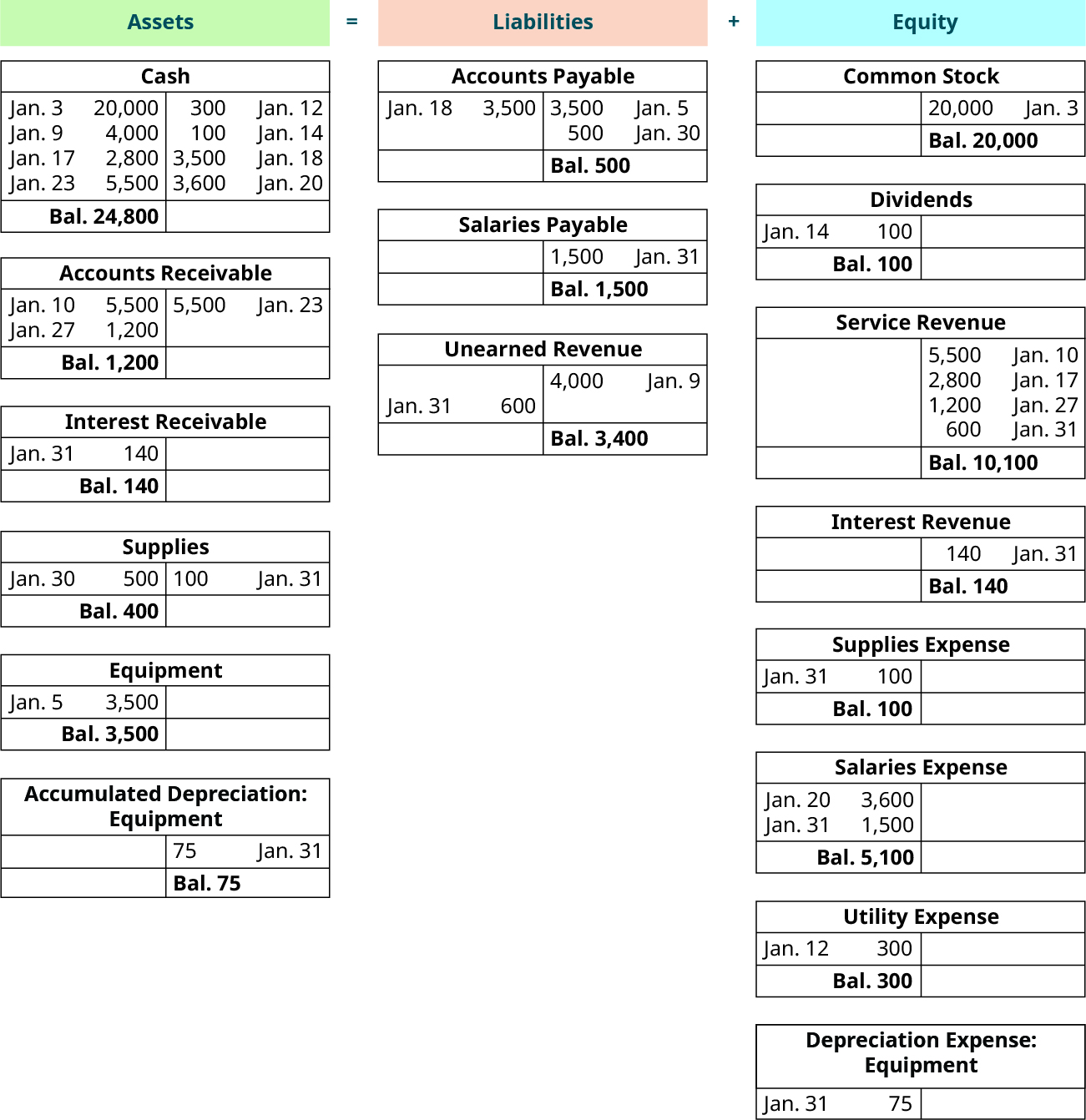

Read more AJE are the entries made in the accounting journals of a business firm to adapt or to update the revenues and expenses accounts according to the accrual principle and the. Indicate the account titles on each of the T-accounts. The preparation of adjusting entries is the fourth step of accounting cycle and comes after the preparation of unadjusted trial balance. Adjustments bring an asset or liability account balance to its correct amount.

1 an asset account balance what you really have now 2 a liability account balance what is really owed now 3 a revenue account balance what was earned this period only. Made whenever management desires to change an account balance. The accumulated depreciation account on the balance sheet is called a contra-asset account and its used to record depreciation expenses.

Debit balances are listed in the left debit column. C usually required before financial statements are prepared. For example suppose a company has a 1000 debit balance in its supplies account at the end of a month but a count of supplies on hand finds only 300 of them remaining.

Discuss The Adjustment Process And Illustrate Common Types Of Adjusting Entries Principles Accounting Volume 1 Financial Google Statements 2017 Provisional Profit Loss Account Format In Excel

A neither an income statement account nor a balance sheet account B an income statement account and a balance sheet account C income statement. Adjusting journal entries can also refer to financial reporting that corrects a mistake made previously in the accounting period. Click on an answer to reveal whether its Right. When an asset is purchased it depreciates by some amount every month.

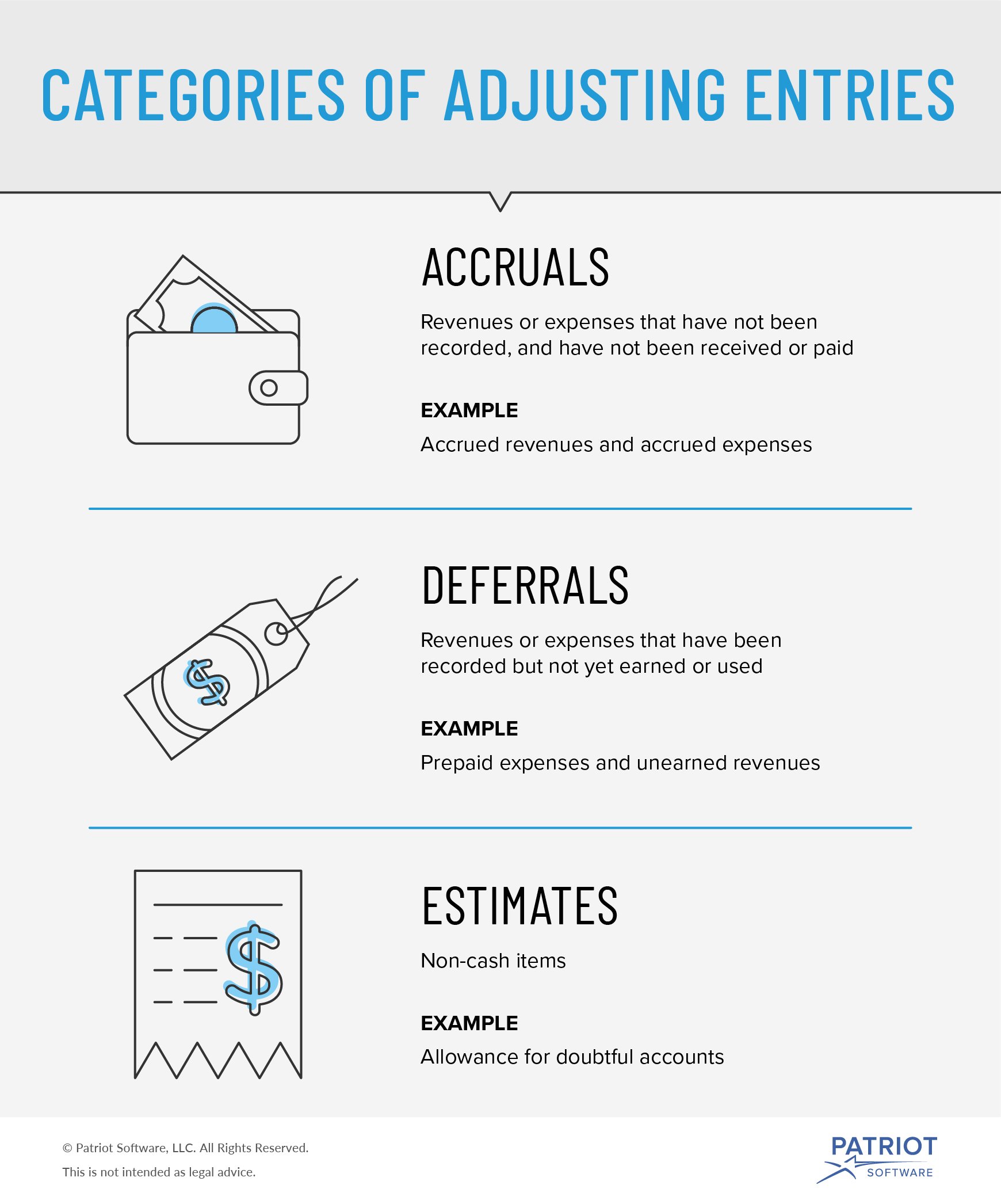

Adjusting entries are a made to balance sheet accounts only. B made whenever management desires to change an account balance. Generally adjusting journal entries are made for accruals and deferrals as well as estimates.

Payroll is the most common expense that will need an adjusting entry at the end of the month particularly if you pay your employees bi-weekly. Here is the process we will follow. Adjustments update related expense or revenue accounts.

Adjusting Entries For Asset Accounts Accountingcoach Marta Communications Inc Income Statement Contents Of Profit And Loss Account

Affects a balance sheet and income statement account. Updating liability and asset accounts to their proper balances. The balance sheet is fixed. Every adjusting entry affects at least one income statement account and one balance sheet account.

Adjusting entries are made at the end of a period to update accounts. One account to be debited and one account to. D not necessary if the accounting system is operation properly.

Balance sheet accounts only. Asked May 17 2016 in Business by Fatal_Furry. Step 1 in the adjusting entry process is complete.

Adjusting Entries Does Your Small Business Need Them Ar Balance Sheet Contingent Liabilities In Bank

Both balance sheet and income statement accounts. Usually required before financial statements are prepared. Adjusting entries are journal entries made at the end of an accounting period for the purpose of. The adjusting entry amounts must be included on the income statement in order to report all revenues earned and all expenses incurred during the accounting period indicated on the income statement.

Wonderful Adjusting Entries Are Made To Balance Sheet Accounts Only Made whenever management desires to change an account balance.

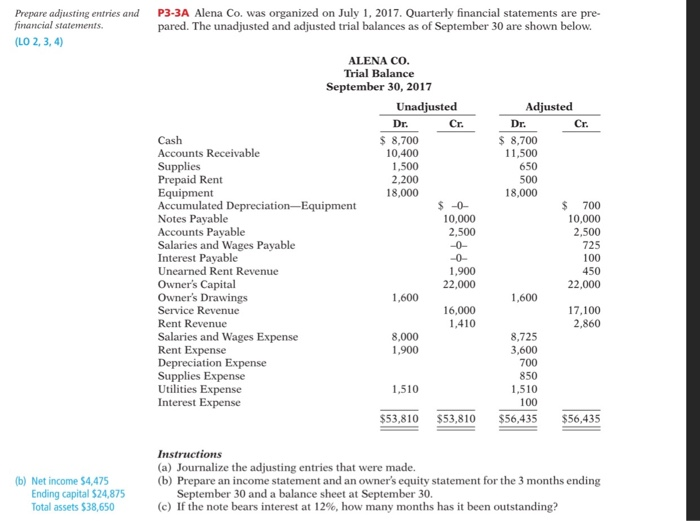

Solved Prepare Adjusting Entries And Financial Statements Chegg Com Reporting Fraud Activity Ratios

Adjusting Entries Meaning Types Importance And More Comparative Statement Analysis Ppt Difference Between Balance Sheet Income Cash Flow