Financial ratio analysis is used by two main users namely investors and management. Quick Ratio Cash and Cash Equivalents Marketable Securities Accounts Receivables Current Liabilities 2.

In essence any quick ratio of 21 or better shows that a company is likely able to pay its short-term obligations. Those are the ones you use for the calculation. The first year in 2016 reported the lowest. Formula for the Quick Ratio.

Analysis of quick ratio.

Pin On Financial Analysis Cash Flow To Balance Sheet Projected Statement Format In Excel

A quick ratio of 05 would suggest that a company is able to settle half of its current liabilities instantaneously. You can calculate the quick ratio from balance sheet data using this formula. The quick ratio defined also as the acid test ratio reveals a companys ability to meet short-term operating needs by using its liquid assets. Quick Ratio helps to check liquidity in a company business for short term.

1 indicates a highly solvent position. Quick ratio is one of the financial ratios which is used to measure the liquidity of a company. Customer Payment Impact on the Quick.

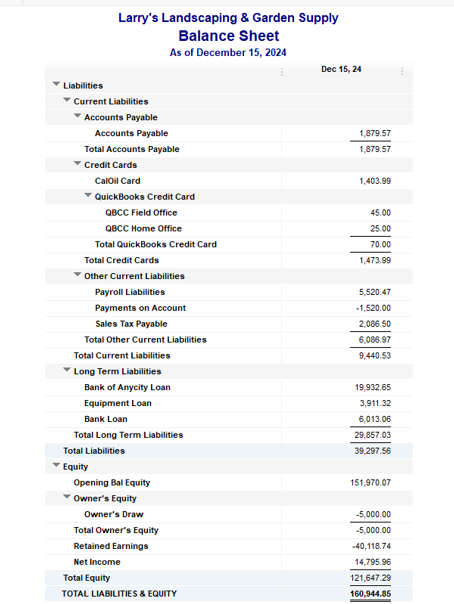

Quick assets cash and cash equivalents marketable securities and short-term receivables are current assets that can be converted very easily into cash. Quick Ratio Cash and Cash Equivalents Marketable Securities Accounts Receivable Current Liabilities or Quick Ratio Current Assets Inventory Prepaid Expenses Current Liabilities Illustration For instance following are the items on the balance sheet of Kapoor and Co. In the balance sheet you can see the highlighted numbers.

The Financial Ratios Are Tool Used By Creditors Investors Stakeholders And Management Of A C Ratio Statement Analysis Sample Pro Forma Statements Comcast

This would indicate that the business has the repayment capacity of its current liabilities 45 times over utilising its liquid assets. This ratio serves as a supplement to the current ratio in analyzing liquidity. Quick ratio Current Assets – Inventories Current Liabilities Calculating liquid assets inventories are deducted as less liquid from all current assets inventories are often difficult to convert to cash. It is simple to understand and a widely used measure to analyze the liquidity of a company.

Quick Ratio Analysis Definition. This is an essential analysis for lenders and creditors who will not extend credit unless they believe they will be paid back on time. The quick ratio is one of the key liquidity ratios used by analysts.

Explanation Quick ratio shows the extent of cash and other current assets that are readily convertible into cash in comparison to the short term obligations of an organization. Generally any quick ratio above 1 will be considered reasonable. Quick ratio Current assets Prepaid expenses Inventory Current liabilities Suppose the quick ratio for a business is 45.

Download Ratio Analysis Excel Template Exceldatapro Templates Financial Statement Common Income And Expenditure Account For Non Profit Organisation

Quick Ratio Acid Test Ratio is a liquidity ratio. Quick ratio Quick assetsCurrent liabilities. Quick Ratio Understanding the Quick Ratio. Quick ratio Total quick assets Current liabilities 2 Click competitor name to see calculations.

A quick ratio that is greater than 1 means that the company has enough quick assets to pay for its current liabilities. 104 Quick Ratio or Acid Test Ratio is a ratio to measure a companys ability to pay short-term financial liabilities by using liquid assets that are more liquid Liquid Assets. Quick Ratio Current Assets-InventoryCurrent Liabilities.

The formula to calculate the quick ratio is Quick Ratio Quick Asset Current Liabilities Here the Quick assets mean the Current assets minus all the inventories and minus all the prepaid expenses because only cash or near to cash assets are considered. Investors suppliers and lenders are more interested to know if a business has more than enough cash to pay its short-term liabilities rather than when it does not. The quick ratio measures the dollar amount of liquid assets available against the dollar.

Quick Ratio Analysis Excel Worksheet Balance Sheet Word Template Net Income Profit Example Of Common Size Statement

A result of 11 is considered to be the ideal ratio of quick ratio. It is similar to the current ratio but is considered a more reliable indicator of a companys short-term financial strength. Using the formula above Company X quick ratio can be calculated as follows. The types of profitability ratios are.

To calculate the quick ratio locate each of the formula components on a companys balance. Accounts receivables ratioIf the companys quick ratio in 2013 increases to 2281 it shows that its ability to meet its. The difference between these two is that the quick ratio subtracts inventory.

Quick ratio analysis is used to examine the ability of a business to pay its bills. Hence the formula for calculating quick ratio is as follows. The quick ratio is the barometer of a companys capability and inability to pay its current obligations.

Download Ratio Analysis Excel Template Exceldatapro Templates Financial Statement Basic Profit And Loss Personal

Quick Ratio 708-422540 0529 X. The quick ratio is calculated by dividing liquid assets by current liabilities. Quick ratio assesses the extent to which cash and other currents assets can be readily converted into cash and meet a companys short-term obligations. Quick Ratio Current Assets – Inventory Current Liabilities Current assets might include cash and equivalents marketable securities and accounts receivable.

Quick ratio Formula Quick assets Quick Liabilities. Profitability Ratios This type of ratio helps in measuring the ability of a company in earning sufficient profits. Interpretation of Quick Ratio Acid Test Ratio Quick ratio evaluates a companys liquidity by comparing its cash plus almost cash current assets with its entire current financial obligations.

Interpreting the Quick Ratio. Cash and Cash Equivalents Accounts receivables Current liabilities Bank overdraft A ratio of 1. However benchmarking is a great.

Current Ratio Formula Meaning Example Interpretation Financial Community Foundation Statements Under Asu 2016 14 Audit Response

What is Quick Ratio Analysis. The quick ratio has a weakness in that it does not account for time. Quick Ratio Indicates the rela. Quick Ratio QR According to Wardiyah 2017.

This ratio helps to analyze the ability of a company to meet its short-term debts with its most liquid assets. Hence companies with good quick ratios are favored by creditors. The following formula is used in the process of calculating quick ratio.

It is also known as the acid-test ratio as it shows the ability of a company to use those assets which can be converted easily into cash. For 2018 the calculation would be. It assists in verifying if the business or company has the capacity to pay off its current liabilities by means of the most liquid assets.

Inventory Turnover Analysis Templates 13 Free Xlsx Docs Financial Statement Of Position Accumulated Depreciation Enron Statements 2001

Ratios That Helps You For Proper Analysis Stop Panicking About Your Liquidity Situation The Company S Ability To Pay Inventory Accounting Financial Statement Of Functional Expenses Quickbooks Non Assurance Engagement

What Is A Financial Ratio The Complete Beginner S Guide To Ratios Fourweekmba Statement Analysis Cash Basis Flow Qbi Rental Real Estate Safe Harbor