FASB ASC 450 Contingencies for Gain Loss The Financial Accounting Standards Board FASB released Accounting Standards Codification 450 ASC 450 to address contingencies for gains and losses which may be incurred now or in the future. Similarly the guidance in ASC 460 on accounting for guarantee liabilities.

Additionally ASC 450 does not require disclosure of loss contingencies when the possibility of loss is remote. A loss will incur if certain future events occur or not occur. In addition to summarizing the accounting framework in ASC 450 and ASC 460 and providing an in-depth discussion of key concepts this Roadmap. This Roadmap provides Deloittes insights into and interpretations of the accounting guidance in 1 ASC 450 on loss contingencies gain contingencies and.

Asc 450 loss contingencies.

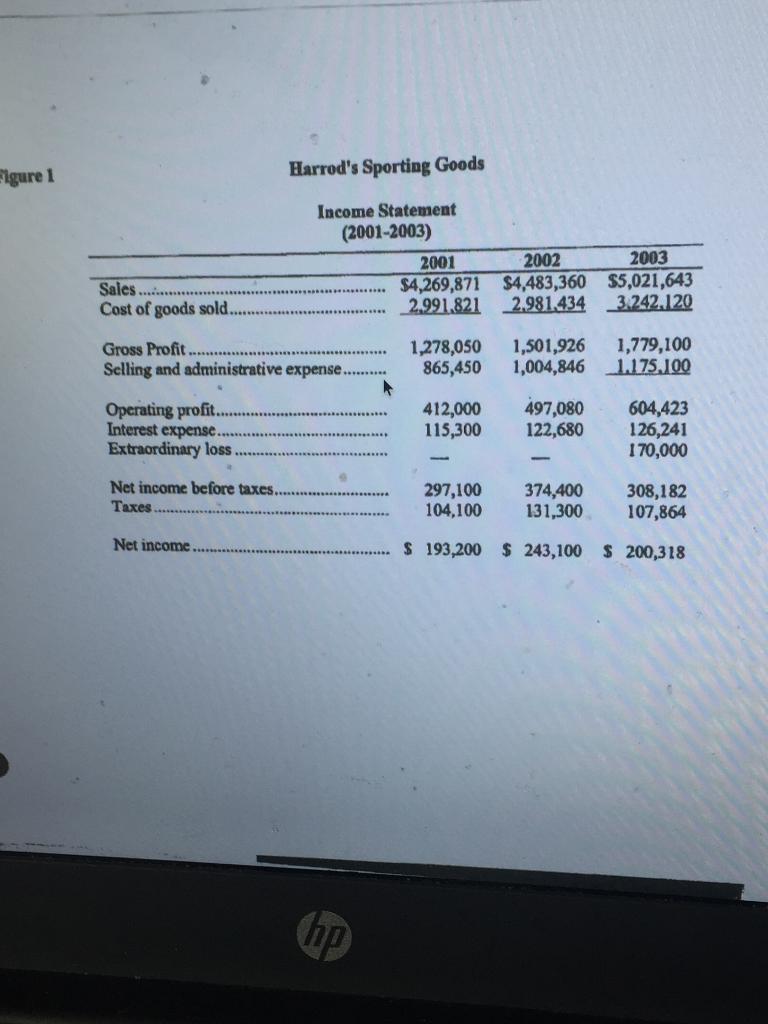

Example Accounting For Unasserted Claims Asc 450 Gaap Dynamics P&l Corporation Income Statement Reports

ASC 450 Contingencies outlines the accounting and disclosure requirements for loss and gain contingencies. Codification Topic 450-20 Loss Contingencies Loss contingency– a loss will incur if certain future events occur or not occur Recognition of a loss contingency 1. An exposure to loss exists in. Accounting Standards Codification ASC 450 Contingencies contains guidance for reporting and disclosure of gain and loss contingencies and has three subtopicsThese include.

According to Topic 450 when a loss contingency exists the likelihood that future events will confirm the loss or impairment of an asset or the incurrence of a liability can range. December 20 2015November 30 2018accta. Click to see full answer.

Keeping this in consideration what does ASC stand for in accounting. Unrecognized Contingencies 450-20-50-3Disclosure of the contingency shall be made if there is at least a reasonable possibility that a loss or an additional loss may have been incurred and either of the following conditions exists. Recognized in the financial statements 2.

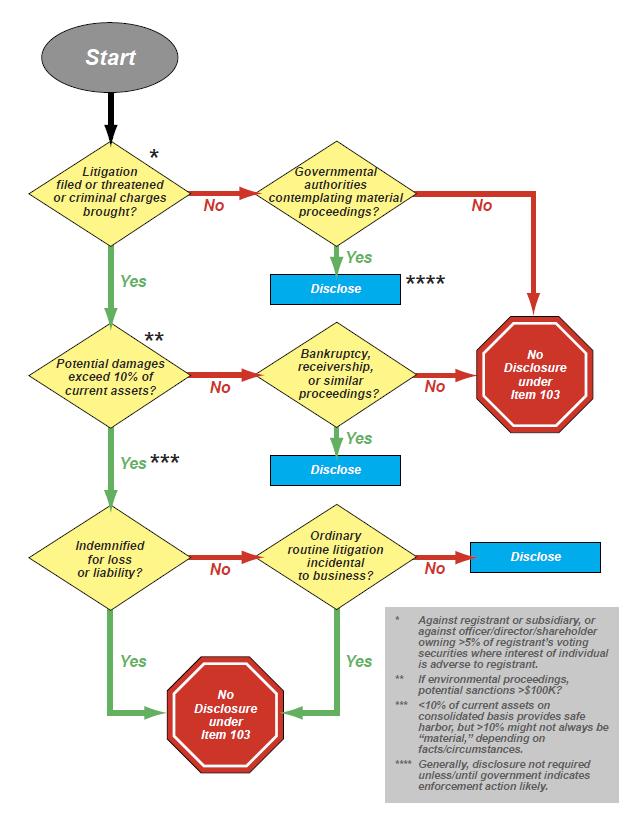

Jd Supra Top 10 Issues To Consider When You Are Sued Issue 8 Disclosing Litigation And Reserving For Losses Pro Forma Business Plan Template Income Spending Spreadsheet

Disclosed in the notes Recognized in the financial statements– if both A and B are satisfied A it is probable that a loss will incur. If the possibility of a loss is remote disclosure is not required. If a loss is probable recognize in the financial statements. Under ASC 450 if a liability from a contingency is reasonably possible the company must disclose the contingency and provide an estimate of the pos-sible loss or range of loss.

ASC 450 defines a contingency as an existing condition situation or set of circumstances involving uncertainty as to possible gain or loss and that will result in the acquisition of an asset the reduction of a liability the loss or impairment of an asset or the incurrence of a liability. Loss contingencies are recognized only if there is an impairment of an. FASB Accounting Standards Codification ASC Topic 450 Contingencies requires companies to assess the degree of probability of an unfavorable outcome before reporting a loss contingency.

Recognition of a loss contingency. A loss will incur if certain future events occur or not occur. However reporting entities should consider disclosing information in the.

On The Radar Contingencies Loss Recoveries And Guarantees Dart Deloitte Accounting Research Tool Income Tax Form 26as Pdf Ratio Analysis In Tamil

450-20 Contingencies Loss Contingencies Amended The proposed amendments would amend the guidance on disclosure of certain loss contingencies. ASC 450 requires the disclosure of loss contingencies as discussed in FSP 23. An accrual is not made for a loss contingency because any of the con-ditions in paragraph 450-20-25-2 are not met. The SECs expectations about disclosures related to regulatory actions are similar to its expectations about litigation contingencies.

For example ASC 450 does not differentiate between near- and long-term contingencies. The Financial Accounting Standards Boards FASB ASC Topic 450 Contingencies formerly known as Statement of Financial Accounting Standards FAS 5 addresses the proper accounting treatment of nonincome tax contingencies. Gain contingencies usually are not be reflected in the financial statements because to do so might be to recognize revenue before its realization.

This Roadmap provides Deloittes insights into and interpretations of the accounting guidance in 1 ASC 450 on loss contingencies gain contingencies and loss recoveries and 2 ASC 460 on guarantees. Scope of loss contingencies. ASC 275 does not change those requirements but supplements them.

How To Account For Gain And Loss Contingencies Company Financial Projections Capta Audit Report

ASC 450 Contingencies outlines the accounting and disclosure requirements for loss and gain contingencies. If a loss is reasonably possible disclose in the notes. ASC 450 incorporates all contingencies which may include regulatory actions brought by the SEC the US. ASC 450-20 Loss Contingencies which.

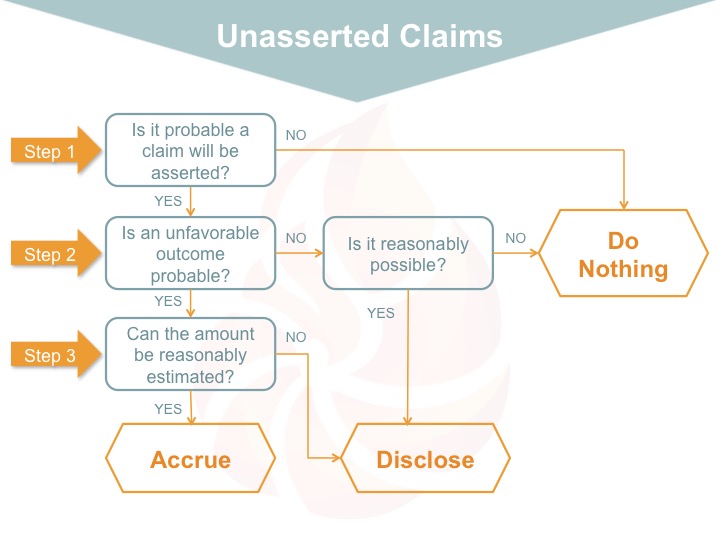

ASC 450 defines a contingency as a situation involving uncertainty as to possible gain or loss that will ultimately be resolved when. An estimated loss from a loss contingency is recognized only if the available information indicates that 1 it is probable that an asset has been impaired or a liability has been incurred at the reporting date and 2 the amount of the loss can be reasonably. With respect to disclosures ASC 450 requires the entity to disclose the nature of the unasserted claim or loss contingency and either an estimate of the possible loss a range of the possible loss or a statement that such an estimate cannot be made be disclosed.

Loss Contingencies is a principal source of guidance on accounting. Loss Contingencies ASC 450. Loss Contingencies ASC 450.

Asc 450 20 Loss Contingencies Orig Pdf Financial Statement Accrual Travel Agency Income And Expenditure Account Balance Sheet Format

As discussed in ASC 450-20-50-6 disclosure is generally not required for a loss contingency involving an unasserted claim or assessment if it is not probable that a claim will be asserted. Contingencies FAS 5 the original FASB pronouncement superseded by the substantively same FASB Accounting Standards Codification ASC subtopic 450 -20 Contingencies. 210-20 Balance SheetOffsetting Consequential Amendment The substance of the guidance in this Subtopic would not be changed by the proposed amendments. Although the guidance in FASBs ASC 450 on accounting for contingencies has not changed significantly for decades it is often challenging to apply this guidance because of the need for an entity to use significant judgment in doing so eg when developing legal interpretations.

If it is probable a liability. ASC 450-10 Overall which along with ASC 450-20 and 450-30 provides guidance on accounting and disclosures for contingencies.

Current Liabilities And Contingencies Ppt Download Major Types Of Financial Statements Define Investing Activities

Top 10 Issues To Consider When You Are Sued Issue 8 Disclosing Litigation And Reserving For Losses Perkins Coie How Do I Get A Financial Statement Retained Earnings From Income

Solved Need Help Answering These Questions And Understanding Chegg Com Capital Expenditure In Balance Sheet Accounts Payable Audit Companies

Example Accounting For Unasserted Claims Asc 450 Gaap Dynamics Usps Audit Blank P&l Statement