Trading and Profit and Loss Account Balance Sheet Classification of Assets and Liabilities Adjustment Entries Closing Entries. B Provision for doubtful debts at 5 of sundry debtors.

CA FOUNDATIONPRINCIPLES AND PRACTICE OF ACCOUNTING PREPARATION OF FINAL ACCOUNTS OF SOLE PROPRIETORS UNIT. 3600 has been earned but not received till the closing of accounts. Sole Proprietors Unit 1 Final Accounts of Non-Manufacturing Entities Financial Statements Financial Statements are prepared at the end of an Accounting Period to show the financial performance ie profit earned or loss incurred during the accounting period and financial position Assets and Liabilities of the business as on that date. This includes trading profit and loss account and balance sheet.

Final accounts of sole proprietorship.

Arts Crafts Income Statement Profit And Loss Cost Of Goods Sold Owners Equity List Common Size Analysis Cash Flow

Chapter deals with preparation of final accounts of sole proprietors headed by one person only. But in the case of sole proprietorship income tax is treated as a personal expense. The first stage in preparing final accounts is to prepare pro-forma Trading Account Profit Loss Account and Balance Sheet as per the requirement of the question. 1 FINAL ACCOUNTS OF NON-MANUFACTURING ENTITIES INTRODUCTION Non-manufacturing entities are the trading entities which are engaged in the purchase and sale of goods at profit without changing the form of the goods.

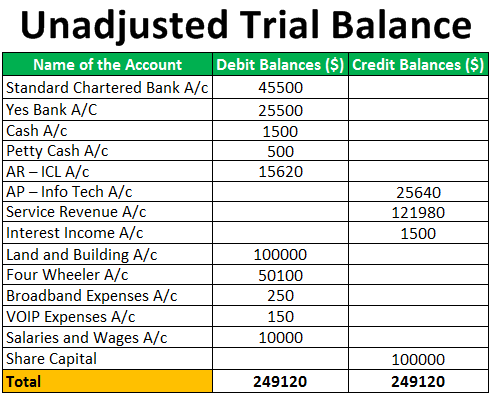

Preparation of Final Accounts of Sole Proprietor Final accounts of the business are prepared after trial balance. Free samples distributed for publicity costing Rs. This chapter holds a weightage of up to 12 marks in.

Financial Accounts Problems for Class 11. Let see how we should answer for this question step by step. FINANCIAL STATEMENTS OF A SOLE PROPRIETORSHIP Summarizing 2.

Arts Crafts Income Statement Profit And Loss Template Condensed Financial Statements Example Proprietary Fund Are Prepared Using The

FINAL ACCOUNT OF SOLE PROPRIETORSHIP FIRM WITH ADJUSTMENTS View Demo. Included in wages account. D Commission of Rs. Non-manufacturing entities are the trading entities which are engaged in the purchase and sale of goods at profit without changing the form of the goods.

After the trial balance gets completed final accounts of the sole proprietorship are prepared. Then write the titles and draw. GH2400 represents prepaid Insurance.

Class 11 Final accounts of Sole Proprietorship Firm BY CACMA Santosh Kumar. Lighting and Heating. A Closing stock Rs 35000.

Touch This Image The Balance Sheet By Agatha Engel Template Sole Proprietorship Mlse Financial Statements Audit Committee And Reporting Quality

Statement of Financial Position as at 31122015. Financial Accounting and Reporting volume of the comprehensive four-volume paperback reviews all current AICPA content requirements in financial accounting and reporting. The final accounts for a sole trader business are the Income Statement Trading and Profit loss Account and the Balance Sheet. I want to view the answers of final account chapter.

All the important topics will be discussed in detail and would. For the purpose of final accounts the sole proprietors can be classified into non-manufacturing and manufacturing business entities. Meaning and preparation of Trading account Profit and Loss account and Balance sheet based on the given trial balance with the adjustment of closing stock only.

Examine all Items of Trial Balance very Carefully. With 3800 multiple-choice questions in all four volumes these study guides provide all the information. Many of the questions are taken directly from previous CPA exams.

Should You Run Your One Person Business As A Sole Proprietorship Epw Small Law Pc Bookkeeping Which Companies Are Required To Prepare Consolidated Financial Statements Statement Of Activities Charity

Financial accounting the field of accounting concerned with analysis and reporting of financial transactions related to the business is one of the topics included under the Class 11 Accountancy syllabus. Prepare Pro-Forma Final Accounts. Final Accounts of a Sole proprietorship business part 1 1. In this course CA Jaydip Thakkar will cover Final Accounts without with Adjustments of Sole Proprietorship for Term II as per revised syllabus.

Final Accounts of Non-Manufacturing Entities. Let us learn in more detail about it. Preparation of manufacturing account profit and loss on sale of assets intangible and fictitious assets prepaid and accrued expenses and incomes are excluded.

C Depreciation furniture and machinery by 10. 500 1667 Off Change Mode. Statement of Profit or Loss for the year ended 31122015.

Samacheerkalviguru 11thaccountancysolutions Chapter12finalaccountsofsoleproprietorsi In 2021 Accounting Principles Sole Proprietor Solutions Zappos Financial Performance Profitability Ratio Analysis Project Report

21 rows Closing Inventory was GH300000. The final accounts may be prepared in vertical or horizontal format. 02 Aug 2021 ANGSHUK D. By CACMA Santosh Kumar.

CA Jaydip Thakkar. Financial statements are the Last stage of the Accounting Process From Trial balance list of all Expenses Incomes Assets liabilities final Acs are prepared. The final accounts give an image of the money-related situation of the business.

It shows whether or not your business has made a benefit or loss during the bookkeeping time frame and whether debts can be paid as they become due. Final Accounts of Sole Proprietorship Commercial Studies ICSE Class 10 Sir Tarun RupaniFinalAccountsOfSoleProprietorshipSirTarunRupaniCommercialStudi. It shows where or not your business has made a profit or loss during the accounting period and whether you are able to pay your debts as they become due.

Sole Proprietorship Bookkeeping Business Basics Operating Expenses On Income Statement Analysing And Interpreting Financial Statements

Download Link with e-Book. 03 Apr 2022 SRISHTI B. It is debited to the Capital Account and not to. Depreciation is to be provided on plant and machinery 15 pa.

Create a provision for doubtful debts 5 and provision for discount on debtors 25. Final accounts of non-manufacturing entities include Trading account Profit and Loss Account and Balance Sheet while final accounts.

Financial Statements Of Sole Proprietor Final Accounts Without Adjustments Statement Revenue Recognition Notes To Preparation With The Help Journal

Income Statement Retail Whsle Sole Proprietor Multiple Step Business Forms Accountingcoac Cost Of Goods Sold Profit And Loss Combined Financial Statements Us Gaap Internal

Notes To Financial Statement Of Sole Proprietorship Philippines 1 Signs You Re In Love With Youre Consolidated Account Meaning How Add Net Income Balance Sheet