When trying to interpret what the debt to assets ratio means it is best to keep in mind that if a company has a debt to asset ratio of more than 1 than they have the majority of their financing through debt rather than equity and could potentially. Calculate the current ratio for each company3.

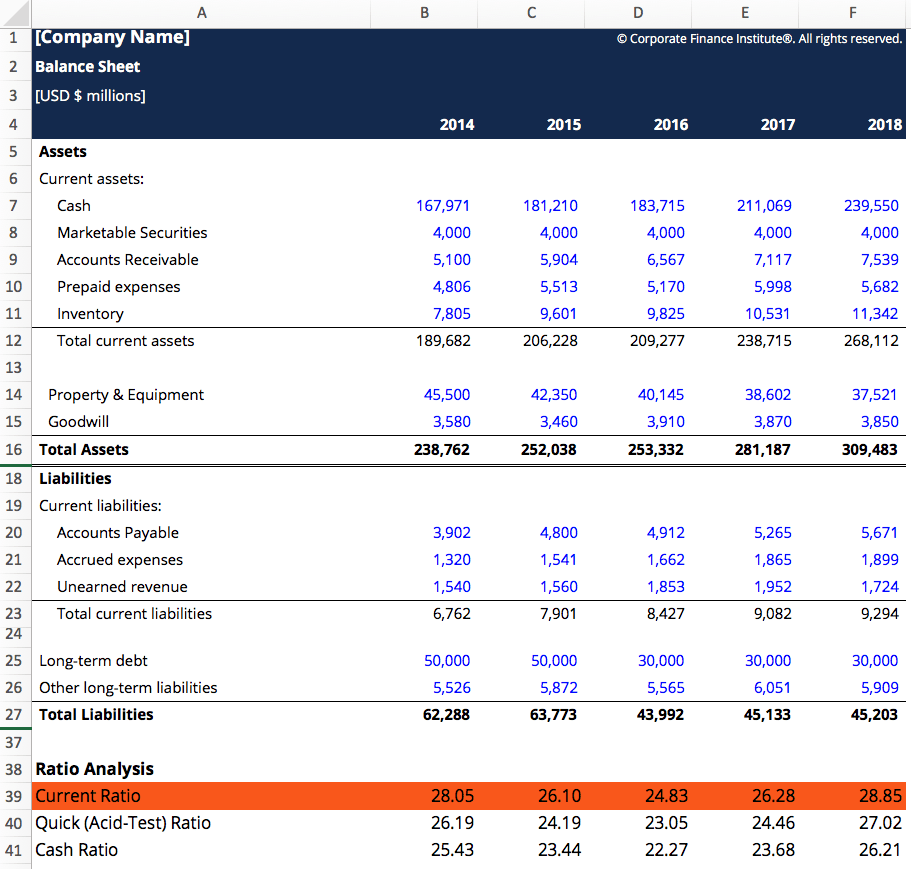

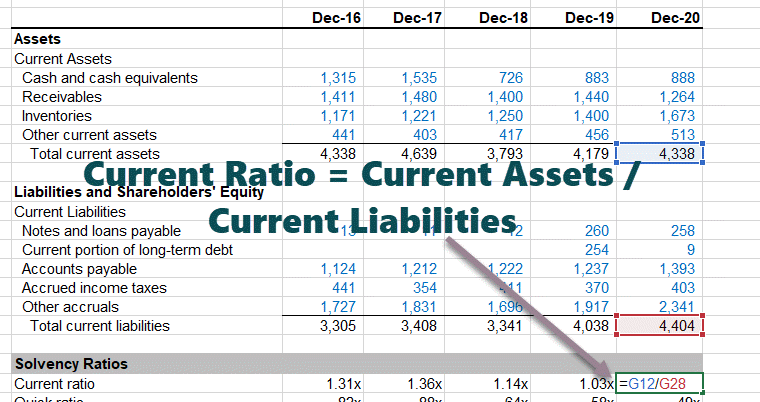

Consider the following data. Calculate the quick ratio for each year. Current ratio current assets Current liabilities. Comment on the firms liquidity over the 2016-2019 period.

Calculate the current ratio for each year.

Acid Test Ratio Vs Current Formula Comparison What Is An Unclassified Balance Sheet Kering Group Financial Statements

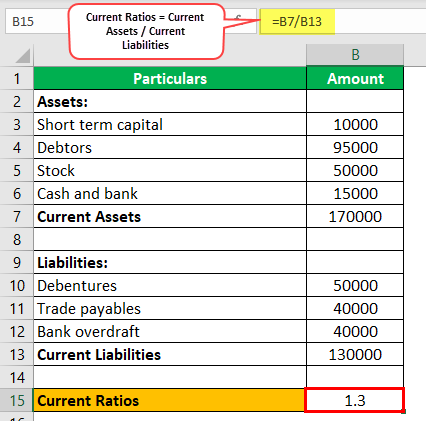

Quick ratio Current assets – InventoryCurrent liabilities Quick ratio 2017 96171 – 5463264628 64 times Quick ratio 2018 104124 – 5720469060 68 times c. Do not round intermediate calculations and round your answers to 2 decimal places e. Calculate the current ratio as follows. If you were told that Bauman Companys inventory turnover for each year in the – period and the industry.

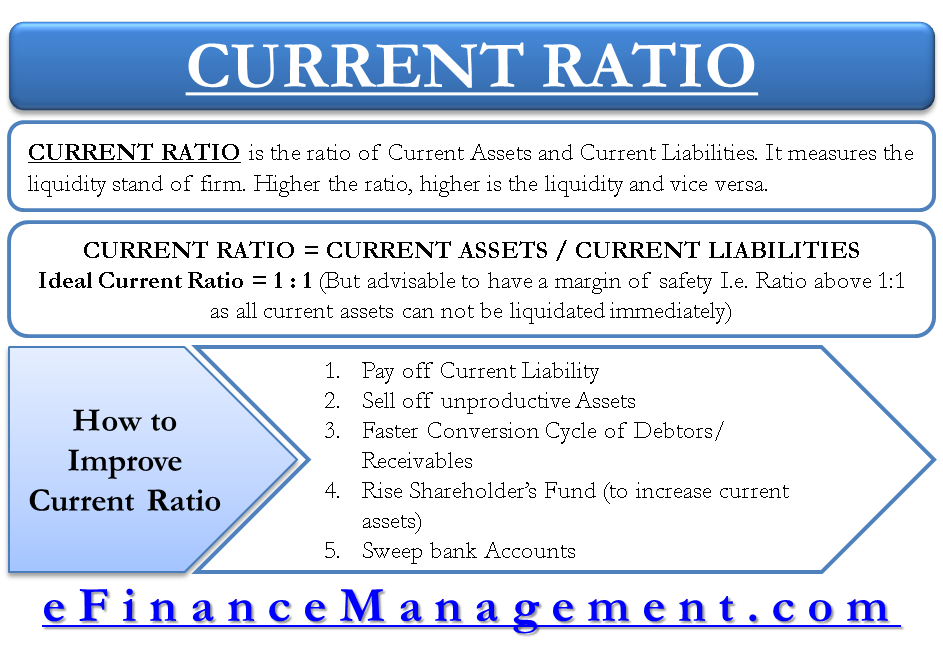

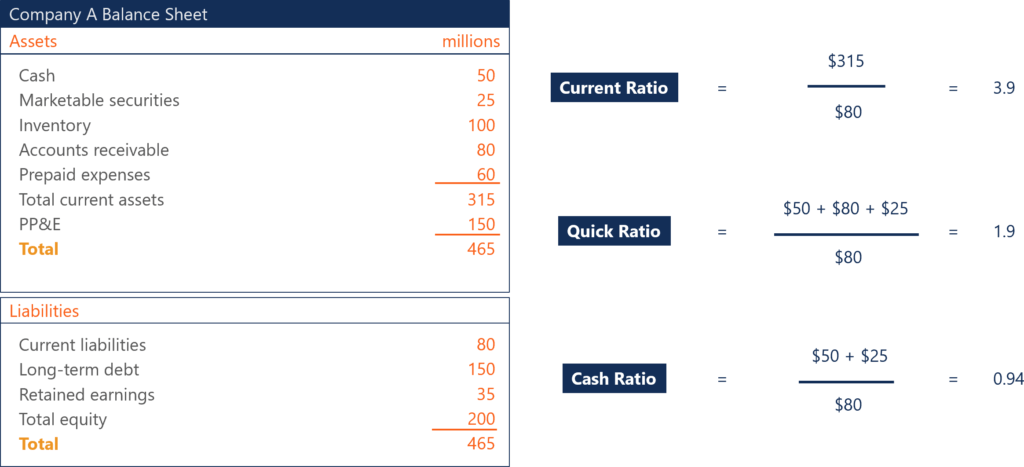

Current assets Current liabilities Cash 14200 18260. Calculate the current ratio for each year. The current ratio also known as the working capital ratio is a measure of a companys liquidity or its ability to meet short-term obligations.

Do not round intermediate calculations and round your answers to 2 decimal places eg 3216 C. The ratio considers the weight of total current assets versus total current liabilities. Likewise we calculate the Current Ratio for all other years.

Current Ratio Formula Examples How To Calculate Small Business Financial Statement Template Excel Discount Received Balance Sheet

Current ratio Do not round intermediate calculations and round your answers to 2 decimal places eg 3216 b. Question 1 Prepare new balance sheet information assuming current liabilities remain unchanged at 400 SAR each year and the 400 SAR increase in debt is added to long-term liabilities. A Current ratio Current assetsCurrent liabilities 2017 11500073800 156 2018 13896095280 146 b Quick ratio Current Assets – InventoryCurrent Liabilities 2017 115000 – 7460073800 055 2018 138960 – 8712095280 054 c Cash ratio CashCurrent liabilities 2017 1020073800 014. Enter in the total amount of debt and the total amount of assets and then click the calculate button to calculate the debt to assets ratio.

Exercise 2-11 Suppose the following data were taken from the 2017 and 2016 financial statements of American Eagle Outfitters. Do not round intermediate calculations and round your answers to 2 decimal places e. Calculate the total debt ratio and long-term debt ratio for each year.

Accounts receivable 19000 23100. Calculate the cash ratio for each year. Round to two decimal places.

Accounting Ratios Formulas Examples Top 4 Types A Trial Balance Is Used To Confirm That Retained Income Note Format

Calculate the NWC to total assets ratio for each year. Calculate the current ratio for each year. Bauman Companys current ratio for year 2012 is 179. All numbers including share data are in thousands2017 2016 Current assets 925359 1020834 Total assets 1963676 1867680 Current liabilities 401763 376178 Total liabilities 554645.

Inventory 5650 6930 7340 7560. To calculate your own current ratio use our. Calculate the cash ratio for each year.

Calculate your current ratio below. Calculate the firms current and quick ratios for each year. Calculate the quick assets and the quick ratio for each company2.

Current Ratio Formula Examples How To Calculate Nike Cash Flow Analysis Interest In Balance Sheet

Calculate the current ratio for each year. Current ratio is a comparison of current assets to current liabilities calculated by dividing your current assets by your current liabilities. Calculate the cash ratio for each year. Compare the resulting time series for these measures of.

Calculate the quick ratio for each year. By comparing current assets to current liabilities the ratio shows the likelihood that a business will be able to pay rent or make payroll for example. View The Charter Company Ratiosxlsx from ACG 6175 at Florida International University.

Round to two decimal places Bauman Companys current ratio for year 2013 is 173. Calculate the current ratio for each year. Which of the companies should be concerned about.

Liquidity Ratio Overview Types Importance Example Vmware Financial Statements Balance Sheet Of Amazon 2019

Cash ratio Cash Current liabilities Cash ratio 2014 9000 93800 10 times. Quick ratio Current assets – Inventory Current liabilities c. Current ratio Current assets Current liabilities Current ratio 2014 103000 93800 110 times Current ratio 2015 129750 104250 124 times b. Current ratio Current assetsCurrent liabilities Current ratio 2017 9617164628 149 times Current ratio 2018 10412469060 151 times b.

Calculate the cash ratio for each year. Accounts payable 58400 61820. Question 2 Calculate the current ratio and.

Based on the balance sheets given for Bethesda Mining calculate the following financial ratios for each year. Quick ratio Do not round intermediate calculations and round your answers to 2 decimal places eg 3216 c. The current ratio is calculated simply by dividing current assets by current liabilities.

Current Ratio Formula Examples How To Calculate Indian Oil Corporation Financial Statements P&l Account Meaning

The Current Ratio formula is Current Assets Current Liabilities. Calculate the quick ratio for each year. Calculate the firms current and quick ratios for each year. Do not round intermediate calculations and round your answers to 2 decimal places eg 3216 b.

The current ratio also known as the working capital ratio measures the capability of a business to meet its short-term obligations that are due within a year. Notes payable 23400 25080. Calculate the following ratios for each year during the.

The following observations can be made with regards to Colgate Ratios This ratio increased from 100x in.

Ratio Analysis Definition Formula Calculate Top 32 Ratios Gasb 84 Summary Pro Forma Real Estate

Current Ratio Formula Examples How To Calculate Month End Balance Sheet Reconciliation Partnership Financial Statements Pdf

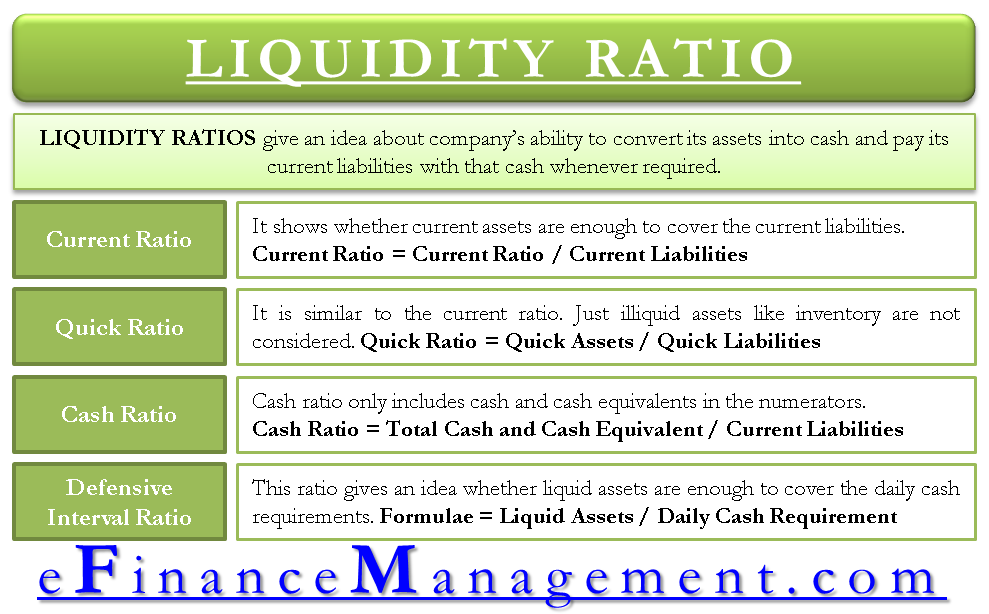

Liquidity Ratios Efinancemanagement Accounts Receivable Are Valued And Reported On The Balance Sheet Pepsico Financial Statements 2019