Characteristics of operating. Analysis and Interpretation The degree of operating leverage can show you the impact of operating leverage on the firms earnings before interest and taxes EBIT.

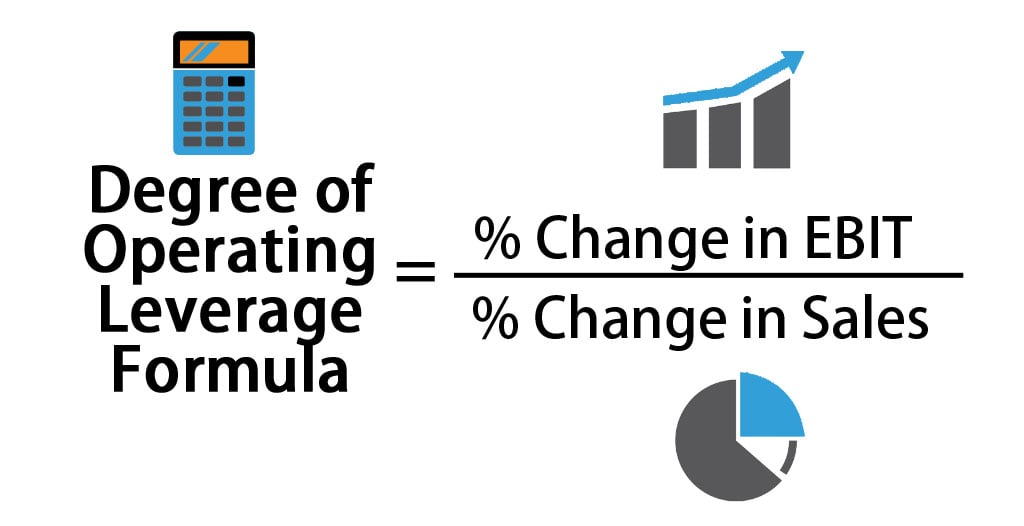

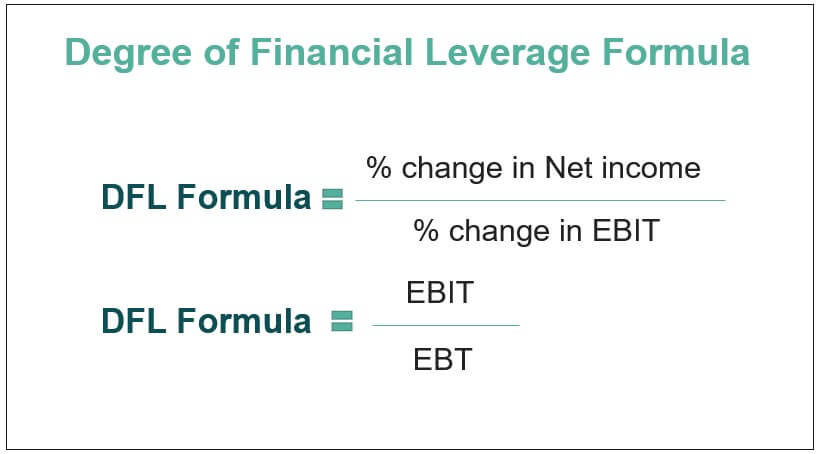

Formula Interpretation Degree of operating leverage DOL An index for a of sales that measures the effect of a change in sales S on the firms operating income EBIT. Also have a look at EBIT vs. The degree of financial leverage is a financial ratio that measures the sensitivity in fluctuations of a companys overall profitability to the volatility of its operating income caused by changes in its capital structure. Alternatively it is an indicator of the riskiness variability of a firms EBIT to the use of.

Degree of operating leverage interpretation.

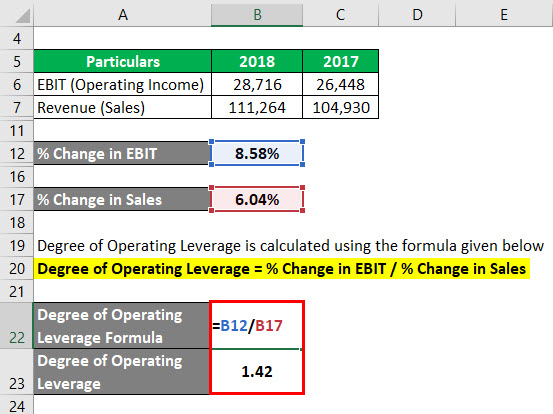

Degree Of Operating Leverage Formula How To Calculate Dol Profit And Loss Statement Analysis Example Other Name For Income

DFL 1 t ROA r D E In this formula DFL degree. The degree of total leverage can be calculated by dividing the percentage change in earnings per share EPS and the percentage change in sales revenue. The Interpretation of Financial Statements. Degree of Total Leverage DTL Percentage change in EPS Percentage change in Sales.

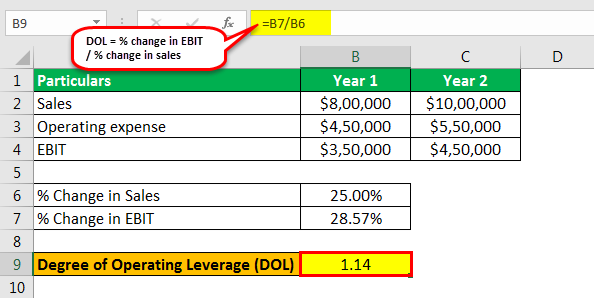

ABC has a contribution margin of 70 and net operating income of 10000 which gives it a degree of operating leverage of 7. The degree of operating leverage is not a constant. This can be seen from the tabulation below which shows the DOL for company A at various levels of sales.

A companys operating leverage involves. Based on the calculation if Gigatons sales increased by 10 its profits would increase by 1278. Operational leverage takes place in the presence of fixed costs in the companys cost.

Degree Of Operating Leverage Formula Calculation Examples What Are The Three Main Financial Statements Profit And Loss Summary Account

DOL measures how sensitive a companys operating income is to changes in product demand as measured by. Multiple Choice Ovelofsalos wm ht to breakaon port rang lowage of 5 mars thit sales can decrease by 5before the terms ament Oper gle erage of 5 mers tat fsalosnoeiseby5the tm wil ht its break aven port 0erangleer ofSmarsthat f sales moease by. Financial leverage helps to magnify the results of debt. The higher the operating leverage the higher is the business risk for a company.

Which of the following is the correct interpretation of a degree of operating leverage of 5. It can be computed as follows. Degree of Financial Leverage Formula change in EPS change in EBIT The ratio shows that the more the value the more volatile is the EPS.

EBITDA – Top Differences EBIT signifies the operating profit the company makes before the inclusion of interest and tax expenses. Also the DOL is important if you want to assess the effect of fixed costs and variable costs of the core operations of your business. Definition of Operating Leverage.

Operating Leverage Ratio Analysis Double Entry Bookkeeping Igl Balance Sheet Prepaid Insurance In Profit And Loss Account

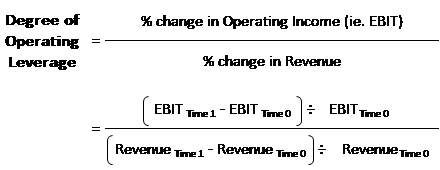

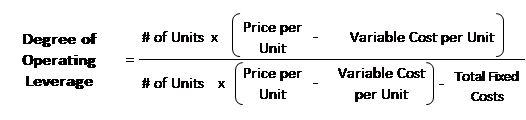

Alternatively it is an indicator of the riskiness variability of a firms EBIT to the use of fixed costs F in the firms cost structure. Degree of Operating Leverage GAO Δ of UAII Δ of sales or the percentage change. The degree of operating leverage DOL is a measure used to evaluate how a companys operating income changes after a percentage change in its sales. Importance and Interpretation A high degree of operating leverage means unpredictability of earnings before interest and taxes for a company even if.

Operating leverage deals with the investment in fixed costs and their effect on the operating profits. Operating leverage of 5 means that the company would need to increase sales by 5 times in order to hit its break-even point. The degree of operating leverage DOL assists a company in quantifying its operational risk ie the risk arising from its mix of fixed and variable costs.

The term degree of operating leverage is used synonymously which is defined as the change in operating profits due to a unit change in the level of revenues. Operating Leverage Analysis The degree of operating leverage reflects the ratios effect on the companys earnings before interest and taxes EBIT. Data used earlier for company A is shown in red color.

Operating Leverage Formula And Excel Calculator Royal Bank Financial Statements Apple Annual Report 2016

EBITDA Top differences EBIT Vs. Since interest is a fixed expense leverage magnifies returns and EPS which is good in situations where the operating income is rising. For instance if your degree of operating leverage is 50 then a 10 increase in Sales will translate into a 50 50 10 increase in Operating profit all other things being equal. Below is the formula that we can use to calculate the DTL.

The degree of operating leverage DOL is a multiple that measures how much the operating income of a company will change in response to a change in sales. It is greatest at sales level near the break even point and decreases as sales and profit rise. In this case Gigaton would have operating leverage of 12778 or 12778.

The degree of operating leverage is a ratio that tells you how much your Operating profit will change due to a change in Sales. Operating leverage of 5 measures the degree of debt employed by the firms debt structure. Degree of Operating Leverage 3325 132x This means that Operating profit changes by 2 for every 1 change in Sales.

Degree Of Operating Leverage Dol Cfa Level 1 List Audit Firms Method Preparing Trial Balance Sheet With An Example

Operating Leverage Operating leverage formula. ABCs sales then increase by 20 resulting in the following financial results.

Degree Of Operating Leverage Formula How To Calculate Dol Ratio Analysis Reliance Industries Limited Pdf Amazon Cash Flow Statement

Degree Of Operating Leverage Dol Cfa Level 1 Financial Ratios For Dummies Vertical Analysis Balance Sheet Example

Degree Of Operating Leverage Fundsnet Share Balance Sheet Understanding Financial Statements For Dummies

Degree Of Financial Leverage Formula Step By Calculation Factset Statements Balance Sheet Software Free Download