Yes it is mandatory for Nidhi company to prepare a. The cash flow statement is a mandatory part of a companys financial reports it records the amounts of cash and cash equivalents entering and leaving the company.

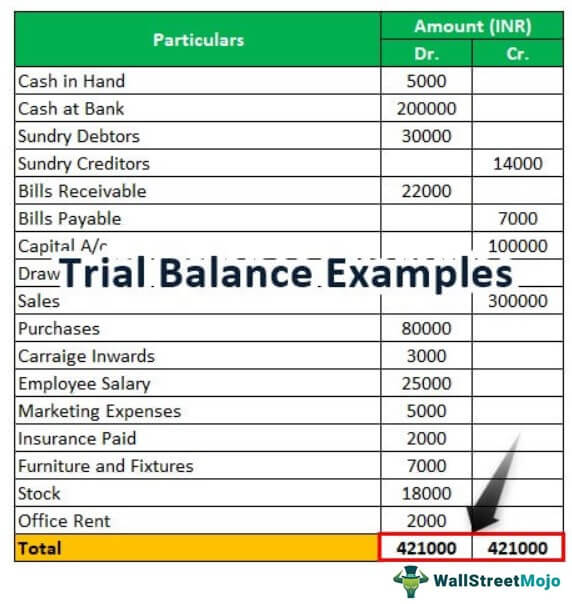

Yes the Subsidiary company or holding company is not considered as a small company hence preparation of Cash Flow Statement is mandatory for both. Ii a profit and loss account or in the case of a company. 32 are required to prepare cash flow statement as per AS 3 of Accounting standards issued by the ICAI. Statement of Cash Flows Direct Method The Towne Companys income statement and comparative balance sheets as of December 31 of 2013 and 2012 follow.

Cash flow statement mandatory for which companies.

Understand Xbrl Filing Procedure With Legalpillers Business Rules Cash Flow Statement Data Key Financial Ratios For Investors Preparation Of Consolidated Balance Sheet Holding Company

Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period. Significant level 3 investments above 10 of a funds securities would trigger a statement of cash flows requirement. Is one of the three key financial statements that report the cash generated and spent during a specific period of time eg a month quarter or year. Earlier only listed companies under listing agreement clause no.

As per Sec 2 40 for financial statement in relation to a company includes. Simply We can state that the cash flow statement is applicable for all companies including Private Company however the certain exemption is provided to OPC Dormant Companies and Small. Do small companies required to prepare a Cash Flow Statement.

Both C and B. AS 3 which deals with the Cash flow statement is not mandatory for medium and small sized companies. Now we have to check the definition of One Person Company small company and dormant company.

Ffmc License Online Financial Advisory Money Changers Statement Us Gaap Statements Balance Sheet Basics Software

Earlier Company act 1956 didnt include cash flow statement in the Defination of Financial statement However as per New Company Act 2013 the Cash flow statement shall to prepare. As per the definition of financial statements Section 2 40 of the Act the cash flow statement is not applicable to small companies. The cash flow statement analyzes the cash income and expenditures during a financial period and it has three parts which show the variations in the firms cash flows including operational investment and. Both A and C.

Earlier only listed companies under listing agreement clause no. Small and medium-sized company SMC as defined in clause 2f of the Companies Accounting Standard Rules 2006 means a company-. Why or why not.

All Companies Public or Private are mandatorily required to prepare Cash flow statement except One Person Company Small Company and Dormant company. The statement of cash flow depicts where a company receives its money from and how it expends its money. None of the above.

What Is Capital Structure And Why It Matters In Business Fourweekmba Cash Flow Statement Profit Loss Sunpower Financial Statements Balance Sheet Ratios Pdf

TOWNE COMPANY Income Statement For the Year Ended December 31 2013 Service Fees Earned 443800 Dividend and Interest Income 19600 463400 Wages and Other Operating Expenses. H ence it has a weaker cash position. Simply We can state that the cash flow statement shall be prepared for all companies including Private Company however the certain exemption is provided to OPC Dormant Companies and Small Companies. As per AS-3 Cash Flow Statement is mandatory for A All enterprises B Companies listed on a stock exchange C Companies with a turnover of more than Rs 50 crores Prepare Practice.

A company is required to present a statement of cash flows that shows how its cash and cash equivalents have changed during the period. Operating activities Dividends from joint ventures and associates Returns on investments and servicing of finance Taxation Capital expenditure and financial investments. Companies with turnover of more than Rs.

As per AS-3 Cash Flow Statement is mandatory for A All enterprises B Companies listed on a stock exchange C Companies with a turnover of more than Rs 50 crores. The definition of a small company makes it mandatory to fulfil both the conditions ie. Companies listed on stock exchange.

What Is A Financial Statement Statements In Nutshell Fourweekmba Cash Flow Income Commerce Balance Sheet Extended Trial

Earlier The Company act 1956 didnt include Cash flow statement in the definition of Financial statement. Both A and B. Under FRS 1 Cash Flow Statements reporting entities preparing a cash flow statement had to classify their cash flows under nine headings as follows. Is a cash flow statement mandatory for Nidhi company.

How is IAS 7 different from ASC 230. Cash flows are classified as either operating investing or financing activities depending on their nature. Do entities other than public business entities that are required to present a statement of cash flows under Topic 230 that is private companies and notforprofit entities but not employee benefit plans need additional time to apply the proposed amendments.

Net Cash Flow -850 Cash In 0 Cash Out 850. The total cash-out in the same years was Rs66 crore. Paid-up capital and turnover as there is and between both the conditions.

Moshiur Rasul I Will Prepare Financial Statement Income Balance Sheet For 25 On Fiverr Com Business P And L Template Pvh Statements

It was able to collect Rs80 crore from its customer. The three main components of a cash flow statement are cash flow from. As per AS-3 Cash flow statement is mandatory for. The entity had little or no debt outstanding during the period presented.

The statement of cash flows acts as a bridge between the. Company B has reported Rs10 crore profit in its profit and loss account. Preparing cash flow statements is mandatory for all companies except one person company dormant company and small company.

As per the definition of financial statements Section 2 40 of the Act the cash flow statement is not applicable to small companies. This company will have a negative cash flow. 32 are required to prepare cash flow statement as per AS 3 of Accounting standards issued by the ICAI.

How To Do A Simple Spreadsheet Statement Template Profit And Loss Templates Financial Analysis Reporting Syllabus Cash Flow Activities

Cash flow statement CFS is mandatory. It means all the companies whether private or public needs to include cash flow statement in its financial statement except the One Person Company small company and dormant company. Again there is no set threshold as to the definition of little or no debt but the industry practice is also 10 as discussed in the November 2012 Investment Companies Expert Panel meeting.

Long Term Debt Types Benefits Disadvantages And More Money Management Advice Finance Investing Accounting Receivable Turnover Ratio Interpretation Expected Credit Loss Journal Entry

The Central Board Of Indirect Taxes And Customs Cbic Has Made Simplification In Filing Gstr 9c Ahe 2020 Cash Flow Statement Tax Business Updates Discontinued Operations Income Prepaid Advertising On Balance Sheet

Pin By Kristina Monroe On Crafts Accounting Education Learn And Finance For Non Profit Organisation Prepare Trading Loss Account Balance Sheet