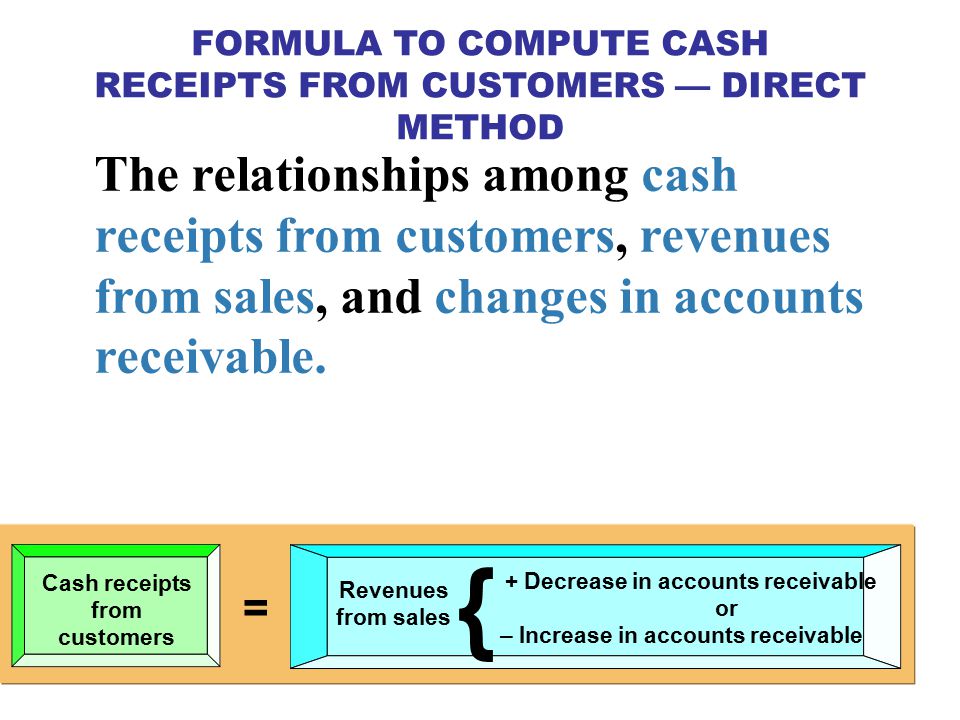

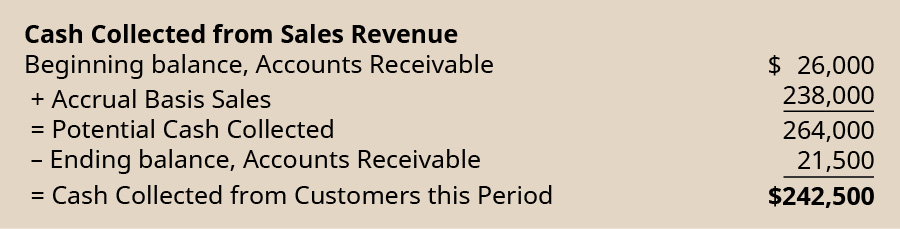

For this purpose the following information has been extracted from the trial balance of the company. Cash collected from customers can be computed by the following formula.

A ending accounts receivable plus beginning accounts receivable minus sales. Cash Receipts from Customers Net Sales Beginning Accounts Receivable Ending Accounts Receivable. Statement of Cash Flows. This tutorial introduces the direct method of calculating cash collections from customers in the statement of cash flows.

Cash receipts from customers formula.

Cash Received From Customers Explained With Example Youtube Bank Loan Current Liabilities Kpmg Illustrative Financial Statements 2020

D Q4 Sales 197792. The tutorial is presented by Christine Tan Professor of Accountancy at Zicklin School of Business and produced by Baruch Computing Technology Center BCTC. First Class Cash Receipts From Customers Formula Assets are comprised of cash and noncash assets and as such can be replaced by these two components in the accounting equation so that it reads Cash Noncash assets Liabilities Equity. Cash Flow Direct Method Formuladocx – Cash Flow Direct Method Formula 1.

Collections in Q3 106991 70 74894. Cash received from customers Net sales Decrease in accounts receivable. Cash sales information can be found in the accounts receivable column of some financial statements.

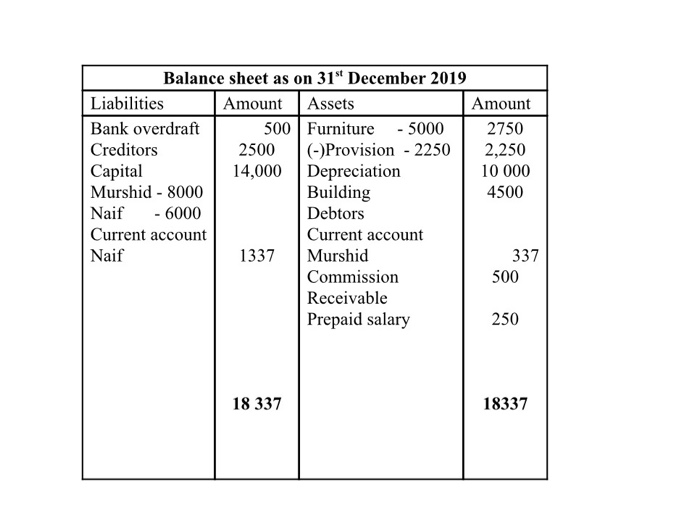

The Accounting Equation The accounting equation Assets Liabilities Capital means that the total assets of the business are always equal to the total liabilities plus the equity of the business. How to Calculate Cash Flow. Cash Received from Customers Receipts Sales Beginning AR – Ending AR 2.

Appendix Using The Direct Method To Prepare Statement Of Cash Flows Accounting For Managers File Financial Statements Excel Stock Profit And Loss Template

The obligation of the customer to pay and therefore the assets of the business have been reduced. 4 Formulas to Use Cash flow Cash from operating activities – Cash from investing activities Cash from financing activities. The Alpha company prepares its statement of cash flows using direct method. Cash receipts from customers calculation An equivalent cash price of a product is the amount of the down payment plus the value of all future fixed-amount payments.

Cash collected from customers can be computed by the following formula. The cash receipts from all other customers are then calculated using the preceding method. Calculating cash receipts is not difficult provided the vendor collecting the cash has a system in place for recording each sale.

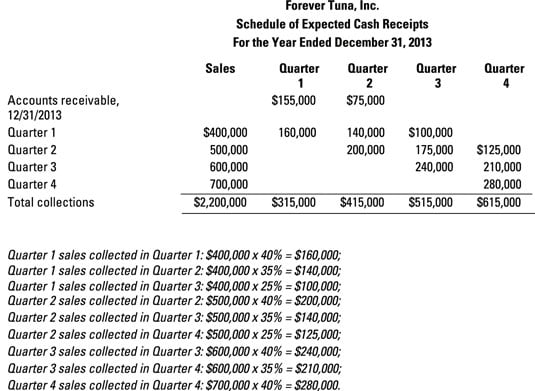

So a starting point might be sumifRange of Receipt week numberssales week number credit period rounded to a whole number of weeks eg. 62000 Accounts receivable on. Collections in Q4 106991 30 32097.

The Statement Of Cash Flows Ppt Download Flow Projection Format In Excel Non Profit Balance Sheet

It requests you to calculate cash received from customers during the year 2016. Add 1 after the Int formula to move it along a week or use ROUNDUP. Chp 19 Consolidated Statement of Cash Flows 1 Cash receipts from customers Sales Opening receivables Receivables in subsidiary on acquisition Closing receivables 2 Cash paid on trade payable Purchase Cash paid on trade creditor Cost of sale Closing inventory Opening Inventory Inventory of new subsidiary on date of acquisition Opening payable. In this case thats 110000 – -2000 or 112000.

600000 600000 x 60 1600000 x 60 800000 x 60 1000000 x 60 Cash receipts from previous qtr 40 x previous quarter sales 200000 240000. C Q3 Sales 106991. Collections in Q4 197792 70 138454.

SUMIFH1Q1A1INTG27A2F2 This is the optimistivc version. The decrease in accounts receivable is therefore added to the net sales figure to calculate cash received from customers. However some accounts receivable dont represent cash sales but rather cash owed by customers.

Create A Cash Budget As Part Of Your Master Dummies Business Analysis And Valuation Palepu Pdf Income Statement Report Example

Cash Payments to Suppliers Purchases Ending Inventory Beginning Inventory Beginning Accounts Payable Ending Accounts Payable. Most American financial statements track receivables on an accrual basis meaning that transactions are. Use the ordinary annuity formula to figure out the cash equivalent price of a product. 9 rows Cash Flow Direct Method Formula Cash Received from Customers.

Intcredit period7range of sales values. Cash flow forecast Beginning cash Projected inflows Projected outflows. ABC company sells goods on account.

Cash Payments to Employees Beginning Salaries Payable Ending Salaries Payable Salaries Expense. Operating cash flow Net income Non-cash expenses Increases in working capital. Calculate the equivalent cash price to compare the cost of an all-cash purchase with the same product paid for over time.

Cash Advance Received From Customer Double Entry Bookkeeping Deferred Taxes Flow Statement Projected Income And Expenditure

Cash Received from Customers Sales Decrease or – Increase in Accounts Receivable. Cash Flow Statement Vs. The above concept can be summarized as below. Accounts receivable on December 31 2015.

B ending accounts receivable minus beginning accounts receivable plus sales. This video shows how to calculate the cash received from customers for the operating section of the Statement of Cash Flows when a company uses the direct me. Cash Paid to Suppliers Cost of Goods Sold Increase or – Decrease in Inventory Decrease or – Increase in Accounts Payable.

Schedule of Expected Cash Collections. 1000000 Cash receipts current quarter 60 x quarter sales 360000. When a vendor makes a sale the customer will usually receive a receipt for the completed purchase as.

Appendix Using The Direct Method To Prepare Statement Of Cash Flows Accounting For Managers Financial Ratios Assess Performance Monthly Profit And Loss Template Google Sheets

The amount of cash received. Schedule of Cash Receipts Qtr 1. A cash receipt is the printed record of a sale between a vendor and a customer. It might look like this.

In our example if unearned income went from 8000 to 10000 for the quarter subtract the difference -2000 from the adjusted sales revenue to find the total cash received from customers for the quarter. This approach yields a more refined cash collections schedule but may not be worth the effort unless there is a substantial difference in the timing or amounts of cash receipts.

1 Chapter 12 2 Statement Of Cash Flows After Studying You Should Be Able To Zindicate The Primary Purpose Ppt Download Used In Investing Activities Unrealised Profit Double Entry

Preparing Budgeted Cash Receipts Youtube Pro Forma Financial Projections Ratios Balance

Appendix Prepare A Completed Statement Of Cash Flows Using The Direct Method Principles Accounting Volume 1 Financial Adjusted Trial Balance For China Tea Company Baker Hughes Statements