Incorrect inclusion towards ledger accounts Example that is at the end of the financial year while tallying the capital account credit amount of 9900 wrongly taken as 8900. For example Mr C sold goods worth Rs 1000- to Mr X and entered them as Goods Sold in the account of Mr Y.

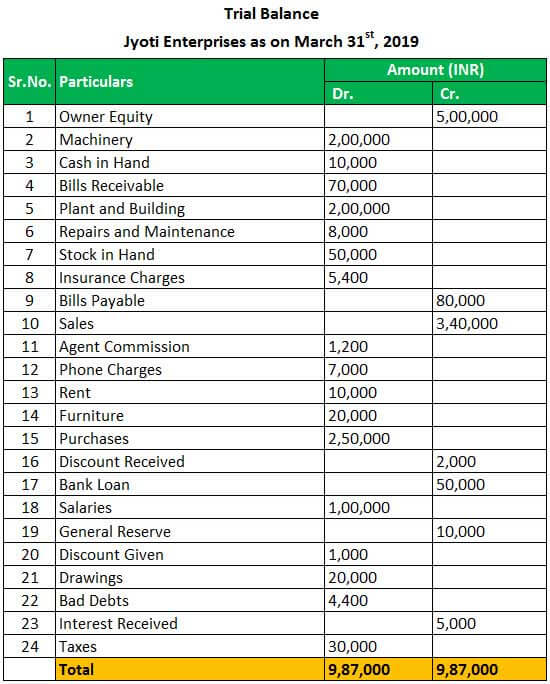

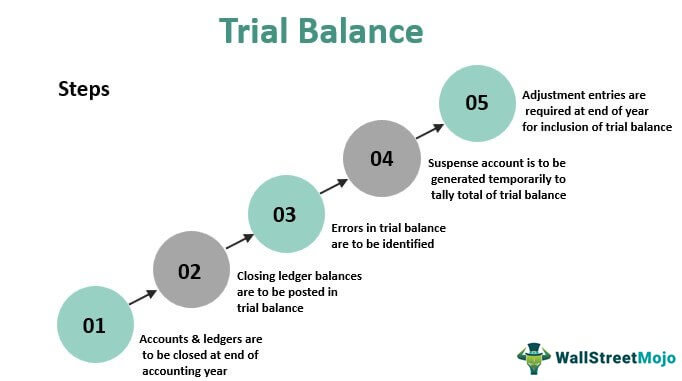

26150 instead of Rs. It is basically prepared at the end of the year of an accounting period to assist in the preparation of the final accounts. Trial Balance Example 1 As per the definition of the trial balance it is the first step in the preparation of the accounts of the statement of any firm. Complete reversal errors 6.

Errors of trial balance with example.

Trial Balance Examples Real Life Example Of In Accounting Restaurant Brands International Financial Statements Salaries Payable On Sheet

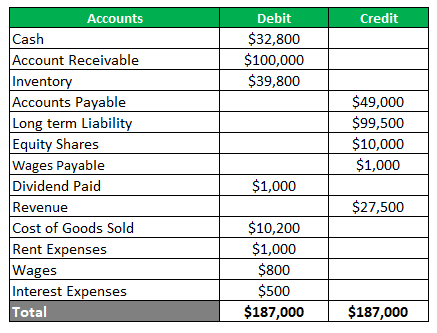

The difference between the debit and credit totals is put into a SUSPENSE ACCOUNT in the smaller of the two columns. ABC International Trial Balance August 31 20XX. If the debit column total is 12 000 and the credit column total is 11 500 then the difference of 500 is put into the suspense account on the Credit smaller side. Examples of other errors highlighted by a trial balance are.

Wrong posting of the total of Subsidiary books in the ledger. For example if the total of the purchase for a month is stuck as Rs. The various errors which would cause a mismatch in the trial balance totals are as follows.

For example a duplicate invoice to a customer will be rejected by the customer while a duplicate invoice from a supplier will hopefully be spotted during the invoice approval process. Adjusting entries are added in the next column yielding an adjusted trial balance in the far right column. Miscalculation of transactions incomplete journal entries errors in posting journals to the ledger incorrect ledger account balances unrecorded transactions duplicate transactions non-cash transactions not included in the trial balance transactions outside the accounting period being.

Post Closing Trial Balance Example Purpose Format Preparation Errors Financial Statement Of A Company Pdf Statements Publicly Listed Companies

For example the amount entered was correct and the appropriate side was chosen but the type of an account was wrong eg expense account instead of liability account. Trial balance is a listing of summary debit and credit account in which the total amount of credit side equal to the total amount of debit side. Errors of Principle in Trial Balance If a revenue expense is recorded as a capital expenditure or vice-versa it is called the error of principle. Errors of Omission a transaction which was not entered in the books at all.

Wrong totaling of the debit amounts and the credit amounts in the Trial Balance. Errors of Commission 3. 26150 as the total from the subsidiary book will be posted to the debit of the purchase account.

The transaction amount is correct but the account debited or credited is wrong. Duplication errors Wrap up The trial balance often forms the bridge that helps accountants in preparing the companys financial statements. Compensating errors errors which cancel each other out eg when balancing the ledger account the.

Adjusted Trial Balance Examples Accountancy Knowledge Profit And Loss Account Format In Excel Nnpc Audited Financial Statements

For example the installation cost of a new machine is accounted for by debiting the wage expense account instead of debiting the machinery account. Trial Balance as at 31 December Bank 1000. Name two types of errors with example which do not affect the Trial Balance. Errors of Principle 4.

Errors of omission 2. These errors occur when the correct amount is in the right class of accounts but the wrong account. In this case trial balance will show immediately that there is an error in the posting if total debit does not equal total credit.

Omitting an account balance in. I Wrong Totaling in a Subsidiary Book. As a result of this error the credit side total of the trial balance will be 1000 short.

The Trial Balance Principlesofaccounting Com Analysis And Use Of Financial Statements Solutions Excel Income Statement Sheet Template

Ii double posting in one account. Causes of Disagreement of Trial Balance. Entries Not Made at All Impossible to find on the trial balance since it is not there. Eg an entry which should have been put in the sales day book.

Journal entry the entry will be the same as you would post from the day book concerned. Error in the total of Subsidiary books. Seven errors not revealed by a trial balance 1.

If by mistake you post an entry two times to the debit or to the credit of an account it would result in extra debit or credit and as such cause disagreement in the trial balance for example 4000 received from ashok were credited twice in his account will increase the total of the credit column by 4000 and. 26250 then the debit in the purchases account would be Rs. Lets take the first example of NSBHandicraft.

Example Of Adjusted And Unadjusted Trial Balance Wikiaccounting Indirect Method Cash Flow Statement Accrued Expenses In Financial Statements

If the balance of an amount is incorrectly calculated and posted the trial balance will not agree If the balance of any account is not recorded at all in the trial balance it will not agree The trial balance will not agree if both sides of it are wrongly totaled. 4 Example of Trial Balance Preparation 5 Limitations of Trial Balance 6 Errors Disclosed by Trial Balance 61 Wrong Casting 62 Posting to the Wrong Side of an Account 63 Posting of Wrong Amount 64 Omission of Posting of One aspect of a Transaction 65 Posting an amount twice in an Account. Some of the errors in the preparation of accounts are. Example of a Trial Balance The following trial balance example combines the debit and credit totals into the second column so that the summary balance for the total is and should be zero.

Some common trial balance errors include. Lets explore some of the errors that can occur in a trial balance.

Trial Balance Example Format How To Prepare Template Definition Owner Withdrawals Are Reported On Which Financial Statement Other Investments Sheet

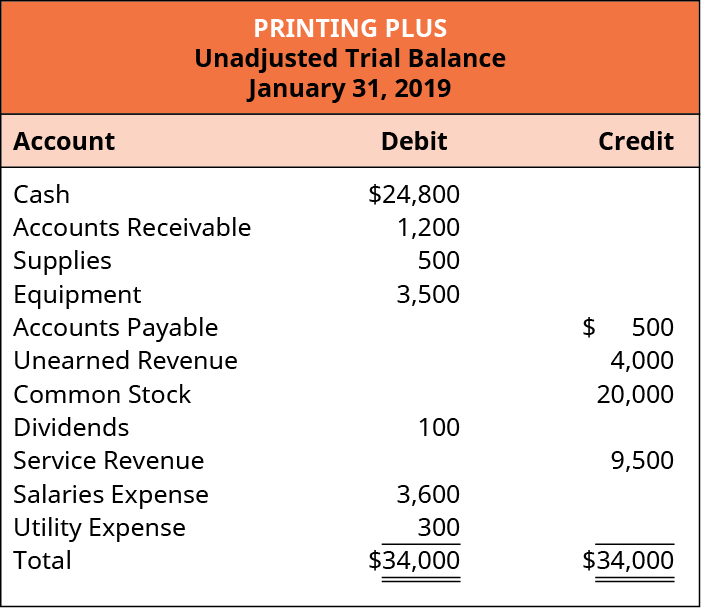

Unadjusted Trial Balance Format Uses Steps And Example Unrealised Profit In Departmental Accounts Audit Opinion

Trial Balance In Accounting Definition Errors How To Prepare Profit And Loss Presentation Template Simple Account

Trial Balance Overview What S Included And Examples Formation Expenses In Sheet Bunge Financial Statements