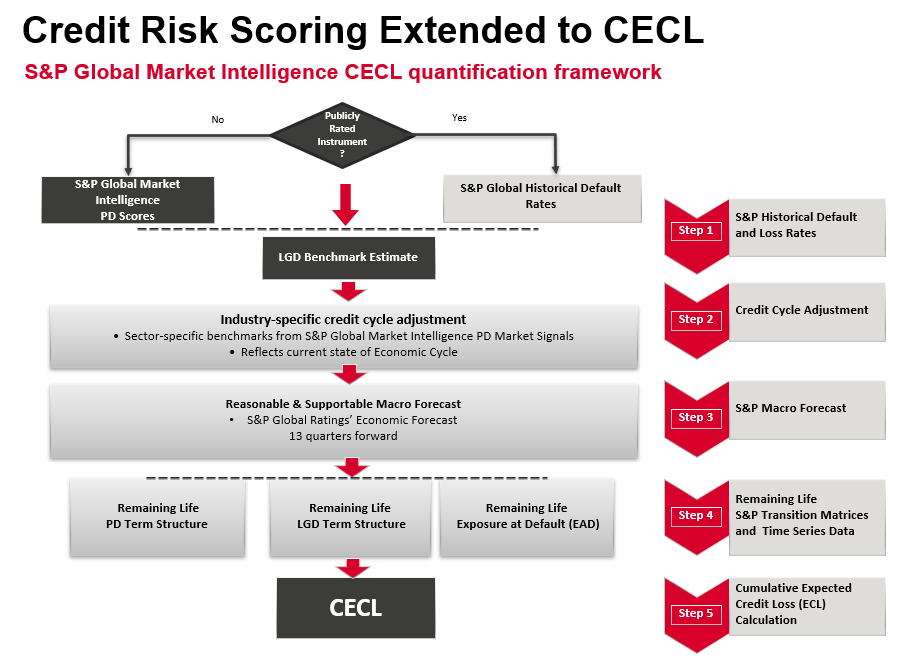

18 Internal or external third-party credit scores or credit ratings. The new credit losses standard changed several aspects of existing US generally accepted accounting principles GAAP such as introducing a new credit loss methodology reducing the number of credit impairment models replacing the concept of purchased credit-.

Previously companies could calculate their bad debt reserve based on years past. Aggregation AICPA Conference on Credit Unions Aggregation An entity shall measure expected credit losses of financial assets on a collective pool basis when similar risk characteristics exist as described in paragraph 326-20-55-5. The FASB introduced the current expected credit loss CECL model with the issuance of ASC 326 which requires financial instruments carried at amortized cost to reflect the net amount expected to be collected. The Financial Accounting Standards Board FASB issued a new expected credit loss accounting standard in June 2016.

Cecl credit loss.

Cecl Pro Alm First Income Tax Is Debit Or Credit In Trial Balance Shareholders Equity A Liability

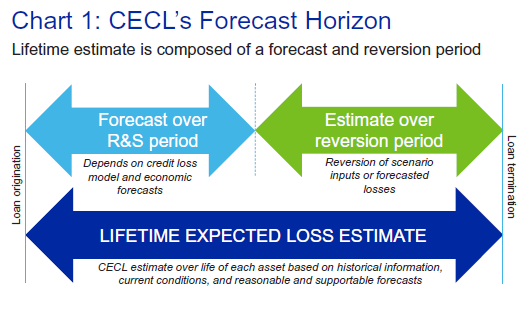

Current Expected Credit Losses CECL Methodology. Its the new methodology for estimating allowances for credit losses issued by the Financial Accounting Standards Board FASB. CECL is FASBs Financial Accounting Standards Board mechanism to account for possible future credit losses. The credit loss forecast ends in December of 2022 so we selected an accounting date that allows for full consideration of 72 month loans that end in.

Introduces the CECL methodology which requires a determination on. Fannie Mae and Freddie Mac the government-sponsored enterprises are also to be subject to CECL credit loss estimates as. Even if the historical loss on a financial asset is zero the models are likely to estimate a low but non-zero probability of default for those financial assets.

CECL requires institutions to measure expected credit losses on financial assets carried at amortized cost on a collective or pool basis when similar risk characteristics exist. This is different from the GAAP and other previous models in the sense that they allow entities to recognize only incurred losses as allowance therefore poorly positioning them for future. Banks but CECL is considered less complex to implement.

Cecl Current Expected Credit Loss A Core Competency Quarterly Audit Llp Report 2019

OVERVIEW In June of 2016 the FASB issued Accounting Standards Update 2016-13 Financial Instruments Credit Losses CECL Current Expected Credit Losses which requires a financial asset or a group of financial assets measured at amortized cost basis to be presented at the net amount expected to be collected. This course includes references to accounting standard codification ASC. CECL requires firms to recognize lifetime expected credit losses for financial assets measured at amortized cost rather than those credit losses that are probable of having been incurred in their allowance for credit losses as of the financial reporting date. CECL Current Expected Credit Loss When the Financial Accounting Standards Board FASB introduced a new impairment model commonly known as CECL Current Expected Credit Losses applicable to the US.

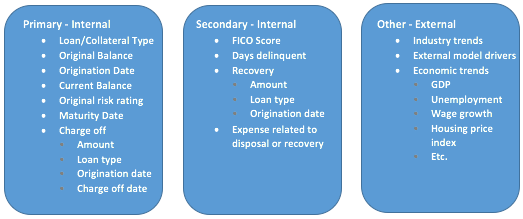

Similar risk characteristics may include one or a combination of the following. The CECL Credit Loss Calculator will calculate loss forecasts at the loan level summarize CECL results for each segment of your loan portfolio and produce reports for senior management and auditors. We use a dataset of national retail auto loans to illustrate potential changes.

Under the CECL model there is no threshold for recognizing expected credit losses allowance is recorded at origination or purchase and a credit loss expense is recognized in net income. The FASB expects this change to result in more timely and relevant information. This paper examines the impact of adopting current expected credit loss CECL standards for US.

Cecl Isn T Just For Banks Anymore Journal Of Accountancy Three Main Components A Cash Flow Statement The Trial Balance Bellemy Fashion Center

Interagency Policy Statement on Allowance for Credit Losses describes the measurement of expected credit losses under the CECL methodology and the accounting for impairment on available-for-sale debt securities in accordance with GAAP. Reduce the complexity in US GAAP by decreasing the number of credit impairment models that entities use to account for. CECL which governs recognition and measurement of credit losses for loans and debt securities presents several challenges for institutions trying to determine how to. The current expected credit loss CECL methodology is a new accounting standard for estimating allowances for credit losses.

CECL email training course is designed to help you understand the new codification requirement of ASC 326 Credit loss and its implication on financial reporting. The CECL standard includes specific guidance to assist entities with developing an estimate of expected credit losses for the following. The objectives of the CECL model are to.

GAAP based countries such as the United States Israel Japan limited Switzerland optional it represented a major shift from the. CECL is a regulatory measure as a direct response of 2008 credit crisis. For example if last year a company wrote off 500000 in bad debt from a handful of accounts the.

Current Expected Credit Loss Cecl Mark H Smith Inc Workday Income Statement Weekly P&l Template

CECL will create the need for higher capital provision across the US banking sector. Its the easiest way to ensure youre prepared for this new rules adoption. Which introduced the CECL methodology for estimating allowances for credit losses. Eliminate the barrier to timely recognition of credit losses by using an expected loss model instead of an incurred loss.

Credit loss estimates are calculated based on CECL and international accounting standards could potentially disadvantage US. The CECL model of reporting financial information encourages entities to recognize as allowance estimates of expected credit losses over the lifetime of each creditloan. Credit Losses on Financial Instruments which introduces the current expected credit losses methodology CECL for estimating allowances for credit losses.

Purchased credit-deteriorated assets Certain benefit interests within the scope of ASC 325-40 Certain collateral-backed financial assets. CECL stands for current expected credit losses. The CECL model requires financial institutions to immediately record the full amount of expected credit losses in their loan portfolios based on forward-looking information rather than waiting until the losses are deemed probable based on whats already happened.

Cecl In Loss Forecasting Challenges And Opportunities Tiger Analytics Ratio Analysis Video Claires Income Expense Statement Answer Key

Replaces the current incurred loss model triggered by the Probable threshold and incurred notion. 2016-13 which introduced the current expected credit loss methodology or CECL. The total allowance for credit losses of 1200 million at the end of the third quarter was comprised of. Insights on implementing the CECL model The CECL standard aims to simplify US GAAP and provide for more timely recognition of credit losses.

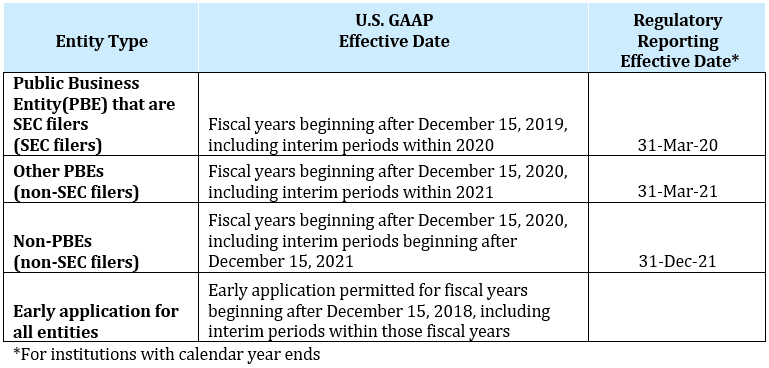

The Current Expected Credit Loss model CECL standard instituted by the Financial Accounting Standards Board will take effect in January 1 2020 for public financial institutions that are registered with the SEC and in January 1 2023 for all other institutions. ASC 326Current expected credit loss standard CECL Audit Assurance Home Audit Innovation Accounting Standards Accounting Events Transactions Perspectives Current expected credit losses On the Radar. The design documentation and validation of expected credit loss estimation processes including the internal controls over.

Any financial institution can adopt the CECL standard early beginning in 2019. The new accounting standard introduces the current expected credit losses methodology CECL for estimating allowances for credit losses. The standard is effective for most SEC filers in.

Current Expected Credit Loss Cecl Model Validation Darling Consulting Group Dcg Prepare Balance Sheet And Income Statement Financial Projections 12 Months Template Excel

Cecl Scorecard S P Global Market Intelligence Sample Personal Financial Statement Form Balance Sheet Template

Fasb S Guidance On Current Expected Credit Loss Cecl Model Youtube Sales Formula In Ratio Analysis Not For Profit Income Statement

White Paper Implementing The Current Expected Credit Loss Cecl Model Debt To Equity Ratio Interpretation Example What Are Accounts Payable On A Balance Sheet