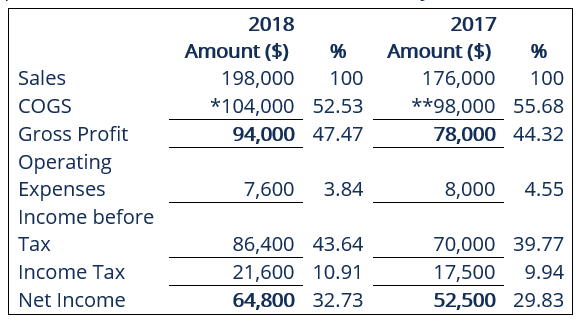

The key difference between comparative and common size financial statements is that comparative financial statements present financial information for several years side by side in the form of absolute values percentages or both whereas common size financial statements present all items in percentage terms balance sheet items are presented as percentages of. However the policy does not provide any returns beyond the stated benefit unlike an insurance policy which allows investors to share in returns from the insurance.

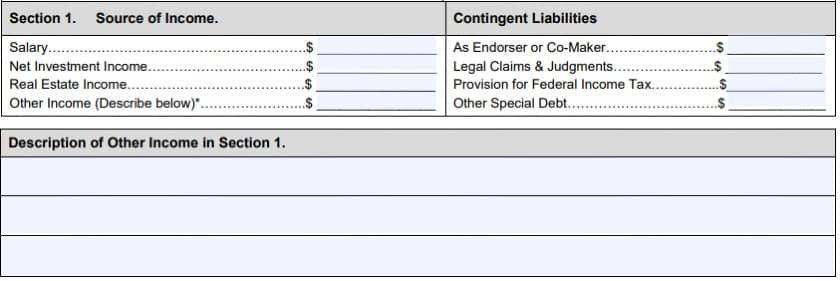

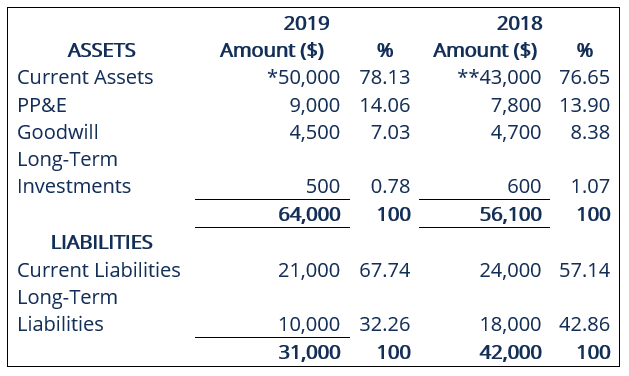

Format of comparative balance sheet and income statement. Balance sheets with comparative financial statements will generally include the prices of specific assets at different points in time along with the percentage changes over the accompanying periods of time. Changes increase or decrease in such assets and liabilities over the year both in absolute and relative terms. In Common size Income Statement SalesRevenue from Operations is taken is common base where as in Common size Balance Sheet Total assets or Total Equity and Liabilities are taken as.

Comparative statement and common size statement format of balance sheet of life insurance company.

Vertical Analysis Overview Advantages Examples Cfo Cfi Cff Cash Flow Prepare Financial Statements From Trial Balance

Similarly each item of Equity and Liabilities is expressed as percentage of total amount of Equity and Liabilities. A common size Statement of Profit and loss is a statement in which the figure of revenue from operations is assumed to be equal to 100 and all other figures. Common size analysis also referred as vertical analysis is a tool that financial managers use to analyze income statements. A comparative balance sheet showcases.

Common Size Income Statement Format. 2 Each individual asset is expressed as a percentage of the total assets ie 100 and different liabilities are also calculated as per total liabilities. This guide will help you understand what a comparative balance sheet is its advantages and how to use it to.

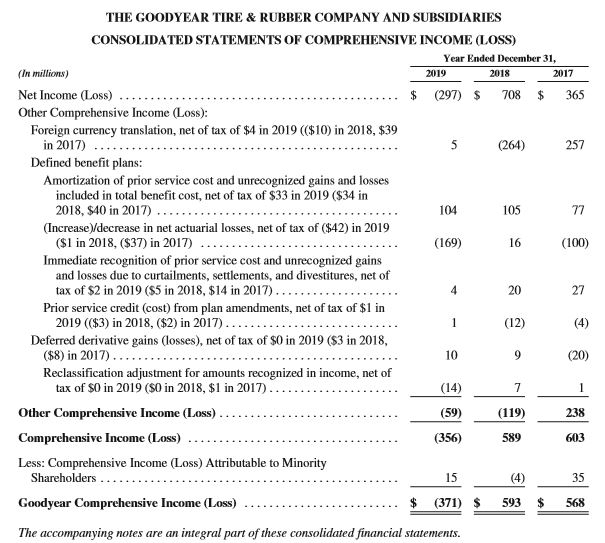

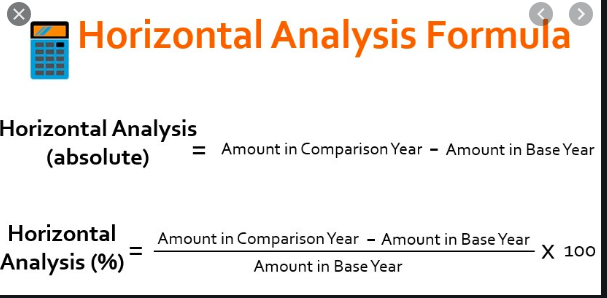

Comparative financial statements present financial data for several years side by side. Comparative statements are also known as horizontal analysis as financial statements are compared side by side. Seeing the common-size statement as a pie chart makes the relative size of the slices even clearer Figure 313 Pie Chart of Alices Common-Size Income Statement for the Year 2009.

Components Of The Income Statement Accountingcoach Pioneer Foods Financial Statements Hotel Industry Ratios

COMMON-SIZE BALANCE SHEET Common-size Balance Sheet is the vertical analysis of Balance Sheet in which Total Assets is taken as 100 and each item of Asset is expressed as percentage of the Total Assets. Comparative and Common Size Balance Sheet 6 Topics. June 25 2021. Common-size financial statements present all items in percentage terms.

Whereas the common size financial statements present all these items in percentage terms more often. This is helpful when not only looking at a single companys financial statements but also comparing multiple business of different sizes at one time. Preparing Common Size Balance Sheet 1 Take the total of assets or liabilities as 100.

Financial statements of life insurance companies include preparation of revenue account profit and loss account and balance sheet. Common size income statement analysis states every line item on the income statement as a percentage of sales. EACH ITEM OF ASSET AS A PERCENTAGE OF.

Vertical Analysis Formula Chegg Com Where Is Common Stock On The Balance Sheet Idbi Bank Financial Statements

Format of balance sheet of life insurance company. These statements include a balance sheet an income statement a statement of stockholders equity a statement of cash flows and the explanatory notes that accompany the financial statements. Title of the Common Size Statement ie. In the Particulars column the various items of the Balance Sheet are shown under the headings ofAssets and Liabilities.

A comparative balance sheet is a type of comparative statement used by business owners investors and analysts to evaluate a companys performance over time. It is a form of Horizontal Analysis. It also reveals the extent to.

Comparative and Common Size Statements with Balance Sheet of Company. Financial Statements of two years are compared and changes in absolute terms and in percentage terms are calculated. Common size statements are also known as vertical analysis as data is analysed vertically.

/dotdash_final_Constant_Currencies_Dec_2020-01-962ae57604464a59bd167a644f759ab7.jpg)

Constant Currencies Definition Apple Income Statement 2019 Balance Sheet Of Financial Statements

The striking difference between the comparative and the common size financial statements is that comparative financial statements present the financial information for several years side by side in the form of absolute values or percentages or both. The balance sheet and the income statement are two of the three major financial. Balance sheet items are presented as percentages of assets while income statement items are presented as percentages of sales. Common Size Balance Sheet is written on the top of the statement.

Business owners use the comparative report to make strategic business decisions. Balance sheet of Reliance Industries Limited 2009 Rupees in Cr 2010 Rupees in Cr amount of increase decrease Percentage of increase decrease Application Of Funds Gross Block 14962870 21586471 6623601 4427 Less. The common size income statement format is as follows.

The analysis helps to understand the impact of each item in the financial. It evaluates financial statements by expressing each line item as a percentage of the base amount for that period. Thus a comparative balance sheet not only gives a picture of the assets and liabilities in different accounting periods.

The Balance Sheet Boundless Accounting Different Types Of Ratios Big 8 Firms In 1980s

Common size statements usually are prepared for the income statement and balance sheet expressing information as follows. Recall that horizontal analysis calculates changes in comparative statement items or totals. Class 4 Comparative and Common Size Income Statement 13 Topics Sample Lesson. Assets and liabilities of business for the previous year as well as the current year.

Comparative Common-Size Financial Statements. Lets take a look at an example of a normal balance sheet and a common size balance. Comparative statements are used for comparing financial performance for internal purposes and for inter-firm comparison.

Typically investors will look at a companys common size balance sheet and common size income statement. Comparative Common-Size Financial Statements. Data may be presented in the form of absolute values.

Comparative Statement Definition Order Of Current Assets On Balance Sheet Statements Financial Accounting Concepts

The comparative format for comparative analysis in accounting is a side by side view of the financial comparatives in the financial statements. Common size balance sheet in this statement the total of balance sheet is taken as 100 all figures are expressed as percentage of total. Income statement items expressed as a percentage of total revenue Balance sheet items expressed as a percentage of total assets The following example income statement shows both the rupee amounts and the common size ratios. COMPARATIVE COMMON SIZE BALANCE SHEET FOR DIFFERENT PERIODS HELP TO HIGHLIGHT THE TRENDS IN DIFFERENT ITEMS OF THE BALANCE SHEET FOR EG.

Vertical Analysis Overview Advantages Examples Off Balance Sheet Leverage Provision For Doubtful Debts In Profit And Loss Account

2 Balance Sheet Order Project Profit And Loss Statement

How Do Net Income And Operating Cash Flow Differ Comprehensive Format In Excel