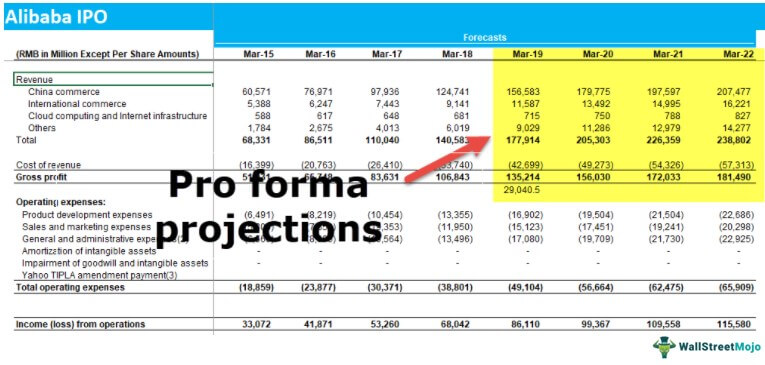

They are useful tools that business owners investors creditors or decision-makers can use to examine different iterations of future events based on certain financial assumptions. Pro forma financial statements incorporate hypothetical amounts forecasts or estimates built into the data to give a picture of a companys profits if.

In other words a pro forma is like a financial statement that projects and predicts what the investments future financial performance is going to look like based on. Having these estimates will help the company budget for future cash expenditures and prepare for strong or weak future profits. We can say that the definition pro forma financial statements are financial statements the reflect the best guess at how a particular investment is going to perform in the coming months and years. Pro forma financial statement definition Essentially pro forma financial statements are financial reports based on hypothetical scenarios that utilize assumptions or financial projections.

Define pro forma statement.

Pro Forma Financial Statements Examples Top 4 Types Consolidated Are Prepared When A Company Owns Accounting Balance Sheet Example

Based on financial assumptions or projections. Pro Forma Financial Statement. Provided or made in advance to describe items or projections a pro forma invoice. Pro forma financial statements focus on the future using the past information as a guideline.

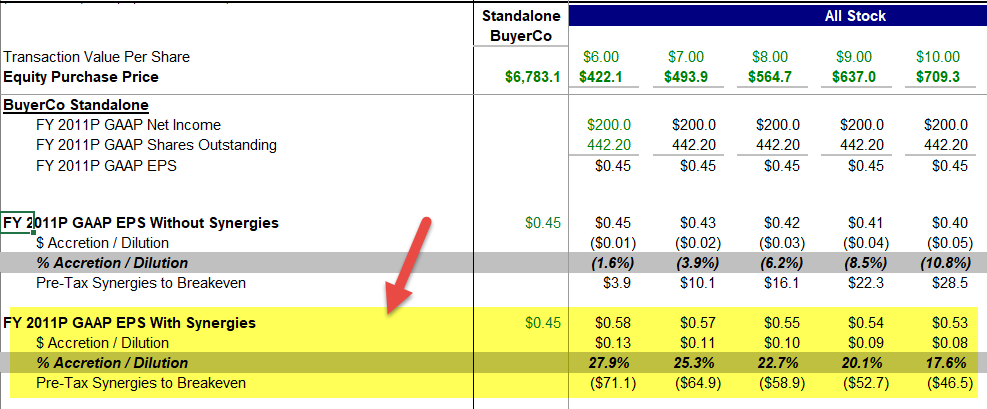

For example if a company is considering acquiring another it may prepare a pro forma financial statement to estimate what effect the acquisition would have on its own financial circumstances. In the online course Financial Accounting pro forma financial statements are defined as financial statements forecasted for future periods. Pro forma financial statements provide a way to make forecasts with information that may not available.

When it comes to accounting pro forma statements are. A pro forma copy of a document. Pro forma financial statements are financial reports issued by an entity using assumptions or hypothetical conditions about events that may have occurred in the past or which may occur in the future.

What Are Pro Forma Financial Statements Examples How To Create Them Different Types Of Cash Flow Certified Statement Example

A pro forma invoice is a preliminary bill of sale sent to buyers describing a shipment of goods in advance of its delivery. A pro forma financial statement leverages hypothetical data or assumptions about future values to project performance over a period that hasnt yet occurred. Made or carried out in a perfunctory manner or as a formality. It may include a best-case or worst-case scenario.

New Latin prō fōrmā. Pro forma financial statements are financial reports based on hypothetical scenarios that utilise assumptions or financial projections. According to Merriam-Webster pro forma means.

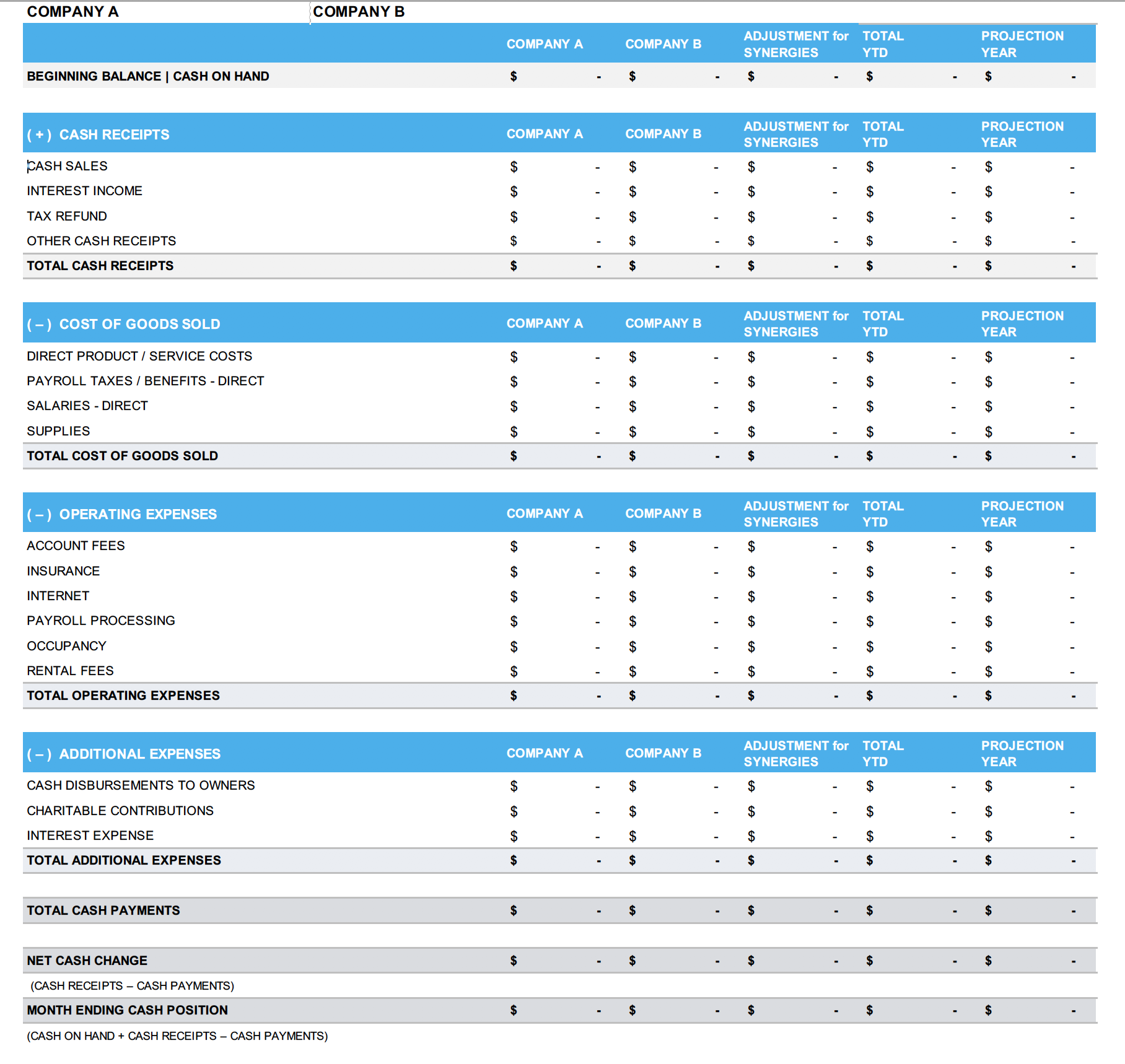

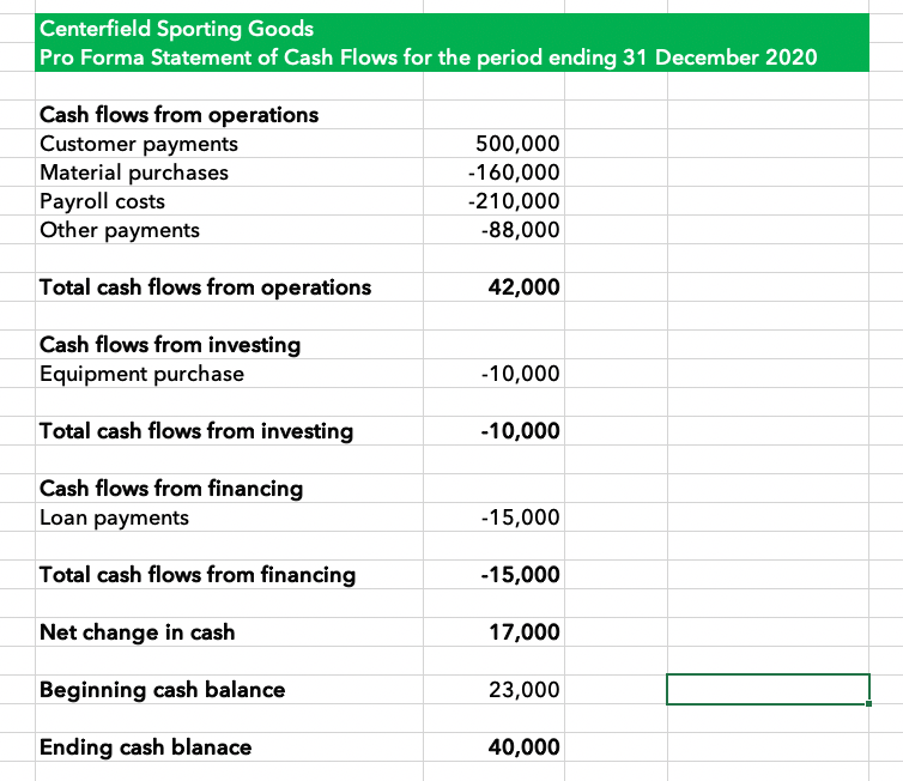

A pro forma financial statement is a financial statement that is based on specific projections and assumptions instead of real past transactions. Pro Forma Cash Flow Statement is a popular accounting practice that reports a voluntary statement prepared by a firm for presenting financial projections. A financial statement constructed from projected amounts.

Pro Forma Definition Gasb 84 Fiduciary Activities Other Operating

Pro forma statements are useful with regard to tracking future financial direction Earnings Guidance An earnings guidance is the information provided by the management of a publicly traded company regarding its expected future results including estimates and occurrences often including some historical numbers to help account for what the projected outcomes. For example the company might merge with or purchase another business and the outcome could affect both cash flow and profits. Pro forma financial statements project how a company might perform in the future if the business takes an assumed course of action. Pro-forma Cash Flow Statement can be developed as part of the.

Pro forma financial statements simply refer to a set of financial statements balance sheet income statement and cash flow statement which have been prepared in order to show the effects of a specific transaction on the historical financial statements of a business prior to the transaction actually taking place. These statements are used to present a view of corporate results to outsiders perhaps as part of an investment or lending proposal. Done as a formality.

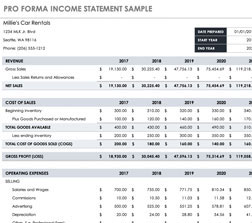

Pro Forma Statement means a financial forecast for the Facility for the next five year period commencing on the anticipated date when the Facility commences operations prepared in accordance with the standards for forecasts established by the American Institute of Certified Public Accountants. The income statement is perhaps the most important of all pro forma statements. A firm might construct a pro forma income statement based on projected revenues and costs for the following year.

Pro Forma Financial Statements Quickbooks Australia Qatar Airways 2018 Balance Sheet Audit Includes Verification Of

Legal Definition of pro forma. Provided in advance so as to prescribe form or describe items. Pro Forma Financial Statement. They are useful tools that business owners investors creditors or decision-makers can use to examine different iterations of future events based on certain financial assumptions.

Likewise a firm may wish to develop a set of pro forma statements to. Pro forma definition. Prō for the sake of fōrmā ablative of fōrma form American Heritage Dictionary of the English Language Fifth Edition.

What Is a Pro Forma Financial Statement. It can be defined as the probable amount of cash inflows and outflows expected in future periods for a specific duration of time. A financial statement that a company prepares to consider the effects of a potential activity.

Pro Forma Income Statement Definition Examples Ifrs Ias Of Hess Law

These Unaudited Pro Forma Financial Statements reflect all adjustments that in the opinion of management are necessary to present fairly the pro forma results of our operations and financial position. The pro forma accounting is a statement of the companys financial activities while excluding unusual and nonrecurring transactions when stating how much money the. The Unaudited Pro Forma Financial Statements give effect to the acquisition and related transactions. Pro forma a Latin term meaning as a matter of form is applied to the process of presenting financial projections for a specific time period in a standardized formatBusinesses use pro forma statements for decision-making in planning and control and for external reporting to owners investors and creditors.

Made or carried out in a perfunctory manner or as a formality. Pro forma is actually a Latin term meaning for form or today we might say for the sake of form as a matter of form.

Pro Forma Financial Statement Template Exceltemplates What Is Accumulated Depreciation On The Balance Sheet Qa Audit Report

Pro Forma Financial Statements Quickbooks Australia Sba Form 413 Printable A Contribution Margin Income Statement Is Usually Used By

Real Estate Pro Forma Full Guide Excel Template And More Blank Financial Statement Form Of Profit Loss Account

/pro-forma-invoice--1053078376-3fb3269f97f84b93832c203f105ac972.jpg)

Pro Forma Definition P&l Balance Sheet Template Step By Cash Flow Statement