Here are a number of highest rated Horizontal Line Test Examples pictures upon internet. Horizontal analysis also known as trend analysis is a financial statement analysis technique that shows changes in the amounts of corresponding financial statement items over a period of time.

Current assets divided by total assets- 4882 31727 6. A horizontal audit is appropriate for. So in our example of Smiths ice-cream business a percentage analysis will tell him that his ice-cream sales have increased by 6667 50000 3000030000 100. Examples of horizontal analysis.

Horizontal analysis sample.

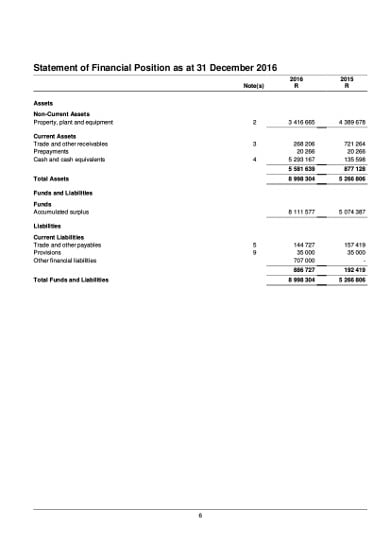

Sample Financial Statement Analysis Example How To Read Audited Statements A Companys Balance Sheet Shows Cash $22 000

Two measures of vertical analysis- 1. Horizontal Analysis also known as Trend Analysis is an analysis technique in accounting used over financial statements such as balance sheets statements of retained earnings and income statements among others. Learn how to apply horizontal analysis methods and how a. Data for the year 2014 and 2015 was obtained to help in the analysis.

This method of horizontal analysis expresses the change in financial values in terms of percentage rather than in terms of actual figures. Order custom essay Horizontal and Vertical Analysis with free. As compared to the last years.

The horizontal and vertical analyses of Starbucks financial statement were carried out to evaluate the companys performance. It is a useful tool to evaluate the trend situations. Last year is your base year and lets say the companys total assets were 600000.

Financial Statement Ratios Example 14 Analysis Psd Google Docs App Format Of Fund Flow Ias 7

Its submitted by running in the best field. Horizontal Analysis also termed as Trend Analysis compares a companys performance over the years ie. Below is the example of percentages of total assets that the current assets and shareholder equity make up. We allow this nice of Horizontal Line Test Examples graphic could possibly be the most trending topic bearing in mind we share it in google.

Use basic financial analysis to examine any horizontal changes in Starbucks accounts receivable balances. In accounting a vertical analysis is used to show. For instance the increase of 344000 in total assets represents a 95 change in the positive direction.

We identified it from obedient source. Vertical analysis on the other hand is an analysis technique that states each account balance on a financial statement as a percentage of a base amount on the. Likewise the following is a horizontal analysis of a firms 2018 and 2019 balance sheets.

Sample Cash Flow Analysis Template Business Jetblue Balance Sheet Statement Online

The analysis computes the percentage changes in each income statement amount at the far right. Holmes Attorney-at-Law indicates both favorable and unfavorable trends. These expenses increased the same as or. Trend Analysis is a technique used to identify trends spanning different accounting periods by highlighting the changes in.

Horizontal Line Test Examples. Horizontal analysis is the aggregation of information in the financial statement that may have changed over time. The increase in fees earned is a favorable trend as is the decrease in supplies expense.

You can use horizontal analysis to examine for example your companys profit margins over time and create strategic spend projections to match projected revenue growth or hedge against seasonality or increased cost of materials. The objective with horizontal analysis is to spot trends in the financial information such as for example whether an expense is increasing or decreasing each year and for this reason horizontal analysis is also known as trend analysis. The statements for two or more periods are used in horizontal analysis.

Download Cost Analysis Template For Free Formtemplate Sample Resume Current Assets And Liabilities Examples Basic Income Statement Format

Horizontal analysis is the comparison of financial statements and accounting ratios over a number of accounting periods. These two approaches are used to tell the users of these financial analyses how well the company is performing in terms of its own performance from one period to another. Imagine that you want to compare a companys balance sheet from this year to the balance sheet from the year before. To help you understand how to use horizontal analysis here are some example scenarios.

You can examine the data from horizontal analysis in a number of ways depending on your goals. Unfavorable trends include the increase in wages expense utilities expense and miscellaneous expense. Horizontal analysis is a process used by financial analysts to observe trends in the growth of a business.

It shows the behavior of revenues expenses etc of the financial statements for comparative periods. With Horizontal Analysis the impact of operational activities is visible on the companys financial. Horizontal analysis is an analysis technique that calculates the change in an account balance from one period to the next and expresses that change in both dollar and percentage terms.

Sample Competitor Analysis Template Financial Warren Buffett Accounting Example Of Profit And Loss Statement For Sole Trader

Horizontal analysis involves taking the financial statements for a number of years lining them up in columns and comparing the changes from year to year. The following is the analysis. Horizontal analysis of income statement with Example Horizontal analysis compares amount balances and ratios over a different time period. Horizontal and Vertical analysis are two of the methods used by the finance analysts to determine the financial health of company.

The number of years over which analysis is required are entered in columnar format and change from last year in terms of amount and percentage is analyzed. The vertical analysis also shows that in years one and two the companys product cost 30 and 29 of sales respectively to produce. An evaluation of one process or activity across several groups or departments within an enterprise.

The Horizontal analysis performs the assessment of relative changes in different items of the balance sheet over a period of time. Again the amount and percentage differences for each line are listed in the final two columns and can be used to target areas of interest. Shareholder equity divided by total assets- 14320 31727 2.

11 Financial Statement Sample Format Income Template Modified Cash Basis Aasb 134

The horizontal analysis for J.

Variance Report Template Analysis Financial Templates Cash Flow Statement From Balance Sheet And Income Accrual Accounting

Download Balance Sheet Horizontal Analysis Excel Template Financial Statement Why Is Cash Flow Important For A Business

Sample Cash Flow Analysis Template How To Be Outgoing Starbucks Financial Performance Statement Tesla