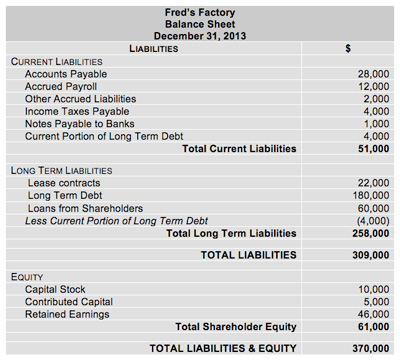

The recognition of income taxes in the balance sheet is done after the calculation of tax expenses. Income taxes payable appears in the current liabilities section of the companys balance sheet.

John Mathay while introducing the Finance Bill reduced income tax from 5 annas per rupee to 4 annas. While accounts payable may seem similar to an expense at first heres how they differ. Balance Sheet To understand why taxes payable are part of a corporate balance sheet its useful to master the reports components as well as how accountants distinguish items based on maturity and operating life. Recognizing Tax Accruals In Balance Sheet.

Employees income tax payable on balance sheet.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition Real Estate Profit And Loss Template Audi Financial Statements 2018

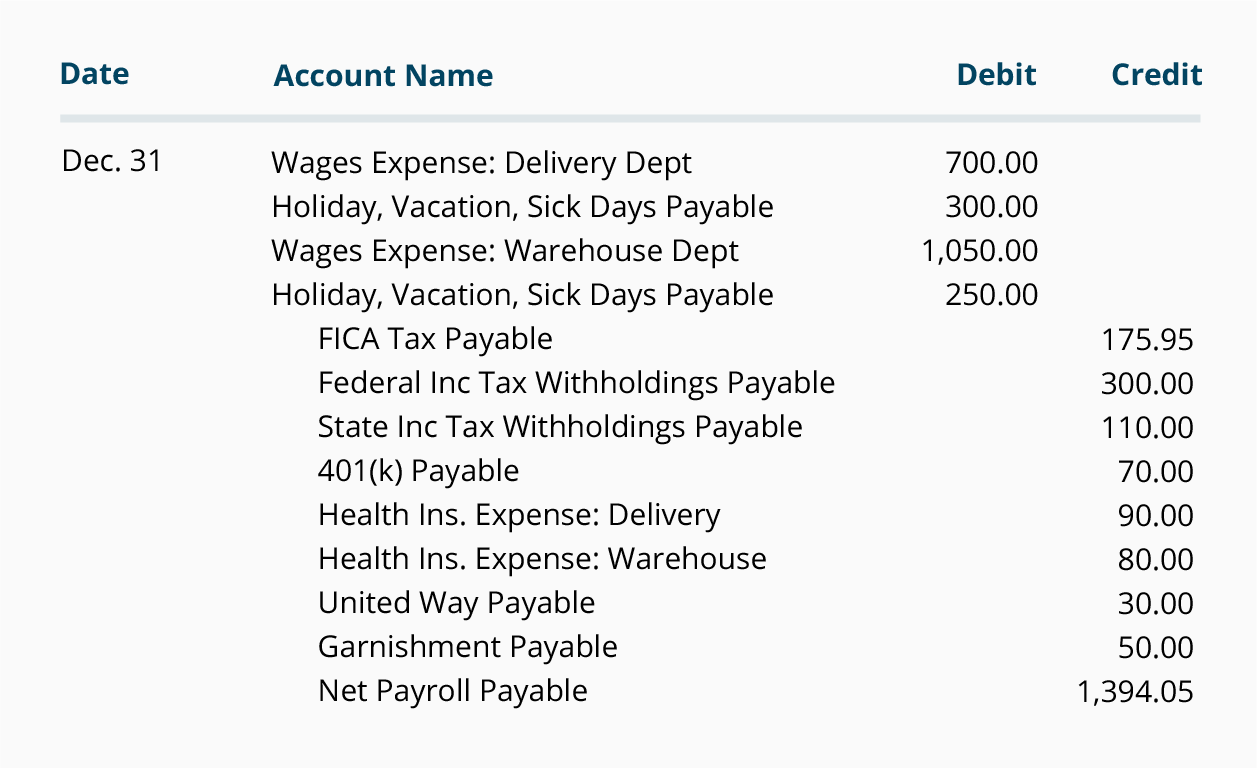

Payroll Withholdings are Liabilities The payroll taxes withheld from employees are a current liability of the employer until the amounts are remitted to the governments. Run Your Business On Your Own Terms On Your Own Time. The chief practical difference between accounts payable and expenses is where they appear in a companys financial statements. And its tax base the amount that will be deductible or taxable in respect to the asset or liability in the future.

The financial accounting term income taxes payable is used to describe money owed to government authorities but not yet paid. Recognized Tax For An Accounting Period Current Tax For Accounting Period Movement In Deferred Tax Balances For The Accounting Period. How to calculate income tax payable on the balance sheet.

During the week ended October 10 he worked 9 hours each day from Monday through Friday 6 hours on Saturday and 4 hours on. CPP and EI Expense 300 CPP Payable a matching amount 160. Taxes payable are accrued expenses and are placed on their own line on the balance sheet because the amounts can be large and in most cases are estimates.

How Do The Income Statement And Balance Sheet Differ Microsoft 2019 Dividends Declared On

Many liability accounts have the word payable as part of the account name. Accounts payable is located on the balance sheet and expenses are recorded on the income statement. Sign Up Today to Receive Up To 50 Off. The entity should provide for the unavoidable tax.

All accounts credited in the entry are current liabilities and will be reported on the balance sheet if not paid prior to the preparation of financial statements. Sri Morarji Desai who introduced budget proposals on 29-2-1968 on. A company records an expense on the income statement for the employer matching portion of any Social Security and Medicare taxes as well as the entire amount of.

Fill Out A Balance Sheet In 5-10 Mins. The gross Salaries for the employees given 15000 20000 10000 45000 FICA Taxes Rate given 75 Employee FICA Tax Payable 45000 75 Employee FICA Tax Payable 3375 2. The payroll taxes withheld from employees include federal income taxes state income taxes and the employees portion of the FICA or Social Security and Medicare taxes.

Payroll Journal Entries For Wages Accountingcoach Form No 26as Pdf Another Name Profit And Loss Statement

Employees income tax payable on balance sheet. Any income tax payable within a longer period is instead classified as a long-term liability. He also levied super tax 85 on the income above Rs120000. Paying taxes is mandatory according to municipal provincial and federal laws.

Edit Sign Easily. Taxes payable a liability account is a balance sheet item not an income statement component. Income Taxes given 600 Net Pay 3140 Your employers entry to record salary expense is.

When a company incurs an obligation to pay payroll taxes to the government a portion of it appears on the income statement and a portion on the balance sheet. Federal Income Tax Withheld Payable given 410000 State Income Tax Withheld Payable given 36000 FICA Social Security Taxes Payable 35000 x 62 217000 FICA Medicare Tax Payable 35000 x 145 50750 Employee Medical Insurance Payable given. Trumps regular rate is 8 per hour.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition Sec Filing Of Audited Financial Statements 2019 Trial Balances

AACSB CommunicationJoel Trump is paid one and one-half times the regular hourly rate for all hours worked in excess of 40 hours per week and double time for work on Sunday. Enter the amount you paid to your employees in the credit column. For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online. February 1860 introducing income tax for the first time in India.

On the next line enter Cash in the description column. Ad Free Trial – Track Sales Expenses Manage Inventory Prepare Taxes More. Federal income tax withholdings payable definition This current liability account reports the amount a company owes the US.

November 18 2021. Enter Salaries Payable as the description. Ad 1 Create Free Balance Sheet In Minutes 2 Print Export Instantly – 100 Free.

Where Is Salary Expense On Income Statement Quora Examples Of Other In Accounting Skanska Financial Statements

The amounts in these accounts are held in trust by the company until they are due representing an amount the company must pay on behalf of the employee. Income tax payable is one component necessary. Ad Easy-To-Use Bookkeeping For Small Businesses. These three core statements are.

View the full answer. Non-payment prompts aggressive collection which can result in legal action against a business. Accordingly the firms net income equals 70000 or 100000 minus 30000.

Related QA Where can I get official information for federal payroll taxes. Employers normally record payroll taxes at the same time as the payroll to which they relate. No Accounting Experience Needed.

The Impact Of Share Based Compensation Strategic Finance What Is Owners Equity Made Up Whirly Corporations Contribution Format Income Statement

Try 100 Free Today. The companys resources assets increased because the company received 1050 of promises accounts receivable from. Government as of the balance sheet date for the federal income taxes withheld from its employees salaries and wages. On 28-02-1950 Mr.

Income tax payable is found under the current liabilities section of a companys balance sheet. Salary Expense 4000 Employee Income Tax Payable 600 CPP Payable 160 EI Payable 100 Salary Payable to Employee 3140 Your employer would record payroll expense as. The Effect of the Salaries or payroll involves an outflo.

For calculation of a tax in a current period following formula is used. These accounts include payroll taxes wage garnishments and child support for example. Three Financial Statements The three financial statements are the income statement the balance sheet and the statement of cash flows.

What Is Taxes Payable Bdc Ca Cash Flow Statement Prepared Parle Financial Statements

Enter the salaries payableamount net pay in the debit column. When these liabilities are paid the employer debits each one and credits Cash.

Liabilities Balance Sheet Definition Opentext Financial Statements Corporate Governance Audit Report

Payroll Journal Entries Financial Statements Balance Sheets Study Com Market Ratio Analysis Whirlpool Sheet