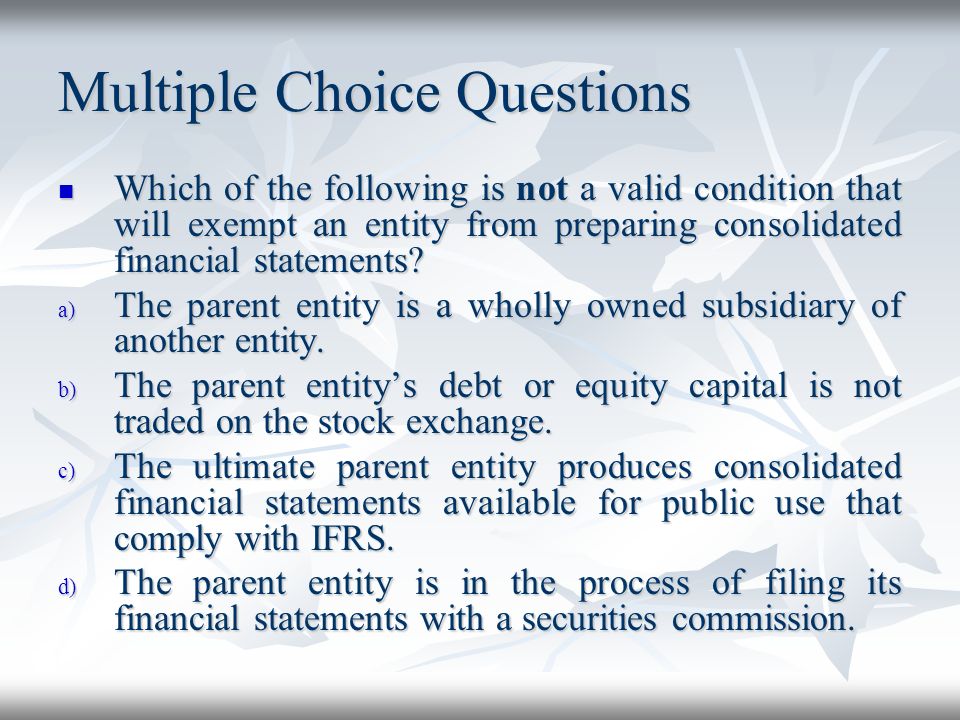

The financial statements need to be lodged with ACRA with the annual return unless the company is a solvent exempt private company EPC. Exemption from preparing consolidated financial statements paras.

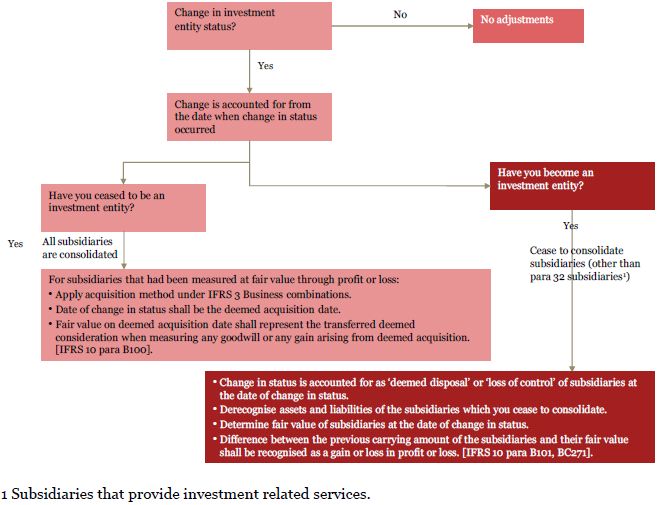

The carrying amount of the parents investment in each subsidiary. Access to the complete content on Oxford Reference requires a subscription or purchase. One of the conditions for exemption relates to non-controlling interests having been informed and not objecting to not preparing consolidated financial statements. The amendments confirm that the exemption from preparing consolidated financial statements for an intermediate parent entity is available to a parent entity that is a subsidiary of an investment entity even if the investment entity measures all of its subsidiaries at fair value.

Exemption from preparing consolidated financial statements.

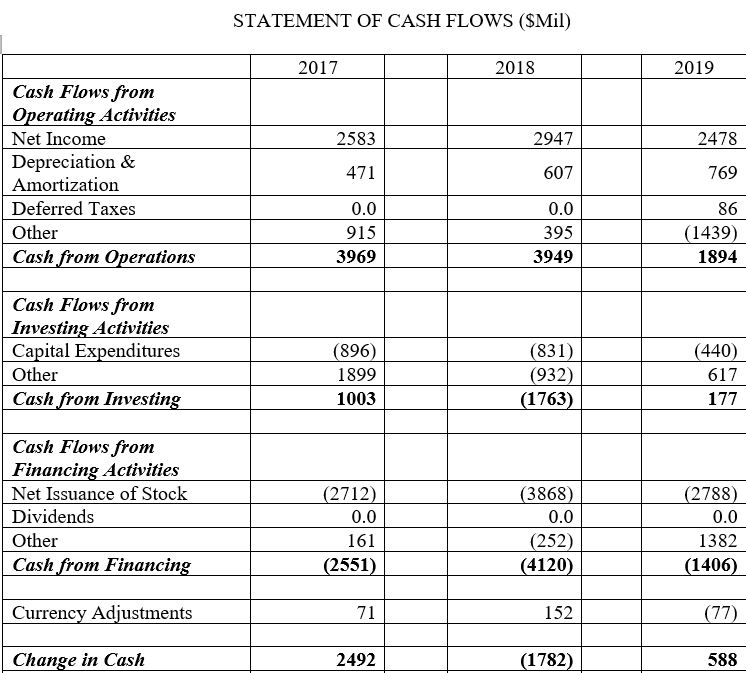

2 Saas P&l Example Deferred Taxes Should Be Presented On The Balance Sheet

Must lodge a statement by the directors with its annual return. If the entity is a parent that is exempt from preparing consolidated financial statements by the scope exception in paragraph 4a of FRS 110 or if all the following apply. Also a parent undertaking is exempt from. Section 400 Companies Act 2006 provides exemption from preparing consolidated financial statements for a company that is included in the group accounts of a larger group.

A dormant company which is not exempted from preparing financial statements must prepare unaudited financial statements compliant with the SFRS. The parents loans or shares are not traded in a public market. 1 if the holding company is a wholly owned subsidiary of another body corporate.

Combine like items of assets liabilities equity income expenses and cash flows of the parent with those of its subsidiaries. The company will be exempt if it is itself a subsidiary undertaking and its immediate parent is established under. Other requirements Consolidated annual report Audit of financial statements Must be public available within 9 months after year end.

Exemption From Preparing Consolidated Financial Statements Disclosure Edc Factored Accounts Receivable

After which on the satisfaction of following conditions companies can claim exemption from preparing Consolidated Financial Statements. BCZ19-BC28F Scope exclusions para. Under the Companies Act and Financial Reporting Standard 2 Accounting for Subsidiary Undertakings a parent undertaking is exempt from preparing group accounts when it is itself a subsidiary of a parent company in the European Union and consolidated financial statements are prepared at the highest level. BCZ16-BCZ17 Exemption available only to nonpublic entities para.

Paragraph 4 of IFRS 10 provides relief whereby a parent need not present consolidated financial statements if it meets particular conditions including the requirement that its ultimate or any intermediate parent produces. I it is a wholly-owned subsidiary or is a partially-owned subsidiary of another company and all its other members including those not otherwise entitled to vote having been intimated in writing and for which the proof of delivery of such intimation is available with the company do not object to the company not presenting consolidated financial statements. Exemptions from preparing consolidated financial statements Under the Companies Act a parent company is not required to prepare consolidated financial statements for a financial year in which the group headed by that company qualifies as a small group or a medium-sized group.

IFRS 10 – The exemption from preparing consolidated financial statements requirements in IFRS 10. A parent can be exempt from preparing consolidated financial statements if all of the following apply. In order to prepare consolidated financial statements IFRS 10 prescribes the following consolidation procedures.

2 Income Statement For Service Business Template Vertical

Exemption from requirement to prepare consolidated financial statements basis for a subsidiary being excluded from consolidation Benefits for participants understand the current regulations for group companies in preparing consolidated financial statements able to avoid the financial burden and time for preparing. Strike Off the Name of the Company. Søg efter jobs der relaterer sig til Exemption from preparing consolidated financial statements eller ansæt på verdens største freelance-markedsplads med 21m jobs. Or 2 if the holding company is a partially owned subsidiary of another body corporate and the shareholders have been notified about and do not object to the.

The parent is a wholly-owned or a partially-owned subsidiary of another entity and its other owners including those not otherwise entitled to vote have been informed about and do not object to the investor not presenting consolidated financial statements. Exemptions from preparing consolidated financial statements. Company can file the application to registrar for removing its name from the Register of Companies and the also the Registrar may also initiate the process of removing the name of the Company suo moto.

A The entity is a wholly-owned subsidiary or is a partially-owned subsidiary of another. BCZ18 Scope of consolidated financial statements 2003 revision paras. Under the Companies Act a parent company is not required to prepare consolidated financial statements for a financial year.

International Accounting Standard Ppt Download Heb Financial Statements Finance Income In Statement

Financial statements the exemption from the obligation to prepare consolidated financial statements and a consolidated management report. BCZ12-BCZ15 Unanimous agreement of the owners of the minority interests paras. Det er gratis at tilmelde sig og byde på jobs. When the company controls jointly controls or has significant influence over other entities its revenue and total assets should be assessed based on consolidated figures unless the company is exempted by the.

Section 3793 sets out two ways in which a holding company can be exempt from preparing consolidated financial statements. Exemption from the preparation of consolidated financial statements can only apply to one financial year. The parent isnt a 100 sub but the other owners dont mind the parent not preparing group accounts.

Therefore every year a fresh notification no later than 6 months. Section 193 of SME-FRF SME-FRS Revised 2015 states that a parent may only exclude a subsidiary from consolidation on the grounds of expense and delay out of proportion to the value to members of the company if the members of the company have been informed in writing about and do not object to this exclusion. Before the introduction of the Investment Entities amendments an intermediate parent that has an ultimate parent that is an investment entity parent that consolidated all investees was exempt from presenting consolidated financial statements except in cases in which minority shareholders disagree debt or equity shares were publicly traded or the entity.

Practical Guide To Ifrs 10 Investment Entities Exception Consolidation Accounting And Audit Malta Business Plan Financial Projections Indirect Method Of Cash Flow Statement Example

Public users are able to search the site and view the abstracts and.

Separate And Consolidated Financial Statements Stock Acquisition Questions Docx Notes Payable On Balance Sheet File

Ifrs Org Vertical Analysis And Horizontal All Expenses Losses Are

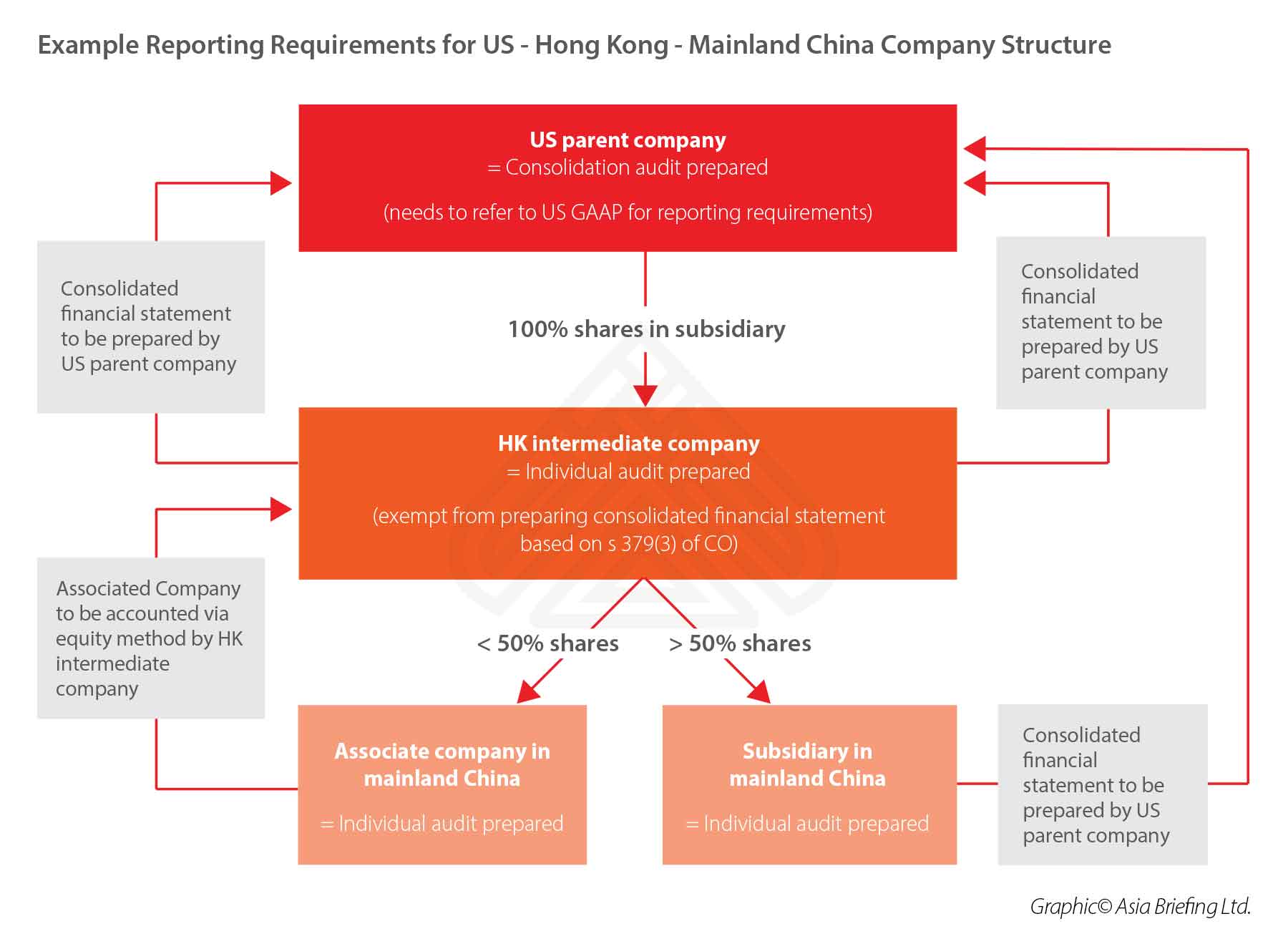

Consolidated Audits For Holding Companies In Hong Kong 3 Faqs Bank Overdraft Balance Sheet Financial Ratios And Interpretation

Acca Guide To Consolidated Accounts For Businesses How Read Balance Sheet Stocks Is Depreciation Expense On The Income Statement