For any sales prepare entries to update the fair-value adjustment record any reclassification adjustment and record the sale. Refer to the information in QS C-4.

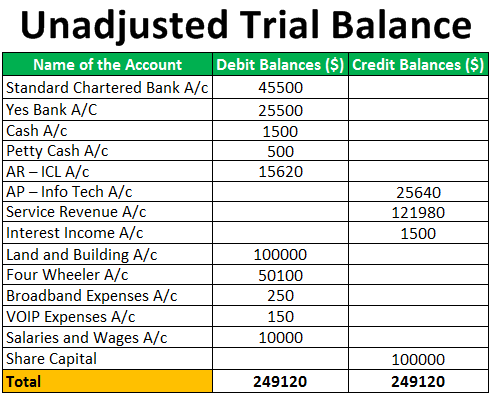

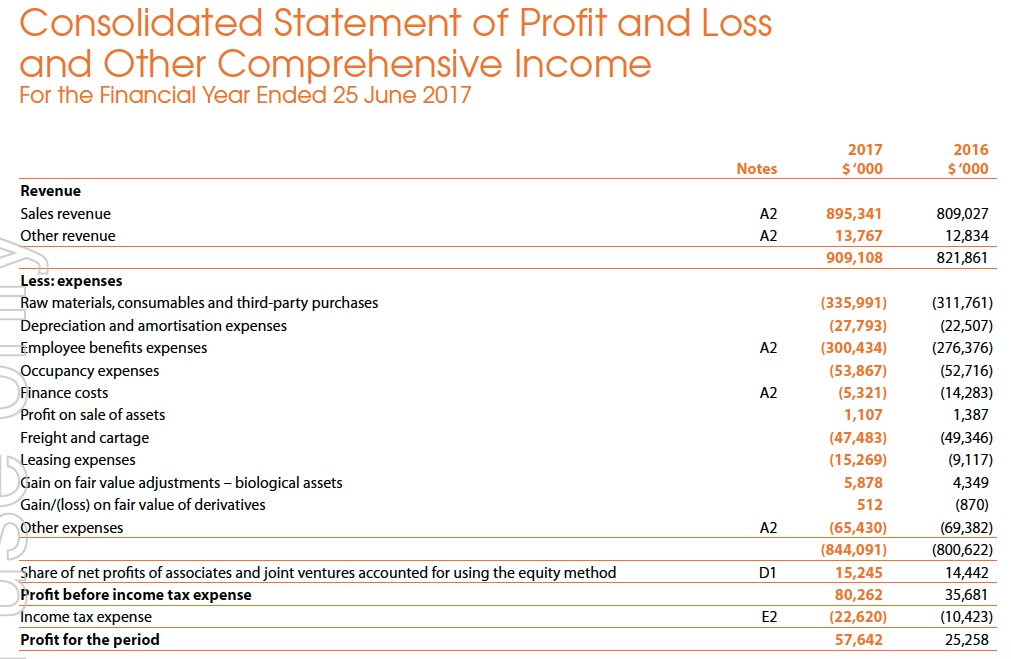

The entry to record the valuation adjustment is. A historical cost balance sheet will value the land at 500000 until its sold. In the consolidated statement of profit or loss. 1 After the fair value adjustment is made prepare the assets section of Kitty Companys December 31 classified balance sheet.

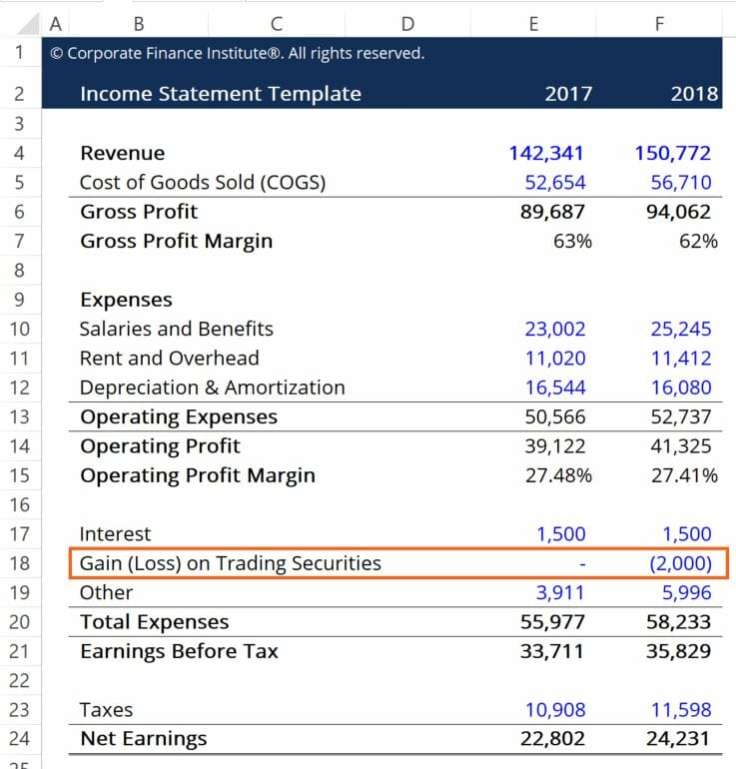

Fair value adjustment income statement.

Equity Method Ifrscommunity Com Stp Income Statement Avgo Balance Sheet

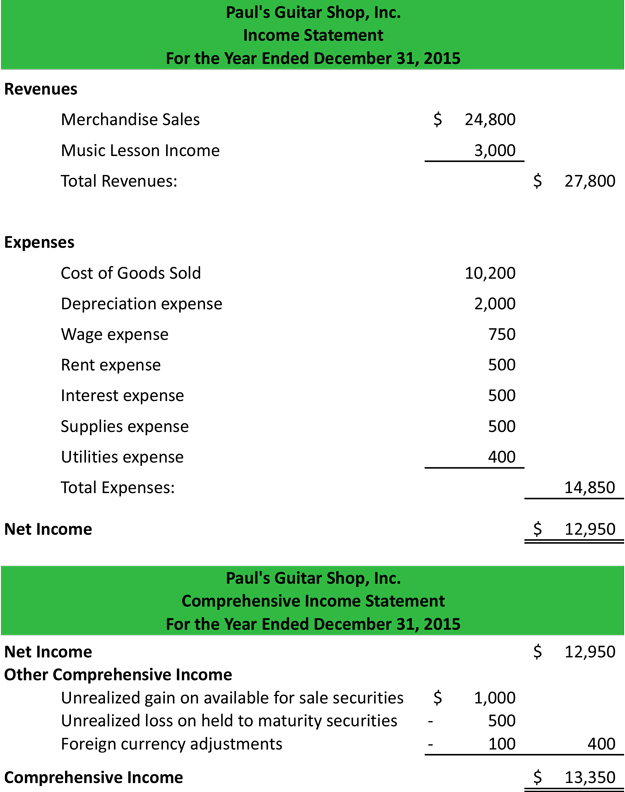

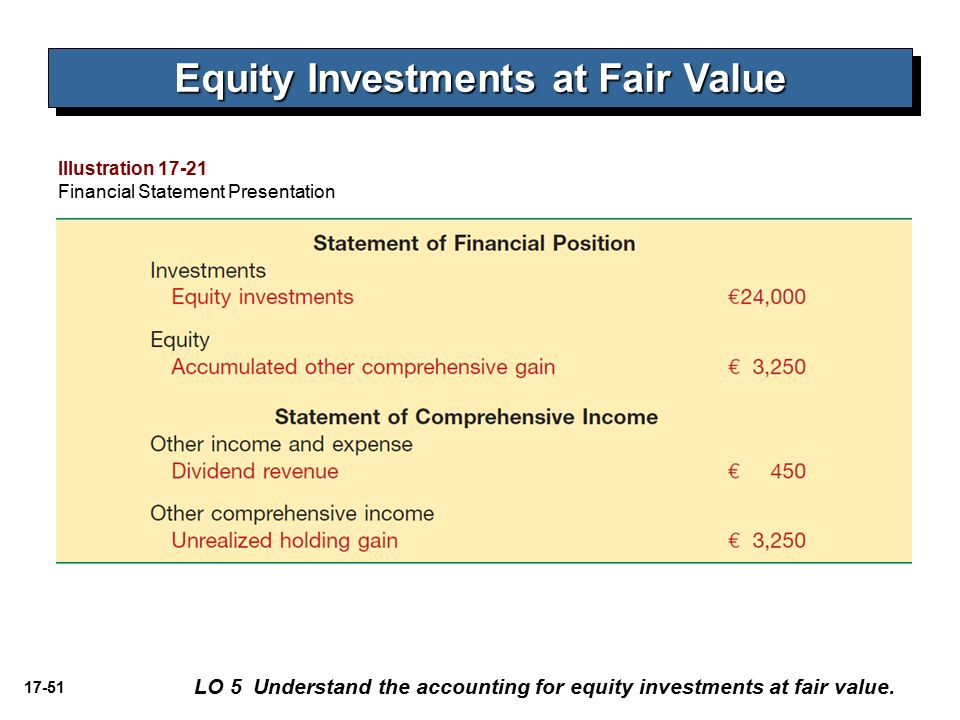

Multiply 1000 shares by 17 per share to get 17000. On the income statement both the dividend revenue of 200 and the unrealized gain of 3000 are shown as increases in net income. The fair value method is also called cost method. Indicate any amounts that Ornamental Insulation would report in its 2021 income statement 2021 statement of comprehensive income and 12312021 balance sheet as a result of these investments.

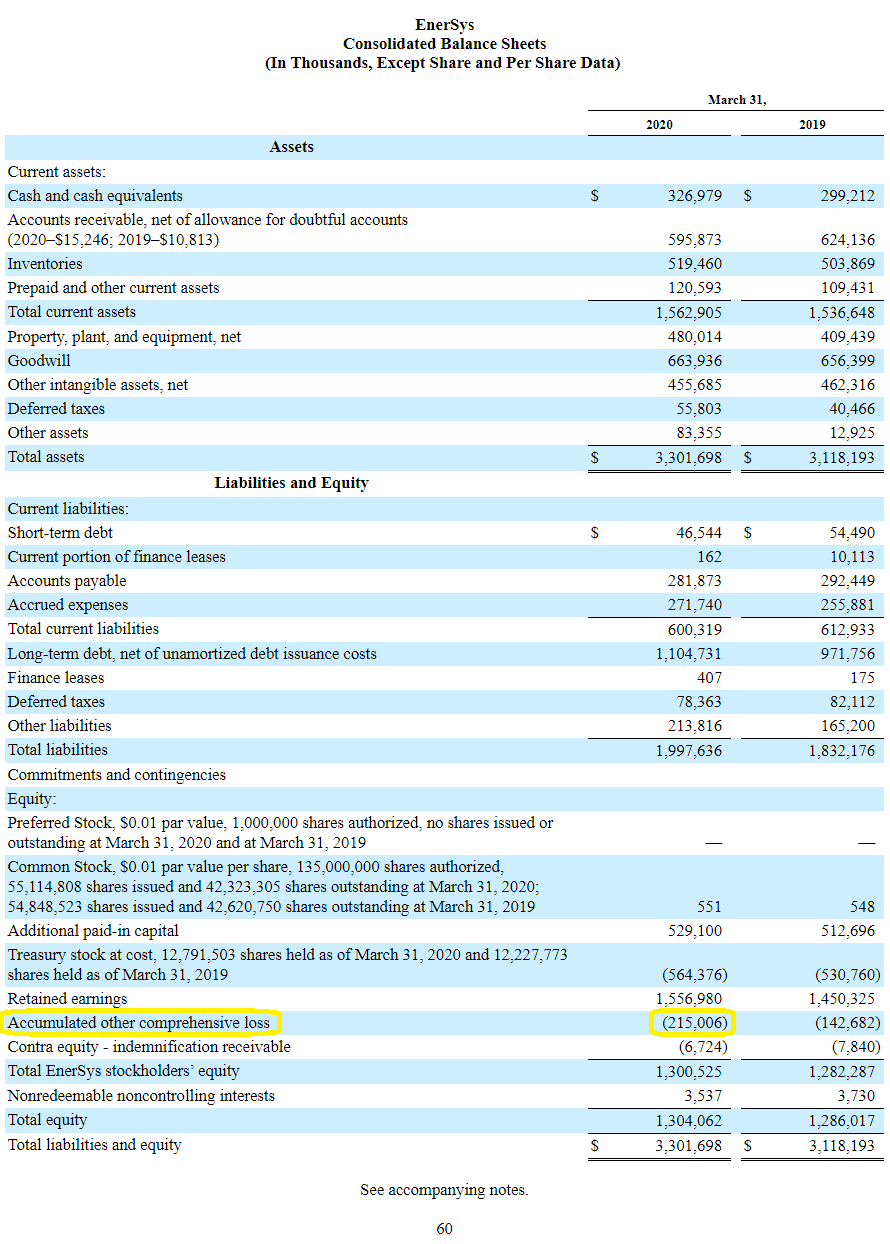

A positive number represents an unrealized gain while a negative number represents an unrealized loss. Instead they are recognized in equity. Is held in a business model see business model test in which assets.

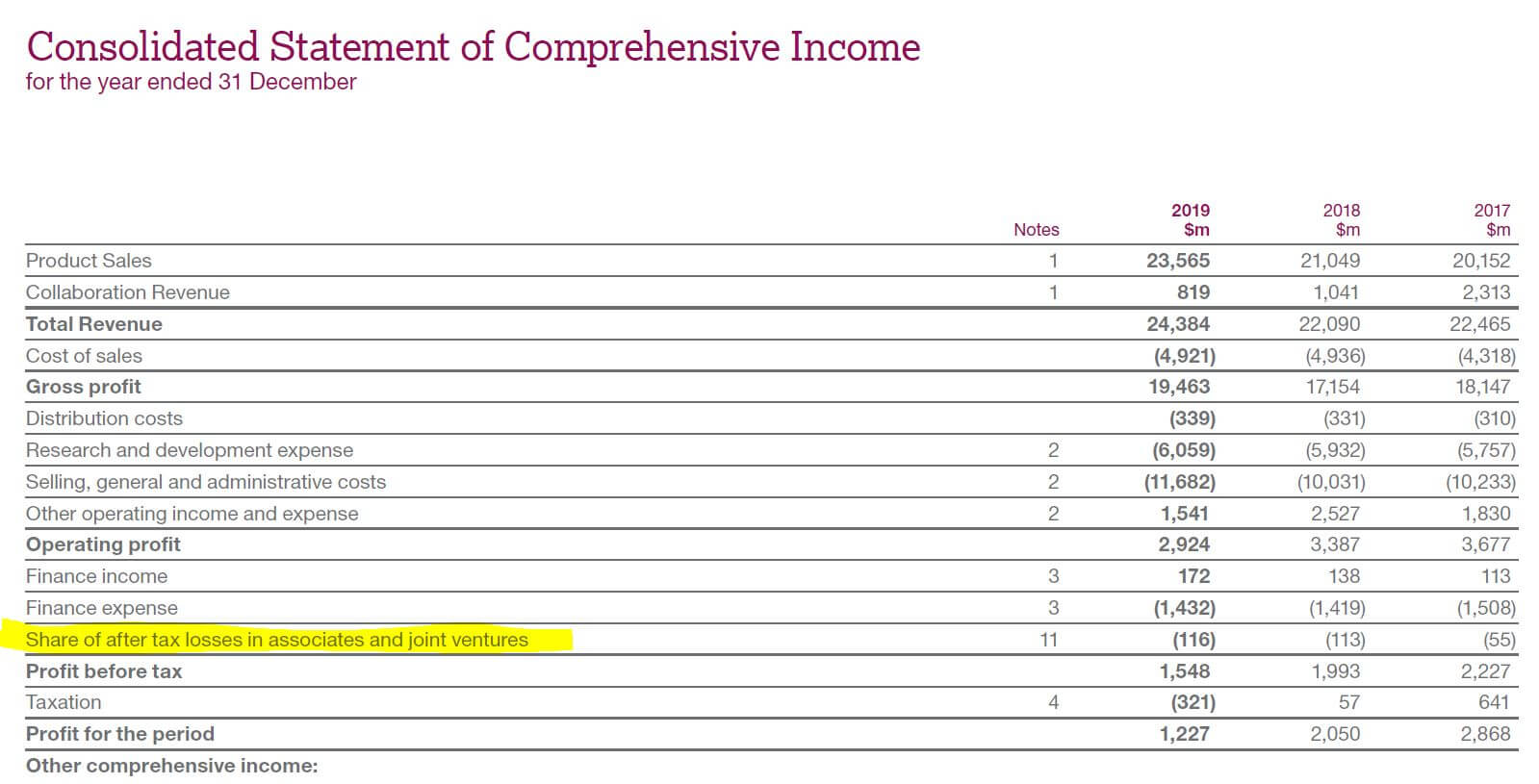

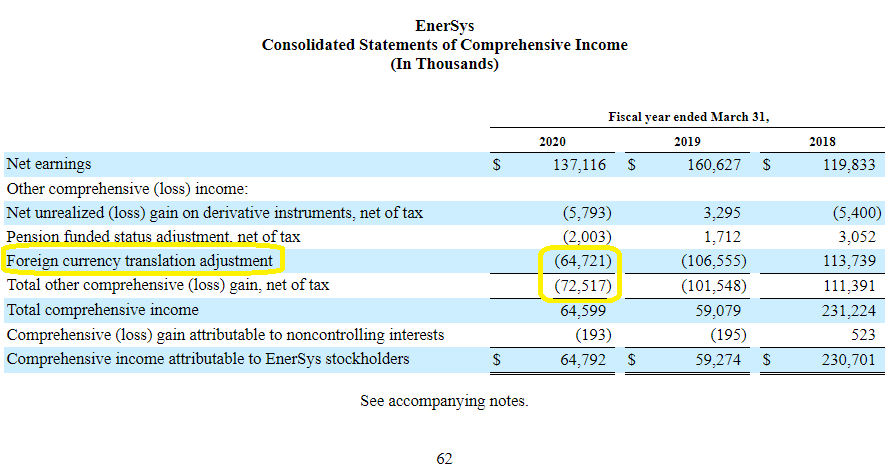

In accounting fair value is a reference to the estimated worth of a companys assets and liabilities that are listed on a companys financial statement. Market participants 29 E. However when securities are classified as financial assets measured at fair value through other comprehensive income unrealized gains and losses are not reported in the income statement.

Other Comprehensive Income Oci Aoci The Basics With 10 K Examples Cash Flow Table Example Notes To Financial Statements Sample

The fair value adjustment account already has a debit balance of 700 recorded on June 30. For the remaining stocks in the portfolio a fair value adjustment amount of 3500 debit balance an increase is needed to reflect the difference between the fair value and the remaining securities original cost. Fair value hierarchy 61 I. Solutions for Chapter C Problem 5QS.

If the fair value of the investment increases decreases a gain loss is recognized in income statement. Such fair value adjustments could be included within an incomeexpense heading such as other operating incomeadministrative expenses or shown. If instead the fair value at year-end had been only 21000 a 4000 unrealized loss will appear on Valentes income statement to reflect the decline in value 25000 historical cost dropping to 21000 fair value.

Your income statement has to reflect that. Analyst Adjustments Related to. In fair value accounting if your investments change in value that represents a change in income.

Other Comprehensive Income Overview Examples How It Works Law Firm Balance Sheet Expenses In An Statement

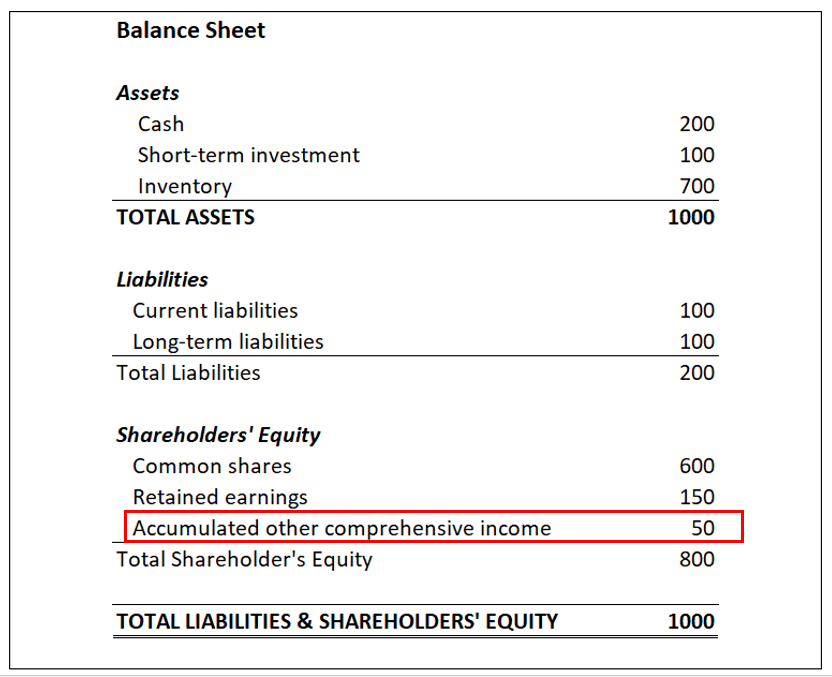

In the balance sheet the market value of shortterm availableforsale securities is classified as shortterm investments also known as marketable securities and the unrealized gain loss account balance of 15000 is considered a stockholders equity account and is part of comprehensive income. Any associated transaction costs are expensed. An increase in assets will be accompanied by a gain on the income statement or an increase in other comprehensive income. Valuation adjustments are made to a companys assets or liabilities.

2 At the reporting date make the adjustment on the face of the SoFP when adding across assets and liabilities. Valuation approaches and techniques 40 G. Subtract the initial fair market value from the fair value at the end of the period to calculate the change in fair value.

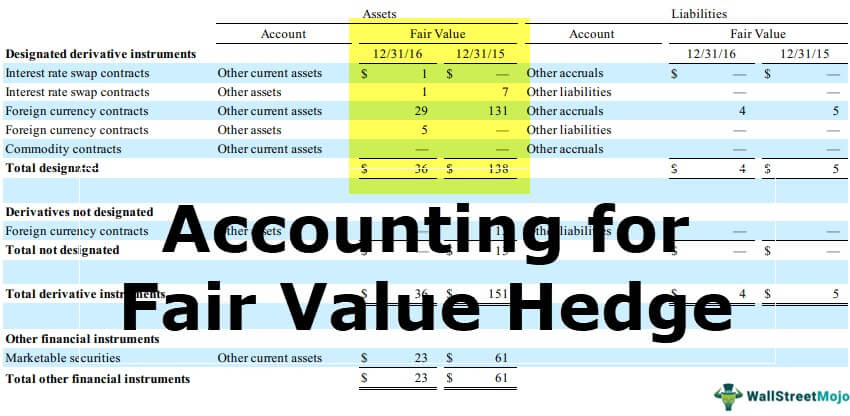

And Fair value through other comprehensive income. This means that the subsidiarys depreciation in its financial statements is based on the carrying amount of the asset before the fair value adjustment has been made. Basis adjustment in hedging Something else – Borrowing costs – QA IAS 23 The effect is to offset gains or losses on the hedging instrument with gains or losses on the hedged item that are attributable to the hedged risk within one line item of the income statement.

Solved Consolidated Statement Of Profit And Loss Ofher Chegg Com Draft Balance Sheet Financial Ratios Formulas Excel

An introduction to fair value measurement 6 B. As the fair value adjustment increases the value of the asset the additional depreciation on this must also be accounted for. In general the fair value hedge accounting model has two main elements. It is a good idea to work with a professional.

You report the changes separate from regular sales income and operating expenses. Inputs to valuation techniques 50 H. Fair value at initial recognition 70.

The contractual terms of the financial asset give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding the SPPI test see Solely Payments of Principal and Interest. Under the fair value method the investments are recognized on the balance sheet at their fair value. Essentially valuation adjustments make accounting records reflect the current market value of the asset or liability rather than the historical cost.

Other Comprehensive Income Oci Aoci The Basics With 10 K Examples Sba 413 Pdf Statement For Nonprofit Organization

If the fair value has increased you would debit the valuation account and credit your income. 2 In which income statement section is the unrealized gain or loss on the portfolio of trading securities reported. The fair value method of accounting would adjust the lands value to. The item being measured and the unit of account 18 D.

For losses you should credit the valuation account and debit your income. The fair value adjustment represents the amount required to adjust the relevant item from their current carrying value in the SoFP to their identified fair value. Subtract 15000 from 17000 to get a 2000 change in fair.

To record your fair value adjustment you will need to make a journal entry that affects the balance sheet account of the asset and your income. Principal and most advantageous markets 32 F. Revaluation of a fixed asset is the accounting process of increasing or decreasing the carrying value of a companys fixed asset or group of fixed assets to account for any major changes in their.

Volume Ppt Download Example Of Statement Financial Performance Dunkin Donuts Income 2019

Normalizing Adjustments To The Income Statement Mercer Capital Qa Audit Report Duracell Financial Statements

Trading Securities Learn About Accounting For Trial Balance Accounts Payable Microsoft Excel Income Statement Template

Accounting For Fair Value Of Hedges Examples Journal Entries Financial Statement Audit Report What Is Included In Comprehensive Income