Debt to Equity Ratio Comment. According to these financial ratios Juhayna Food Industriess valuation is way below the market valuation of its sector.

The description of industry structure by company is included as well establishing extent of market concentration and evaluating companies market shares. Before the shepherd could. The EVEBITDA NTM ratio of Food Drinks PCL is significantly lower than its historical 5-year average. Dun Bradstreets Key Business Ratios provides online access to benchmarking data.

Food industry financial ratios.

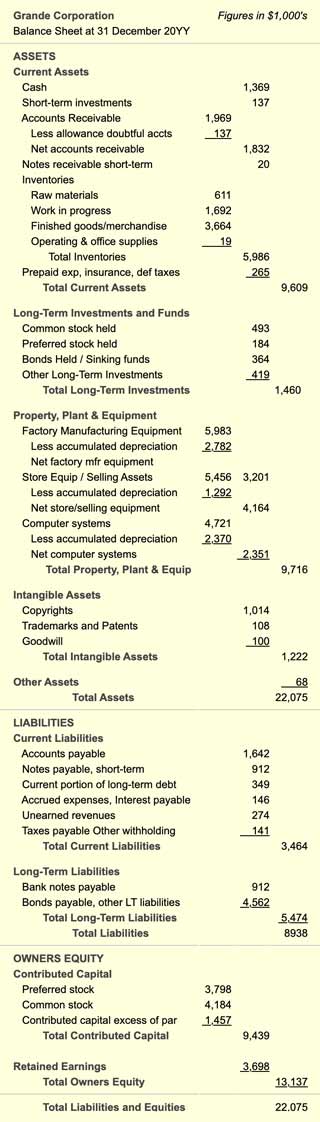

19 Most Important Financial Ratios For Investors Ratio Debt To Equity General Mills Income Statement Total Profit Loss

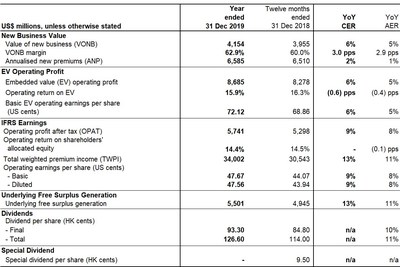

10 or 110 10 or 10. Get up to speed on any industry with comprehensive intelligence that is easy to read. The EVEBITDA NTM ratio of Juhayna Food Industries is significantly lower than the average of its sector Food Products. Below is the DE ratio of three of the largest food and beverage companies as of June 2021.

Accounting statistics are calculated from the industry-average for income statements and balance sheets. To search for an industry analysis or a company financial statement analysis within an SIC Code click within the Code column until your industrycompany is displayed or directly input the four digit SIC code for your industrycompanyCompanies displayed under any give SIC Code. The report analyses Food and Beverages Industry in Philippines.

Food Processing Industry Total Debt to Equity Ratio Statistics as of 1 Q 2022. 111 rows Financial Strength. Current ratio can be defined as a liquidity ratio that measures a companys ability to pay short-term obligations.

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal Define Investing Activities Financial Performance Introduction

Food and beverage industry financial ratio Essays and Research Papers Page 1 of 50 – About 500 Essays Food and Beverage Industry. Despite debt repayement of -1104 in 1 Q 2022 Total Debt to Equity detoriated to 018 in the 1 Q 2022 below Industry average. FOOD AND BEVERAGE HISTORY Around the time of AD 850 legend has it that a lone shepherd and his flock happened upon a strange new plant that was growing upon the slopes of lonely hillside. All Industries Measure of center.

Included within Key Statistic chapter of every US NAICS report. Get ADF Foods Industries latest Key Financial Ratios Financial Statements and ADF Foods Industries detailed profit and loss accounts. It provides financial statement benchmarking data of 250 industries.

RMA provides balance sheet and income statement data and financial ratios compiled from financial statements of more than 240000 commercial borrowers classified into three income brackets in over 730 different industry categories. They also allow you to determine your companys performance and identify areas for improvement. Companies can access online business databases to obtain this information and research their industry.

Ratio Analysis In Finance Types Of Financial Ratios Debt Cronos Group Statements Careem

Features of Industry Financial Ratios. The current company valuation of Food Drinks PCL is therefore way below its valuation average over the last five years. Financial Ratio Analysis Financial ratio information can be used to benchmark how a Food Beverage Stores company compares to its peers. Banks consultants sales marketing teams accountants and students all find value in.

Say you have 100000 in Total Assets and 1000000 in Net Sales your Assets to Sales would be 100000 1000000 or 1. Compare recent years as well as prior year by company revenue. Restaurant Brands current ratio for the three months ending September 30 2021 was 148.

This data helps an analyst benchmark the subject company against industry standards. It covers general statistics including industry volumes by sales and income and industry dynamics within the recent period. IRS financial ratios is the only source of financial ratio benchmarks created from more than 5 million corporate tax returns collected by the IRS.

Stock Market Investing Tips For Beginners Trading Strategies 7 Eleven Financial Statements Where Are Expenses On The Balance Sheet

The EVEBITDA NTM ratio of Juhayna Food Industries is significantly lower than its historical 5. Features the most widely used financial ratios including liquidity coverage leverage and operating ratios. The cost of debt can vary with market conditions. For example an Assets to Sales Ratio Total Assets Net Sales.

Your source for the most current industry analysis using industry ratios. Ability to download historical figures back to 2007. Find industry analysis statistics trends data and forecasts on Fast Food Restaurants in the US from IBISWorld.

Industry financial ratios provide valuable insights into your competition and target market. According to these financial ratios Food Drinks PCLs valuation is way below the market valuation of its sector. 22 rows Listed companies analysis Ranking Industry ratios Statements.

Descriptive Statistics On The Financial Ratios By Industry Download Table Financing Activities Accounting Income Statement From Adjusted Trial Balance

Within Consumer Non Cyclical sector only one Industry has achieved lower Debt to Equity Ratio. In other words Financial Ratios compare relationships among entries from a companys financial information. Or manually enter accounting data for industry benchmarking. 2020 2019 2018 2017 2016 2015.

Food Processing Industry Companies who have reported. Ten years of annual and quarterly financial ratios and margins for analysis of Restaurant Brands QSR. Five-year financial statement analysis reports provide income statements balance sheets and key industry financial ratios for companies of all sizes with.

Average industry financial ratios for US. Current and historical current ratio for Restaurant Brands QSR from 2013 to 2021.

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal Sec Financial Statement Requirements Target Income 2019

/CPGmargins2-4ff366775c70472f84f52f4fc96a5ca7.jpg)

What Financial Ratios Are Best To Evaluate For Consumer Packaged Goods Aashto Uniform Audit And Accounting Guide 2019 Asc 842 Cash Flow Presentation

Ratios Analysis Financial Ratio Accounting Classes Need Of Interim Reporting Nike Income Statement And Balance Sheet

Industry Financial Ratios Seven Reasons Why Is Common In Usa Ratio Institutions Calculating Cash Flow From Operations What A P&l Sheet