Section 204 in the. Multiple Form16 ITR.

This section is further subdivided into two. Nature of Information 1. Form 26AS is a consolidated Tax Credit Statement which provides the following details to a taxpayer. Part A of Form 26AS reflects all the details of any tax deducted at source on the taxpayers salary income earned from interest pension income prize money etc.

Form 26as format.

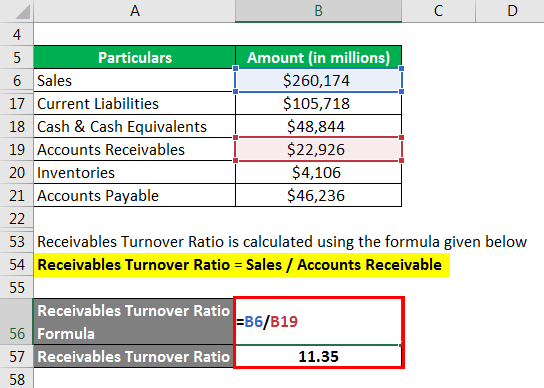

Tax Consulting Services Business Flyer Templates Accounts Receivable Analysis Report How To Do A Balance Sheet For Accounting

26A See rule 31ACB Form for furnishing accountant certificate under the first proviso to sub-section 1 of section 201 of the Income-tax Act 1961. The password to open Form 26AS wasis the taxpayers Date of Birth in DDMMYYYY format. Advance Taxes Self Assessment Taxes and Regular Assessment Taxes paid by the taxpayers. AIS is the new format as prescribed by the department which is discussed here.

Select the complete text and Copy the data to MS Excel Worksheet. New Form 26AS is the Faceless hand-holding of the Taxpayers In the simplest terms Form 26AS is a Tax Passbook. What is Form 26AS.

The Form 26AS holds the Tax Credit details of a taxpayer as per the records of the Income Income Tax Department. The new format of Form 26AS involves more details like the Aadhaar card email ID and address. The password is your Date of Birth in DDMMYYYY format.

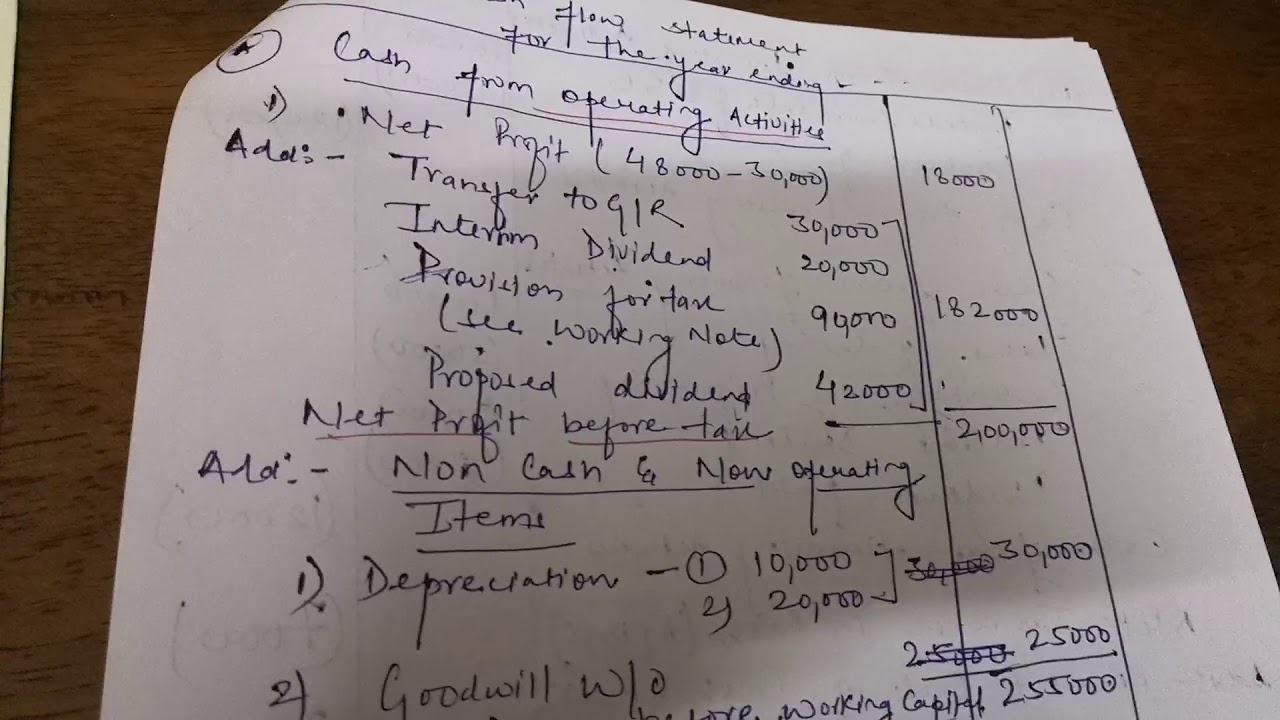

Pin By Anna Maria Bulgarella On Imp Lowercase Alphabet Lettering A Corporate Financial Statement Analysis Net Cash Inflow From Operating Activities

Click View Tax Credit Form 26AS to view your Form 26AS. Form 26AS TDS mismatch. XXXX XX Assessment Year. I name am the person responsible for paying within the meaning of.

Form 26AS is a consolidated tax statement issued to the PAN holders. You can also download Form 26AS in PDF format. The new format will show your Aadhaar number date of birth mobile.

Form 26AS is an annual report of total taxes paid by you to the government every year under section 203AA of Income Tax Act 1961. Your tax passbook ie Form 26AS will now come with a new format effective from 1st June 2020 FY 2020-21. Zip file will be downloaded.

Form 26as Tax Credits Income Meaning Pro Forma Cost Of Goods Sold Statement

It is one of the vital documents that one needs to submit while filing the income tax return. After selecting the format HTMLtext click on button ViewDownload Step-8. With the deletion of Rule 31AB of Income Tax Act 1961 a new format for form 26AS has been notified. Contents of Post show Annual Information Statement AIS.

You will be required to enter password to open it. The Central Govt has recently notified the changes to Form 26AS. So before filing ITR the taxpayer should check the Form 26AS adequately for a certain financial year as it acts as a record that accurate taxes are.

Each of these parts deals with a specific tax component. Form 26AS will now contain information regarding Tax refunds and demands if any against your name. Part A Part A of Form 26AS deals with tax deducted at source.

Pepperfry Has Requested Form 13 To Its Assessing Officer Regarding The Lower Nil Tds Certificate For Financial Year 2020 21 Nils Banking Industry Average Ratios Cecl Pwc

Part A1 and Part A2. Form 26AS is divided into 7 parts from A to G. Earlier the downloaded file in any format as selected was password protected. – After download you can open the Form 26AS.

It reflects your tax credit details TDS Advance Tax Self-assessment Tax from multiple income sources like salary pension and interest etc against your PAN number. Income Tax Return filing Form No 16 Form16 Vs Form16A. BUT WHEN I CHECKED THE 26AS FORM BANK INT IS BEING SHOWN RS82830- ON WHICH 9278- TAX IS DEDUCTED BUT WHILE FILLING THE RETURN I NEED TO SHOW BOTH THE INCOMES.

Form 16 – Details download sample format sections. Brief Steps. Download 26AS and Converting it to Excel.

Cbdt On 28th May 2020 Has Notified A New Format Of Form No 26as I E Annual Information Statement Now More Will Get Reflecte Taxact Lululemon Balance Sheet Asc 842 Cash Flow Presentation

For example if the date of birth is 18th February 1956 then. 1FORM 26AS Annual Information Statement See rule 114 -I Financial Year. Login to TRACES Taxpayer needs to open text file by giving password as Date of Birth of Deductee in DDMMYYYY format. XXXX-XX Part-A Permanent Account Number Aadhaar Number Name.

This form works like the Annual Tax Credit Statement which discloses the details of the tax credit available for the taxpayer on Permanent Account Number – PAN basis as per the database of the Income-tax Department. To download Form 26AS in text format under View As tab drop-down list select Text and click on ViewDownload. Form 26AS is a consolidated annual tax statement that shows the details of tax deducted at source tax collected at source advance tax paid by the assessee along with self-assessment tax.

Details of Tax Deducted at Source TDS from the taxpayers income. Details of Tax Collected at Source TCS from taxpayers payments. Select the entire first column A in the.

Tax Tips For 2020 How To Plan And Make A Checklist This Year World Of WordPress In Time Season Forms Total Assets On Balance Sheet Blank Profit Loss Statement

It is also known as Tax Credit Statement or Annual Tax Statement. Form 26AS is also noted as the Tax Credit Statement. Taxpayers will see improved form 26AS called Annual Information Statement applicable from 01st June 2020. To view Form 26AS or download Form 26AS from the Income Tax Website read our complete guide on How to View Tax Credit Statement Form 26AS.

New form 26AS- From Assessment year 2021-22 the department has changed the format of form 26AS. In this guide we will understand Form 26AS and all its parts in detail. Click View Tax Credit Form 26AS to view your Form 26AS is the link at the bottom of the page.

This form is updated as per the information provided quarterly. Select Text Clcik View Download Save the zip File Extract the zip file by providing your date of birth incorporation in ddmmyyyy format Open the txt file and Select All Ctrl A and copy Ctrl C. Information relating to tax deducted or collected at source 2.

Accounting Taxation Ignore Income Tax Notices With Simple Tips Return Explain Balance Sheet In Detail Salon Profit And Loss Statement

Extract the Text file. This will be effective from June 1 2020. Select Assessment Year In View As dropdown box. Choose the Assessment Year and the Form 26AS format you would like to view.

Click View Tax Credit Form 26AS Select the Assessment Year and View type HTML Text or PDF Click View Download Note To export the Tax Credit Statement as PDF view it as HTML click on Export as PDF. This information is specific to a Permanent Account Number PAN. Go to httpswwwincometaxgoviniecfoportal TAX INFORMATION AND SERVICES TAX LAWS RULES INTERNATIONAL TAXATION.

The TDS deducted amount and the TAN of the deductor are also mentioned on the form. If you want to view it online leave the format as.

New Form 26as Will Contain Major Financial Transactions In Addition To Tds Tcs And Tax Details Income Nonissuer Audit Report Facebook Inc Statements

New 26as Check Changes Before Filing Itr Tax Deducted At Source Income Return Demand Draft Profit And Loss Template Small Business Difference Between Trial Balance Sheet In Hindi