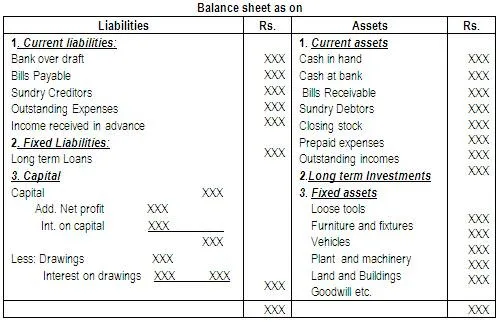

Cont 1 Checks or drafts in process of collection that are drawn on another depository institution or on a Federal Reserve Bank and that are payable immediately upon presentation in. Balance Sheets as on 31st March 2018 and 31st March.

Following are the advantages of bank overdraft. Creditors Overdraft 10k. In some cases businesses treat a bank overdraft in the balance sheet as an asset or an operating expense especially if they expect to pay back and reverse the overdraft quickly. In business accounting an overdraft is considered a current liability which is generally expected to be payable within 12 months.

Interest on bank overdraft in balance sheet.

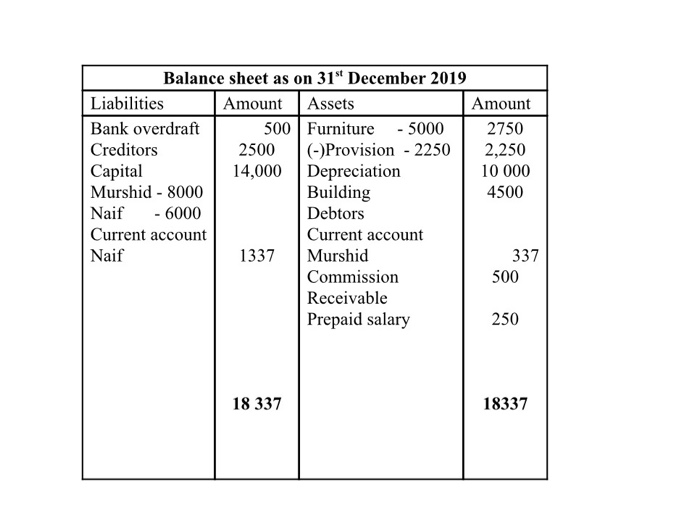

Solved Balance Sheet As On 31st December 2019 Liabilities Chegg Com Approach Bad Debt Operating Cash Flow Ratio Example

The bank charged 95 on bank overdraft account during the year and the assessee earned 925 on its FDR accounts. Book overdraft occurs when the business issues checks that exceed its bank account. The formula for overdraft interest rate by average daily balance method is as follows Formula Interest AN RP Where A Amount Overdrawn N Number of Days in a billing period R Annual interest rate P number of periods per year The banks may have different policies for compounding the interest rates. Cash items in process of collection include.

If the assessee incurred interest on overdraft on account of investment in mutual fund the assessee earned interest on FDRs at the same time for non-breaking the same for investment in mutual fund. An overdraft occurs when money is withdrawn from a bank account and the available balance goes below zero. Interest needs to be paid only on the amount that is utilised and not the total limit.

Interest is charged by the banks on debit balance only for the period of loan only. Part of an entitys cash management. Interest on bank overdraft is debited in the bank pass book as it is charged by the bank and reduces the balance in our bank pass book.

Bank Overdraft Facility Efinancemanagement Condensed Income Statement How To Calculate Retained Earnings From Balance Sheet

FFIEC 051 RC-2 RC – BALANCE SHEET 6-20 Item No. Helps in fulfilling urgent cash requirements. Should it be either. Debenture Interest Unpaid Dividend and Bank Overdraft From the following Balance Sheet s of A Ltd.

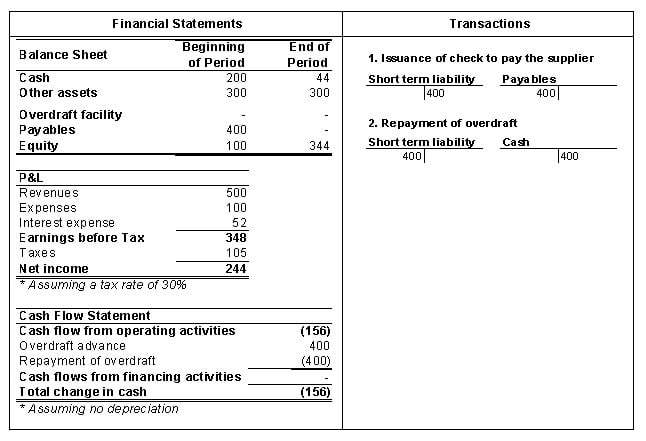

A company has a cash account balance of USD 200 and has issued a check of USD 400 to pay raw materials to its suppliers. Since a borrower only incurs interest charges on the amount used as a loan it offers a flexible credit facility to save interest costs. In that case bank overdrafts are included as component of cash and cash equivalents.

Creditors Overdraft 2k. Or b Current Assets Cash at bank and in hand 8k. Interest on overdraft is calculated at the rates negotiated between the bank and customer in the offer letter.

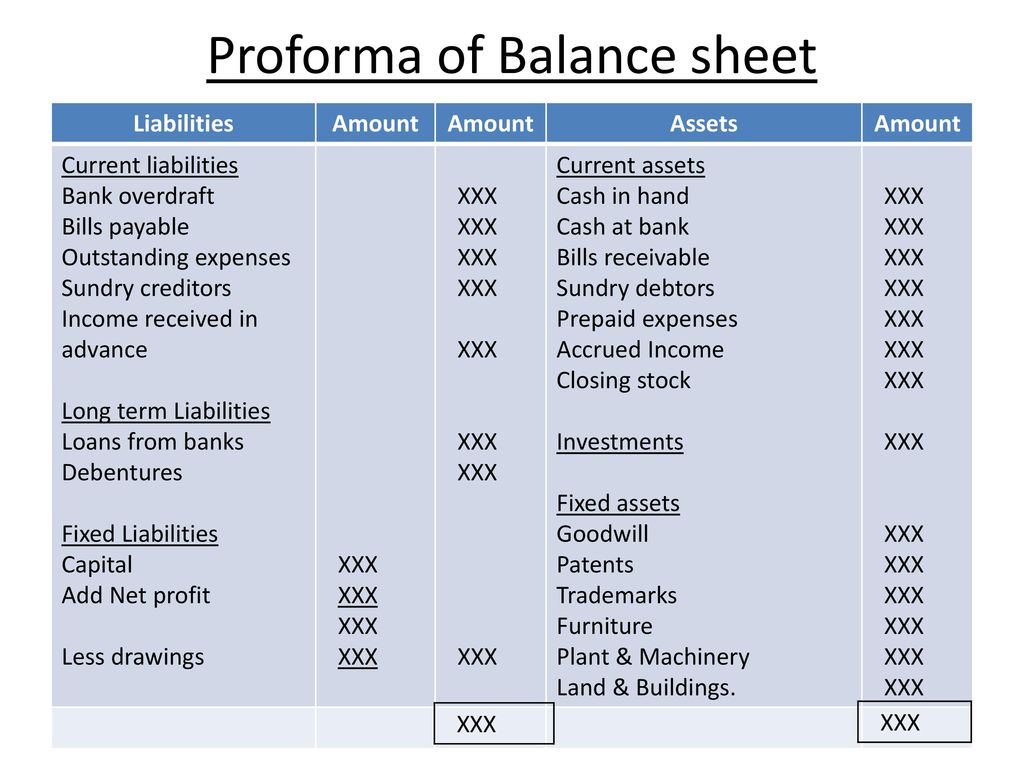

Module 6 Balance Sheet Is A Statement Of Assets And Liabilities Which Helps Us To Ascertain The Financial Position Concern On Particular Ppt Download Trial Used In Preparing Statements Insurance For Income Tax

Click to see full answer. That varies from bank to bank. If you do then the accounts payable detail report will no longer exactly. FFIEC 051 RC – BALANCE SHEET.

A borrower can utilize the normal bank balance without paying any interest. The rate of interest is generally higher than the rate of interest of Cash Credit. The company has an overdraft limit of USD 1000 and the bank charges an interest bank overdraft in balance sheet rate of Prime Rate 3 2 plus an overdraft fee of USD 50.

Helps in managing the availability of cash for a business or an individual. A Current Assets Cash at bank and in hand nil. BANK OVERDRAFT DEBIT OR CREDIT.

Solved Balance Sheet Assets S Liabilities And Shareholders Equity Cash 4 186 548 Accounts Payable 11 302 098 Receivable 7 288 442 Bank Ov Course Hero Objective Of Trial Integrated Audit Report

In other words if a company paid 20 in interest on its debts and earned 5 in interest from its savings account the income statement would only show Interest. If the interest rate on overdraft is 10 pa then Outstanding Balance on 1 April 2018 Rs 100000 Interest is 100000101365 Rs 2740. It shall show a corresponding bank overdraft liability of 10 million the sum of overdrafts. How is this reflected in the balance sheet.

Overdraft on balance sheet. Being a loan bank overdraft is shown in liabilities side of the balance sheet. Usually the fee is charged daily weekly or monthly plus interest which can be as high as a 15 to 20 annual percentage rate.

Should it be either. In some cases businesses treat a bank overdraft in the balance sheet as an asset or an operating expense especially if they expect to pay back and reverse the overdraft quickly. It goes to the balance sheet only when the company starts using it.

Balance Sheet Mba Knowledge Base The P&l Ias 7 Cash And Equivalents

For the business it is an expense which is credited in the cash book when paid and debited in the Profit and. Bank Charged Interest On Overdraft To make it easier to compare costs between accounts interest on all overdrafts is levied at a single annual interest rate APR. It does not have a place on the Balance Sheet. The bank would charge interest on the overdraft amount only.

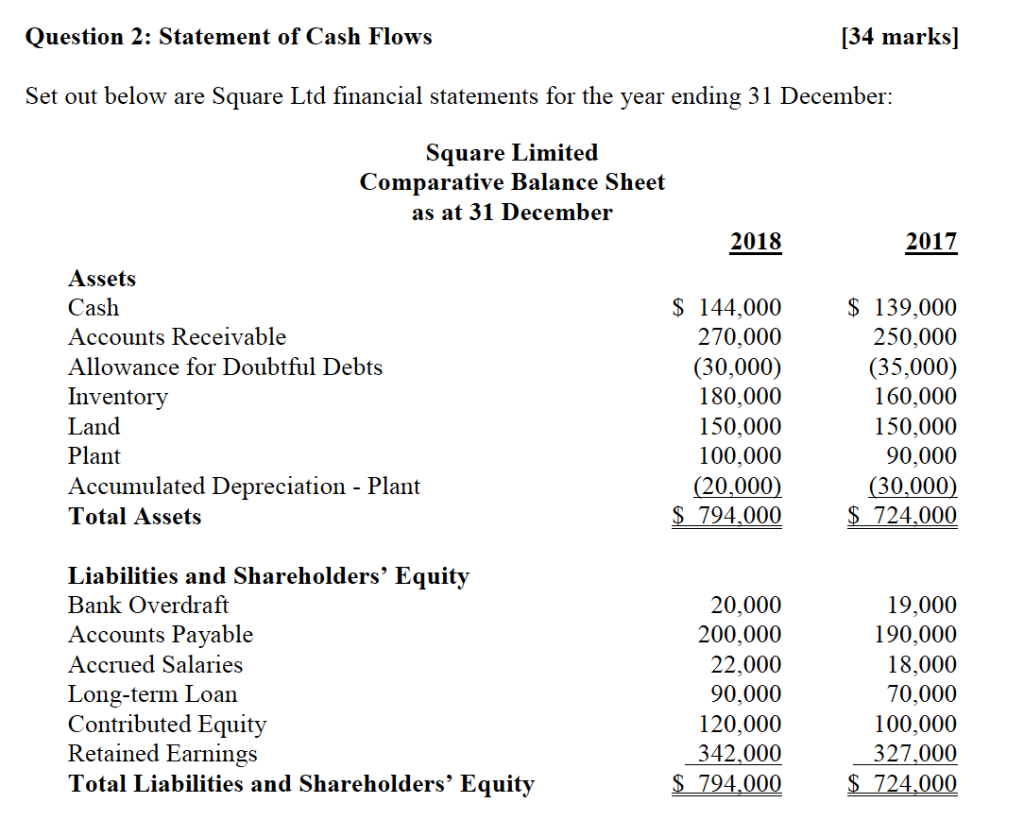

Prep are Cash Flow S tatement as per AS-3 Revised. Considering the sometimes very high fees an overdraft arrangement can be very expensive especially if the borrowed amount is very small. There is just one company bank account no petty cash.

In its balance sheet Earth Inc. Interest on bank overdraft in profit and loss account. Both give same net balance.

Solved 34 Marks Question 2 Statement Of Cash Flows Set Chegg Com Accrued Expenses Flow Financial

Interest is calculated by the banks system on a daily basis. Bank overdraft is shown in balance sheet same as bank account or any other cash account its a short term bank credit. Again if the overdraft is against any security then it will be shown as secured loan and if no. One has to pay the interest on the loan amount irrespective of the bank balance.

There is less amount of paperwork involved in availing bank overdraft. Shall report cash and cash equivalents of 70 million 20 million in Account A plus 50 million in Account C. Overdraft interest rates charged by banks and building societies range from 19 percent to 40 percent or more per month.

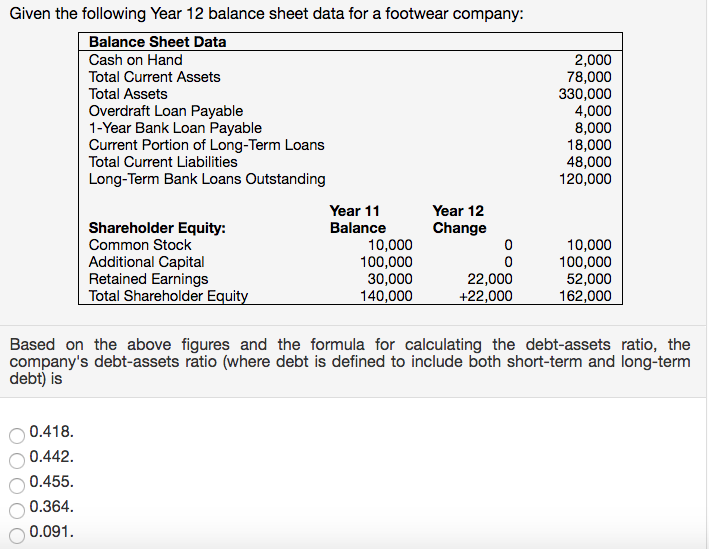

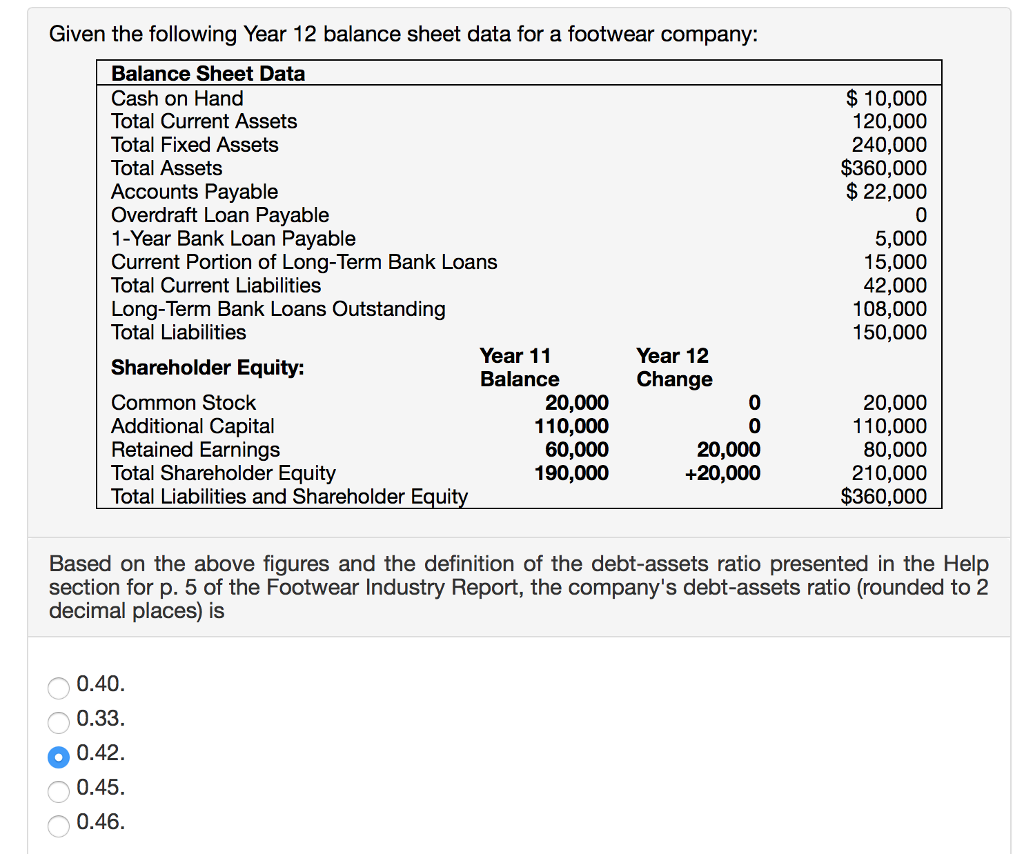

Solved Given The Following Year 12 Balance Sheet Data For A Chegg Com Kering Group Financial Statements Interim Financials

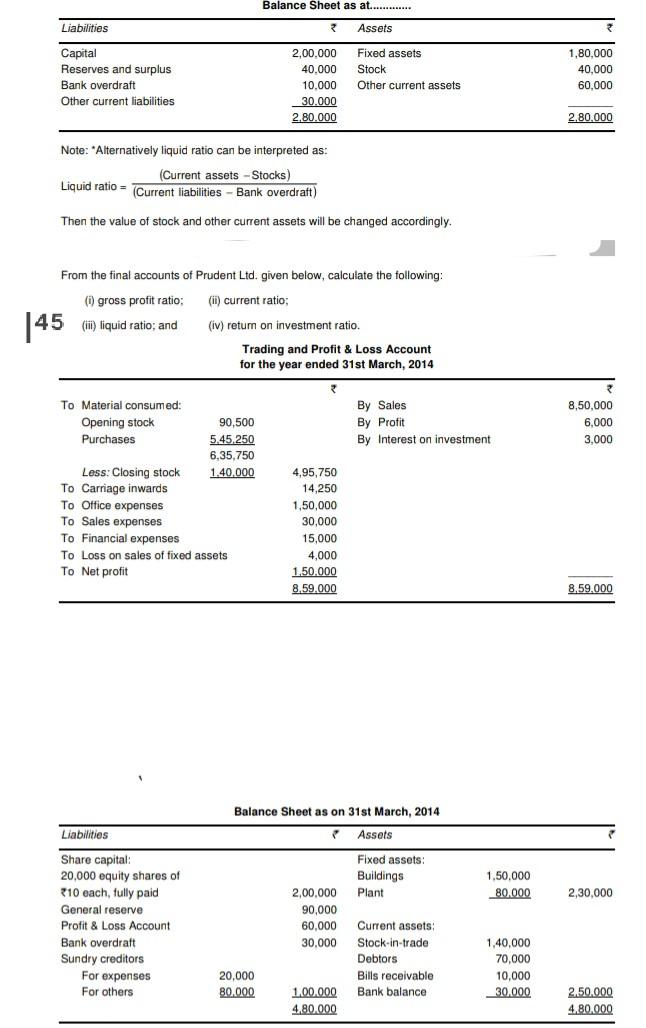

Solved Balance Sheet As At Liabilities Assets Chegg Com Preference Dividend In Audit Report Acca

Balance Sheet Explained Maslins Accountants Managerial Accounting Income Statement Example P & L And