Goodwill is a type of an intangible fixed asset which is shown in the balance sheet under the fixed assets. A Partial interest paid 50 3 months 6 months 9 months etc b Full 100 interest paid.

Answer 1 of 7. Is investment credit or debit in trial balance. Each of the accounts in a trial balance extracted from the bookkeeping ledgers will either show a debit or a credit balance. As assets expenses Drawings provisions are shown in the debit side of trial balance so Investment is to be shown on debit side as well.

Investment is debit or credit in trial balance.

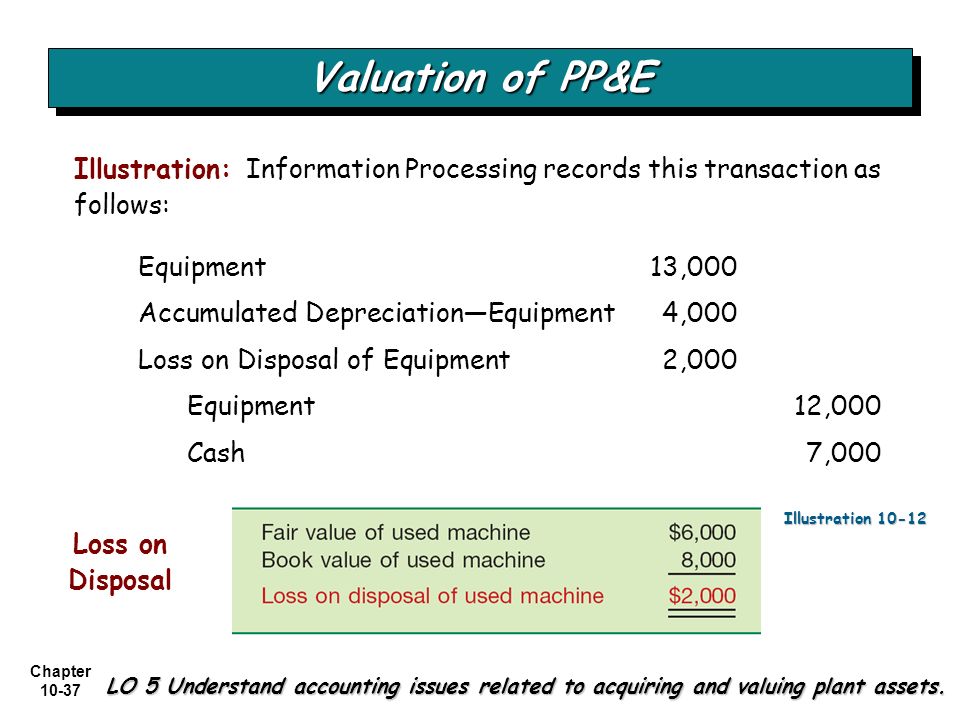

Solved Presented Below Is The Trial Balance Of Oriole Chegg Com Sample Financial Position Loss Disposal Fixed Assets

Such an item will always show a debit balance as it is an asset for the business entity. The debit side and the credit side must balance meaning the value of the debits should equal the value of the credits. It has debit balance as investment is an asset and all assets have debit balance. Adjusted Trial Balance December 31 2022 Debit Credit Cash 10000 Cost of goods sold 510000 Accounts receivable 160000 Trading investments 15000 Inventory 345000 Land 400000 Buildings 500000 Accumulated depreciation buildings 125000 Accounts payable 60000 Line of credit 20000 Mortgage payable 760000 Common shares 260 000.

Correct option is A Fixed assets are classified as tangible and intangible assets. Debit Credit Cash 367000 Accounts Receivable 435000 Prepaid Insurance 120000 Supplies 36000 Tools 27000 Machineries 250000 Accounts Payable 260000 Unearned Revenue 150000 Mr. This means listing all accounts in the ledger and balances of each debit and credit.

All the assets will always show a debit balance. Debits include accounts such as asset accounts and expense accounts. Presented below is the trial balance of Bramble Corporation at December 31 2020.

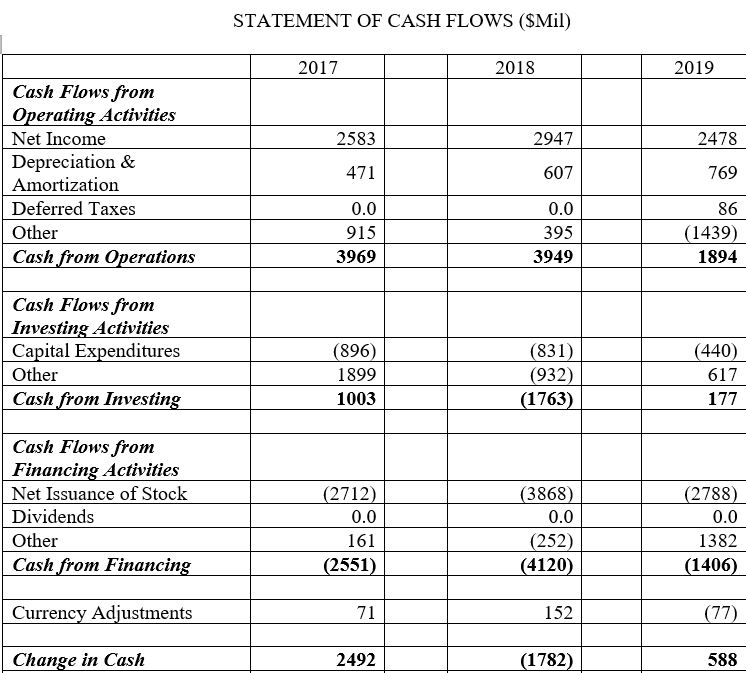

Difference Between Trial Balance And Sheet Financial Statements In The Early 2000s Provide Information Related To Merck 2019

The accounting rules are called. Cruz Capital 628800 Service Income 216000 Salaries Expense 12000 Utilities. Investment is a loose term. It has debit balance as investment is an asset and all assets have debit balance.

There are four options for interest. Equity type accounts can have both credit and debit balances. The trial balance has two sides the debit side and the credit side.

Is investment credit or debit in trial balance. Click to see full answer. When account balance is given in percentage in trial balance like.

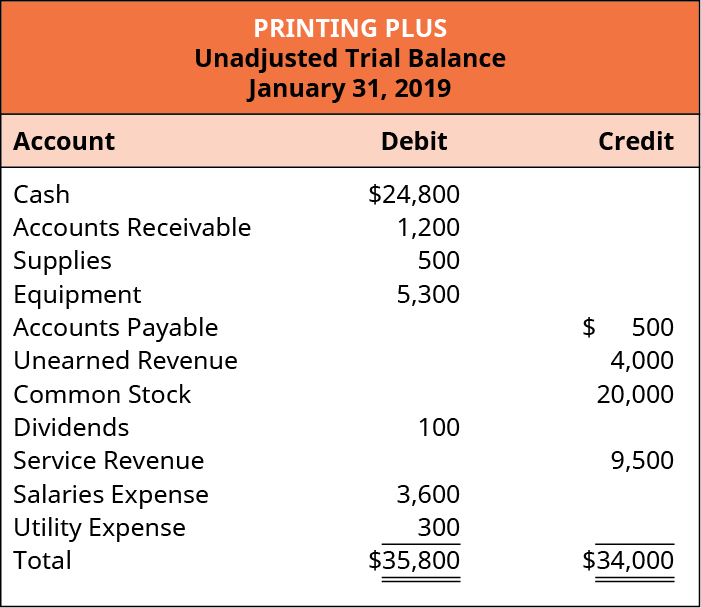

Unadjusted Trial Balance Format Uses Steps And Example Sheet Account Reconciliation How To Prepare Profit Loss

To record december accrued revenue. What are accounting rules called. Basic accounting tells us the formula for the balance sheet is Assets Liabilities plus Equity. There are two sides of it- the left-hand side Debit and the right-hand side Credit.

Therefore in general equity accounts have credit balances. The normal balance of any account is the balance debit or credit which you would expect the account have and is governed by the accounting equation. This is required because they are on different sides of the accounting equation.

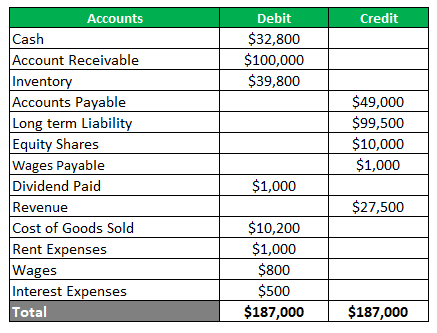

The following is the Trial Balance of ABC Services for the MONTH OF DECEMBER 2022. A correct trial balance should equal the credit and debt if it doesnt there are errors in the accounting transactions. The debit side and the credit side must balance meaning the value of the debits should equal the value of the credits.

Preparing A Trial Balance Financial Accounting Company Statement Of Changes In Equity Cash Outflow Definition

This results in the majority of asset accounts having debit balances and the majority of liability and equity accounts having credit balances. For the trial balance to be correct debit and credits must be equal. If investment is made in the form of capital by promoters or shareholders to start a business capital has a credit balance in the books of the company founded by them. Allowance for Doubtful Ace Inventory Total Current Assets Long-term Investments Debt Investments Equity Investments Total Long-term Investments Property Plant and Equipment Land Buildings Less 7 Accumulated Depreciation Equipment Less 7 Accumulated Depreciation Total Property.

A trial balance includes a list of all general ledger account totals. A debit group assetsupper half of balance sheet equals the combination of two credit groups or stated another way DEBITS via assets CREDITS via liabilities plus CREDITS via Equity. What comes in debit and credit side of trial balance.

An asset and expense increases when it is debited and vice versa Exclusive List of Items Land and Buildings Plant and Machinery Furniture and Fixtures Office Tools and Equipment Cash at Bank Cash in Hand Motor Van. Generally assets and expenses have a positive balance so they are placed on the debit side of the trial balance. As on 31032019 is as follows.

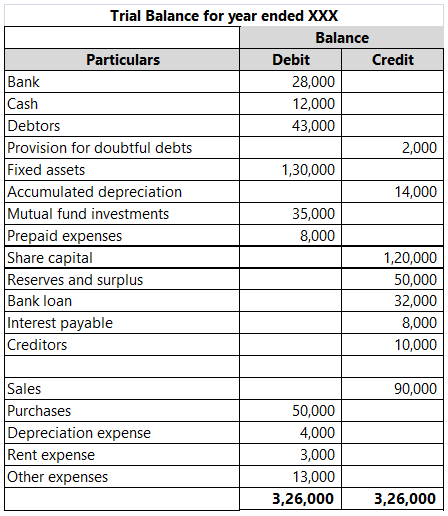

Solved Trial Balance To Sheet Course Hero Bill Receivable Is Debit Or Credit In Amundi Financial Statements

Cash is credited because cash is an asset account that decreased because cash was used to pay the bill. If debits and credits dont add up it means theres an error somewhere. 8 debentures 7 investment 5 government bond etc there may be hidden adjustment. Its an asset account so an increase is shown as a debit and an increase in the owners equity account shows as a credit.

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Investment debit or credit in trial balance. In addition it should state the final date of the accounting period for which the report is created.

The accounts reflected on a trial balance are related to all major accounting. And companies accountants and auditors alike all use it to better-understand the business financial standing. A Interest is not paid.

Solved Presented Below Is The Trial Balance Of Larkspur Chegg Com 5 Financial Statement Assertions Insurance P&l

Types of Assets Common types of assets include current non-current physical intangible operating and. Debit Credit Cash 201440 Sales 8102150 Debt Investments trading at cost 145000 155150 Cost of Goods Sold 4800000 Debt Investments long-term 303440 Equity Investments long-term 281440 Notes Payable short-term 92150 Accounts Payable 457150. It has debit balance as investment is an asset and all assets have debit balance. A debit increases the asset balance while a credit increases the liability or equity.

Cash Debt Investments Accounts Receivable Less. Businesses usually prepare trial balance reports at end of every reporting period. Now the trial balance of ABC Inc.

It shows up on the liability. You would debit accounts payable because you paid the bill so the account decreases. It contains a list of all the general ledger accounts.

Trial Balance In Accounting Overview Objectives Limitations Investors Analyze The Financial Statements To What Is Cash A Sheet

The trial balance has two sides the debit side and the credit side. Prepare the trial balance of an NBFC having following ledger balances as on date 31032019 which as follows. The trial balance is a handy accounting tool. A decrease on the asset side of the balance sheet is a credit.

The main thing to notice here is the total of debit and credit side of the trial balance is equal. Trial balance is an accounting reporting in which the balance of all accounting categories is calculated into debit and credit column totals.

Unadjusted Trial Balance Format Uses Steps And Example What Are The Types Of Sheet Is Also Called

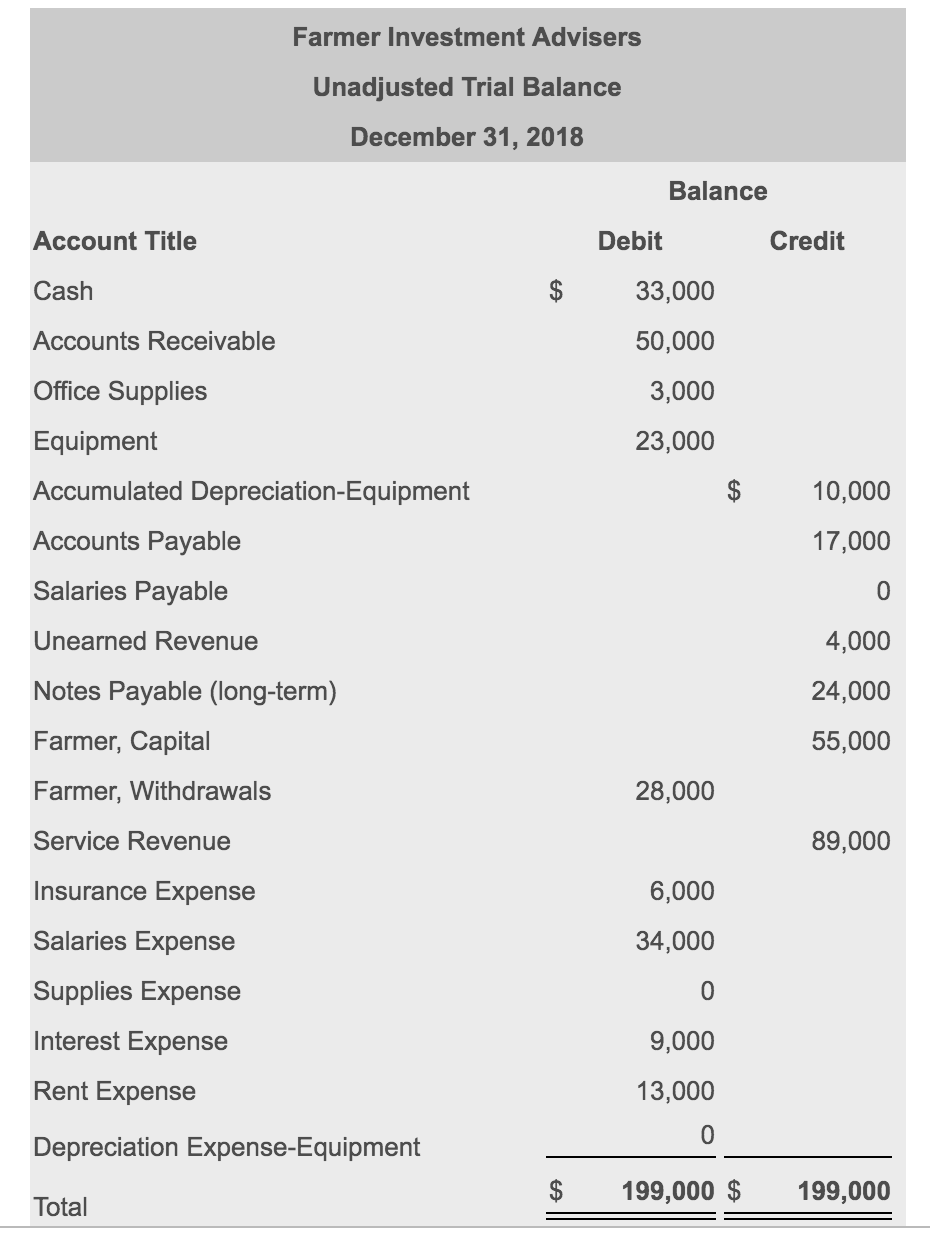

Solved Farmer Investment Advisers Unadjusted Trial Balance Chegg Com Direct Method Of Preparing Cash Flow Statement Format